Lately, I have discovered @Increment_HQ, a tool that helps you to analyze data without knowing to code.

So, I give it a try :)

Let's explore #Avalanche DeFi ecosystem with graphics made by @Increment_HQ 🧵

So, I give it a try :)

Let's explore #Avalanche DeFi ecosystem with graphics made by @Increment_HQ 🧵

1⃣ Active Addresses on @avax in 2023

It is clear that there is consistent growth that makes us optimistic about the future.

From early 2023 to now daily active addresses increased from around 30K to 90K

It is clear that there is consistent growth that makes us optimistic about the future.

From early 2023 to now daily active addresses increased from around 30K to 90K

2⃣ Transactions per day on @avax in 2023

As expected, transactions per day have also increased significantly.

From early 2023 to now daily active addresses increased from around 100K to 600K

As expected, transactions per day have also increased significantly.

From early 2023 to now daily active addresses increased from around 100K to 600K

3⃣ Number of Traders on Avalanche DEXs

Tbh, I believe that this number should be way higher as @traderjoe_xyz is killing the DEX ecosystem with Liquidity Book and soon the launch of Auto-pools

Tbh, I believe that this number should be way higher as @traderjoe_xyz is killing the DEX ecosystem with Liquidity Book and soon the launch of Auto-pools

However, it is clear that there is a growing trend and the number of traders have increased from around 2K to almost 6K.

With the adoption of DEXs around the ecosystem, Avalanche ecosystem can attract more traders

With the adoption of DEXs around the ecosystem, Avalanche ecosystem can attract more traders

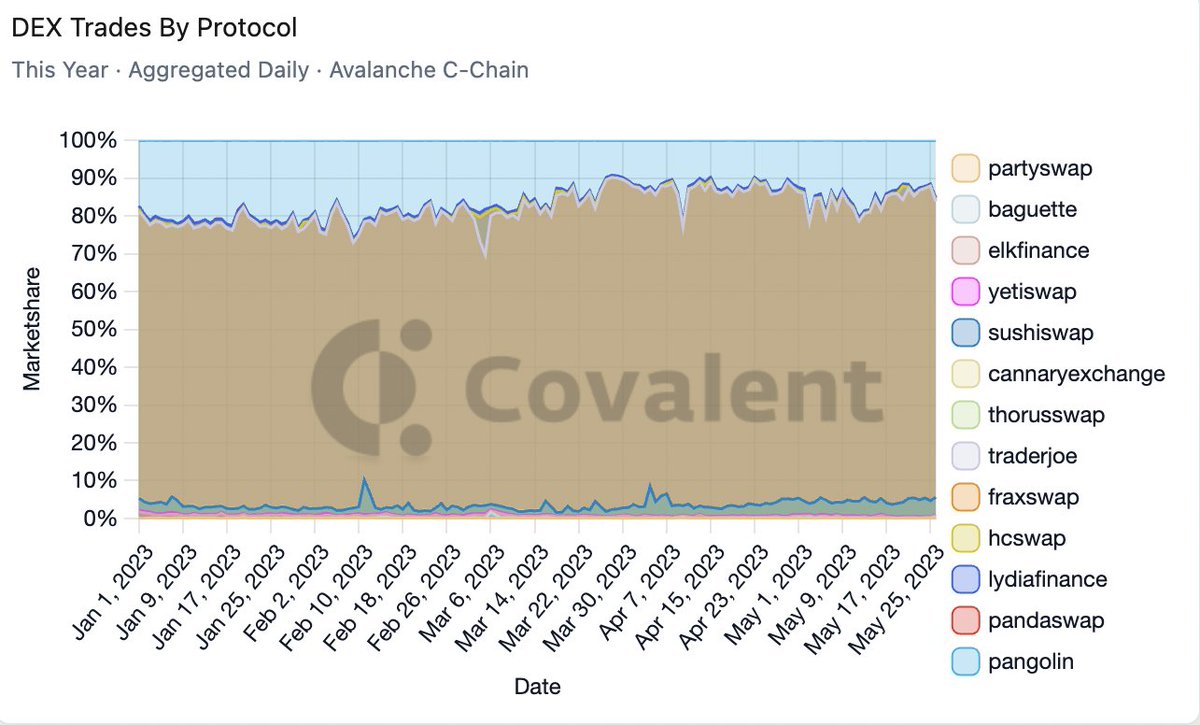

4⃣ DEX Trades by protocols on @avax

It seems like there are only 3 important actors in the Avalanche DEX space right now, with @traderjoe_xyz having a clear monopoly.

1- @traderjoe_xyz %78

2- @pangolindex %15

3- @SushiSwap % 4.5

It seems like there are only 3 important actors in the Avalanche DEX space right now, with @traderjoe_xyz having a clear monopoly.

1- @traderjoe_xyz %78

2- @pangolindex %15

3- @SushiSwap % 4.5

5⃣ Trader Distribution of Protocol Userbase

As expected, most of the traders are concentrated in the same protocols, namely, @traderjoe_xyz, @pangolindex, and @SushiSwap

Just wondering how the expansions of @Balancer and @Uniswap will change this graph

As expected, most of the traders are concentrated in the same protocols, namely, @traderjoe_xyz, @pangolindex, and @SushiSwap

Just wondering how the expansions of @Balancer and @Uniswap will change this graph

That's all for today, hope you will like it😍

I am a newbie at data analytics and trying to learn how to capitalize data on crypto

I can share similar content in the future as I am continuing to learn how to utilize @Increment_HQ

I am a newbie at data analytics and trying to learn how to capitalize data on crypto

I can share similar content in the future as I am continuing to learn how to utilize @Increment_HQ

• • •

Missing some Tweet in this thread? You can try to

force a refresh