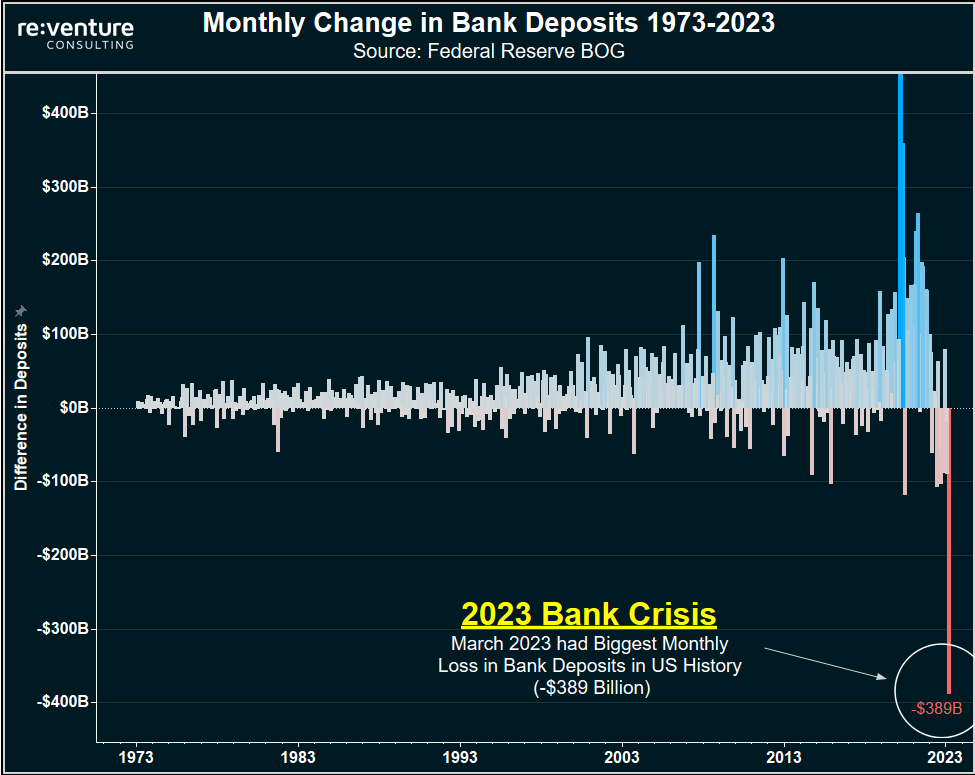

Money Supply contracts again in March. 📉

This is a massive economic warning. Money Supply contraction hasn't happened in 90 years.

Only other times it has happened we had Depression / Major Banking Crisis.

This is a massive economic warning. Money Supply contraction hasn't happened in 90 years.

Only other times it has happened we had Depression / Major Banking Crisis.

1) Other periods of Money Supply Contraction other than 2023:

-Great Depression 1929

-Depression of 1921

-Panic of 1893

-1870s Banking Crisis

All previous situations had unemployment rate north of 10%. And massive bank failures.

-Great Depression 1929

-Depression of 1921

-Panic of 1893

-1870s Banking Crisis

All previous situations had unemployment rate north of 10%. And massive bank failures.

2) What's amazing to me is how NO ONE is paying attention to this.

Fed is sucking money out of the system through QT. Just while banks are at beginning of a credit crunch.

And stock/real estate investors are still "risk on". Insane.

Fed is sucking money out of the system through QT. Just while banks are at beginning of a credit crunch.

And stock/real estate investors are still "risk on". Insane.

3) Look at First Republic's earnings report to see how this money supply contraction works in practice.

First Republic's deposits were down -36% YoY. 📉

But their loans were still up +23% YoY. 📈

That's not sustainable.

First Republic's deposits were down -36% YoY. 📉

But their loans were still up +23% YoY. 📈

That's not sustainable.

4) So now First Republic is having to severely CUT BACK it's loan portfolio.

To bring their balance sheet back into balance to account for lower deposits.

Which means fewer available mortgages, business loans, and overall money in economy.

To bring their balance sheet back into balance to account for lower deposits.

Which means fewer available mortgages, business loans, and overall money in economy.

5) What's so problematic about this money supply contraction is that inflation is STILL an issue.

So businesses will have less access to capital just as they need it most to pay for expenses and payroll expansion.

Yikes. That's a recipe for mass bankruptcies and layoffs.

So businesses will have less access to capital just as they need it most to pay for expenses and payroll expansion.

Yikes. That's a recipe for mass bankruptcies and layoffs.

6) Especially because of the massive Corporate Debt Bubble that has been fueling the economy for the last 10 years.

$20 Trillion in Corporate/Business Debt at end of 2022.

Double the level in 2008.

$20 Trillion in Corporate/Business Debt at end of 2022.

Double the level in 2008.

7) What happens to all those levered Corporations / Businesses when money supply contracts?

Doesn't take a rocket scientist to figure it out.

Big layoffs. And big shutdowns.

Doesn't take a rocket scientist to figure it out.

Big layoffs. And big shutdowns.

8) But most people are writing off these possibilities.

Simply because "they haven't happened yet".

Which I understand to some degree. "Recession" has been discussed for a year. And it hasn't gotten real yet.

But that doesn't mean it won't.

Simply because "they haven't happened yet".

Which I understand to some degree. "Recession" has been discussed for a year. And it hasn't gotten real yet.

But that doesn't mean it won't.

9) The ignorance of the Fed to these realities is shocking.

They rarely, if at all, discuss money supply. Just interest rates.

But I suspect that will change over the next 3-6 months. Because if money supply keeps contracting, there will be big problems.

They rarely, if at all, discuss money supply. Just interest rates.

But I suspect that will change over the next 3-6 months. Because if money supply keeps contracting, there will be big problems.

10) Of course - I don't have a crystal ball. Just evidence from history about what happens to economy when money supply contracts.

Maybe I'm wrong and banks will get aggressive with lending again in 2023.

And Fed will pivot earlier than expected, thereby "saving the day".

Maybe I'm wrong and banks will get aggressive with lending again in 2023.

And Fed will pivot earlier than expected, thereby "saving the day".

11) But based on current chess board, it seems like Fed is determined to hike/tighten until inflation is down to 2%.

Just as banks are getting scared. And cutting back on lending.

Tough combo for a debt-bubble economy to handle.

Just as banks are getting scared. And cutting back on lending.

Tough combo for a debt-bubble economy to handle.

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter