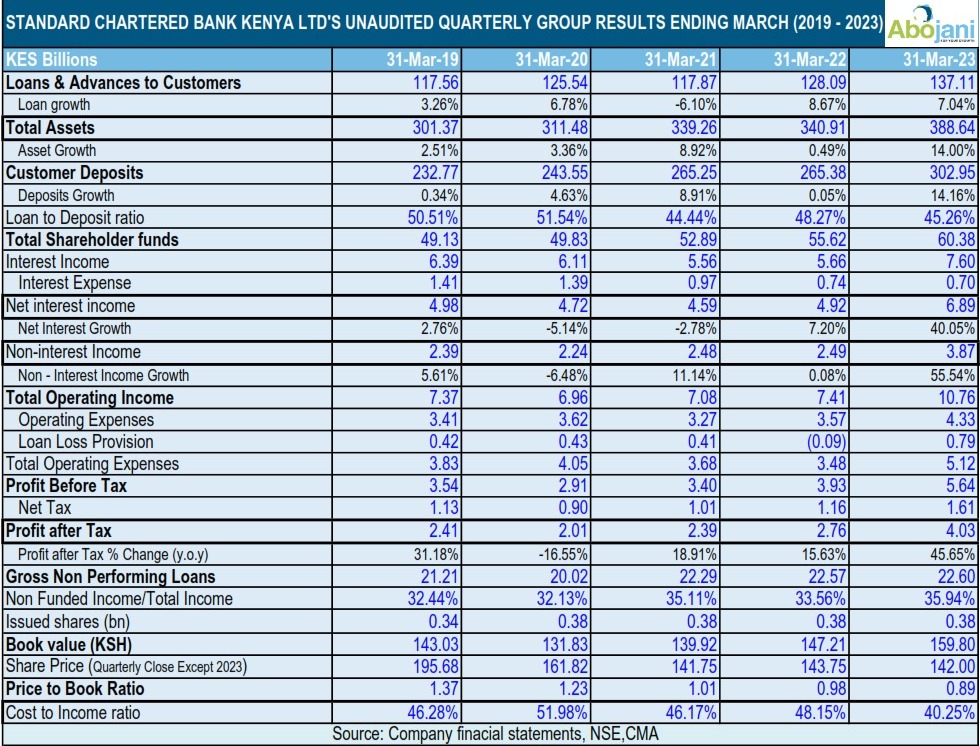

📈 Here are some key insights from Standard Chartered Bank Kenya Ltd's unaudited quarterly group results:

1/6 @StanChartKE Limited has been experiencing consistent growth in loans and advances to customers, and total assets.

1/6 @StanChartKE Limited has been experiencing consistent growth in loans and advances to customers, and total assets.

Loans & Advances to Customers

Loans and Advances to Customers have been volatile over the years, with fluctuations from Ksh117.56 billion in Q1:2019 to Ksh128.09 billion in Q1:2022.

However, the bank grew its Loans and Advance to Customers to Ksh137.11 billion in Q1 of 2023,… twitter.com/i/web/status/1…

Loans and Advances to Customers have been volatile over the years, with fluctuations from Ksh117.56 billion in Q1:2019 to Ksh128.09 billion in Q1:2022.

However, the bank grew its Loans and Advance to Customers to Ksh137.11 billion in Q1 of 2023,… twitter.com/i/web/status/1…

@StanChartKE Limited's assets have been on a growth trajectory, increasing from Ksh301.37 billion in Q1:2019 to Ksh388.64 billion in Q1 of 2023.

Customer Deposits for @StanChartKE have consistently been increasing from Ksh232.77 billion in Q1:2019 to Ksh302.95 billion in Q1:2023.

2/6 @StanChartKE Limited's Loan to Deposit ratio (LDR) declined from 51.54% in 2020 to 45.26% in Q1 of 2023. This indicates that the bank is holding more deposits than it is lending out.

3/6 @StanChartKE Net Interest Income (NII) increased significantly to Ksh6.89 billion in Q1 of 2023. Although growth rates were volatile in the past years, the bank is now on an upward trend.

4/6 Non-Interest Income grew by 55.54% in Q1 of 2023, largely driven by Foreign exchange trading income which grew to Ksh2.19 billion in Q1:2023 from Ksh1.02 billion in Q1:2022.

5/6 Profitability is increasing. The Profit after tax grew from Ksh2.01 billion in 2020 to Ksh4.03 billion in Q1 of 2023. The bank's Cost to Income Ratio decreased from 51.98% in 2020 to 40.25% in Q1 of 2023, indicating their efficient operations.

6/6 Share Price declined from 161.82 in end Q1 of 2020 to 142.00 year to date. The Price to Book Ratio declined from 1.23 in Q1 of 2020 and currently at 0.89, indicating that the bank's stock is becoming more undervalued.

#banking #kenya #financialresults

#banking #kenya #financialresults

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter