The next #Bitcoin halving is in less than a year.

My base case: the 2024 halving could send Bitcoin's price 4-8x higher.

Here's what you need to know... (Thread 👇)

My base case: the 2024 halving could send Bitcoin's price 4-8x higher.

Here's what you need to know... (Thread 👇)

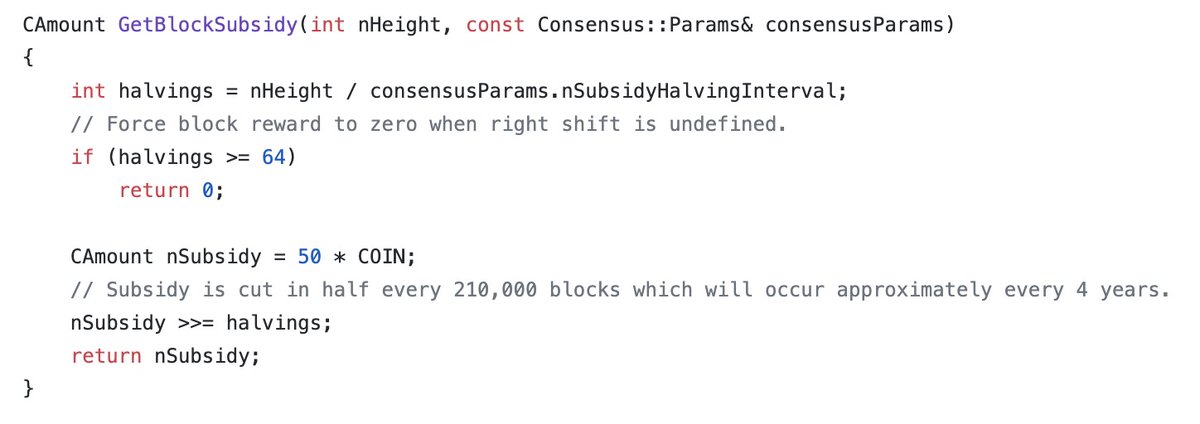

This is Bitcoin's issuance schedule.

The day Bitcoin launched in Jan 2009... there were 0 Bitcoin in existence. Eventually, there will be a hardcapped, absolute maximum of 21M Bitcoin.

Coins are issued with each new block "mined"

This "block subsidy" decreases every 4 years

The day Bitcoin launched in Jan 2009... there were 0 Bitcoin in existence. Eventually, there will be a hardcapped, absolute maximum of 21M Bitcoin.

Coins are issued with each new block "mined"

This "block subsidy" decreases every 4 years

These moments in time when Bitcoin issuance decreases by 50% are "halvings"

This is written in stone in the Bitcoin protocol and can never be changed.

Here is the relevant bit of code - Bitcoin's entire monetary policy.

This is written in stone in the Bitcoin protocol and can never be changed.

Here is the relevant bit of code - Bitcoin's entire monetary policy.

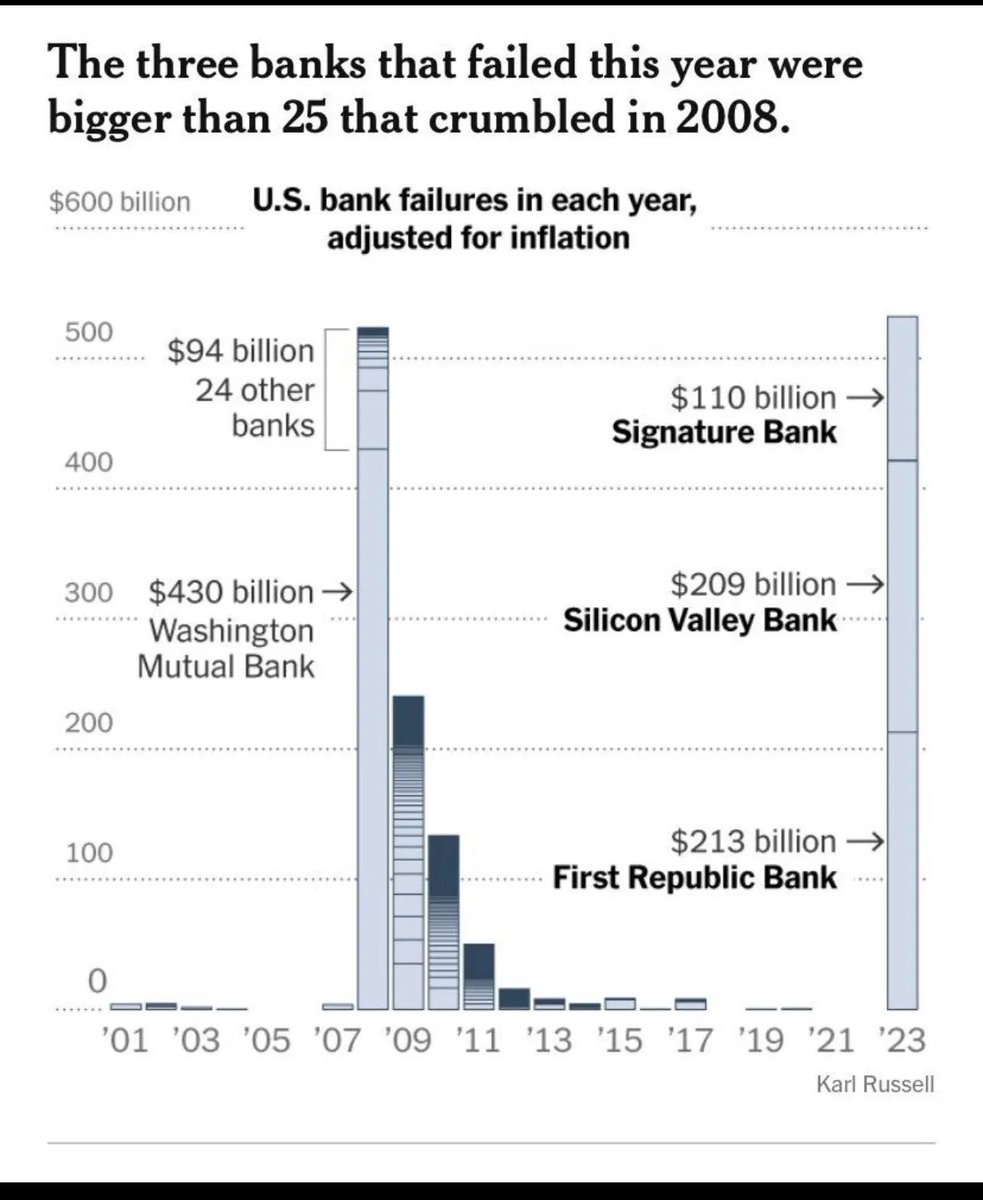

Bitcoin has had 3 halvings in its 14-year existence. In 11.5 months, the next halving will arrive.

BTC issued per block will go 6.25 --> 3.125.

Bitcoin's annual supply inflation will drop from ~1.8% to ~0.9%, making it a "harder" asset than gold (1.5-2% annual supply growth).

BTC issued per block will go 6.25 --> 3.125.

Bitcoin's annual supply inflation will drop from ~1.8% to ~0.9%, making it a "harder" asset than gold (1.5-2% annual supply growth).

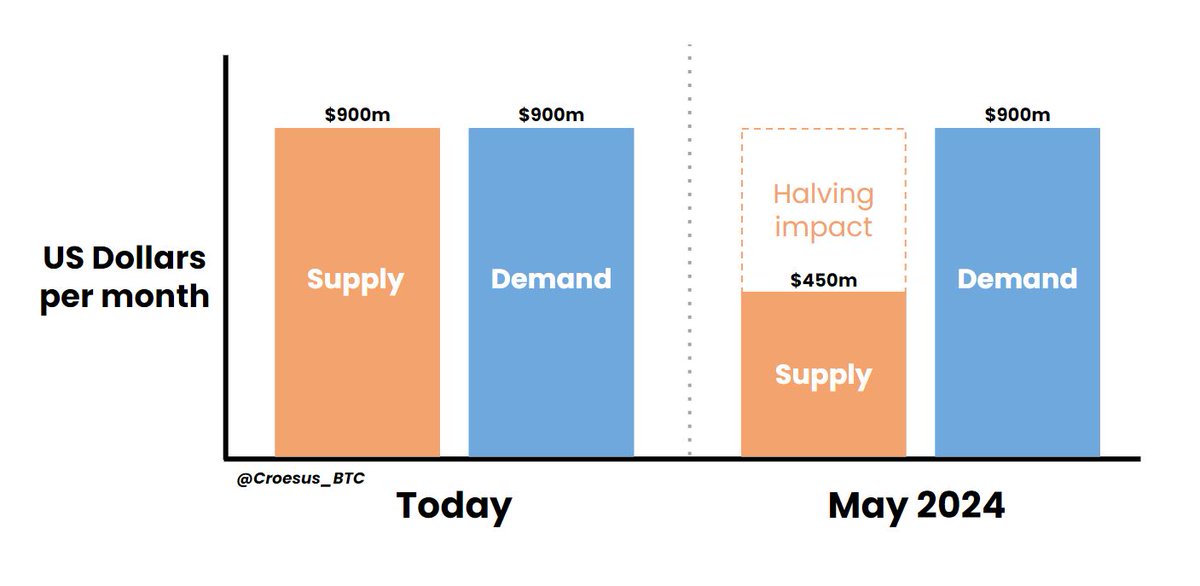

Currently, 900 BTC are issued every day to Bitcoin miners. At ~$30k/BTC, that's $27m/day, or $900M every month.

This goes into the market to meet incoming demand, which is ~$900M/month right now. Price goes sideways.

But April 2024, the halving will precipitate a supply shock

This goes into the market to meet incoming demand, which is ~$900M/month right now. Price goes sideways.

But April 2024, the halving will precipitate a supply shock

With not enough new supply to meet demand, price equilibrium can only be restored by:

-Demand suddenly dropping (no reason to happen)

-Supply creation increasing (literally can't happen with Bitcoin)

-Price going up 🚀

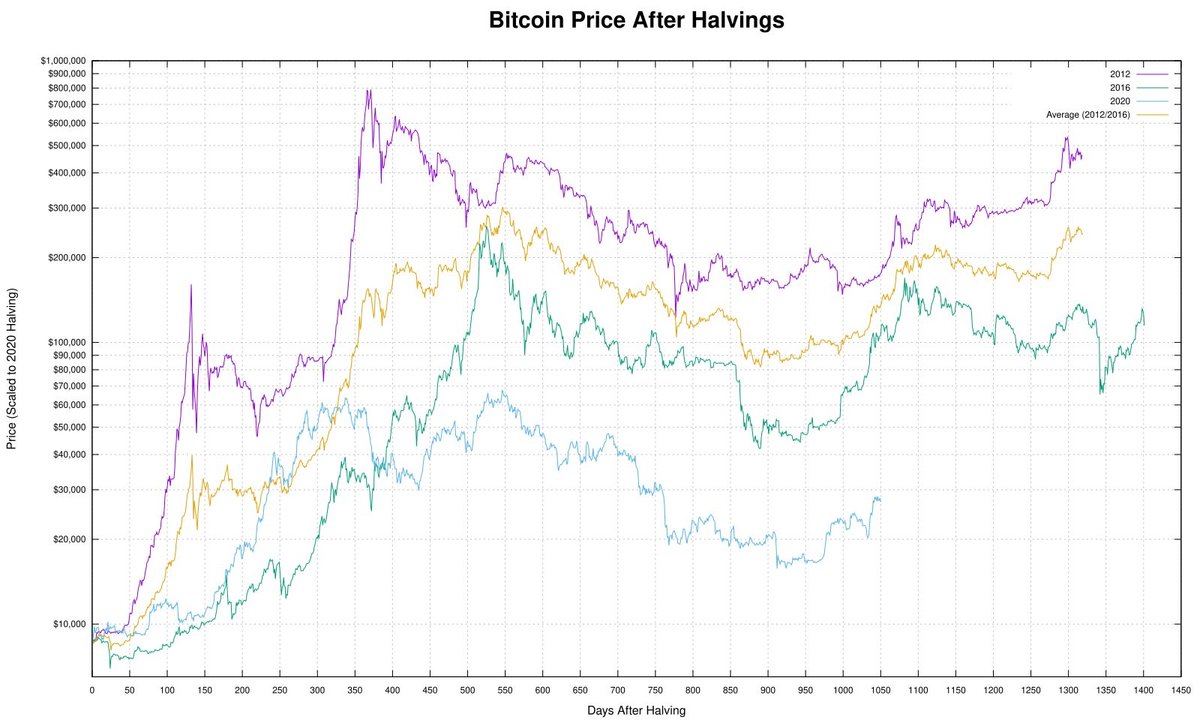

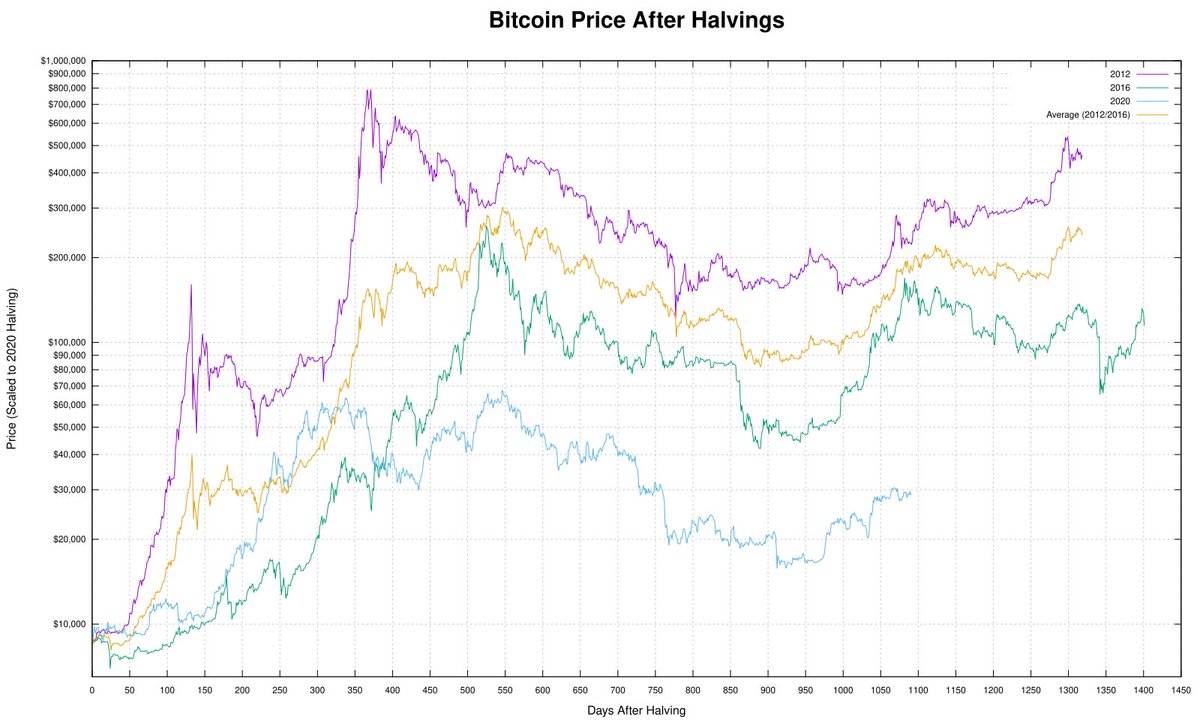

Here's the result of the last 3 halvings:

-Demand suddenly dropping (no reason to happen)

-Supply creation increasing (literally can't happen with Bitcoin)

-Price going up 🚀

Here's the result of the last 3 halvings:

The same mechanics will play out again, once the 840,000th block is added to the #Bitcoin blockchain in April 2024.

It's just supply & demand.

But how high could Bitcoin's price go as a result of the 2024 halving? It's helpful to take stock of past halvings' stats:

It's just supply & demand.

But how high could Bitcoin's price go as a result of the 2024 halving? It's helpful to take stock of past halvings' stats:

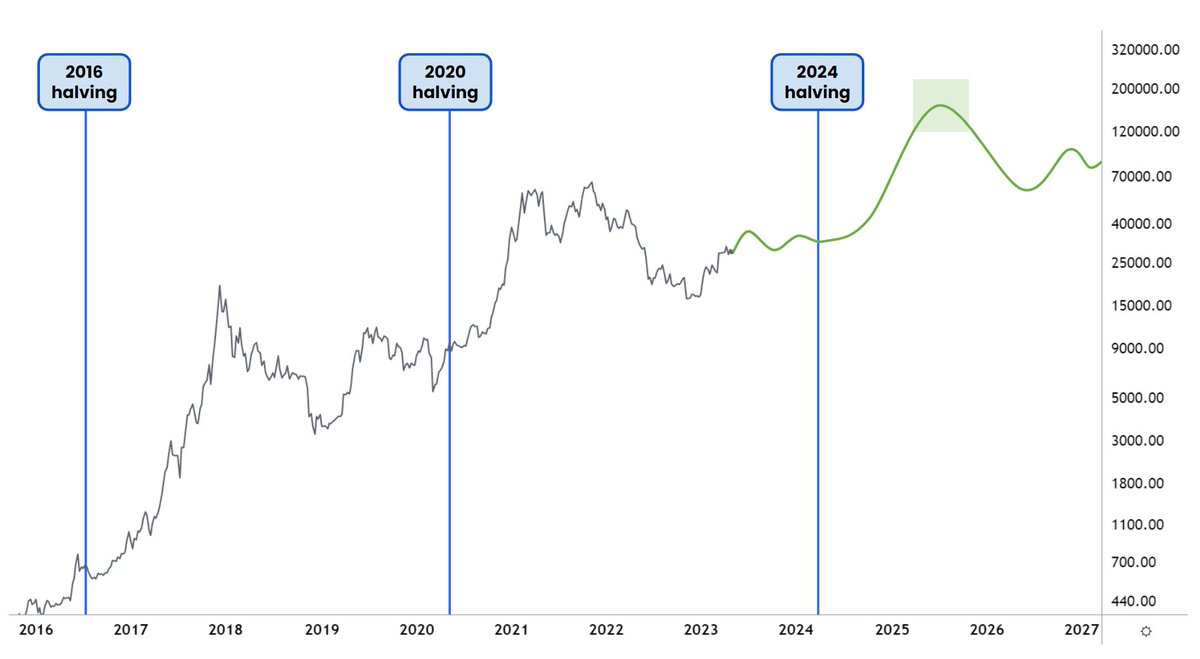

Bitcoin has a way of proving everyone's predictions wrong (certainly true with me). However, my rough analysis for 2024-25:

-Bitcoin's price likely peaks 12-18 months after the April 2024 halving

-Price peak could be between $120k and $240k

Not so crazy on the price chart:

-Bitcoin's price likely peaks 12-18 months after the April 2024 halving

-Price peak could be between $120k and $240k

Not so crazy on the price chart:

If you want to see the full analysis (100% free), leave a comment with 👍 & I'll DM you the link.

And if you enjoyed this thread:

1. Follow me @Croesus_BTC for more of these

2. RT the tweet below to share this thread with your followers

And if you enjoyed this thread:

1. Follow me @Croesus_BTC for more of these

2. RT the tweet below to share this thread with your followers

https://twitter.com/892945654451851265/status/1655566037838962691

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter