PROMETHEUS CYCLE STRATEGIES

1. Over the past two months, our 'Month in Macro' reports have discussed two main themes. Firstly, we discussed how our systems have now triggered to expect a recession. Below we show our estimated projection for GDP:

1. Over the past two months, our 'Month in Macro' reports have discussed two main themes. Firstly, we discussed how our systems have now triggered to expect a recession. Below we show our estimated projection for GDP:

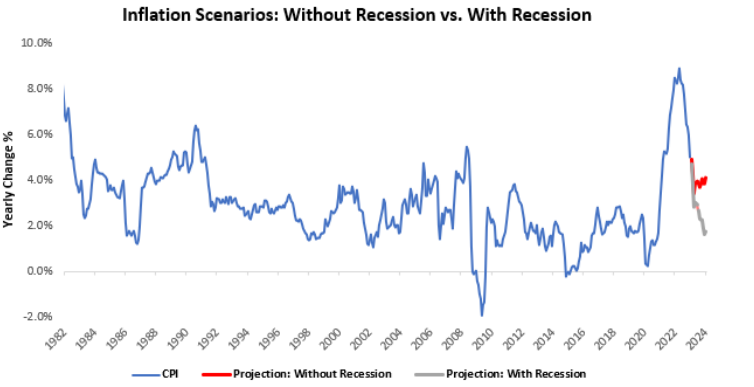

2. Second, we focused on how after a period of disinflationary market pricing, there is significant potential for markets & policymakers to have now have to wrestle with an elevated

inflationary trend well above 2%. This trend will likely only be resolved through a recession.

inflationary trend well above 2%. This trend will likely only be resolved through a recession.

3. Both of these scenarios have augmented our thinking in developing our cycle strategies that aim to use our cyclical expectations to trade markets.

4. These strategies reflect the understanding that particular points in the economic cycle offer an asymmetrically positive return on risk, either long or short assets. Therefore, by attemption to forecast these points, we can harvest these return-to-risk characteristics.

5. The first strategy seeks to short equity markets as we head into an impending recession and go 2X leveraged long equity markets during recoveries; otherwise, it remains in cash, with monthly turnover:

6. The second strategy seeks to short Treasury bonds during periods where inflationary pressures lead to policy tightening expectations, goes long during easing cycles, and otherwise remains in cash.

7. It is essential to recognize that the expectation of a recession does not equal the realization of one. Thus, it does not make sense to double down on a recession bet. This distinction is crucial not just conceptually but for adequate diversification in signal construction.

8. Macro alphas tend to be small, with Sharpe ratios between 0.2 and 0.4 on average, and therefore overlying on anyone is likely to cause significant pain in allocation.

9. Therefore, while our

growth strategy has turned short stocks this month, we think it is important to recognize that this doesn't mean that we should also buy bonds, given inflation dynamics. In fact, the strategy for inflation remains short bonds this month.

growth strategy has turned short stocks this month, we think it is important to recognize that this doesn't mean that we should also buy bonds, given inflation dynamics. In fact, the strategy for inflation remains short bonds this month.

10. To offer insight into the value-add of a mechanically diversified approach to take macro bets, we show a combined portfolio of our two released Prometheus Cycle Strategies, which go long or short stocks and bonds based on growth and inflation cycles, respectively:

11. Overall, we think we are headed toward a recession. However, nominal growth dynamics show persistently strong spending, which may prolong the economic cycle. By being tactical and diversified, we think it is possible to navigate these regimes unscathed.

12. Both the 'Month in Macro' reports are available on our Substack. Make sure to #Subscribe to @prometheusmacro for ongoing updates.

prometheusresearch.substack.com

prometheusresearch.substack.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter