@threadreaderapp So I thought I'd add a couple of extra tweets to my thread re: the fake bank #bandenia. Last week I banged on about about some pretty easy to spot fudging of financials. Most scammers battle to read financial statements so they are not particularly good at fudging.

@threadreaderapp More problematic than the scammers crappy accounting is that mostly no one bothers to spend more than 2 mins looking. (remember... #celsius....anyone?) So here's some even dumber examples of the same fraudulent attempted alchemy.

@threadreaderapp One of my fav peeps to poke fun at is #rohnmonroe (you know the guy that #bitfinex was chasing for information on the missing $300m that #reginaldfowler was meant to have...yeah the guy they misspelled his name three different way and took a year to find.

@threadreaderapp well back in April last year I wrote a few tweets about #rohnmonroe's $1.6Billion subscription for E.C.C.I.B.T LTD

https://twitter.com/intel_jakal/status/1510325369945088006?s=20

@threadreaderapp I wrote about this at length back then but had to delete the posts after scamster complained that I doxxed him (or someone claiming to represent him since he doesn't have an account on twitter). By doxxing I mean I pointed out that he had committed a $1B fraud.

@threadreaderapp So this dingbat setup the company as sole director and sole shareholder and lodged the filing saying that he had paid for and issued himself 1Billion shares at 1 pound each....at that time around US$1.6billion cash.

@threadreaderapp I remember now...probably why he got his knickers in a knot about how he was clearly incapable of even a fraction of the amount since he had not long defaulted on [redacted] and the subscription amount was 100000x more.

@threadreaderapp So financially prudent was Rhonny boy that he forgot to lodge a couple of simple filings and allowed the company to be struck off (and wave goodbye to his imaginery billion dollar investment).

or he was probably mostly annoyed that I pointed out the whole charade was to pretend that he had control of $1B via one of his shitbox shells European Chamber of Commerce for Investment Banks & Trust (aka E.C.C.I.B.T)....

I digress. The point was to compare #bandenia and #ECCIBT In Bandenia's case they issued several tranches of shares but all the shares were issued unpaid...so at least they didn't lie about stumping the cash up.

well kinda. because in the accounts they show GBP80million in current assets (aka a payable from shareholders for their shares...i.e. they settled the issue with a back to back loan and not only get to pretend they paid it but also make it appear that the company has assets....

If Rohnny boy did file accounts it would been very similar to #bandenia just with a bucketload more zero's.

I know this because its exactly what he attempted to do with his OTC shells. btw the clown nose and jester's hat that's my addition...the rest Rohnny got from fivver.

I know this because its exactly what he attempted to do with his OTC shells. btw the clown nose and jester's hat that's my addition...the rest Rohnny got from fivver.

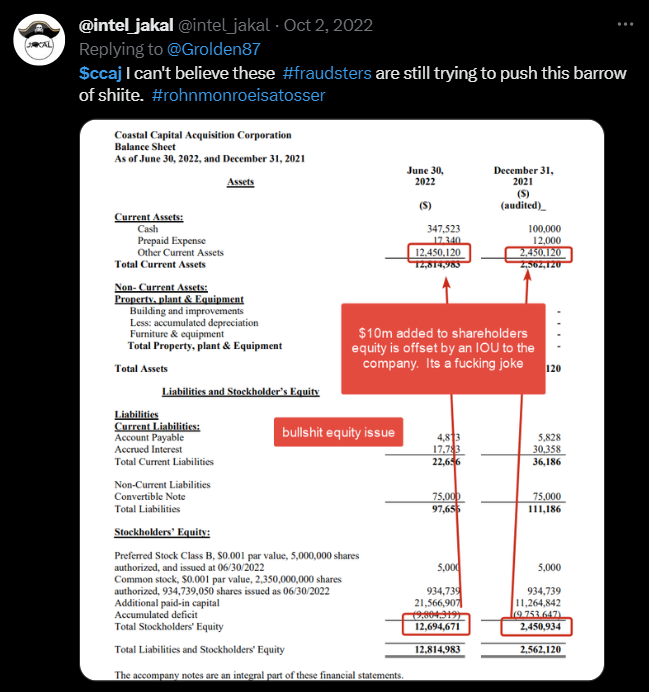

As I pointed out in several posts $ccaj (and copped no end of flack accusing me of dumb shit like those current assets could relate to a plethero of really awesome deals that Rhonny and co had secured.

oh. the audit is outsourced to a Nigerian firm.

oh. the audit is outsourced to a Nigerian firm.

but above ....the most amusing tell is the reuse of stock logo's. Here Rohnny regurgiated the ECCIBT logo for Panthera Capital Holdings.

oh when I said Rhonny used @fivver I wasn't kidding all their logo's and art work is from fivver.

Best of all even the original #houseofslugs gets a cameo #slugsofzug

Best of all even the original #houseofslugs gets a cameo #slugsofzug

@fivver Just a couple extras coz I feel like it. Here's @sm_sm001 shilling the $ccaj dumpster... $16m in assets....but doesn't bother to find out what the $14m of current assets are or how they magically appeared. #muppets

unroll @threadreaderapp

• • •

Missing some Tweet in this thread? You can try to

force a refresh