Withdrawals have been live on #Ethereum for almost 2 weeks, and now that the chaos of #Shapella has subsided, I thought it was time for a 🧵on the trends we’ve been seeing. 👇

Note: the time of the Shapella upgrade is annotated on all of these charts.

Note: the time of the Shapella upgrade is annotated on all of these charts.

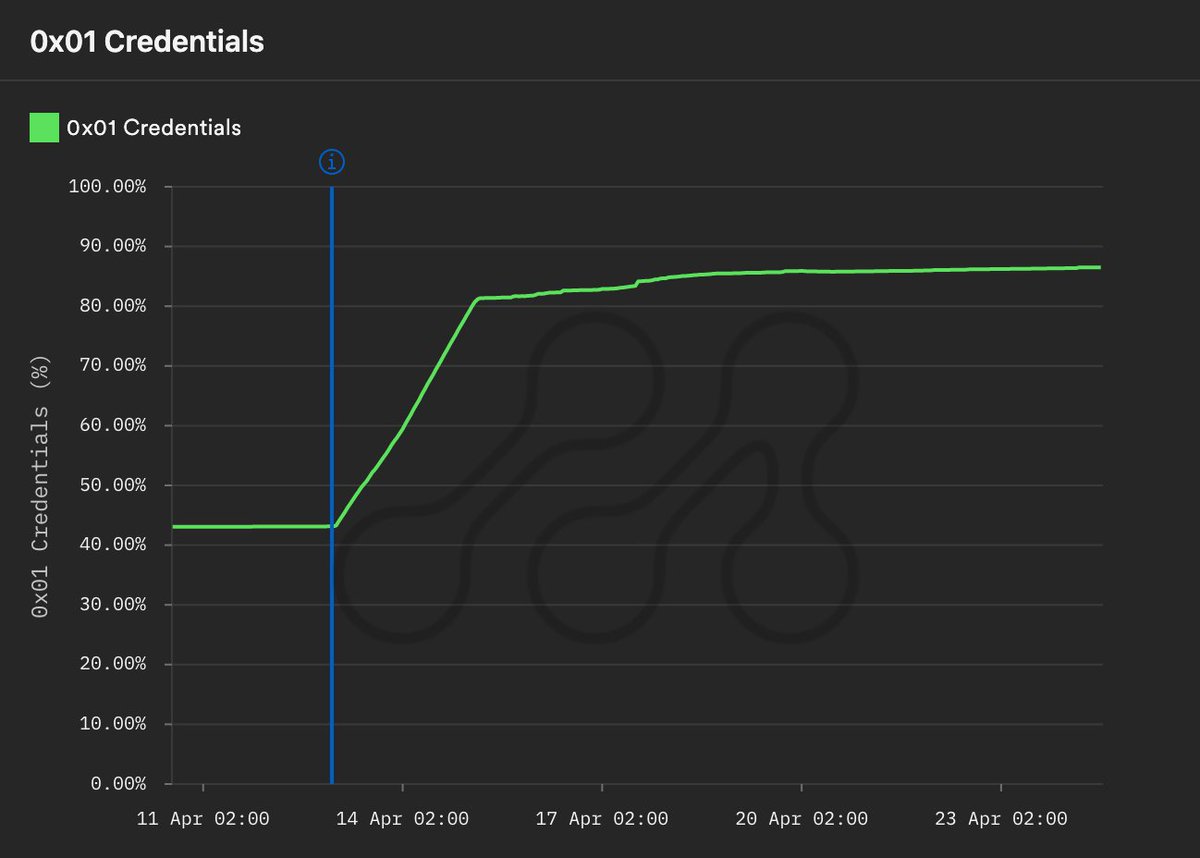

1/ Shapella enabled validators to change their withdrawal credentials, this is required to receive withdrawals if they weren’t set when creating the validator. For the first 48hrs, ~4k credentials were processed an hour. Since then they have been few and far between.

2/ The proportion of validators with 0x01 (withdrawable) credentials has subsequently increased by just over 40% and is now sitting at ~86.5%.

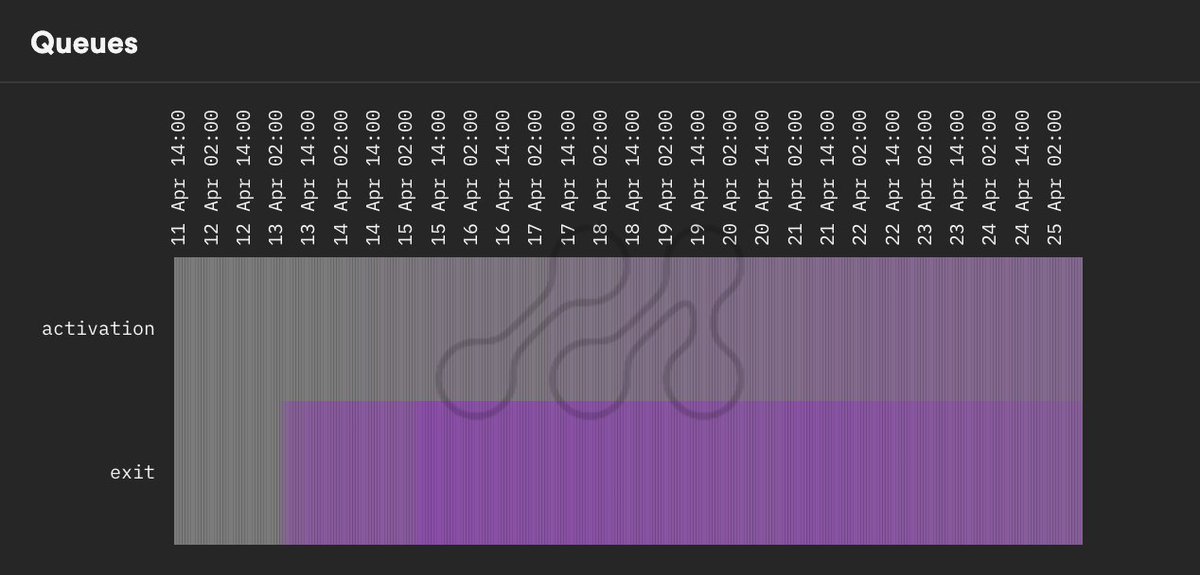

3/ The exit queue has been on fire 🔥 since the upgrade and currently contains ~15.6k validators, these validators are still required to perform their duties and only 8 may exit per epoch given the size of the current validator set (561.7k).

4/ There was no particular reason for node operators to wait until Shapella to exit their validators, if anything it would have made sense to begin exiting earlier so they received their full withdrawals ASAP.

5/ Given that the vast majority of these exits have been from @krakenfx, it would seem that “exiting after Shapella” may have been part of their agreement with the SEC.

Despite Kraken, the activation queue is also on fire 🔥, currently containing over 10k validators.

Despite Kraken, the activation queue is also on fire 🔥, currently containing over 10k validators.

@krakenfx 6/ This is likely due to validator reshuffling, compounding of rewards into new validators, @Rocket_Pool 8-ETH bonded minipools since their Atlas upgrade 🚀, and institutional stakers that have been waiting for withdrawals.

@krakenfx @Rocket_Pool 7/ In the past two weeks, there have been ~21.5k activations and ~22.5k exits, resulting in a net change of about -1k. Whilst both queues are full, and processing 8 validators per epoch, the number of active validators will remain stable.

@krakenfx @Rocket_Pool 8/ This visualisation of staked $ETH moving through the validator states shows the exit (pink) and activation (light blue) queues and inactive validators waiting for withdrawals (orange + dark blue).

@krakenfx @Rocket_Pool 9/ The total staked $ETH has reduced since Shapella, mainly due to partial withdrawals which have contributed about 25% more to the total $ETH withdrawn than full withdrawals.

@krakenfx @Rocket_Pool 10/ The steps in this chart correspond to the sweep; the sweep starts at the older validators, that have accumulated more rewards, as it makes its way through the validator set the size of withdrawals decreases.

@krakenfx @Rocket_Pool 11/ The sweep is even more pronounced when looking at the average withdrawal sizes. Interestingly, the second sweep actually has larger partial withdrawals, as OG validators, with greater accrued rewards, missed the first sweep whilst getting their credentials changed.

@krakenfx @Rocket_Pool 12/ The two largest withdrawers are Kraken and Lido, so far withdrawing 600k ETH and 264k ETH respectively. It's worth noting that the Lido withdrawal address has only received partial withdrawals.

So what has been the effect on ETH’s circulating supply?

So what has been the effect on ETH’s circulating supply?

@krakenfx @Rocket_Pool 13/ We define circulating supply as the amount of Eth on the execution layer, excluding the balance of the one-way validator deposit contract. It is increased by withdrawals and decreased by fee burns and validator deposits/activations.

@krakenfx @Rocket_Pool 14/ The start of each sweep has caused short-term inflation of the circulating supply but the downtrend resumes once the larger withdrawals have been processed. It seems likely that it will continue its high-timeframe downtrend, and remain @ultrasoundmoney. 🦇🔊

@krakenfx @Rocket_Pool @ultrasoundmoney 15/ If you’re interested to read more, we’ve written a blog post covering this and the upgrade itself in more detail: medium.com/@metrikaco/sha…

@krakenfx @Rocket_Pool @ultrasoundmoney 16/ You can also listen to the Spaces I did going over this with @christine_dkim, @TimBeiko, @metachris, and others from @galaxyhq: twitter.com/i/spaces/1LyxB…

@krakenfx @Rocket_Pool @ultrasoundmoney @christine_dkim @TimBeiko @metachris @galaxyhq 17/ Thanks to @ethereum for sponsoring our Withdrawals dashboard! All of these charts, plus lots more, can be found at @metrikaco: eth.metrika.co

Happy withdrawing!

Happy withdrawing!

• • •

Missing some Tweet in this thread? You can try to

force a refresh