The House of Republicans has passed a bill to raise the Debt Ceiling to 1.5T$

Let's understand what the implications are going forward, for the US #Liquidity conditions and financial markets:

How will impact Crypto and equity risk?

a 🧵 👇

Let's understand what the implications are going forward, for the US #Liquidity conditions and financial markets:

How will impact Crypto and equity risk?

a 🧵 👇

https://twitter.com/WatcherGuru/status/1651343288639553536?s=20

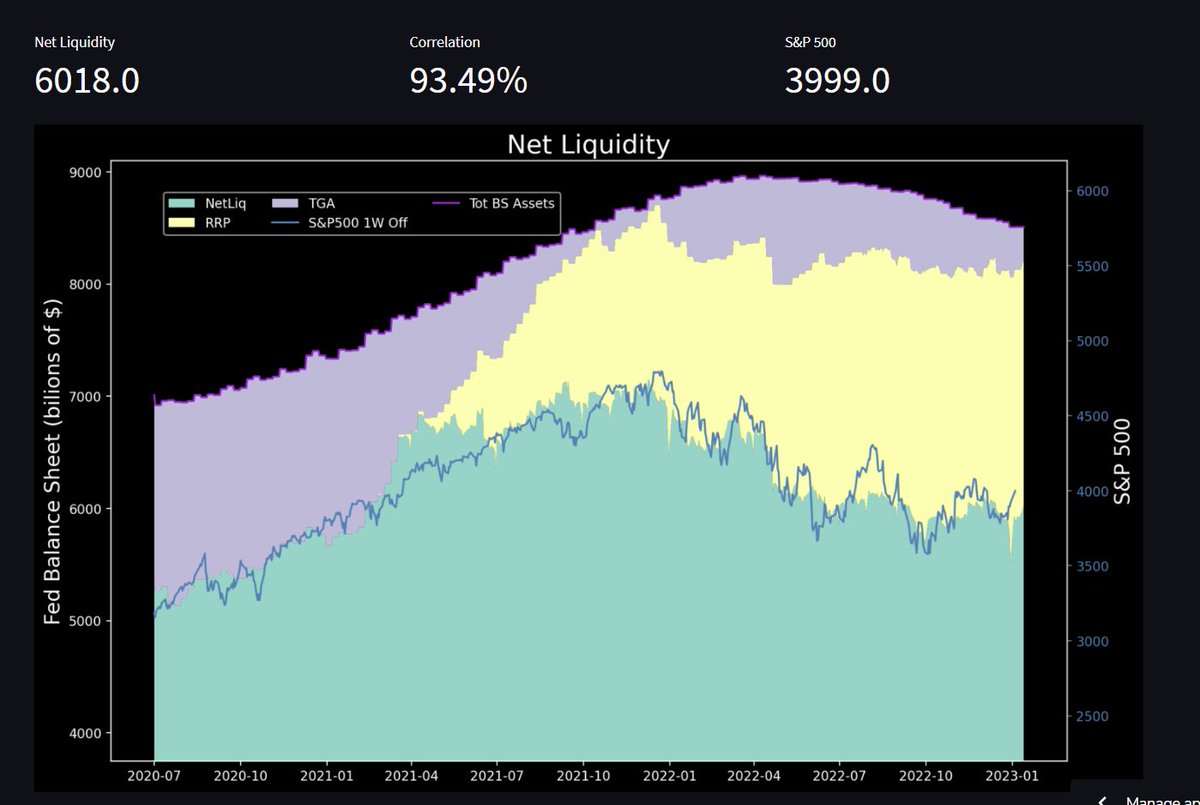

To understand the matter and the implications of the bill one should first understand the basics of US #Liquidity:

🟡 Repo market (RRP)

🟣 Treasury General Account (TGA)

Tot Fed's Balance sheet Assets - ( 🌕RRP +🟣 TGA) =

🟢 Net US Liquidity

🟡 Repo market (RRP)

🟣 Treasury General Account (TGA)

Tot Fed's Balance sheet Assets - ( 🌕RRP +🟣 TGA) =

🟢 Net US Liquidity

I've created a few shorts on YT 🎬 to explain the details and mechanics of each component of the formula.

On the Repo:

On the Repo:

On the TGA:

On Net Liquidity:

By now you should understand that as the RRP or the TGA grow, #Liquidity is sucked out of the system and that the withdrawal has a very tight correlation with financial assets.

Notice the correlation scores over the last 2 years 👇

Notice the correlation scores over the last 2 years 👇

https://twitter.com/Liscivia_/status/1650055366695059456?s=20

During these last months, the Debt Ceiling imposed a cap that forced the Treasury to spend its content into the economy.

That acted as a bullish catalyst while this forced spending effectively counteracted QT from the Federal Reserve.

That acted as a bullish catalyst while this forced spending effectively counteracted QT from the Federal Reserve.

https://twitter.com/Liscivia_/status/1624720907229954048?s=20

This 1.5T bill will allow the TGA to grow its balance, which was growing smaller and smaller, raising concerns over the political decision and eventually the solvency of the US debt, unleashing tremendous volatility in the Treasury markets.

https://twitter.com/Liscivia_/status/1649097494767489024?s=20

The bill won't actually 'print' the money for the Treasury, it will be American and international investors to finance the TGA, through the purchase of the newly minted securities that it will issue.

The issuance of new debt:

🔴 T-Bonds

🔵 T-Notes

🟢 T-Bills

Will dilute the current outstanding supply, pressuring prices ↓ and pushing rates ↑

🔴 T-Bonds

🔵 T-Notes

🟢 T-Bills

Will dilute the current outstanding supply, pressuring prices ↓ and pushing rates ↑

So, the first implication for risk assets is:

a) Rates 📈 = Prices 📉

but also, since the liquidity to finance the purchase of those bonds will mainly come from the public, the second implication is:

b) 🟣 TGA #Liquidity ↑ = 🟢 Net #Liquidity ↓

a) Rates 📈 = Prices 📉

but also, since the liquidity to finance the purchase of those bonds will mainly come from the public, the second implication is:

b) 🟣 TGA #Liquidity ↑ = 🟢 Net #Liquidity ↓

At this stage, the bill has yet to be approved by the US Senate

but the volatility in the Treasury markets, especially at the front-end of the curve, due to the supply constraints for short-term Treasuries imposed by the ceiling, is probably going to speed up the process.

but the volatility in the Treasury markets, especially at the front-end of the curve, due to the supply constraints for short-term Treasuries imposed by the ceiling, is probably going to speed up the process.

Coupling this fundamental macro-analysis with some TA paints a very grim picture:

https://twitter.com/Liscivia_/status/1649310660428275712?s=20

Not to mention that:

https://twitter.com/GRDecter/status/1649757261856645120?s=20

As always, we stand @ a critical juncture for markets. ⚠️

I would be skeptic calling this a bull market in face of an upcoming recession, consider that:

- The beginning of a recession has *never* been bullish

- Everytime it looked like a soft-landing before it became 'hard'

I would be skeptic calling this a bull market in face of an upcoming recession, consider that:

- The beginning of a recession has *never* been bullish

- Everytime it looked like a soft-landing before it became 'hard'

The next FOMC meeting happens next week, so take care

I think $PEPE szn is over ☠️

Tagging some friends and chads for visibility:

@OuroborosCap8 @crypto_condom @ColeGarnerXBT

@ByzGeneral @RunnerXBT @cryptobrucey @ape_rture

@0xLordAlpha @hansolar21 @DeFiMinty @CC2Ventures

I think $PEPE szn is over ☠️

Tagging some friends and chads for visibility:

@OuroborosCap8 @crypto_condom @ColeGarnerXBT

@ByzGeneral @RunnerXBT @cryptobrucey @ape_rture

@0xLordAlpha @hansolar21 @DeFiMinty @CC2Ventures

• • •

Missing some Tweet in this thread? You can try to

force a refresh