(1/x) We’re short $OLED, which we find is using aggressive accounting to obscure revenue declines since its key patent expired in 2020.

(We also call on $OLED to explain why its top Seeking Alpha cheerleader has so much in common with its longtime CFO/current Board Member?)

(We also call on $OLED to explain why its top Seeking Alpha cheerleader has so much in common with its longtime CFO/current Board Member?)

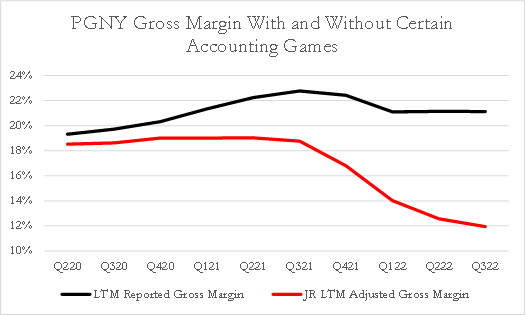

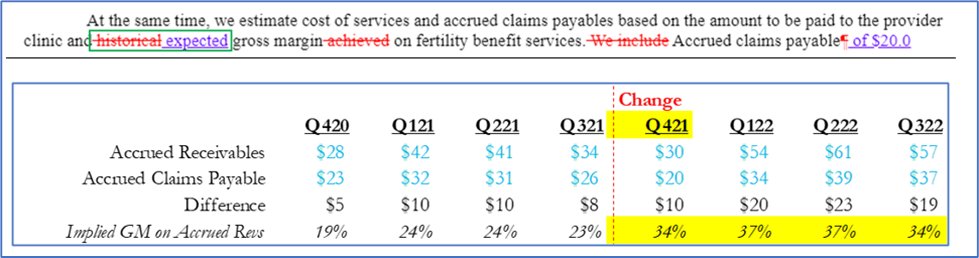

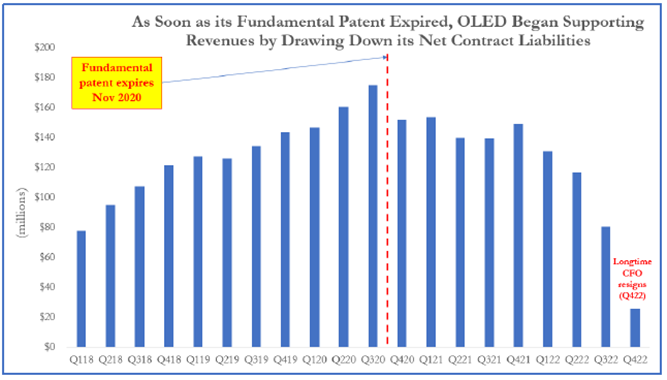

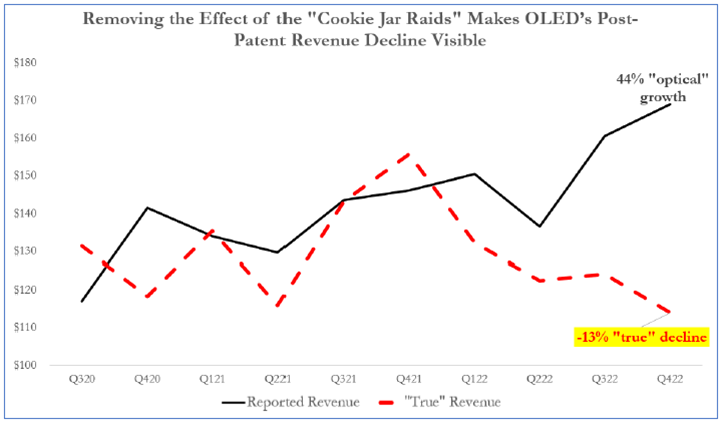

(2/x) $OLED uses complex, long-term contract accounting to come up with its revenues. We believe the company has abused the flexibility of this accounting model to pull tomorrow’s revenues into today. This is how you turn 2020’s patent cliff into 2023’s revenue cliff.

(3/x) We expect $OLED to miss 2023 expectations by a wide margin because the accounting “cookie jar” that has enabled these accounting games has run out. We calculate that the “true” business is in decline. Reported revenues will catch up (or better said, down).

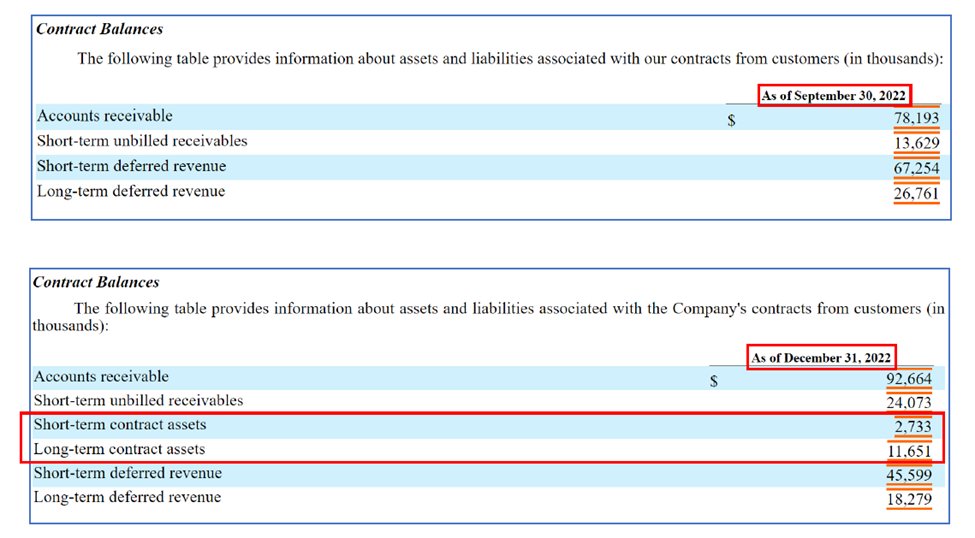

(4/x) Unbilled receivables & contract assets have blown out. Unbilled receivables no longer getting billed. Contract assets, mostly long-term, emerged for the first time in Q422. Both developments consistent with revenue inflation/contract accounting shenanigans.

(5/x) Inventory days have skyrocketed. This is a problem for any company, but implies something worse for $OLED. A special agreement whereby its third-party manufacturer can “put” excess (unused) raw materials back to $OLED means inventory days deserve special attention.

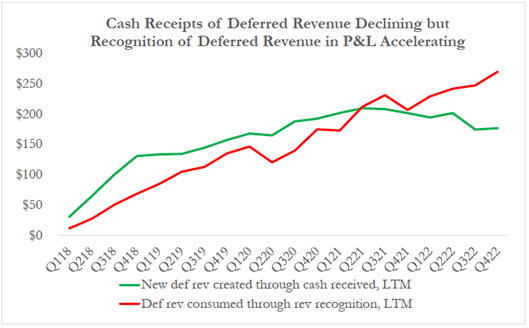

(6/x) $OLED’s deferred revenue creation has fallen, while recognition of revenues from the existing deferred revenue balance has accelerated.

This combination is incompatible with business growth but compatible with revenue inflation/manipulation.

This combination is incompatible with business growth but compatible with revenue inflation/manipulation.

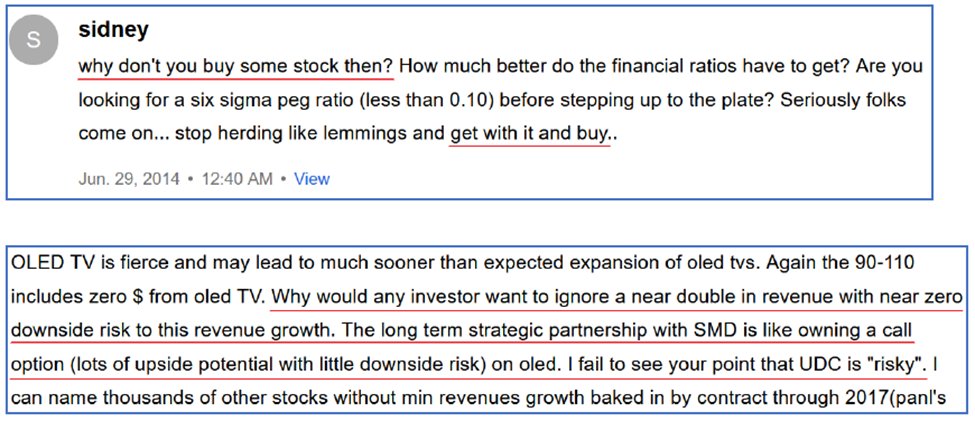

(7/x) Longtime CFO left in Q422 after overseeing $OLED’s financial reporting for decades. Speaking of this CFO, whose name is Sidney, we were surprised to discover a Seeking Alpha commentator, “sidney”, who is obsessed with $OLED…

(8/x) “sidney” has been touting $OLED on Seeking Alpha for over a decade, but has rarely had anything to say about other stocks. In 2011 he said he’d been “exhaustively” studying $OLED for 16 years. Guess who became CFO of $OLED 16 years before 2011? Sidney Rosenblatt.

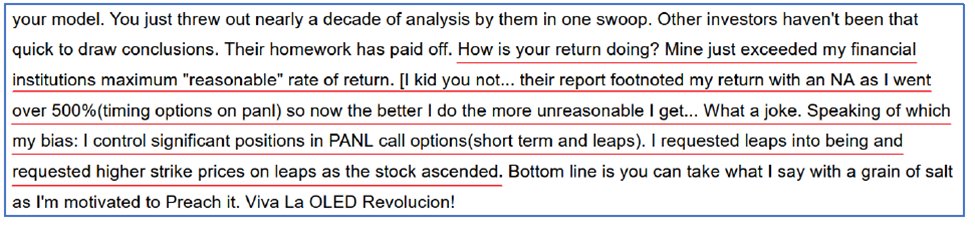

(9/x) Some of “sidney’s” concerning posts include phenomenally prescient calls on quarters and dividend hikes, bragging about profitably “timing options” in $OLED (or its old ticker, PANL), thanking Seeking Alpha authors for their coverage of the stock…

(12/x) $OLED should investigate this stock promoter and confirm or deny whether “sidney” is in fact the longtime $OLED CFO who oversaw its accounting practices when these apparent accounting shenanigans took place.

(13/x) $OLED’s recent contract renewal with its 40% customer is seen as de-risking the story, but investors have this backwards. This renewal replaces an older contract that was struck when $OLED’s critical patent was still in force. New contract terms hit the P&L in Q123.

(14/x) Rounding out our analysis: a triple-digit FCF multiple (and free cash flow is flat to declining), an 8% capex/sales ratio for an R&D company with outsourced manufacturing, and a history of dramatic guidance slashes.

(15/x) Short interest is only 1.9% of float.

Market cap of $7bn. Stock is up 34% YTD.

Full report at jehoshaphatresearch.com. You can also read all our other research reports there.

Market cap of $7bn. Stock is up 34% YTD.

Full report at jehoshaphatresearch.com. You can also read all our other research reports there.

• • •

Missing some Tweet in this thread? You can try to

force a refresh