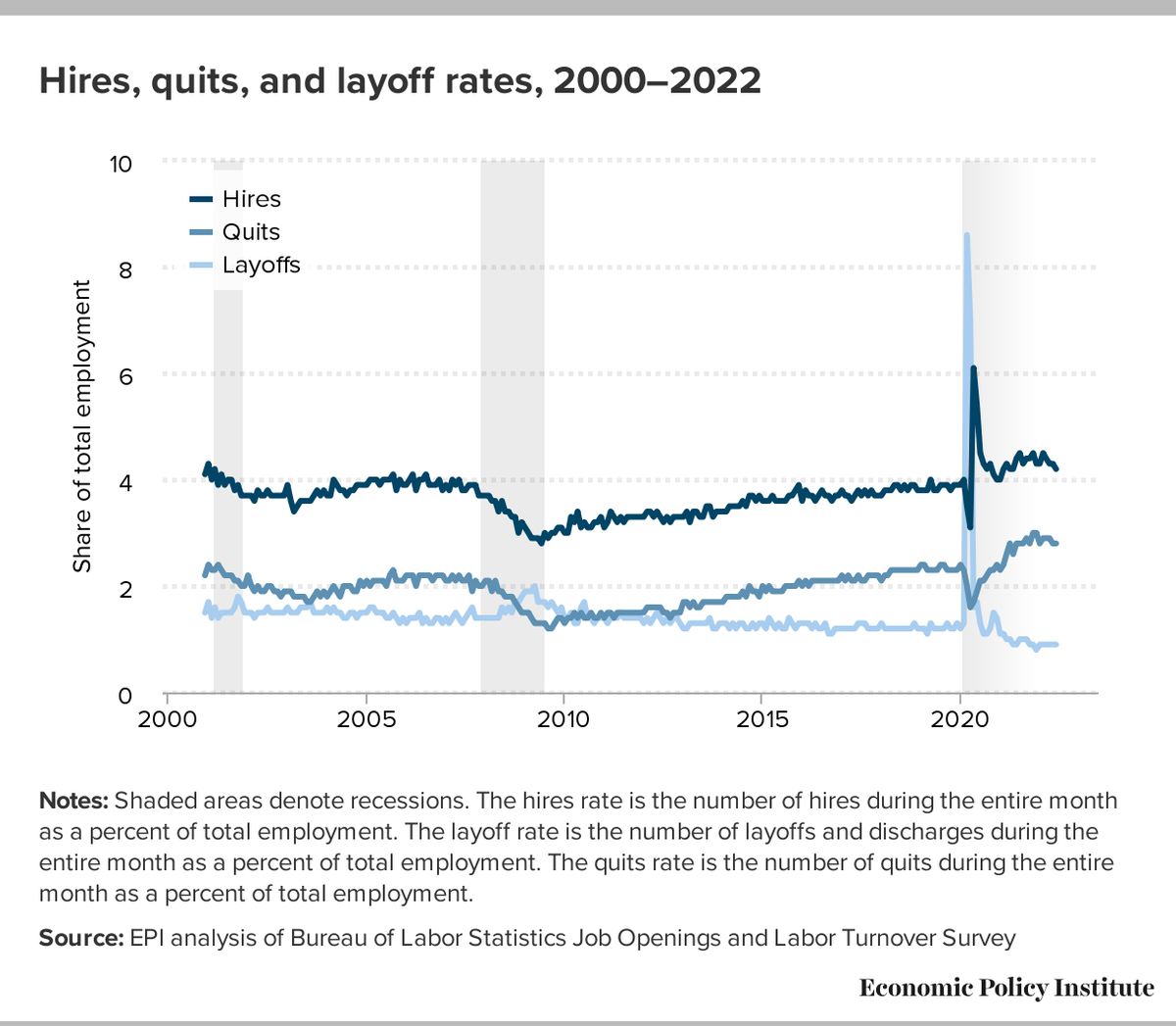

Job openings edged up in April 2023, but remain close to their level two years ago (in April 2021) and significantly lower than in the height of labor market churn in the pandemic recovery. Layoffs and discharges decreased in April while hires held steady and quits softened.

Job openings have generally been decreasing over the last year, slowly but steadily moving closer to their pre-pandemic levels, though clearly not there yet. Much of the elevated rates we've seen may have been because of the increased labor market churn and not net new demand.

After increasing in March, layoffs dropped in April closer to its February level. Hires held steady in April, while quits continued to edge down.

Layoffs still remain significantly lower than their prepandemic levels while hires and quits are still elevated.

Layoffs still remain significantly lower than their prepandemic levels while hires and quits are still elevated.

Last month, it appeared that the labor market might be cooling given the rising layoffs in March, but job growth in April and the drop in layoffs in today's report suggest the labor market remains steady and is not rapidly cooling.

For more #JOLTS charts, check out @EconomicPolicy's job openings landing page: epi.org/indicators/jol…

Shout out to @Katiedeco4 for pulling data and constructing charts!

Shout out to @Katiedeco4 for pulling data and constructing charts!

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter