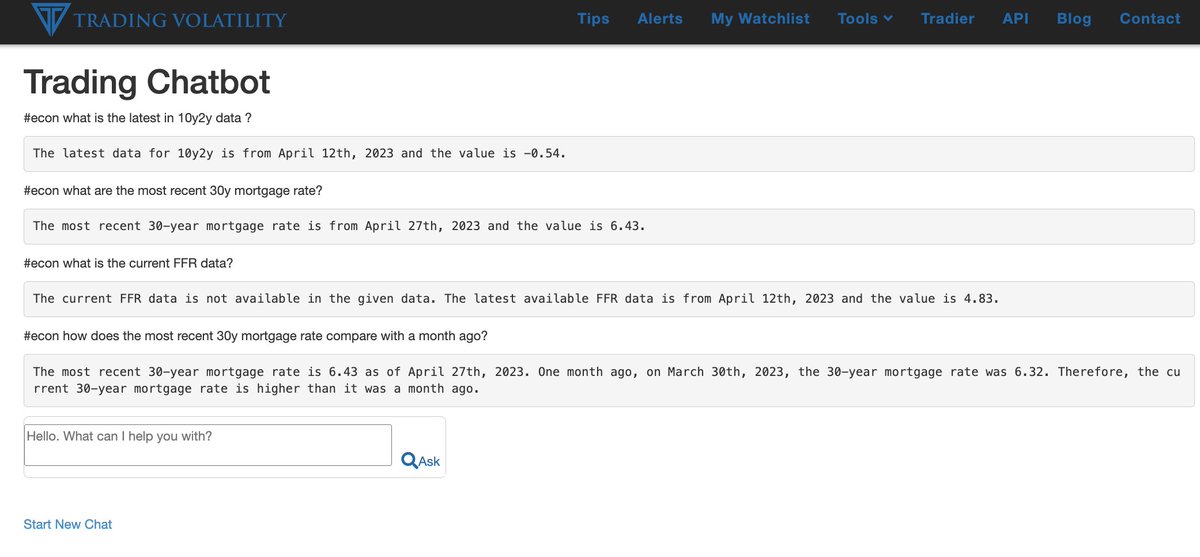

ChatGPT can already be used to perform various tasks related to finance and stocks & options trading, including:

1) get stock and options data for summarizing data:

#stocks

Examples:

- calculate the sum of the call options volume for all strikes in $SPY for an expiration

-… twitter.com/i/web/status/1…

1) get stock and options data for summarizing data:

#stocks

Examples:

- calculate the sum of the call options volume for all strikes in $SPY for an expiration

-… twitter.com/i/web/status/1…

2) use probabilities to identify a day's likely closing price.

https://twitter.com/TradeVolatility/status/1651949539568529408

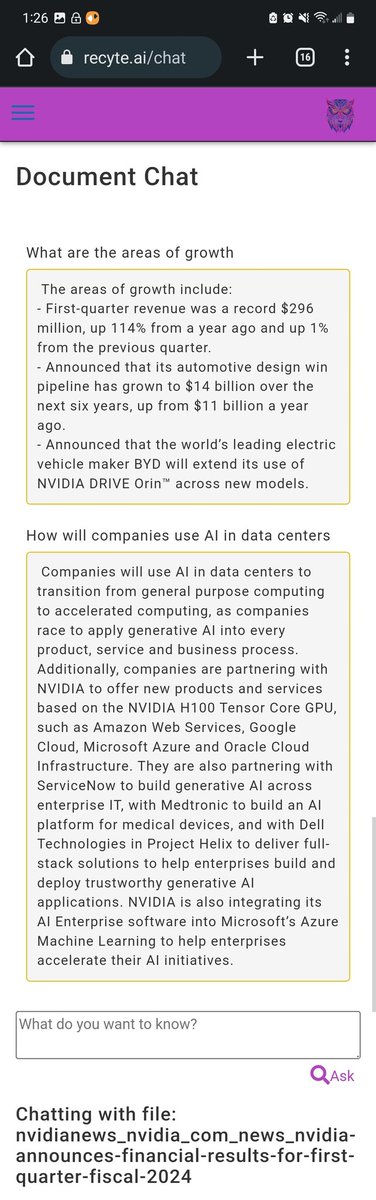

3) Obtain and summarize earnings reports

https://twitter.com/TradeVolatility/status/1651233116864802825

5) Added in some contextual awareness, which will be critical when we start feeding the bot large dataframes.

#ChatGPT

#ChatGPT

6) Added some multi-variable queries into our ChatGPT project.

💪

Thank you @hwchase17 and others for building an easy framework!!

Every day brings new capabilities! 🤖

💪

Thank you @hwchase17 and others for building an easy framework!!

Every day brings new capabilities! 🤖

• • •

Missing some Tweet in this thread? You can try to

force a refresh