#Uranum biography 2⃣

John Borshoff, CEO of @DeepYellowLtd

Thread 🧵 1/25

When investing in the mining sector I believe there are 2 main factors one should consider when taking decisions:

1⃣ The Asset

2⃣ The Management

In these threads, we will concentrate on the CEO.

John Borshoff, CEO of @DeepYellowLtd

Thread 🧵 1/25

When investing in the mining sector I believe there are 2 main factors one should consider when taking decisions:

1⃣ The Asset

2⃣ The Management

In these threads, we will concentrate on the CEO.

2/25

Borshoff served in the Aussie Army during the Vietnam War, an experience that connected him with Dustin Garrow, who became a lifelong companion throughout John's #Uranium ventures. Both drew valuable lessons from their time in the war, which later influenced their careers.

Borshoff served in the Aussie Army during the Vietnam War, an experience that connected him with Dustin Garrow, who became a lifelong companion throughout John's #Uranium ventures. Both drew valuable lessons from their time in the war, which later influenced their careers.

3/25

John Borshoff relates the lessons he learned during his time in the Vietnam War, and how it impacted his corporate #Uranium experience:

John Borshoff relates the lessons he learned during his time in the Vietnam War, and how it impacted his corporate #Uranium experience:

4/25

John Borshoff obtained his Bachelor of Science in Geology from the University of Western Australia and started off his geological career in a company called International Nickel which was operating out of Australia at that time.

John Borshoff obtained his Bachelor of Science in Geology from the University of Western Australia and started off his geological career in a company called International Nickel which was operating out of Australia at that time.

5/25

John Borshoff: "The oil shock happened in '70-'71, and all hell broke loose. Where was the next energy fuel?” This search for alternative energy sources piqued John's interest in #uranium as a potential solution for the world's growing energy needs.

John Borshoff: "The oil shock happened in '70-'71, and all hell broke loose. Where was the next energy fuel?” This search for alternative energy sources piqued John's interest in #uranium as a potential solution for the world's growing energy needs.

6/25

John Borshoff then joined Canadian Superior Oil, which allowed him to work in Northern Australia and gain hands-on experience in the #uranium sector. "I joined a company called Canadian Superior Oil and worked a little bit there in about '73."

John Borshoff then joined Canadian Superior Oil, which allowed him to work in Northern Australia and gain hands-on experience in the #uranium sector. "I joined a company called Canadian Superior Oil and worked a little bit there in about '73."

7/25

After gaining experience in the #uranium sector, John Borshoff joined Uranerz, a West German group focused on uranium exploration & production. Uranerz was a large company with an international footprint, seeking to find uranium to support Germany's nuclear program.

After gaining experience in the #uranium sector, John Borshoff joined Uranerz, a West German group focused on uranium exploration & production. Uranerz was a large company with an international footprint, seeking to find uranium to support Germany's nuclear program.

8/25

During his time at Uranerz, John Borshoff expanded his knowledge & skills in the field of geology and the #uranium sector. "I worked there for 15 years until 1992 and got a tremendous experience, broad international spectral across not only geology but the full gamut."

During his time at Uranerz, John Borshoff expanded his knowledge & skills in the field of geology and the #uranium sector. "I worked there for 15 years until 1992 and got a tremendous experience, broad international spectral across not only geology but the full gamut."

9/25

Following Uranerz's withdrawal from Australia in 1992 due to political reasons, John Borshoff founded a consulting company to continue working in the uranium sector. "When they pulled out of Australia because of political reasons, I then formed a consulting company."

Following Uranerz's withdrawal from Australia in 1992 due to political reasons, John Borshoff founded a consulting company to continue working in the uranium sector. "When they pulled out of Australia because of political reasons, I then formed a consulting company."

10/25

He leveraged his expertise and connections to acquire valuable resources for his new venture, including Uranerz's database. "For my golden handshake, I actually swapped their database and got that in lieu of a pay-out. And that became a tremendous asset."

He leveraged his expertise and connections to acquire valuable resources for his new venture, including Uranerz's database. "For my golden handshake, I actually swapped their database and got that in lieu of a pay-out. And that became a tremendous asset."

11/25

Rick Rule:

"Uranerz spent a billion $ on its database. when they shut down they were gonna give John his severance in cash, but he asked for the database. He had enough faith in #uranium & his own skills. Rather than taking $, he took the database and he bet on himself."

Rick Rule:

"Uranerz spent a billion $ on its database. when they shut down they were gonna give John his severance in cash, but he asked for the database. He had enough faith in #uranium & his own skills. Rather than taking $, he took the database and he bet on himself."

12/25

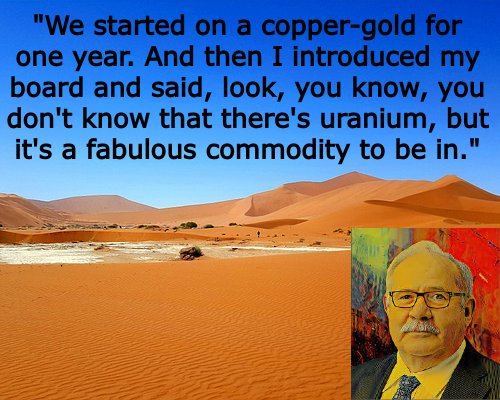

After successfully running his consulting firm, John Borshoff founded Paladin Energy Ltd in 1993. Paladin initially focused on copper-gold exploration, but John Borshoff recognized the potential in the #uranium market and convinced the board to shift the company's focus.

After successfully running his consulting firm, John Borshoff founded Paladin Energy Ltd in 1993. Paladin initially focused on copper-gold exploration, but John Borshoff recognized the potential in the #uranium market and convinced the board to shift the company's focus.

13/25

He believed that if the #uranium market picked up, Paladin would be well-positioned to seize the opportunity. "And if it does click, this will be a tremendous opportunity for the company." He started picking up cheap properties in Namibia and Malawi.

He believed that if the #uranium market picked up, Paladin would be well-positioned to seize the opportunity. "And if it does click, this will be a tremendous opportunity for the company." He started picking up cheap properties in Namibia and Malawi.

14/25

Borshoff's vision for Paladin was not to simply find deposits & sell them, but rather to build a company that would develop & operate mines. "We weren't dressing the bride to sell her, we were actually going to make a marriage between deposit & the company & build mines."

Borshoff's vision for Paladin was not to simply find deposits & sell them, but rather to build a company that would develop & operate mines. "We weren't dressing the bride to sell her, we were actually going to make a marriage between deposit & the company & build mines."

15/25

But having cheaply-bought assets alone would not build a mine by itself. With the sentiment in the sector at its lowest levels ever, and with only a 2 million dollar valuation, his company was in need of capital to be able to execute John Borshoff's #uranium vision.

But having cheaply-bought assets alone would not build a mine by itself. With the sentiment in the sector at its lowest levels ever, and with only a 2 million dollar valuation, his company was in need of capital to be able to execute John Borshoff's #uranium vision.

16/25

So John Borshoff turned to Rick Rule who then worked at Sprott.

Rick: “I met this amazing man named John Borshoff, just a bundle of determination & knowledge, a wonderful human with a $2 million MC when nobody cared about uranium, instant love between John and me."

So John Borshoff turned to Rick Rule who then worked at Sprott.

Rick: “I met this amazing man named John Borshoff, just a bundle of determination & knowledge, a wonderful human with a $2 million MC when nobody cared about uranium, instant love between John and me."

17/25

"Nobody wanted to talk to us, my play was too contrarian, based on demand. So, I teamed up with Rick Rule in 1998. He sort of backed me a little bit. In 2003 the price started to go up, Rick's support was vindicated and we then built our mine in 2005 and demand kicked in."

"Nobody wanted to talk to us, my play was too contrarian, based on demand. So, I teamed up with Rick Rule in 1998. He sort of backed me a little bit. In 2003 the price started to go up, Rick's support was vindicated and we then built our mine in 2005 and demand kicked in."

18/25

"When Rick first came in he bought it at $0.10 and it went down to $0.01 and then he supported it at $0.01, and then when other people started to come in, and institutions started to come in seeing that we were legitimate, price just went from $0.03 in 2003 to $10."

"When Rick first came in he bought it at $0.10 and it went down to $0.01 and then he supported it at $0.01, and then when other people started to come in, and institutions started to come in seeing that we were legitimate, price just went from $0.03 in 2003 to $10."

19/25

Paladin became a major player in the #uranium sector, thanks in large part to Borshoff's leadership & vision. The company successfully developed multiple mines & generated significant revenue. But there was a danger lurking in the shadows that was about to ruin the party.

Paladin became a major player in the #uranium sector, thanks in large part to Borshoff's leadership & vision. The company successfully developed multiple mines & generated significant revenue. But there was a danger lurking in the shadows that was about to ruin the party.

20/25

Paladin had raised a lot of debt to finance the construction and upgrade of their mines. When Fukushima happened, the #uranium sector suddenly experienced a huge demand destruction phase with Japanese NPPs shutting down. And this started a vicious cycle.

Paladin had raised a lot of debt to finance the construction and upgrade of their mines. When Fukushima happened, the #uranium sector suddenly experienced a huge demand destruction phase with Japanese NPPs shutting down. And this started a vicious cycle.

21/25

"When Fukushima came along, there was still about 3.2 billion in debt, and we thought after Chernobyl and the experience there, that the Japanese would restart quickly, but they didn't. I did not kill the debt on time, and it became a problem"

"When Fukushima came along, there was still about 3.2 billion in debt, and we thought after Chernobyl and the experience there, that the Japanese would restart quickly, but they didn't. I did not kill the debt on time, and it became a problem"

22/25

John Borshoff resigned from Paladin and retired in 2015. But...

"I couldn't retire. I just, my whole attitude is I come from a farming background and people, 80 years old, are still planting oak trees, and for a future, for a tree they will never see in its full glory."

John Borshoff resigned from Paladin and retired in 2015. But...

"I couldn't retire. I just, my whole attitude is I come from a farming background and people, 80 years old, are still planting oak trees, and for a future, for a tree they will never see in its full glory."

23/25

So John looked for a company in the sector that did not have a compromised share structure, one that allowed for greater autonomy and flexibility in decision-making. He became CEO of @DeepYellowLtd, a former exploration branch from Paladin, and he reunited his old team.

So John looked for a company in the sector that did not have a compromised share structure, one that allowed for greater autonomy and flexibility in decision-making. He became CEO of @DeepYellowLtd, a former exploration branch from Paladin, and he reunited his old team.

24/25

Since then, John Borshoff and his stellar team, the only team that turned an explorer into a real producer in the last cycle, have been working hard to create a multi-jurisdiction, top-tier, #uranium developer. Will he be able to repeat the Paladin story?

Since then, John Borshoff and his stellar team, the only team that turned an explorer into a real producer in the last cycle, have been working hard to create a multi-jurisdiction, top-tier, #uranium developer. Will he be able to repeat the Paladin story?

25/25

Has he learned from his mistakes at Paladin though?

John Borshoff:

"What I did learn is to be very wary of debt. Even though your model might be great, there are outside influences like Fukushima."

Has he learned from his mistakes at Paladin though?

John Borshoff:

"What I did learn is to be very wary of debt. Even though your model might be great, there are outside influences like Fukushima."

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter