A mega thread 🧵on why I am more bullish on #Litecoin than any other asset in the space starting with what I believe is cyclical perfection using Hurst Cyclical theory

Internal 1/3 harmonics match up with a larger cycle, which also has 1/3 harmonics

I see the grand finale next

Internal 1/3 harmonics match up with a larger cycle, which also has 1/3 harmonics

I see the grand finale next

Litecoin is currently dramatically undervalued compared to $BTC and $ETH on a relative basis.

IMO, LTC should be at least $250 per coin according to this. Serious undervaluation compared to other undervalued assets

#Litecoin outperforms both at cycle conclusions after lagging

IMO, LTC should be at least $250 per coin according to this. Serious undervaluation compared to other undervalued assets

#Litecoin outperforms both at cycle conclusions after lagging

Litecoin $LTCUSD has already crossed bullish on the 1M LMACD, while BTC and ETH are lagging behind.

This is indicative of a larger timeframe momentum change. Note specifically when the histogram turns from red to green and vice versa

This is indicative of a larger timeframe momentum change. Note specifically when the histogram turns from red to green and vice versa

Get you head out of the daily chart, and turn on the line chat to get a better idea of a wave count

With the right perspective, wave 4 never crossed into wave 1 territory, and Litecoin is forming an expanding ending diagonal

In these patterns, wave 5 is the longest & strongest

With the right perspective, wave 4 never crossed into wave 1 territory, and Litecoin is forming an expanding ending diagonal

In these patterns, wave 5 is the longest & strongest

Litecoin transactions superimposed behind $LTCUSD

When people are using Litecoin, price skyrockets. The metrics tends to lead price slightly and has gone vertical

Will price follow as it has historically? I think yes

We have a halving, ordinals buzz, regulatory support, etc.

When people are using Litecoin, price skyrockets. The metrics tends to lead price slightly and has gone vertical

Will price follow as it has historically? I think yes

We have a halving, ordinals buzz, regulatory support, etc.

Same transactions chart, but with $LTCBTC above it

Note that the ratio flipped hardcore each time network transactions spiked

Note that the ratio flipped hardcore each time network transactions spiked

Being bearish here doesn't make sense to me

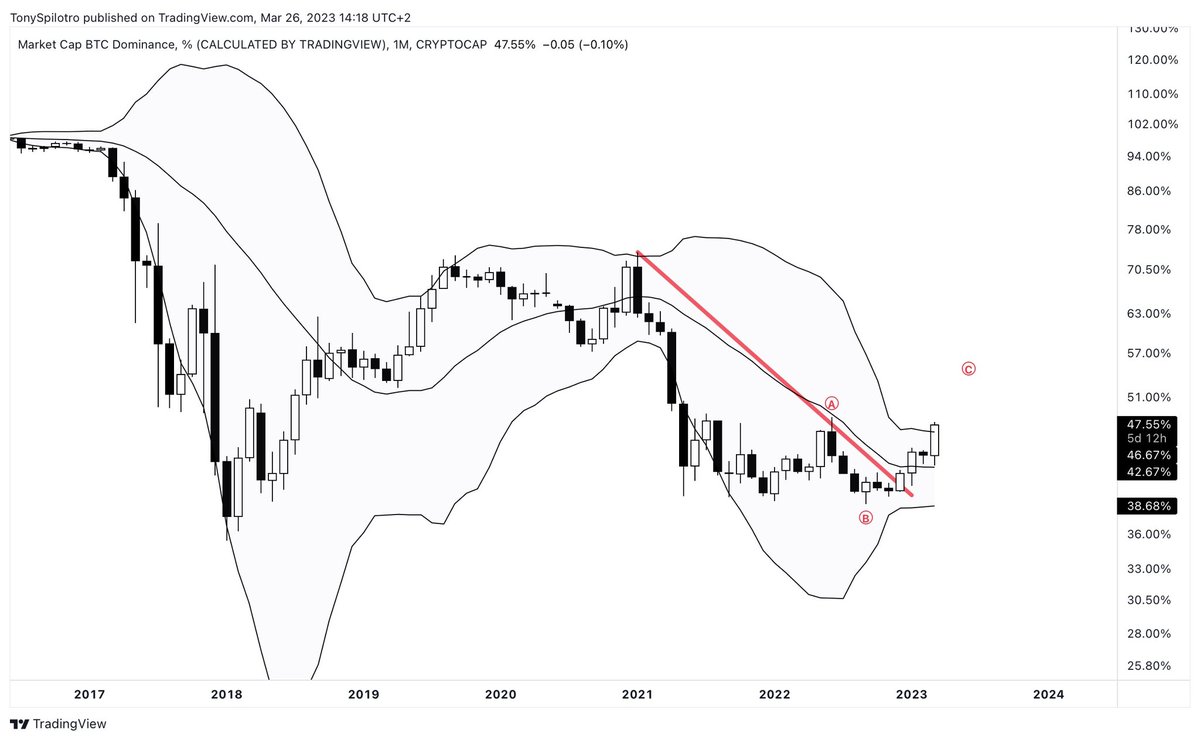

The idea that we're merely seeing another 2019 repeat, is extremely basic & is going to fool people into thinking they have several years to buy back in

Momentum says otherwise. This is going to run & you are going to chase it

The idea that we're merely seeing another 2019 repeat, is extremely basic & is going to fool people into thinking they have several years to buy back in

Momentum says otherwise. This is going to run & you are going to chase it

Damn, too many errors in this tweet. Awful, Tony! Sorry all.

Get your*

line chart*

Where's my editors! 😅 @BestOwie @rl_m

Get your*

line chart*

Where's my editors! 😅 @BestOwie @rl_m

• • •

Missing some Tweet in this thread? You can try to

force a refresh