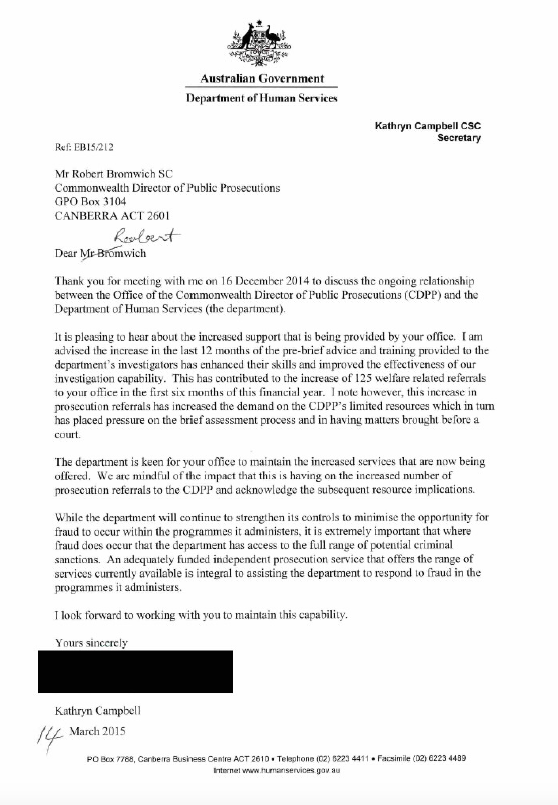

I have only just now seen among the #robodebtrc docs what's IMO a smoking gun linking the Poniatowska/Keating decisions to the origin of #robodebt. In March 2015, Withnell arranged for a letter to be signed by Campbell addressed to Bromwich J, then the Dir of the CDPP, ...

... spelling out their concerns. A concern was that CDPP policy had changes so that the CDPP now refused to prosecute on the basis of 'short-form briefs' from DHS, whereas they used to accept such briefs. (The CDPP refusal was based on the fact those briefs were insufficient ...

... at law following the Poniatowska and Keating decisions.) The letter shows that Withnell was intent to ensure that the CDPP continued to prosecute and even provided a reminder that the CDPP's funding was 'tied to the volume of briefs received per referring agency.'

The letter to Bromwich J (as HH now is) was composed following a meeting bw Campbell and Bromwich regarding the tension between (a) the CDPP's inability to receive short-form briefs as it used to do, and (b) the desire from Campbell that the CDPP receive as many briefs as ...

... they were sent, given that there was now additional training going on within DHS so that it's investigators would be able to provide more detailed briefs as required.

For the untrained eye (respectfully), this looks pretty inane. But for those who know the history of Poniatowska/Keating, and who know that 40% of welfare recoupments were rendered impossible by those cases, this negotiation about whether the CDPP will still prosecute is key.

What it effectively means is that Campbell, Withnell, and Golightly were trying to ensure that the CDPP maintained its prosecution of all the welfare recipients it briefed the CDPP to prosecute. Why? because prosecution was a great way to recover $. Those accused of welfare ...

... crimes paid up quickly, even if they were arguably innocent, because it ensured they might escape a conviction being recorded against them (for cooperation). But 40% of all welfare convictions were rendered impossible by Keating, and Campbell/Withnell/Golightly, ...

... here in 2015, are trying to hold the ship together. Prosecution, at 2014-2015, was still the gold standard for welfare overpayment recoupment, and it was going down the tubes here. What would possible solve this problem? The answer, of course, is a civil recoupment scheme ...

... where the criminal standard of proof is not necessary to discharge. Imagine if instead of prosecuting all these potential briefs, you just wrote to them directly -- not even involving the CDPP -- and accused them of overpayments.

cc @maximumwelfare @SquigglyRick @jeremy_gans @NotmydebtS @kristin8X @BabbyUnit @Robs_au @CriminalLawAus

The importance of the CDPP's inability to prosecute has been tied by some to matters other than Keating/Poniatowska -- and that's true. The Auditor General (ANAO) also wrote a report in which it said that the CDPP should prosecute more serious offences rather than only the ...

... small-scale ones. But to really understand the situation going on here, you have to understand the legal fraternity too. Bromwich J, with great respect, was an expert in welfare law and s 135.2(1)(a). It is public record, for eg, that HH was successful in high-profile ...

... appeals under s 135.2(1)(a) involving at least one celebrity. The change in policy within the CDPP came at a time when Bromwich J was director and also when a few other factors, such as advice being received from the other major expert in this area of law, another ...

... member of the judiciary now, was giving advice to the CDPP in the wake of the Keating matter. If that contextual stuff if not enough, it is clear as day that the change in policy comes after Keating and Poniatowska, and as a result of those cases, when one looks at the ...

... updated policy notes here:

cdpp.gov.au/sites/default/…

cdpp.gov.au/sites/default/…

cdpp.gov.au/sites/default/…

cdpp.gov.au/sites/default/…

cdpp.gov.au/sites/default/…

cdpp.gov.au/sites/default/…

In short, Keating and Poniatowska had a huge impact on the Cth's ability to see a *return* from alleged welfare overpayments. The Cth could no longer prosecute as it had done after 2014, and yet there was a directive to DHS/Campbell now to increase recoupments from overpayments.

What would Campbell et al do? The prosecution lever had been fettered significantly by the High Court and yet it was seemingly impossible to go after alleged welfare overpaids through the civil system. They would have to invent a process by which civil recoupments were ...

... not only possible, but efficient. This would entail merely 'accusing' a person of a debt (querying, confirming details, etc) and, where no contrary evidence was used to contradict the accusation, imposing an invoice on the accused debtor. That was it. That's the solution.

Campbell would not have to bother the CDPP anymore. The CDPP would not be needed to ensure recoupment from overpayment. All they'd need would be confirmation to go ahead from the Minister.

Another thing I should add is this. The CDPP had also had their funding reduced. This meant it could hardly do anything more to prosecute overpaids. Everything was leaning towards a civil process of recoupment with a low proof burden. As it turns out, even the Cth ...

... misunderstood (and denied for several years) the minimal proof required to prove a debt to the civil standard (on the balance of probabilities). Finally, in 2019, the FCA found that the civil process Campbell/Withnell et al invented was unlawful.

It is important to note that every overpayment of a welfare payment is a potential crime under s 135.2(1) of the Criminal Code. Every person who was robodebted could have been prosecuted. That, in fact, is practically what used t o happen. The cases 'on the shelf' when Campbell..

... took charge and when Payne/Morrison became the Ministers -- that is, the cases that the Ryman/Withnell/Golightly et al were wondering what to do with -- were those that had been rejected as de minimus (not good prosecution candidates bc too low value) or evidence-poor in ...

... original audit round. The CDPP's failure to prosecute in this context just becomes an additional factor that exercises DHS' appetite to get a maximum return on alleged welfare overpayments through the civil recoupment program that became known as robodebt. It was a ...

... perfect storm. (1) The CDPP would not prosecute like it used to; (2) there was a bunch of untapped debt tied up in the files the CDPP would never have prosecuted to begin with going back to 2009-2010; and (3) there was pressure to recoup as many $ in welfare as possible.

Pro-tip: If an agency like the CDPP is absolutely not interested in getting involved with your agency's allegations against citizens, maybe you should be careful about what you do with those allegations when you bring them into the civil context. The civil law ...

... may appear like the wild west, but it ain't. People still have the right to a defence and, in a civil claim of social security theft (even if it's not criminal) the Cth still have to prove the existence of the debt.

The technical common law basis of why the Cth may have the onus to prove the existence of the debt (McDonald) and what proof entails (Briginshaw discretionally used through Sullivan [or even going back to Bott 7 ALJR 169 1933]) was not even needed. That's because ...

... Amato used the SS Act on its terms as sufficient to find that a debt needed to be proved to the satisfaction of a decision-maker under the Act.

To dig a little deeper, it was held that the decision that a debt existed was irrational. So, after this original plan, four years later and after more than 400,000 irrational debts, the program was ended. comcourts.gov.au/file/Federal/P…

For fun, let's explore what 'irrational' means legally based on the case law citations from Amato. @NotmydebtS this is for you. Firstly, the master case is SZMDS. Here are the paras:

If you've read all that, now you might know a bit more about the way in which the decision-makers who decided robodebts existed made 'irrational' decisions. all of the above describes the state of mind that the decision-maker held and why it was irrational.

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter