I'm really glad you corrected me, Lisa. People are always really glad when they're corrected. - Homer Simpson

How to get URL link on X (Twitter) App

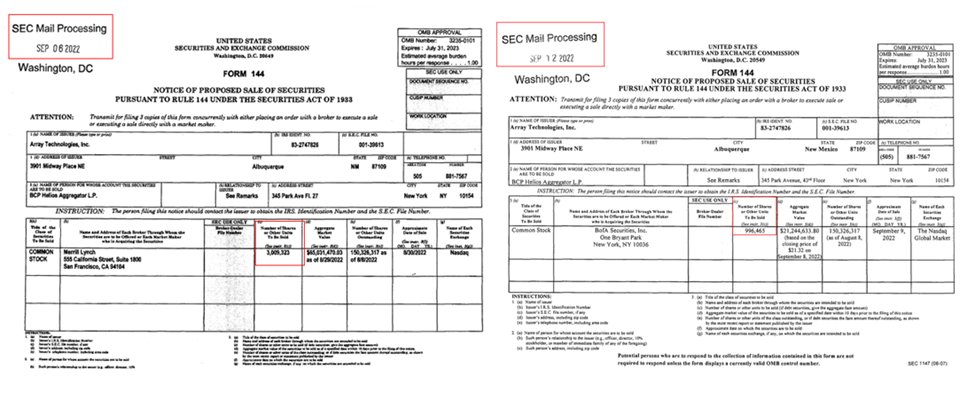

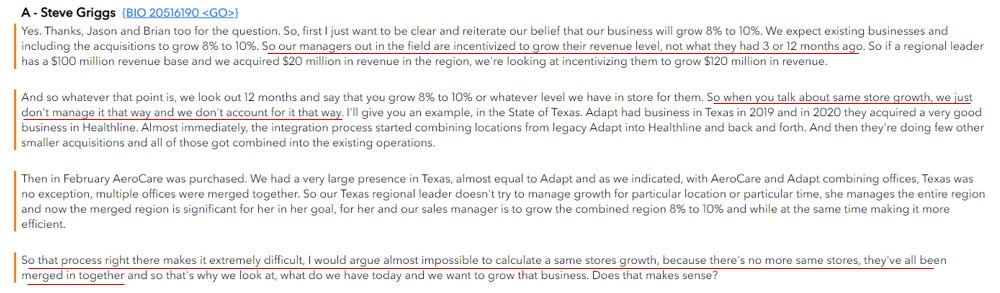

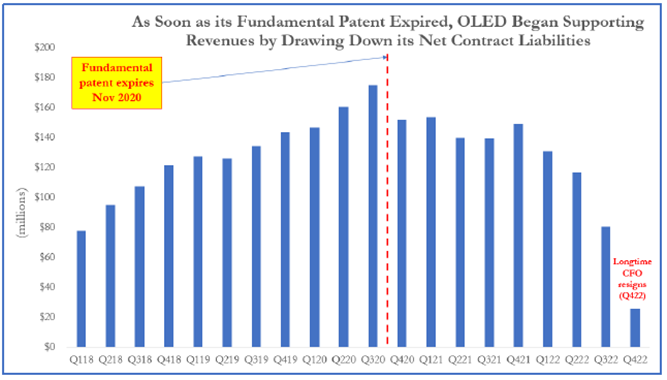

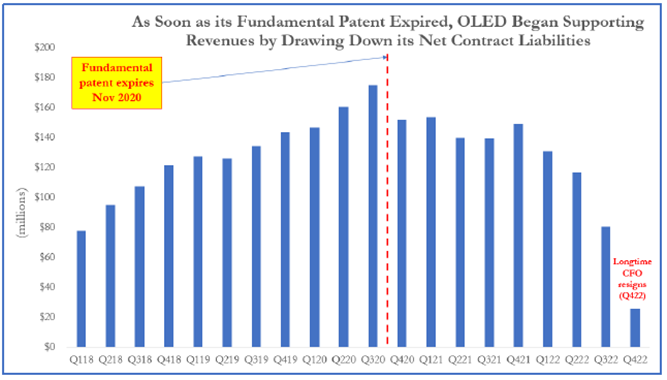

(2/x) We believe TTI’s income has been inflated for many years, but the inflation has gotten more and more aggressive as the web of deceit has gotten harder to maintain.

(2/x) We believe TTI’s income has been inflated for many years, but the inflation has gotten more and more aggressive as the web of deceit has gotten harder to maintain.

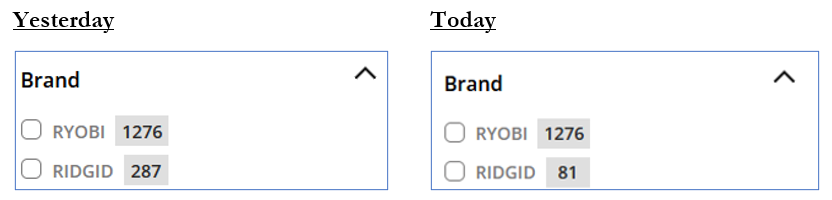

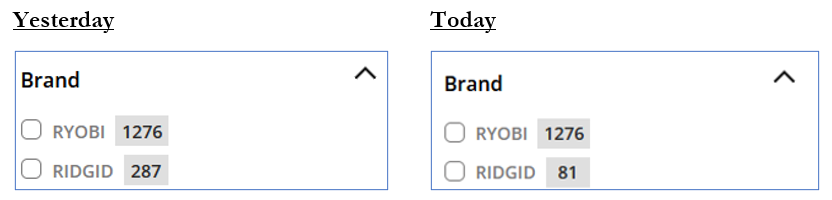

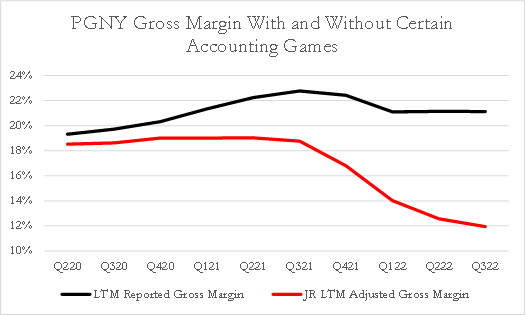

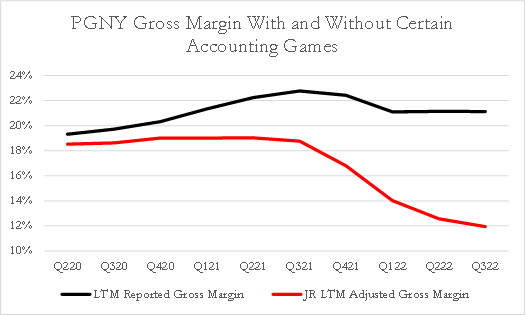

(2/8) Three quick steps to inflating profits:

(2/8) Three quick steps to inflating profits: