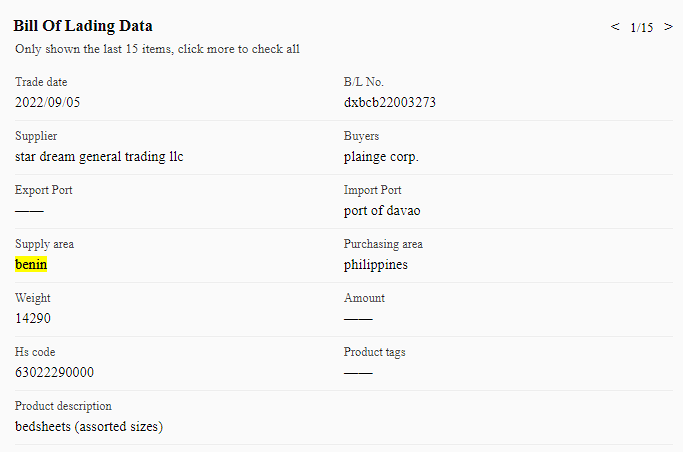

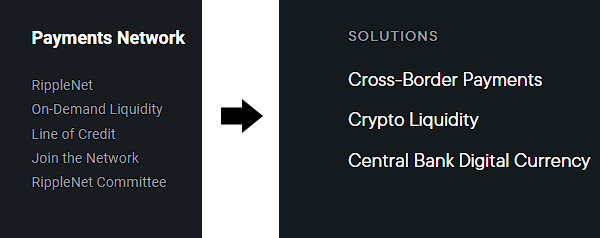

Observation: #Ripple has actually doubled down on crypto, moving away from marketing themselves as a plain payments network. They used to advertise RippleNet w/ crypto options. Now they market themselves as crypto for enterprise, pushing the pay network off center stage. 1/3

If this isn't a change, it could be important corporate clarity. They are not one payments network among many, a Wise or Visa competitor. They are fundamentally about crypto, the XRPL in particular, and this is better reflected in the marketing now.

2/3

2/3

A lot of what #Ripple does is interpreted through the SEC lawsuit, with good reason, but this public product refinement looks more like leaning into the crypto world as a credible org than trying to present as a payments network using crypto. Is it more appealing to tradfi? 3/3

Note - the initial tweet shows the front page in 2021 and also today, if you're curious.

[shameless plug] Otherwise, there's this:

[shameless plug] Otherwise, there's this:

https://twitter.com/WKahneman/status/1640475370939092992

(Sadly, I know pundits will want to seize on these tweets & try to frame it as an indictment. That is not my point. The numbers bear otherwise. I am trying to observe what I hope is a refining process to be well positioned in the market.)

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter