Head of Bitcoin Strategy @smarterwebuk |

creator of Bitcoin valuation framework used by @saylor |

past: Stanford MBA, Bain & Co

8 subscribers

How to get URL link on X (Twitter) App

To set the stage, there is $1000T of asset value in the world.

To set the stage, there is $1000T of asset value in the world.

Bond market:

Bond market:

Saylor's analysis allows for a bearish scenario of "only" $3M per BTC...

Saylor's analysis allows for a bearish scenario of "only" $3M per BTC...

The primary framing of the document, and the primary argument for the court to deny the SEC its request for a temporary restraining order (TRO) to halt Binance activities is...

The primary framing of the document, and the primary argument for the court to deny the SEC its request for a temporary restraining order (TRO) to halt Binance activities is...

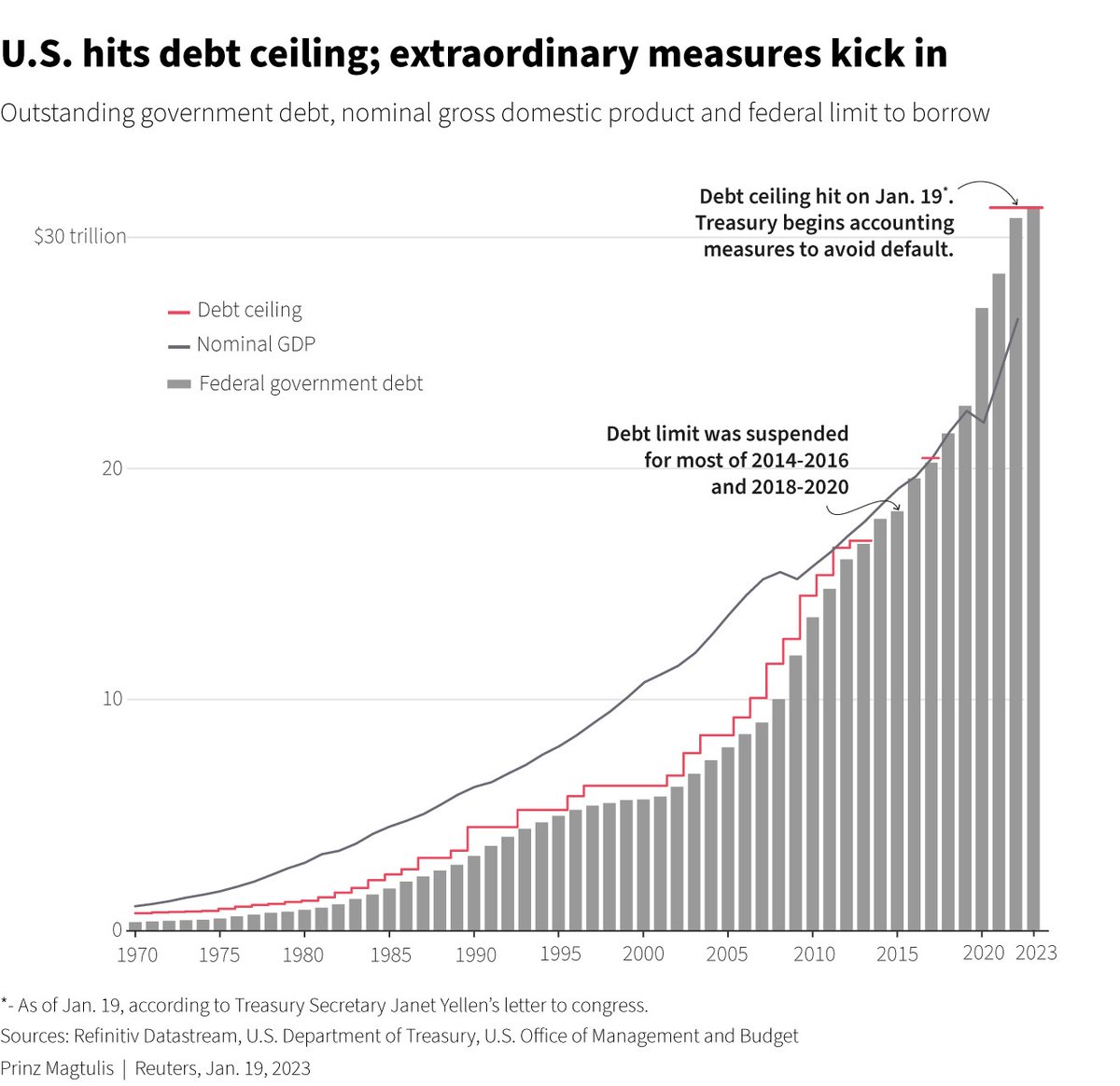

The debt ceiling deal was brokered between US House Speaker McCarthy (R) and President Biden (D). The deal is expected to be voted on by Congress this Wednesday.

The debt ceiling deal was brokered between US House Speaker McCarthy (R) and President Biden (D). The deal is expected to be voted on by Congress this Wednesday.

This is Bitcoin's issuance schedule.

This is Bitcoin's issuance schedule.

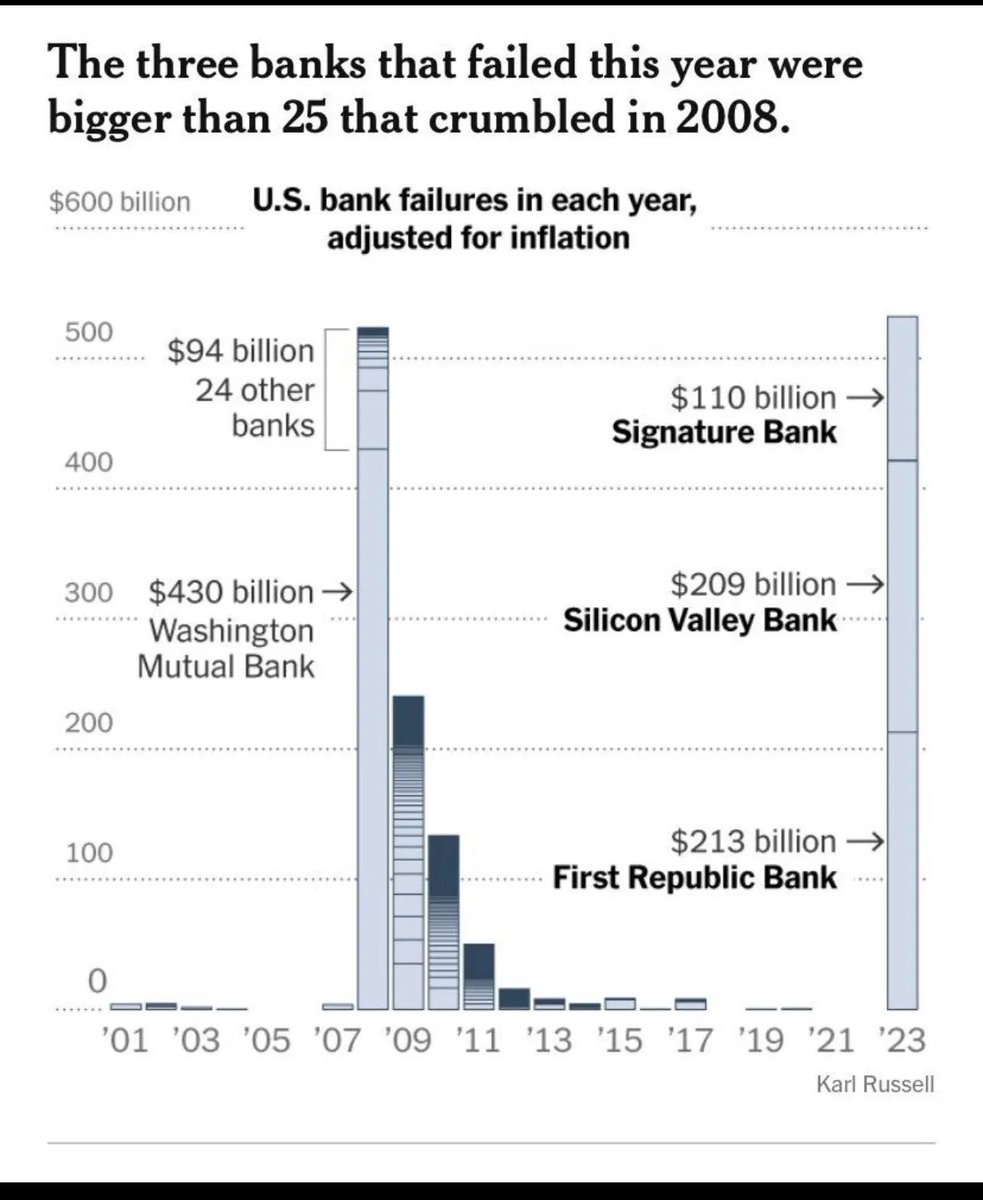

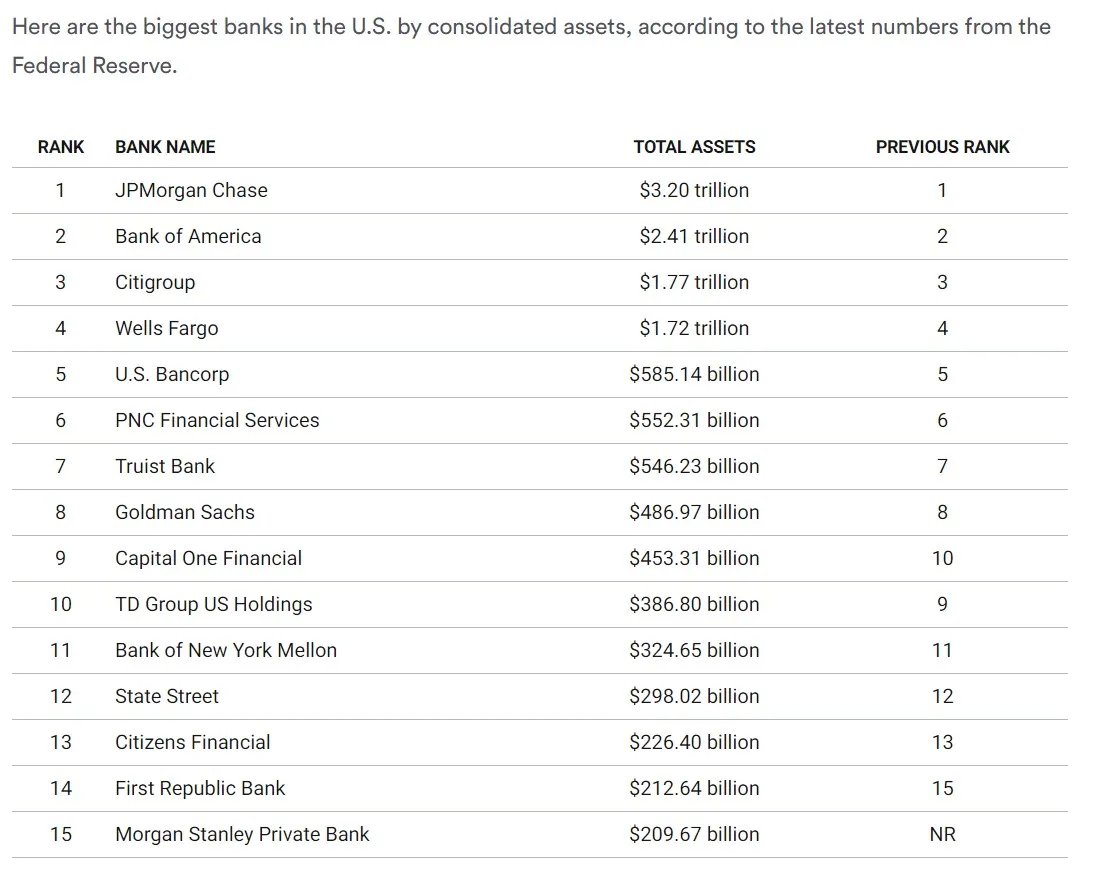

#2 - First Republic was the 14th largest bank in the United States.

#2 - First Republic was the 14th largest bank in the United States.

#2 - The problem with deficits is that they add up. Each annual deficit adds to the total National Debt.

#2 - The problem with deficits is that they add up. Each annual deficit adds to the total National Debt.

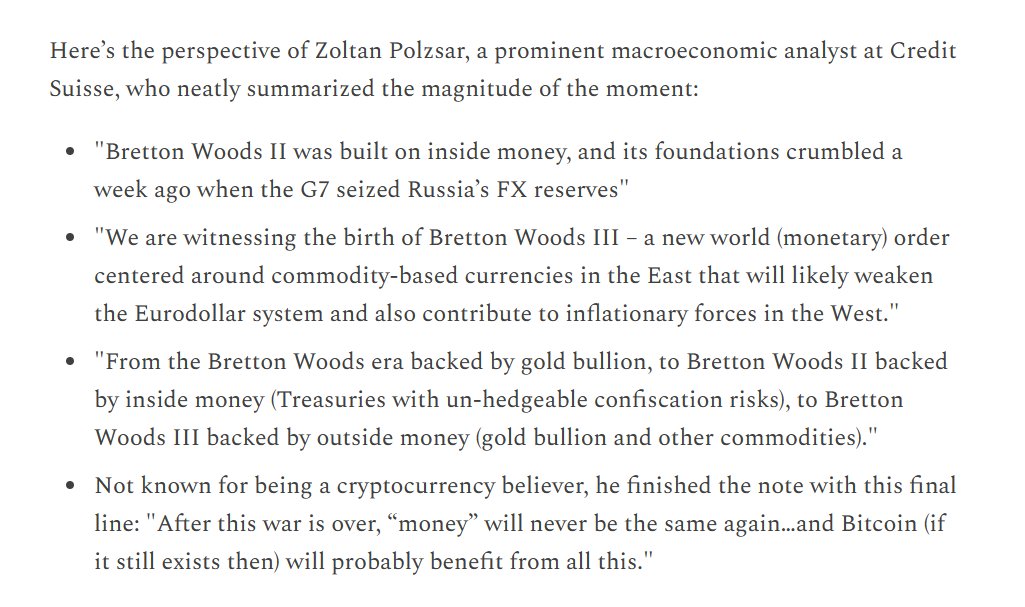

#2 - In early 2022, the US froze Russia's foreign currency reserves & cut them off from the SWIFT banking system.

#2 - In early 2022, the US froze Russia's foreign currency reserves & cut them off from the SWIFT banking system.

2/ In the 1960s, Superman had to deal with another Earth — eerily like ours — but where many details were the opposite of what we call normal.

2/ In the 1960s, Superman had to deal with another Earth — eerily like ours — but where many details were the opposite of what we call normal.

As a reminder, when the banking crisis hit a couple weeks ago, bond yields suddenly dropped.

As a reminder, when the banking crisis hit a couple weeks ago, bond yields suddenly dropped.

Everyone misses the bottom. The bottom feels like a disaster, so we all freeze up and watch it go by.

Everyone misses the bottom. The bottom feels like a disaster, so we all freeze up and watch it go by.

#2 - the Fed added ~$100B to its balance sheet last week, adding to the ~$300B in money printing the week before.

#2 - the Fed added ~$100B to its balance sheet last week, adding to the ~$300B in money printing the week before.

https://twitter.com/Croesus_BTC/status/1280599224766226433

The graphic above shows the proliferation of cryptocurrencies over time. In truth, they exist in two categories: Bitcoin and copycats.

The graphic above shows the proliferation of cryptocurrencies over time. In truth, they exist in two categories: Bitcoin and copycats.