One of the best ways to learn about the Copper Industry is by studying the Top 10 Global Producers.

I read each of the Top 10 #Copper Producer quarterly reports so you don't have to.

Here's a thread on the most important data and themes from the world's largest players ... 🧵

I read each of the Top 10 #Copper Producer quarterly reports so you don't have to.

Here's a thread on the most important data and themes from the world's largest players ... 🧵

1/ Codelco $CODELCO

• Copper Production DOWN 9% to 357.1Kmft

• Cash Costs UP 33.7% to $2.04

• Reasons for Product Decline: Operational difficulties, lower production and ore grades, and mine shutdowns

• Reasons for High Cash Costs: Higher input prices (diesel & electric).

• Copper Production DOWN 9% to 357.1Kmft

• Cash Costs UP 33.7% to $2.04

• Reasons for Product Decline: Operational difficulties, lower production and ore grades, and mine shutdowns

• Reasons for High Cash Costs: Higher input prices (diesel & electric).

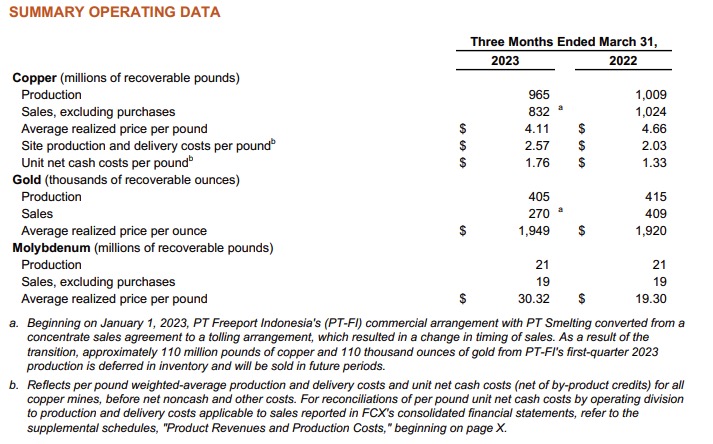

2/ Freeport-McMoRan $FCX

• Copper Production DOWN 4.3% to 965Mlbs

• Cash Costs UP 33% to $1.76/lb

• Reasons for Production Decline: Lower ore grades, unplanned maintenance, weather

• Reasons for Cash Cost Increase: Lower volumes, higher labor and energy costs

• Copper Production DOWN 4.3% to 965Mlbs

• Cash Costs UP 33% to $1.76/lb

• Reasons for Production Decline: Lower ore grades, unplanned maintenance, weather

• Reasons for Cash Cost Increase: Lower volumes, higher labor and energy costs

3/ Glencore $GLEN

• Copper Production DOWN 5% to 244Kt and down 15% from prior Q

• Reasons for Production Decline: lower grades with phasing out of Collahuasi pit, weather delays in Antamina.

• Copper Production DOWN 5% to 244Kt and down 15% from prior Q

• Reasons for Production Decline: lower grades with phasing out of Collahuasi pit, weather delays in Antamina.

4/ BHP $BHP

• Copper Production DOWN 4% to 405.9kt and UP 12% YoY YTD

• Escondida Production UP 11% to 762kt

• Olympic Dam Production UP 88% to 156kt

Commentary on Copper Production: "Lower volumes at Escondida reflect the impact of diff ore feed sources & refine capacity"

• Copper Production DOWN 4% to 405.9kt and UP 12% YoY YTD

• Escondida Production UP 11% to 762kt

• Olympic Dam Production UP 88% to 156kt

Commentary on Copper Production: "Lower volumes at Escondida reflect the impact of diff ore feed sources & refine capacity"

5/ Southern Copper $SCCO

• Production UP 4% YoY to 223kt but DOWN 7% from the prior Q

• Cash Costs UP 31% YoY to $0.76/lb and UP 70% from the prior Q

• Reasons for Production Decline: Lower grades and temp production suspensions

• Reasons for High Cash Cost: Low volumes

• Production UP 4% YoY to 223kt but DOWN 7% from the prior Q

• Cash Costs UP 31% YoY to $0.76/lb and UP 70% from the prior Q

• Reasons for Production Decline: Lower grades and temp production suspensions

• Reasons for High Cash Cost: Low volumes

6/ Antofagasta $ANTO

• Copper Production UP 5.1% to 146kt YoY by DOWN 25.4% from prior Q

• Cash Costs UP 6.4% YoY to $2.49/lb and UP 24.5% from prior Q

• Reasons for Production Decline: Rduction at Los Pelambres, water issues

• Reasons For High Cash Costs: Inputs & prod.

• Copper Production UP 5.1% to 146kt YoY by DOWN 25.4% from prior Q

• Cash Costs UP 6.4% YoY to $2.49/lb and UP 24.5% from prior Q

• Reasons for Production Decline: Rduction at Los Pelambres, water issues

• Reasons For High Cash Costs: Inputs & prod.

7/ First Quantum $FM

• Copper Production DOWN 24% YoY to 139Kt and DOWN 33% from prior Q

• Cash Costs UP 39% YoY to $2.24/lb and UP 20% from prior Q

• Reasons for Production Decline: suspensions, lower grades, rain

• Reasons for Cash Cost Increase: Volumes & input prices

• Copper Production DOWN 24% YoY to 139Kt and DOWN 33% from prior Q

• Cash Costs UP 39% YoY to $2.24/lb and UP 20% from prior Q

• Reasons for Production Decline: suspensions, lower grades, rain

• Reasons for Cash Cost Increase: Volumes & input prices

8/ KGHM Polska $KGH (2022 Results)

• Copper Production DOWN 3% to 733kt

• Cash Costs UP 5% to $2.39/lb

• Reasons for Production Decline: Lower ore grades and recovery rates

• Reasons for Cash Cost Increase: Lower volumes, higher input prices (energy & labor)

• Copper Production DOWN 3% to 733kt

• Cash Costs UP 5% to $2.39/lb

• Reasons for Production Decline: Lower ore grades and recovery rates

• Reasons for Cash Cost Increase: Lower volumes, higher input prices (energy & labor)

9/ Anglo American $AAL

• Copper Production UP 28% to 178kt YoY

• Cash Costs are $1.56/lb, unchanged from prior guidance

• Reasons for Production Increase: Ramp-up of Quellaveco mine in Peru, offset by Chilean mine declines due to lower ore grades.

• Copper Production UP 28% to 178kt YoY

• Cash Costs are $1.56/lb, unchanged from prior guidance

• Reasons for Production Increase: Ramp-up of Quellaveco mine in Peru, offset by Chilean mine declines due to lower ore grades.

10/ Jiangxi Copper $JIAXF (2022)

• Copper Production UP 3.21% YoY to 184kt

• Operating Costs UP 9.5% YoY

• Reasons for Increased Production: Higher volumes, fewer suspensions

• Reasons for Higher Operating Costs: Increase in raw material costs

• Copper Production UP 3.21% YoY to 184kt

• Operating Costs UP 9.5% YoY

• Reasons for Increased Production: Higher volumes, fewer suspensions

• Reasons for Higher Operating Costs: Increase in raw material costs

11/ Recap: Key Takeaways From Top 10 Copper Producers

There are a few key takeaways from these producers:

• Cost inflation is real and isn't showing signs of a slowdown

• Lower ore grades increase costs and pressure margins

• Diseconomies of scale at lower volumes.

There are a few key takeaways from these producers:

• Cost inflation is real and isn't showing signs of a slowdown

• Lower ore grades increase costs and pressure margins

• Diseconomies of scale at lower volumes.

12/ Conclusion

I hope you enjoyed this thread and learned something new!

Please consider liking, RT, and sharing with friends if you did.

Also, check out my podcast to learn more about the coming Commodity Super Cycle.

podcasts.apple.com/us/podcast/val…

I hope you enjoyed this thread and learned something new!

Please consider liking, RT, and sharing with friends if you did.

Also, check out my podcast to learn more about the coming Commodity Super Cycle.

podcasts.apple.com/us/podcast/val…

https://twitter.com/1017745052544749569/status/1658858833295425536

• • •

Missing some Tweet in this thread? You can try to

force a refresh