2. Saudi Aramco likely made net income of just over $32 billion, according to the median estimate in a Bloomberg survey of analysts. That would mark a slowdown from a year earlier — similar to other oil firms that have already reported

3. Energy stocks- a look at the technicals adds to the bearish sentiment: The gauge’s 50-day moving average fell below its 200-day average last week in a so-called death cross, the first time since late 2018. That often signals that further selling pressure is in store.

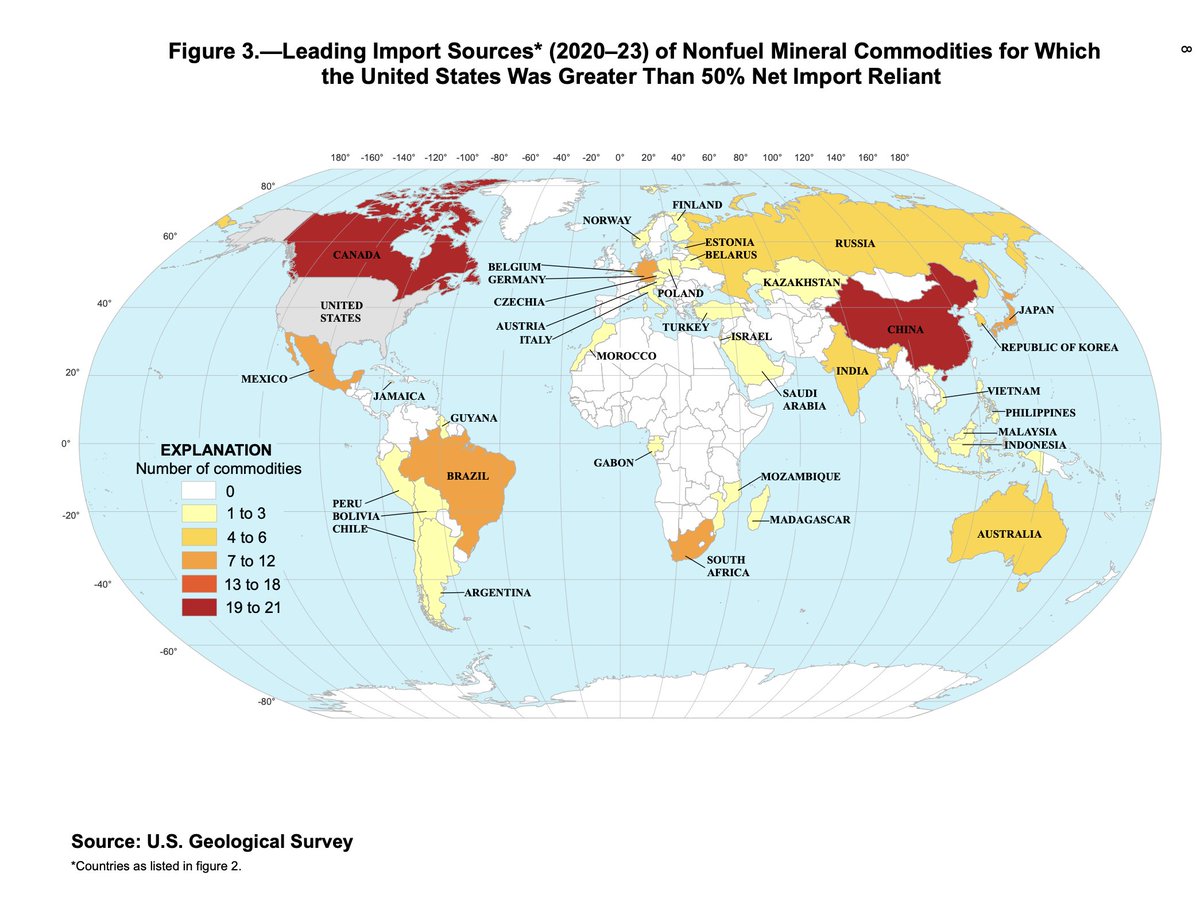

4. Metals

BloombergNEF’s New Energy Outlook 2022, demand for the metal will be 16 times the total #lithium in use today by 2040, potentially outrunning supply by more than 40%.

BloombergNEF’s New Energy Outlook 2022, demand for the metal will be 16 times the total #lithium in use today by 2040, potentially outrunning supply by more than 40%.

5. Agriculture

American corn exports will be in focus on Friday when the US Department of Agriculture releases its first outlook for the upcoming 2023-24 season as part of the monthly World Agricultural Supply and Demand Estimates (WASDE) report.

American corn exports will be in focus on Friday when the US Department of Agriculture releases its first outlook for the upcoming 2023-24 season as part of the monthly World Agricultural Supply and Demand Estimates (WASDE) report.

• • •

Missing some Tweet in this thread? You can try to

force a refresh