Edge Edge Edge.

Everyone talks about it, including myself, but what does it actually look like?

And Most Importantly how can you spot it?

Here's How:

Everyone talks about it, including myself, but what does it actually look like?

And Most Importantly how can you spot it?

Here's How:

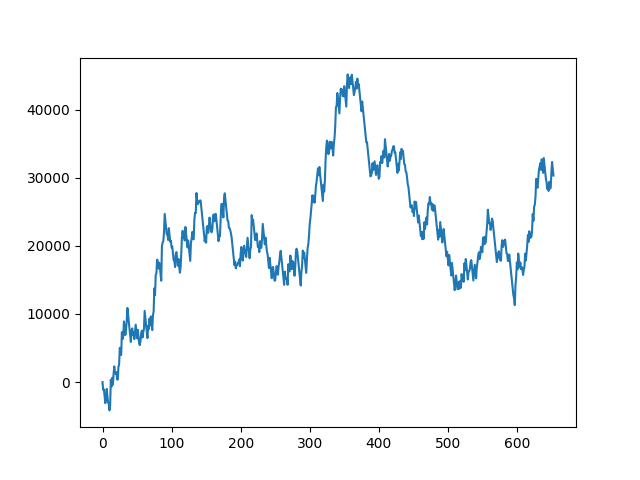

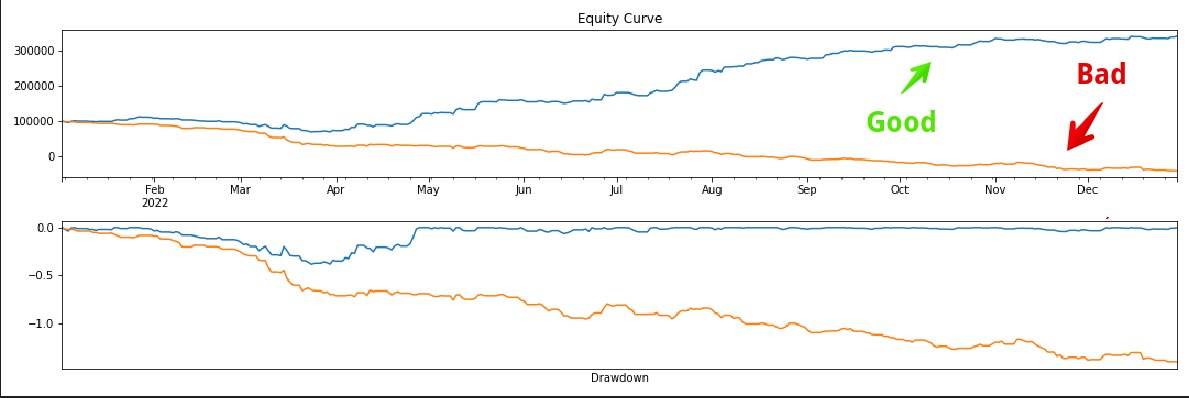

Equity Curves:

These show the cumulative returns of your particular strategy over time.

You are looking for a steadily upward sloping equity curve, while avoiding the ones look more like a heart beat or a nosedive.

These show the cumulative returns of your particular strategy over time.

You are looking for a steadily upward sloping equity curve, while avoiding the ones look more like a heart beat or a nosedive.

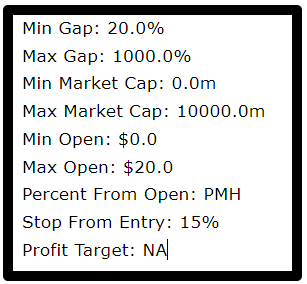

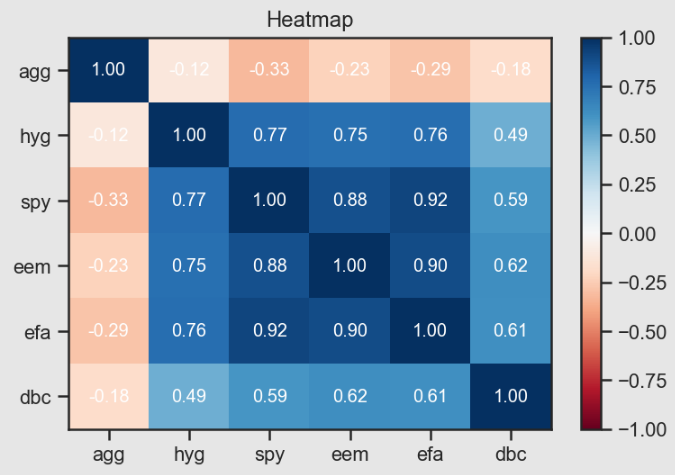

Heatmap:

These are two-dimensional visual representation of returns using colors, where the colors all represent different returns.

You are looking for a consistent high return colors over the heatmap, with a clear direction of returns over time.

These are two-dimensional visual representation of returns using colors, where the colors all represent different returns.

You are looking for a consistent high return colors over the heatmap, with a clear direction of returns over time.

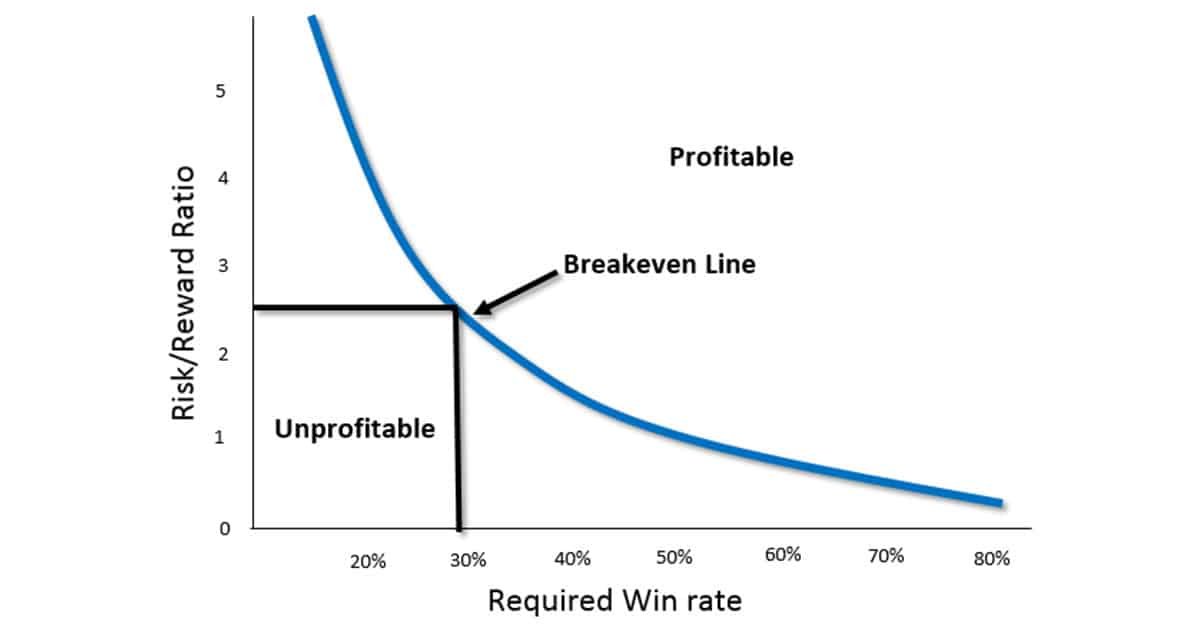

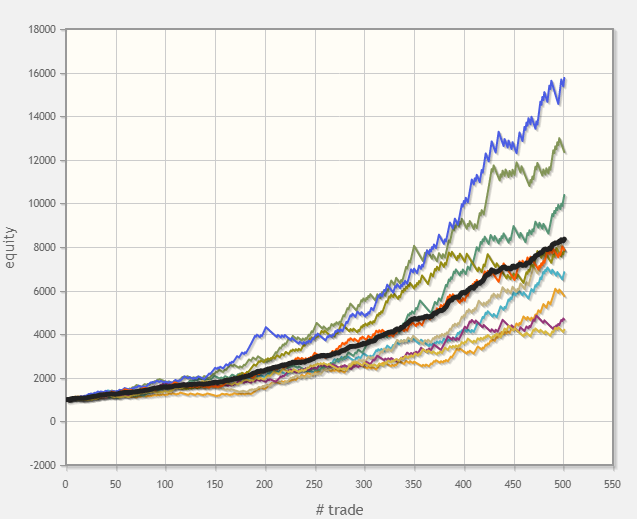

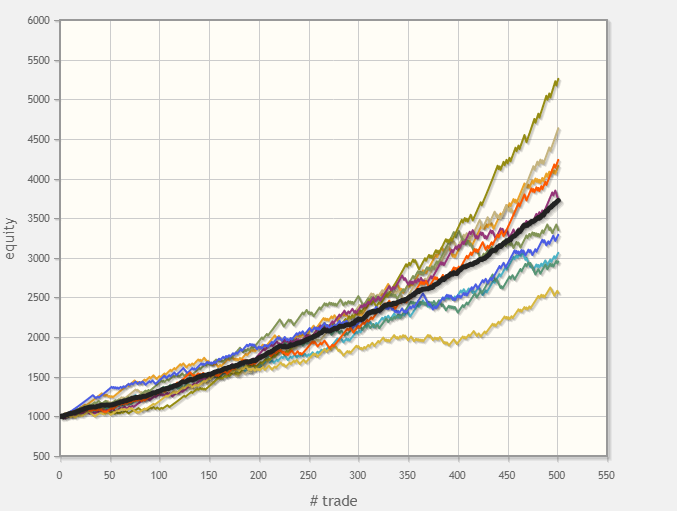

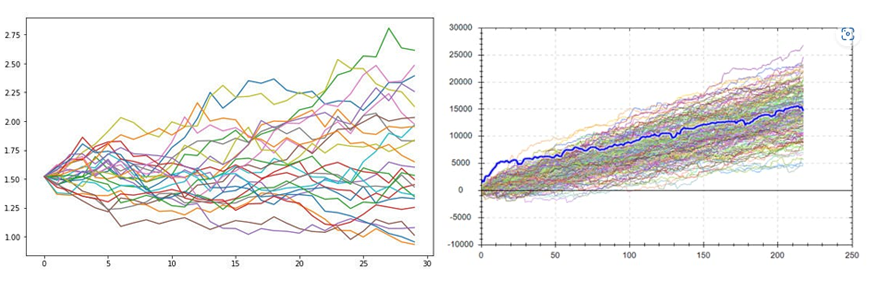

Monte Carlo:

These allow you to show the historical trades of your strategy reshuffled over time over 100s of different reshufflings.

You are looking for a your avg equity curve to be trending upwards, instead a mess of uncorrelated equity curves.

These allow you to show the historical trades of your strategy reshuffled over time over 100s of different reshufflings.

You are looking for a your avg equity curve to be trending upwards, instead a mess of uncorrelated equity curves.

It's super important to test and visualize your edge. Don't just rely on intuition - put your strategies to the test!

If you found this useful, give the tweet below a like.

Follow @GoshawkTrades for insights on backtesting / systematic trading

If you found this useful, give the tweet below a like.

Follow @GoshawkTrades for insights on backtesting / systematic trading

https://twitter.com/GoshawkTrades/status/1658198121254363145

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter