Is the sensex currently overvalued? 📈

You can use the following metrics to find out.

A thread🧵⬇️

You can use the following metrics to find out.

A thread🧵⬇️

1/ Sensex is the benchmark index of the Bombay Stock Exchange (BSE).

Here’s how the Sensex has fared in the past decade.

To assess the index’s valuation, you can look at the following metrics⬇️

Here’s how the Sensex has fared in the past decade.

To assess the index’s valuation, you can look at the following metrics⬇️

2/ Price-to-earnings (P/E)

If an index’s current P/E is higher than its median P/E, the index might be overvalued.

If an index’s current P/E is higher than its median P/E, the index might be overvalued.

3/ Price-to-book value (P/B)

If an index’s current P/B is more than its median P/B, then it might be overvalued.

If an index’s current P/B is more than its median P/B, then it might be overvalued.

4/ Dividend yield

If an index’s current dividend yield is more than its median dividend yield, then the index might be undervalued.

If an index’s current dividend yield is more than its median dividend yield, then the index might be undervalued.

5/ Market cap to GDP

If the market cap of an index is higher than GDP, then the index might be overvalued.

If the market cap of an index is higher than GDP, then the index might be overvalued.

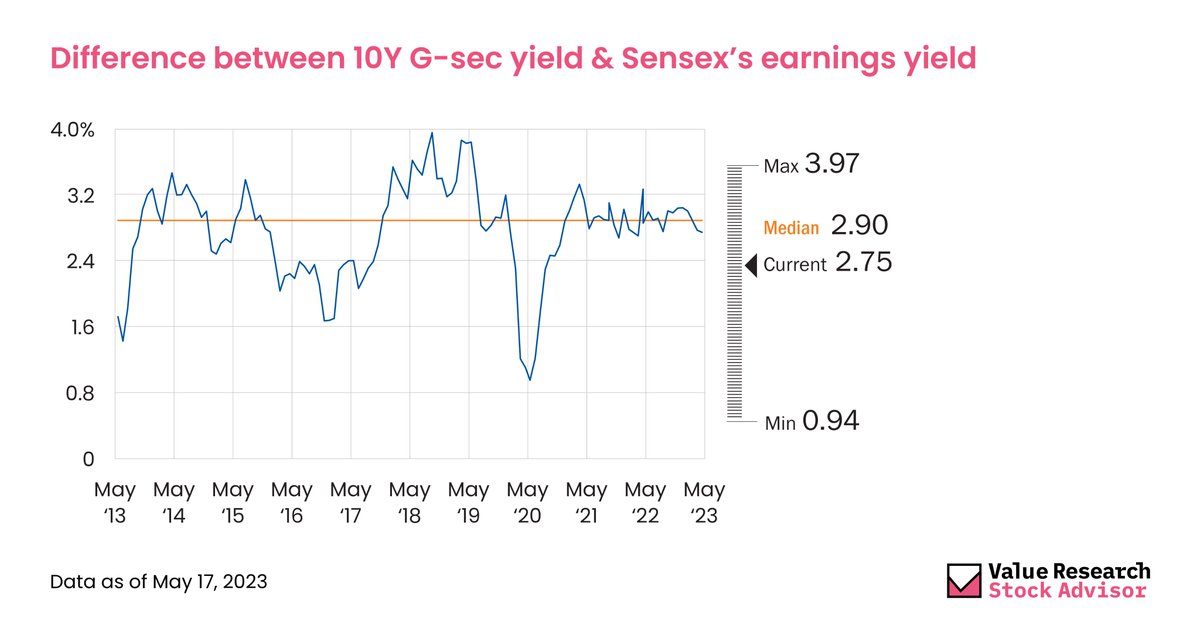

6/ Difference between 10Y G-sec yield and Sensex’s earnings yield

If the difference between the 10-year government bond yield and the index's earnings yield is higher than the median value, the index might be overvalued.

If the difference between the 10-year government bond yield and the index's earnings yield is higher than the median value, the index might be overvalued.

7/

🔔To keep yourself updated with market movements every month.

➡️Subscribe to our Wealth Insight monthly magazine: bit.ly/3oBSJMc

Follow @VROStocks for stock insights and information.

#stockmarkets #sensex #stocks

🔔To keep yourself updated with market movements every month.

➡️Subscribe to our Wealth Insight monthly magazine: bit.ly/3oBSJMc

Follow @VROStocks for stock insights and information.

#stockmarkets #sensex #stocks

• • •

Missing some Tweet in this thread? You can try to

force a refresh