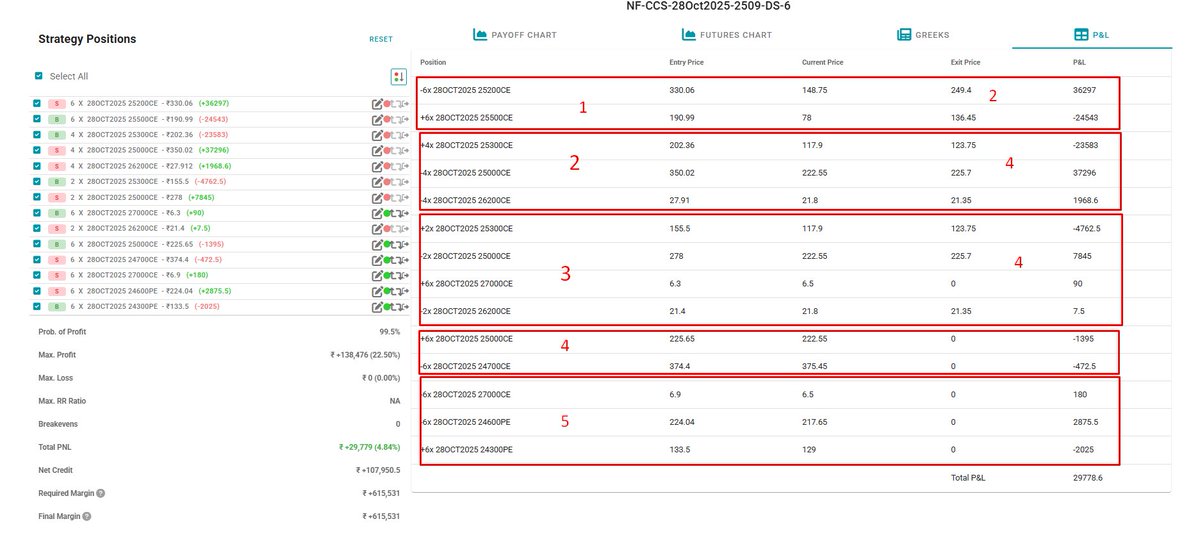

I am sharing an options trade and its adjustments which I did recently. I had goofed up in one of the straddle shorts in Nifty. At one stage I was down nearly 1.5% of total capital but with some hectic adjustments and (some luck) I could escape with almost no loss at the end.

1/n

1/n

1) Initiated a #Nifty straddle at 17850 strike on 26052023 for 04052023 expiry at fag end of the day at 15:29 . I had forgotten about this trade as I was on holidays from 27052023.

2/n

2/n

2) I did not check the status of straddle on 27052023. Status at the beginning and end of the day

3/n

3/n

3) I did not check the status on 28052023 (Friday) with a longer weekend ahead due to trading holiday on 01052023 (a risky proposition)

Notice that the breakeven already breached on CE side

4/n

Notice that the breakeven already breached on CE side

4/n

4) Next day (on 01052023) Nifty gapped up and my position was bleeding.

5) On 02052023 at open - loss was 56K

5.1) First bought 18000CE (at 09:16:22)

5.2) shorted 18150PE (at 09:17:18) - loss at 9:20 was 59K

5/n

5.1) First bought 18000CE (at 09:16:22)

5.2) shorted 18150PE (at 09:17:18) - loss at 9:20 was 59K

5/n

6) Shorted 18150CE (9:21:46) - idea was to shift the short straddle to 18150 strike and convert to a broken wing fly

7) bought 18250CE (9:26:00) - Loss 60K

8) bought some OTM hedges on PE side - 17500PE

6/n

7) bought 18250CE (9:26:00) - Loss 60K

8) bought some OTM hedges on PE side - 17500PE

6/n

9) Closed 17850PE and added to 18150PE (still holding 17850CE) (10:10:52)

10) Next shifting CE leg inside to 18200CE (did delayed shifting) Loss now at 67K

11) Next set of adjustments between 11:25 and 11:27

7/n Loss at 70K

10) Next shifting CE leg inside to 18200CE (did delayed shifting) Loss now at 67K

11) Next set of adjustments between 11:25 and 11:27

7/n Loss at 70K

12) Converted strategy back to straddle at 18150 (idea was to buy hedges before close and gain on intraday theta decay)

13) closed all buy legs of CE and also covered 17850CE

14) now had 20 lots of straddle at 18150 with far OTM hedges (loss at 70K now)

8/n

13) closed all buy legs of CE and also covered 17850CE

14) now had 20 lots of straddle at 18150 with far OTM hedges (loss at 70K now)

8/n

On 02052023 - Traded an intraday strangle 18100PE-18250CE (profit approx 5k)

At EOD 0n 02052023 - loss had comedown to 55 K

Carried a highly risky position.

9/n

At EOD 0n 02052023 - loss had comedown to 55 K

Carried a highly risky position.

9/n

On 03052023 - Nifty gapped down and the position was still hopeless with loss back above 65K

continued...

10/n

continued...

10/n

16) Did not do any adjustment till 15:05. Strategy loss has reduced to 50K and breakeven was broken on PE side. Decided to shift straddle to 18100 and convert to an Ironfly to mitigate overnight risk

11/n

11/n

17) On 04052023 - Nifty opened at most favorable position and loss came down to 41k

Removed buy wings and bought far OTM hedges

12/n

Removed buy wings and bought far OTM hedges

12/n

13/n

18) At 10:10, Nifty was going up. to reduce risk on CE side and increase the range, shifted CE leg to 18150CE

19) Now if Nifty expires between 18100-18150 I thought I will escape with no gross loss !!!!

20) Did some directional selling

14/n

18) At 10:10, Nifty was going up. to reduce risk on CE side and increase the range, shifted CE leg to 18150CE

19) Now if Nifty expires between 18100-18150 I thought I will escape with no gross loss !!!!

20) Did some directional selling

14/n

14/n

At 14:05 loss had reduced to 3k - only two PE sold positions at this stage

At 14:30 - loss free at gross level!!!!

15/n

At 14:05 loss had reduced to 3k - only two PE sold positions at this stage

At 14:30 - loss free at gross level!!!!

15/n

15/n

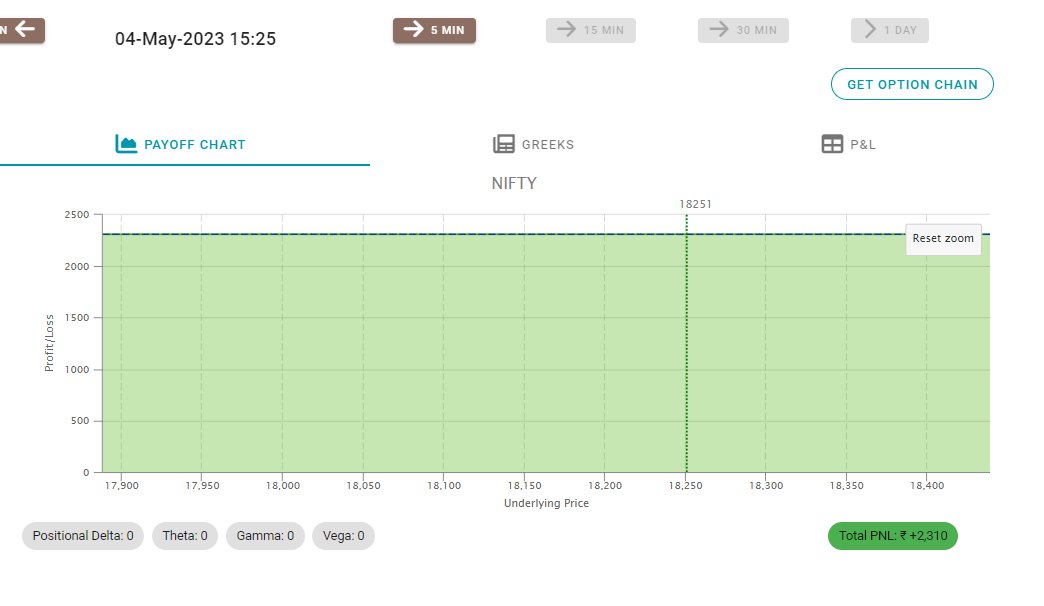

At 14:45 only one position was open

Closed at 15:25 with Gross profit of 2+ k

One hell of a series of adjustments !!!!!!!!

Net loss was around 8K after expenses

16/n

At 14:45 only one position was open

Closed at 15:25 with Gross profit of 2+ k

One hell of a series of adjustments !!!!!!!!

Net loss was around 8K after expenses

16/n

Lessons learnt -

1) Never carry overnight positions without proper hedges

2) Do not carry positions without hedge if you are likely to be away from terminal even for a couple of days

3) In case of directional moves, quickly adjust with directional view at least for intraday

17/n

1) Never carry overnight positions without proper hedges

2) Do not carry positions without hedge if you are likely to be away from terminal even for a couple of days

3) In case of directional moves, quickly adjust with directional view at least for intraday

17/n

17/ You need real luck if things go completely wrong to come out with minor injuries

This strategy was executed in an account with 50L capital. Normally I do not trade Delta Neutral Nifty Options Strategies in this account. It seems I had a brain fade at 15:29 to initiate this strategy!!

Look at the time of execution - 15:29:45 - Phew!!!

Look at the time of execution - 15:29:45 - Phew!!!

• • •

Missing some Tweet in this thread? You can try to

force a refresh