List of Some Useful Contact Numbers and Email id (Income Tax, GST, CBIC, TRACES, ICEGATE, Udhyam, NSDL Protean Tech, MCA)

https://twitter.com/TaxationUpdates/status/1632345361519112192?s=20

Password Format for Deductor and Tax Payer for TRACES Portal Services

https://twitter.com/TaxationUpdates/status/1631321135156715520?s=20

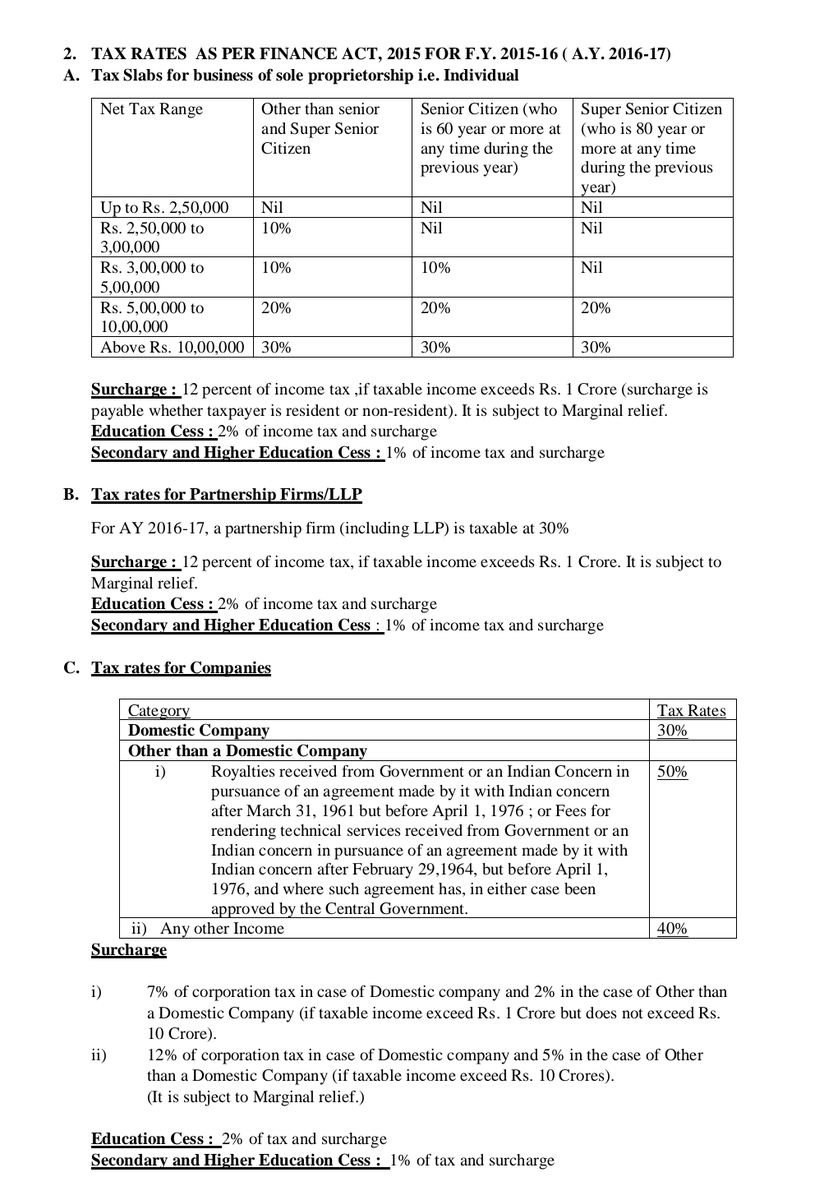

Tax Rates for last 8 assessment years (A.Y.15-16 to A.Y.22-23)

https://twitter.com/TaxationUpdates/status/1625895184683900930?s=20

Turnover Limit for GST Registration & Documents Required for GST Registration

https://twitter.com/TaxationUpdates/status/1579526258266079233?s=20

If Aggregate Turnover during FY 22-23 exceeds below specified amounts then following new compliances applicable w.e.f.01/04/2023

https://twitter.com/TaxationUpdates/status/1635988934869000194?s=20

Changes in Display of Form 26AS/Annual Tax Statement

https://twitter.com/TaxationUpdates/status/1626104119021957120?s=20

TDS on Rent (Pic 1) TDS on Sale of Immovable Property (Pic 2)

https://twitter.com/TaxationUpdates/status/1596817004941352960?s=20

Commonly Used TDS Sections with TDS Rates

https://twitter.com/TaxationUpdates/status/1643230275063926785?s=20

TDS/TCS Due Dates for Payment/Statement/Certificate for F.Y.2023-24

https://twitter.com/TaxationUpdates/status/1653348038629359617?s=20

Income Tax Return and Audit Due Date for A.Y.2023-24 (F.Y.2022-23)

https://twitter.com/TaxationUpdates/status/1646044650510356481?s=20

Note on ITR Filing options Till A.Y. 2023-24 and A.Y. 2024-25 onwards

https://twitter.com/TaxationUpdates/status/1647565424417206272?s=20

Income Tax Portal allows Tax Payment through various modes

https://twitter.com/TaxationUpdates/status/1642836011670700034?s=20

Some important points to be remembered with regard to e-Invoice

https://twitter.com/TaxationUpdates/status/1634771382239387650?s=20

Which Regime to be opted for different combinations of Income and Deduction along with Tax Amount based on that for AY 2024-25 (FY 2023-24) (Pic 1)

Income Tax Slab Rates for AY 2024-25 (Pic 2)

Income Tax Slab Rates for AY 2024-25 (Pic 2)

https://twitter.com/TaxationUpdates/status/1646827616568213508?s=20

Everything about TDS u/s 194Q and TCS u/s 206C(1H) (Pic 1 & 2)

Accounting Entries for TDS u/s 194Q and TCS u/s 206C(1H) (Pic 3)

Accounting Entries for TDS u/s 194Q and TCS u/s 206C(1H) (Pic 3)

https://twitter.com/TaxationUpdates/status/1640349683620143104?s=20

44AD APPLICABLE OR NOT?

https://twitter.com/TaxationUpdates/status/1636715802861907968?s=20

Section 44AA/44AB/44AD/44ADA of Income Tax Act, 1961-2023 (To whom it is Applicable and when it is applicable)

https://twitter.com/TaxationUpdates/status/1621412189704970240?s=20

Cash Transaction Limits under Income Tax Act

https://twitter.com/TaxationUpdates/status/1644256636176048130?s=20

If you have not received your Income Tax Refund then kindly do the below mentioned process once (It might help in knowing the status of Refund)

https://twitter.com/TaxationUpdates/status/1567103115677306880?s=20

Updated Return of Income (Section 139 (8A))

https://twitter.com/TaxationUpdates/status/1611981908174602243?s=20

Deduction u/s 80D - Deduction in Respect of Health Insurance Premium

https://twitter.com/TaxationUpdates/status/1653088519202684928?s=20

Reporting u/s 269SS & 269T in Income Tax Audit Report

https://twitter.com/TaxationUpdates/status/1562454752541126658?s=20

A wonderful compilation of threads and tweets that will definitely serve as a referencer for all the professionals

https://twitter.com/TaxationUpdates/status/1628027433076023297?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter