@GNDProtocol is a project that gives its investors #RealYield

In 3 weeks from launching on #Arbitrum they have amassed 31M in TVL

And their $GND token is up 6x from launch

But how exactly does it all work? 🧵👇

In 3 weeks from launching on #Arbitrum they have amassed 31M in TVL

And their $GND token is up 6x from launch

But how exactly does it all work? 🧵👇

At the core of the protocol sits $gmUSD an algorithmic yield-bearing stablecoin

gmUSD is fully backed by $gmdUSDC and $gDAI from #Arbitrum heavyweights @GMDprotocol and @GainsNetwork_io

And is expected to produce 15-25% APY

👇

gmUSD is fully backed by $gmdUSDC and $gDAI from #Arbitrum heavyweights @GMDprotocol and @GainsNetwork_io

And is expected to produce 15-25% APY

👇

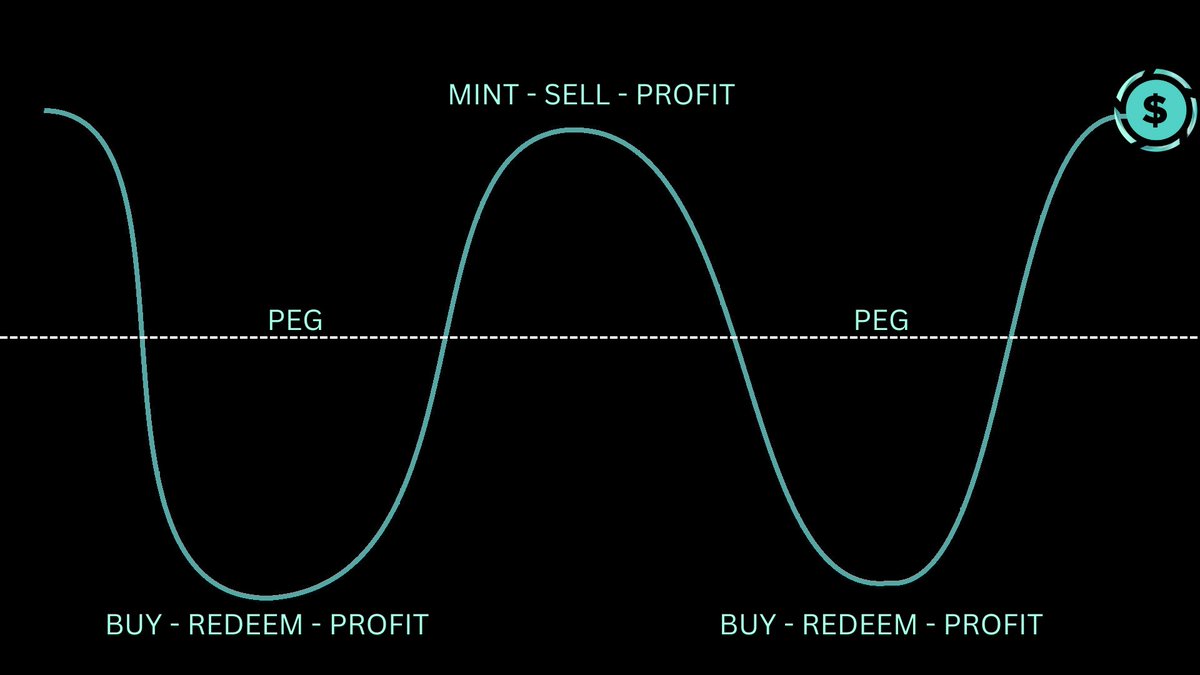

To maintain the peg GND Protocol uses minting and redemption arbitrage through the PSALM (Protocol Smart Arbitrage Leveraging Mechanism)

But the difference here is only GND Protocol can mint and redeem

All profits from arbitrage go to the protocol and benefit investors

👇

But the difference here is only GND Protocol can mint and redeem

All profits from arbitrage go to the protocol and benefit investors

👇

The next protocol revenue stream is the farms and GND Protocol has 29 of them

From native and partner protocol stablecoin pairs offering 50% APR and $GND - $WETH 206% APR

To $PEPE - $WETH offering 489% APR

👇

From native and partner protocol stablecoin pairs offering 50% APR and $GND - $WETH 206% APR

To $PEPE - $WETH offering 489% APR

👇

But why use the GND Farm rather than farming Uniswap V3 directly?

While the V3 liquidity engine can offer better capital efficiency for those with the time and money to constantly monitor it, it can be challenging for even advance users

GND Farm simplifies the process

👇

While the V3 liquidity engine can offer better capital efficiency for those with the time and money to constantly monitor it, it can be challenging for even advance users

GND Farm simplifies the process

👇

Instead of deciding ranges and monitoring them yourself the GND Farm manages this for you

Farmers are paid out in $GND and $xGND

And xGND holders can direct emissions to their preferred LP pair by voting

👇

Farmers are paid out in $GND and $xGND

And xGND holders can direct emissions to their preferred LP pair by voting

👇

The combined revenue from trading fees and PSALM arbitrage is then used to maintain protocol sustainability and benefit $GND holders and $xGND stakers

40-60% is dedicated to GND buyback & burn, reducing supply and supporting the price

👇

40-60% is dedicated to GND buyback & burn, reducing supply and supporting the price

👇

And $xGND stakers receive 20% of the protocols revenue in $ETH

Currently that means a base APR of 62%

But long term stakers can boost this by accruing RP

The longer you keep your xGND staked the higher your boosted APR

👇

Currently that means a base APR of 62%

But long term stakers can boost this by accruing RP

The longer you keep your xGND staked the higher your boosted APR

👇

So with a yield bearing stable coin, farming, #RealYield revenue streams and deflationary tokenomics, @GNDProtocol offers something very different from the usual #DeFi ponzi-nomics

$gmUSD holding and farming is a great high-yield play for those with lower risk tolerance

👇

$gmUSD holding and farming is a great high-yield play for those with lower risk tolerance

👇

$GND could be a great option for those looking to make a quick profit from price appreciation, as well as high-yield farming

And $xGND is the high conviction long-term play that gives stakers all the benefits of the protocols revenue streams

And $xGND is the high conviction long-term play that gives stakers all the benefits of the protocols revenue streams

As always this is NFA and please DYOR before you even consider investing

If you found this thread informative please give it a like and @arbitrumapex a follow

And if you'd like to discuss GND Protocol or other Arbitrum topics join my telegram channel 👇

t.me/arbitrumapex

If you found this thread informative please give it a like and @arbitrumapex a follow

And if you'd like to discuss GND Protocol or other Arbitrum topics join my telegram channel 👇

t.me/arbitrumapex

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter