Deputy Director @sydneyhealthlaw and lecturer @sydneylawschool CI @cellhorizons MRFF #healthlaw #welfarelaw BA LLB PhD

How to get URL link on X (Twitter) App

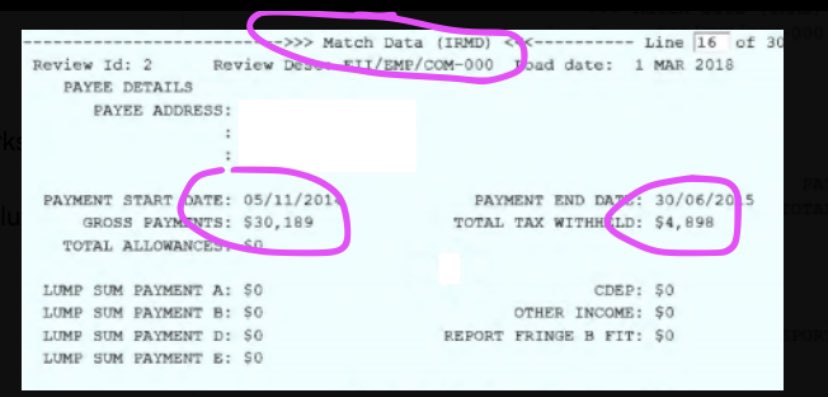

The process by which this figure has been arrived at is document in the data below, which has not been released until now, despite Services Australia being asked for more detail at several senate inquiries and by several reporters.

The process by which this figure has been arrived at is document in the data below, which has not been released until now, despite Services Australia being asked for more detail at several senate inquiries and by several reporters.

Before now, statements have said that s 1073B debts go back only to 'at least 2003'; it appears someone has looked carefully and found there's another 10 years of unlawful administration. That's about 27+ rather than 17 years of liability.

Before now, statements have said that s 1073B debts go back only to 'at least 2003'; it appears someone has looked carefully and found there's another 10 years of unlawful administration. That's about 27+ rather than 17 years of liability.

As this report discloses, the initial sampling activity of @ServicesGovAU did not meet the Ombudsman's requirements, and so this reports records the second attempt to fulfil those commitments. Of 2150 source cases, 1117 involved income updates (debts) and of those, 714 (64%) ...

As this report discloses, the initial sampling activity of @ServicesGovAU did not meet the Ombudsman's requirements, and so this reports records the second attempt to fulfil those commitments. Of 2150 source cases, 1117 involved income updates (debts) and of those, 714 (64%) ...

In making the direction, the Commissioner relied on advice received from the Deputy Commissioner, which assured the Commissioner that a mandatory direction by her would be compatible with human rights under the Human Rights Act 2019 (Qld) -- see below.

In making the direction, the Commissioner relied on advice received from the Deputy Commissioner, which assured the Commissioner that a mandatory direction by her would be compatible with human rights under the Human Rights Act 2019 (Qld) -- see below.

https://twitter.com/austaxpolicy/status/1687281449928392704The desktop review is the tip of the iceberg. Unlawfulness happens when a person reports their income out of sync with their entitlements fortnight or when the income covers more than 14 days. This was utterly commonplace and there are likely 500k unlawful debts from 2003-20.

... does not identify against whom the action could be brought and in respect of which evidence it might be partially made out. But it would involve an individual or a class of persons suing a minister. The tort, however, is pretty complicated. (fr Aronson, 2011)

... does not identify against whom the action could be brought and in respect of which evidence it might be partially made out. But it would involve an individual or a class of persons suing a minister. The tort, however, is pretty complicated. (fr Aronson, 2011)

https://twitter.com/johnpilger/status/1655357410020818944The proposition that the Voice is powerless is unsupported: the wording of the amendment establishes a new body empowered to make representations. One might say that this is not powerful enough; but the fact that its powers are limited to making reps does not make it a 'con.'

... version of this offence is at s 135.1 and leads to 10 years maximum imprisonment (as opposed to 12 months). This conversation about fraud/criminality versus mistake is super superficial. Because plenty of people are convicted for offences that simply require knowledge. ...

... version of this offence is at s 135.1 and leads to 10 years maximum imprisonment (as opposed to 12 months). This conversation about fraud/criminality versus mistake is super superficial. Because plenty of people are convicted for offences that simply require knowledge. ...