In theory, patents are for novel, nonobvious inventions. But as computers ate our society, grifters began to receive patents for "doing something we've done for centuries...with a computer." "With a computer": three words with the power to cloud patent examiners' minds.

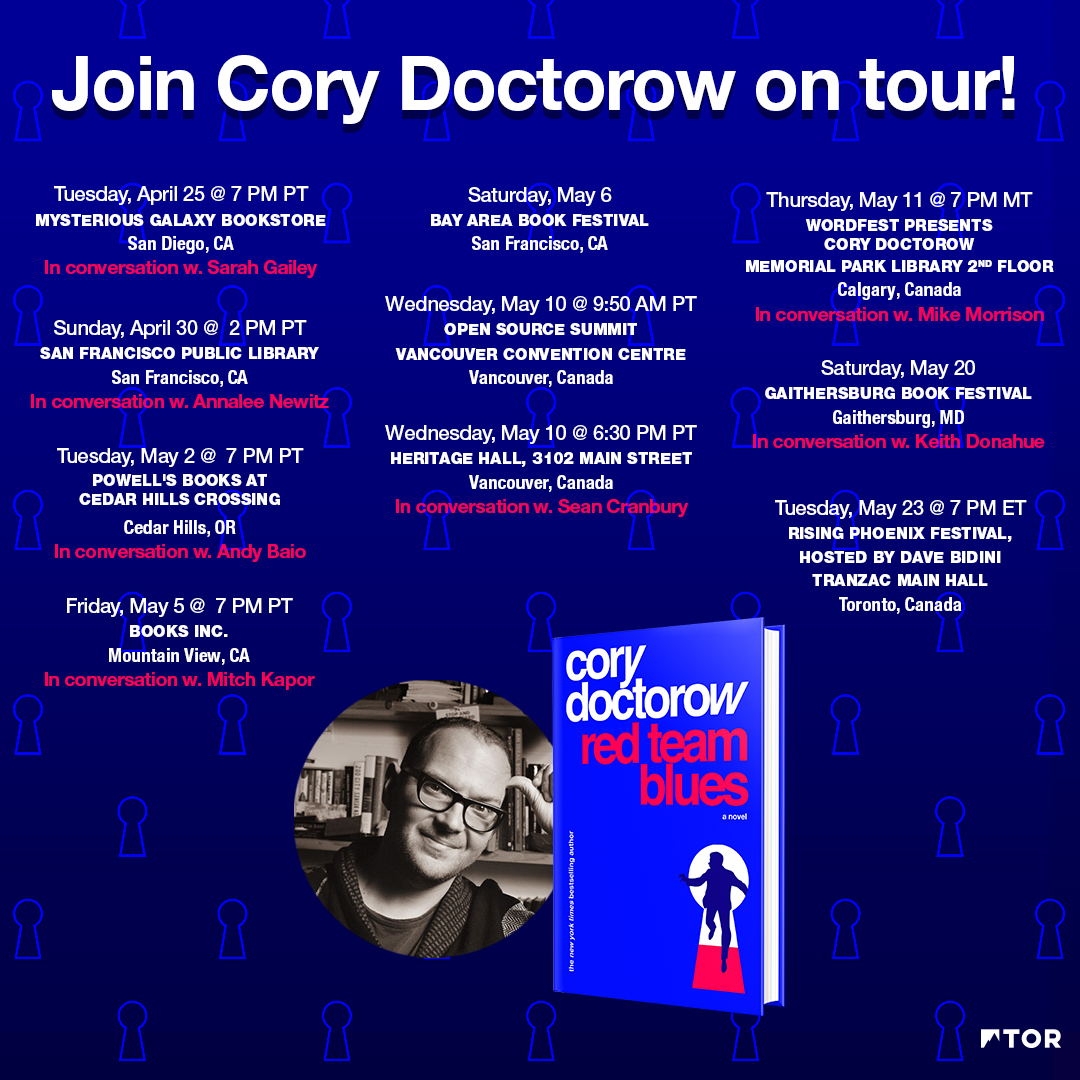

1/

1/

If you'd like an essay-formatted version of this thread to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

pluralistic.net/2023/05/01/usu…

2/

pluralistic.net/2023/05/01/usu…

2/

#PatentTrolls - who secure "with a computer" patents and then extract ransoms from people doing normal things on threat of a lawsuit - are an underappreciated form of "#TechExceptionalism."

3/

3/

Normally, "tech exceptionalism" refers to bros who wave away things like privacy invasions by arguing that "with a computer" makes it all different. These tech exceptionalists are the legit face of tech exceptionalism, the Forbes 30 Under 30 set.

4/

4/

They're grifters, but they're *celebrated* grifters. There's a whole bottom-feeding sludge of tech exceptionalists that don't get the same kind of attention, like patent trolls.

Oh, and the #fintech industry.

5/

Oh, and the #fintech industry.

5/

As @raaleh says, "when you hear 'fintech,' think: 'unlicensed bank.'" The majority of fintech "innovation" consists of adding "with a computer" to highly regulated activities and declaring them to be *unregulated* (and, in the case of crypto, *unregulatable*).

6/

6/

There are a lot of heavily regulated financial activities, like dealing in securities (something the crypto industry is *definitely* doing and claims it isn't). Most people don't buy or sell securities regularly - indeed, most Americans own little or no stocks.

7/

7/

But you know what regulated financial activity a lot of Americans participate in?

Going into debt.

8/

Going into debt.

8/

As wages stagnate and the price of housing, medical care, childcare, transportation and education soar, Americans fund their consumption with debt. Trillions of dollars' worth of debt.

9/

9/

Many of us get to borrow by walking into a bank and asking for a loan, but millions are denied that genteel path.

Instead, working Americans increasingly rely on #PaydayLenders, usurers who charge sky-high interest penalties and fees, trapping borrowers in endless debt.

10/

Instead, working Americans increasingly rely on #PaydayLenders, usurers who charge sky-high interest penalties and fees, trapping borrowers in endless debt.

10/

This is an historical sign of a civilization in decline: productive workers require loans to engage in useful activities. Normally, the activity pans out - the crop comes in, say - and the debt is repaid.

But eventually, you'll get a bad beat.

11/

But eventually, you'll get a bad beat.

11/

The crop fails, the workshop burns down, a pandemic shuts down production. Instead of paying off your debt, you have to roll it over. Now, you're in an even worse situation, and the next time you catch a bad break, you go further into debt.

12/

12/

Over time, all production comes under the control of creditors. The historical answer to this is #jubilee: a regular wiping-away of *all* debt. While this was often dressed up in moral language, there was an absolutely practical rationale for it.

13/

13/

Without jubilee, eventually, all the farmers stop growing food so that they can grow ornamental flowers for their creditors' tables. Then, as starvation sets in, civilization collapses:

pluralistic.net/2022/07/08/jub…

14/

pluralistic.net/2022/07/08/jub…

14/

As the historian Michael Hudson says, "Debts that can't be paid, won't be paid." Without jubilee, indebtedness becomes chronic and inescapable. As more creditors attach their claims to debtors' assets, they compete to terrorize the debtor into paying them off first.

15/

15/

One creditor might threaten to garnish your paycheck. Another, to repossess your car. Another, to evict you from your home. Another, to break your arm.

16/

16/

Debts that can't be paid, won't be paid - but when you have a choice between a broken arm and stealing from your kid's college fund or the cash-register, maybe the debt can be paid...a little.

17/

17/

Of course, digital tools offer all kinds of exciting new tools for arm-breakers - immobilizing your car, say, or deleting the apps on your phone, starting with the ones you use most often:

pluralistic.net/2021/04/02/inn…

18/

pluralistic.net/2021/04/02/inn…

18/

Under Trump, payday lenders *romped* through America. A lobbyist for the payday lenders became a top Trump lawyer:

theintercept.com/2017/11/27/whi…

19/

theintercept.com/2017/11/27/whi…

19/

This lobbyist then oversaw Trump's appointment of a #ConsumerFinanceProtectionBureau boss who deregulated payday lenders, opening the door to *triple digit* interest rates:

latimes.com/business/lazar…

20/

latimes.com/business/lazar…

20/

To justify this, the payday loan industry found corruptible academics and paid them to write papers defending payday loans as "inclusive." These papers were secretly co-authored by payday loan industry lobbyists:

washingtonpost.com/business/2019/…

21/

washingtonpost.com/business/2019/…

21/

Of course, Trump doesn't read academic papers, so the payday lenders also moved their annual conference to a Trump resort, writing the President a check for $1m:

propublica.org/article/trump-…

22/

propublica.org/article/trump-…

22/

Biden plugged many of the cracks that Trump created in the firewalls that guard against predatory lenders. Most significantly, he moved @chopracfpb from the @FTC to the @CFPB, where, as director, he has overseen a determined effort to rein in the sector.

23/

23/

As the CFPB re-establishes regulation, the fintech industry has moved in to add "with a computer" to many regulated activities and so declare them beyond regulation.

One fintech "innovation" is the creation of a "direct to consumer #EarnedWageAccess" product.

24/

One fintech "innovation" is the creation of a "direct to consumer #EarnedWageAccess" product.

24/

Earned Wage Access is just a fancy term for a program some employers offer whereby workers can get paid ahead of payday for the hours they've already worked. The direct-to-consumer #EWA offers loans without verifying that the borrower has money coming in.

25/

25/

Companies like #Earnin claim their faux EWA are free, but everyone who uses the service pays for the "Lightning Speed" upsell.

Of course they do. Earnin charges sky-high interest rates and twists borrowers into *leaving a "tip"* for the loan (yes, you tip your loan-shark).

26/

Of course they do. Earnin charges sky-high interest rates and twists borrowers into *leaving a "tip"* for the loan (yes, you tip your loan-shark).

26/

Anyone desperate enough to pay triple-digit interest rates and *tip* the service for originating their loan is desperate and needs to the money *now*:

prospect.org/power/05-01-20…

EWA annual interest rates sit around *300%*.

27/

prospect.org/power/05-01-20…

EWA annual interest rates sit around *300%*.

27/

The average EWA borrower uses the service two or three times *per month*. EWA CEOs and lobbyists claim they're banking the unbanked - but in reality they're acting as sticky-fingered brokers between banks and young, poor workers, marking up traditional bank services.

28/

28/

This is rarely mentioned when EWA companies lobby state legislatures seeking to be exempted from usury rules that are supposed to curb predatory lenders. In Vermont, Earnin wants an exemption from the state's 18% interest rate cap - remember, the APR for EWA is about 300%.

29/

29/

In Texas, payday lenders are classed as loan *brokers*, not loan *originators* and are thus able to avoid the state's usury caps.

30/

30/

EWAs are lobbying the Texas legislature for further exemptions from state money-transmitter and usury limit laws, principally on the strength of the "it's different: we do it *with a computer*" logic.

31/

31/

But as @dorajfacundo writes for @TheProspect, quoting Monica Burks from @CRLONLINE, a loan is a loan even if it's with a computer:

> The industry is trying to create a new definition for what a loan is in order to exempt themselves from existing consumer protection laws…

32/

> The industry is trying to create a new definition for what a loan is in order to exempt themselves from existing consumer protection laws…

32/

> When you offer someone a portion of money on the promise that they will repay it, and often that repayment will be accompanied with fees or charges or interest, that's what a loan is."

33/

33/

Image:

Andre Carrotflower (modified)

commons.wikimedia.org/wiki/File:30_N…

CC BY-SA 4.0

creativecommons.org/licenses/by-sa…

eof/

Andre Carrotflower (modified)

commons.wikimedia.org/wiki/File:30_N…

CC BY-SA 4.0

creativecommons.org/licenses/by-sa…

eof/

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter