CA | Tweets are personal | Retweet ≠ endorsement 🇮🇳🇮🇳🇮🇳

How to get URL link on X (Twitter) App

Statutory Provision of Reverse Charge Mechanism

Statutory Provision of Reverse Charge Mechanism

Determination of Residential Status of an Individual

Determination of Residential Status of an Individual

https://twitter.com/TaxationUpdates/status/1647998538830471168?s=20

Credit to @abhishekrajaram

Credit to @abhishekrajaram https://twitter.com/abhishekrajaram/status/1579789604177477633?s=20

https://twitter.com/abhishekrajaram/status/1596711676174372864?s=20

Proposed Changes in Tax

Proposed Changes in Tax

Who is Required to Link PAN with Aadhaar:

Who is Required to Link PAN with Aadhaar:

1:Overview

1:Overview

Unlock e-filing account: 2 Option

Unlock e-filing account: 2 Option

T2

T2

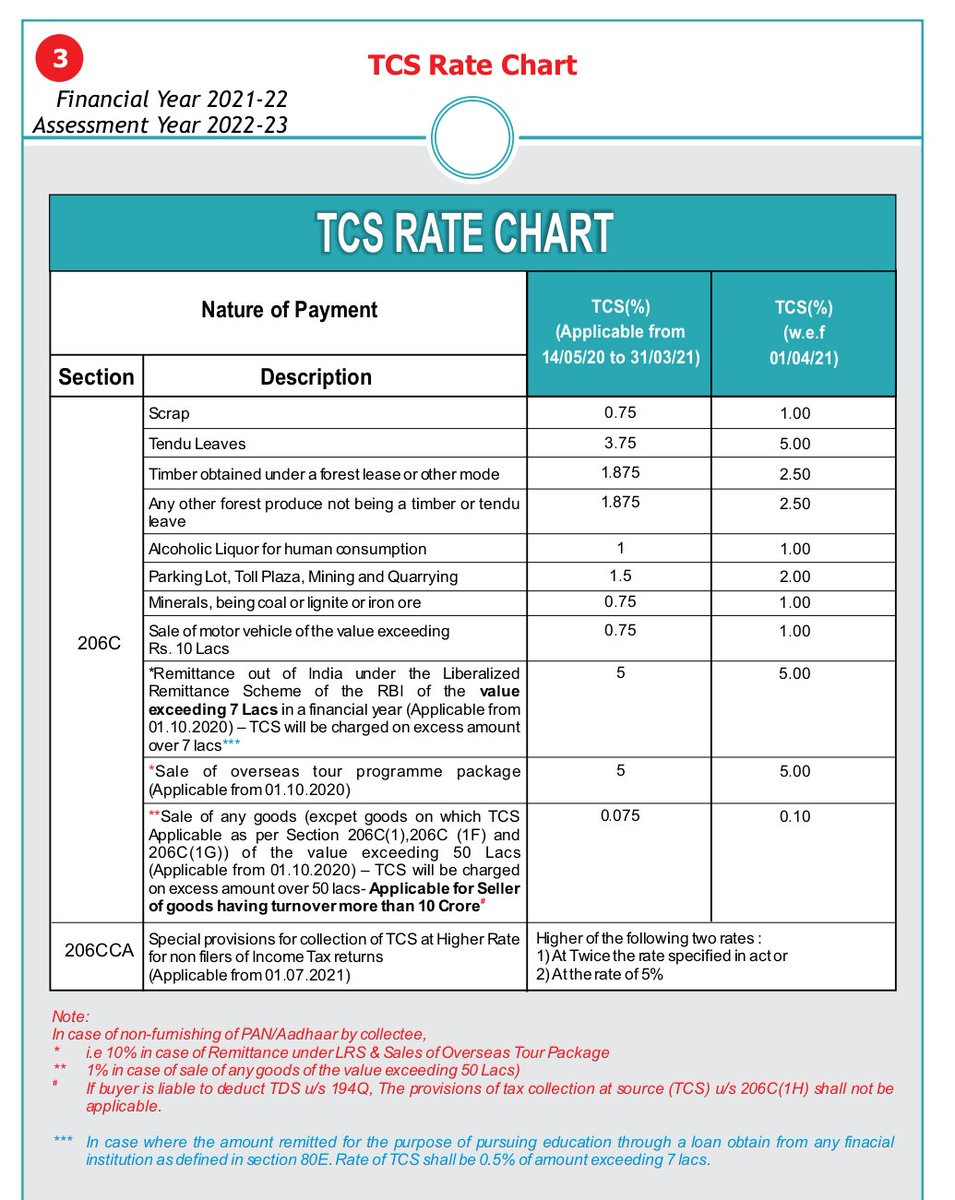

TCS Rate Chart

TCS Rate Chart

2. Please enable single GST Tax instead of IGST, CGST, SGST, Cess etc and currently there are too many different GST Rates (0, 0.1, 0.25, 0.5, 1, 1.5, 3, 5, 7.5, 12, 18, 28), so combines this GST Rates

2. Please enable single GST Tax instead of IGST, CGST, SGST, Cess etc and currently there are too many different GST Rates (0, 0.1, 0.25, 0.5, 1, 1.5, 3, 5, 7.5, 12, 18, 28), so combines this GST Rates

Update 2

Update 2