1/ Decentralization is key to a resilient Proof-of-Stake network.

Let's explore the benefits, challenges, and new standards set by @sunnydece and @theSamPadilla for measuring and improving operational decentralization in public PoS networks. 🧵

Let's explore the benefits, challenges, and new standards set by @sunnydece and @theSamPadilla for measuring and improving operational decentralization in public PoS networks. 🧵

2/ In a PoS system, validators play a crucial role as the backbone of global computing platforms.

They validate and record transactions, ensuring consensus on the chain of blocks.

Understanding their functions and operational factors is essential to measure decentralization.

They validate and record transactions, ensuring consensus on the chain of blocks.

Understanding their functions and operational factors is essential to measure decentralization.

3/ Exploring operational decentralization in PoS networks, we examine factors like hardware requirements, ongoing expenses, stake delegation, and active validator set caps.

Network design impacts diversity of operators and resource-intensive infrastructure choices.

Network design impacts diversity of operators and resource-intensive infrastructure choices.

4/ Measuring operational decentralization in PoS networks involves assessing stake and validator distribution across software, hosting, and location.

The Nakamoto coefficient sets a threshold for system compromise.

Qualitative factors and caveats add depth to the analysis.

The Nakamoto coefficient sets a threshold for system compromise.

Qualitative factors and caveats add depth to the analysis.

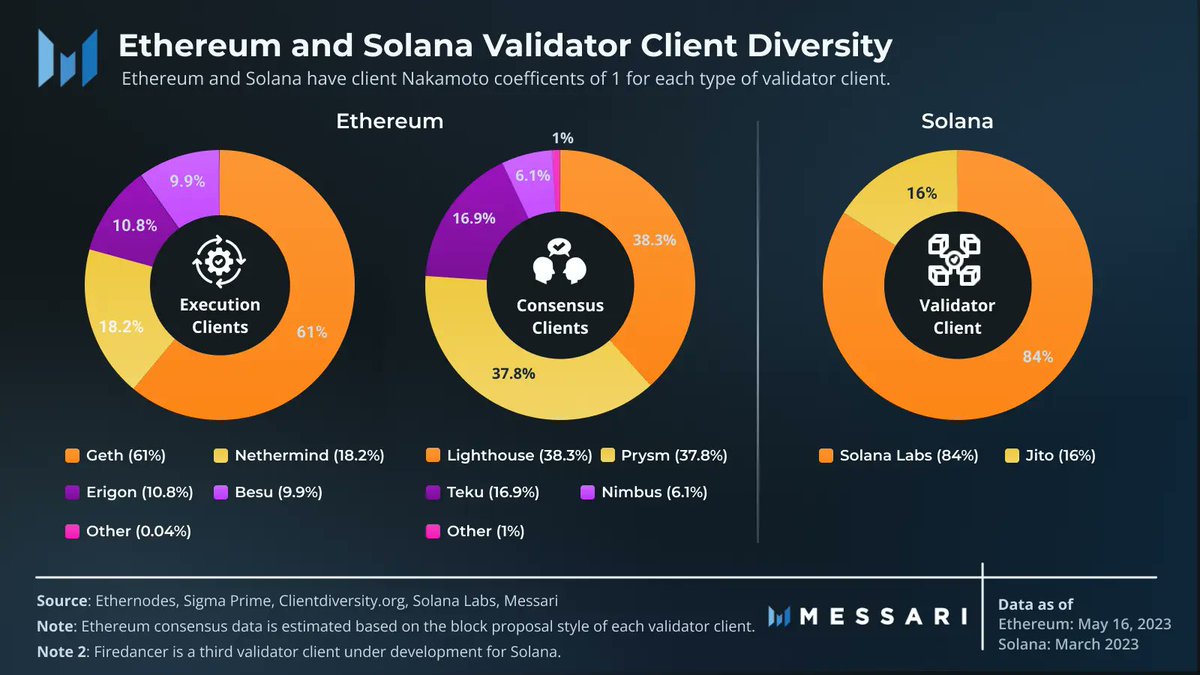

5/ Analyzing operational decentralization in PoS networks.

Client diversity is crucial for network stability.

Different validator client implementations offer varied performance and reduce the risk of code errors. Let's dive into client distribution and its impact.

Client diversity is crucial for network stability.

Different validator client implementations offer varied performance and reduce the risk of code errors. Let's dive into client distribution and its impact.

6/ Validator clients are the software that node operators use to connect to the network.

Networks like @avax, @Cardano, and @NEARProtocol have single-client implementations, leading to concentration.

@ethereum has multiple clients, but @go_ethereum and @prylabs dominate.

Networks like @avax, @Cardano, and @NEARProtocol have single-client implementations, leading to concentration.

@ethereum has multiple clients, but @go_ethereum and @prylabs dominate.

7/ #Ethereum's dominance of @go_ethereum (62% execution clients) and @prylabs (38% consensus clients) caused network instability at times.

@solana experienced downtime due to reliance on a single client but is developing new clients like @jito_labs and @jump_firedancer.

@solana experienced downtime due to reliance on a single client but is developing new clients like @jito_labs and @jump_firedancer.

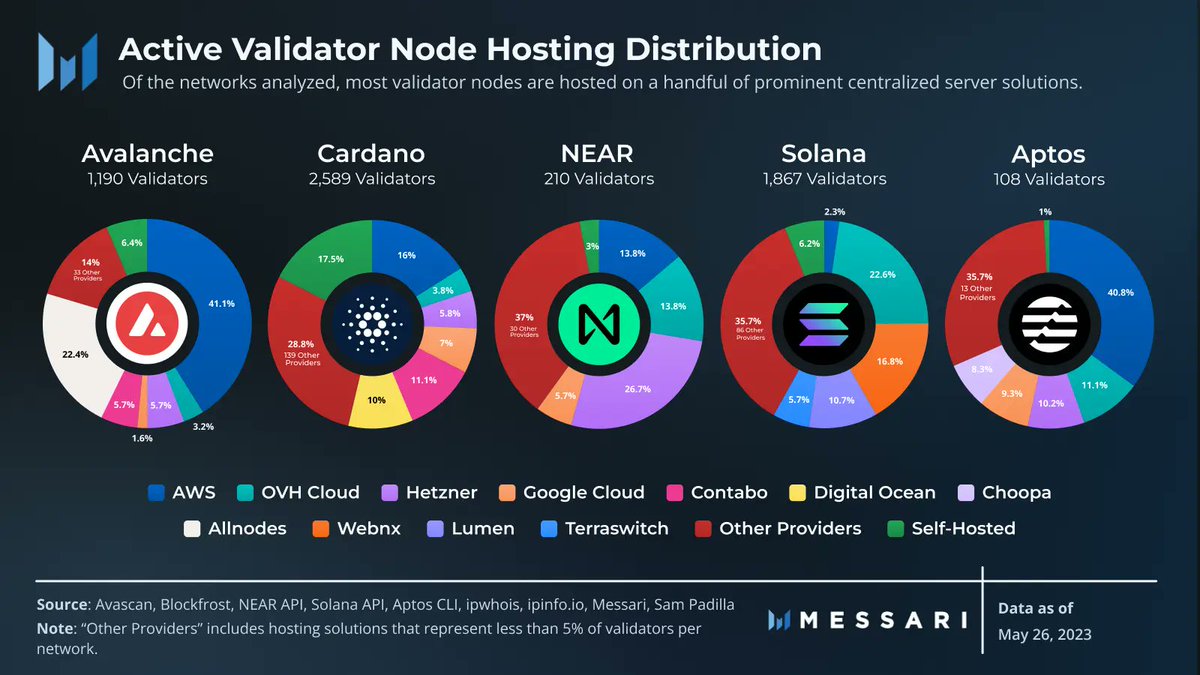

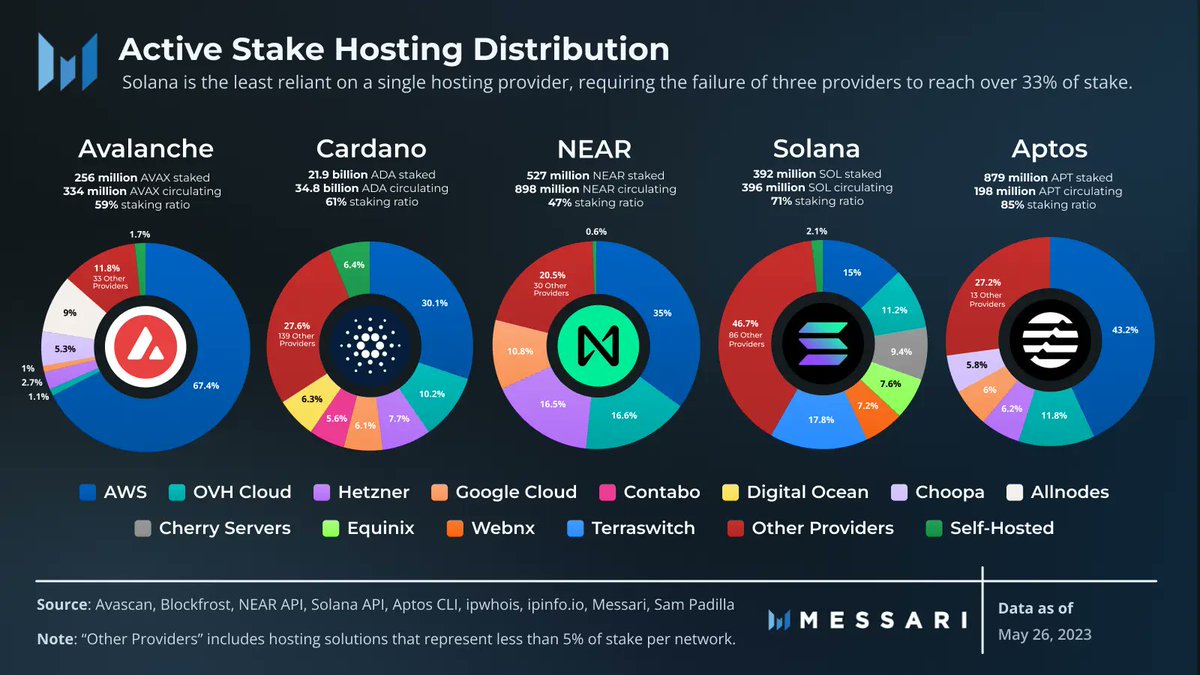

8/ Hosting distribution also affects operational decentralization.

Most networks rely on hosted servers due to convenience and cost efficiency.

@awscloud, @OVHcloud, @Hetzner_Online, and @googlecloud are dominant providers.

Most networks rely on hosted servers due to convenience and cost efficiency.

@awscloud, @OVHcloud, @Hetzner_Online, and @googlecloud are dominant providers.

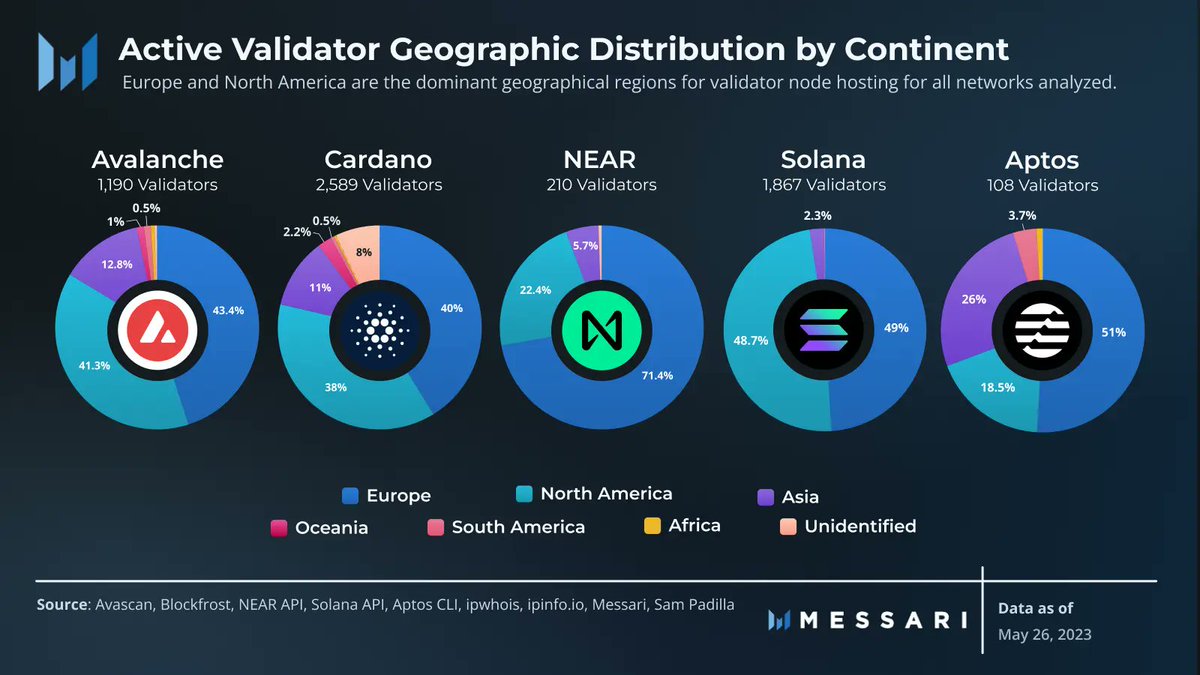

9/ Geographic distribution plays a vital role in network resilience.

Networks should be well-distributed across regions to mitigate localized issues and avoid censorship risks.

However, Europe and North America dominate, with limited representation in other regions.

Networks should be well-distributed across regions to mitigate localized issues and avoid censorship risks.

However, Europe and North America dominate, with limited representation in other regions.

10/ Stake concentration across dominant hosting providers like @awscloud is a concern.

@Cardano has a notable amount of self-hosted validators, while @solana relies less on dominant providers.

Understanding hosting distribution helps mitigate risks of infrastructure failures.

@Cardano has a notable amount of self-hosted validators, while @solana relies less on dominant providers.

Understanding hosting distribution helps mitigate risks of infrastructure failures.

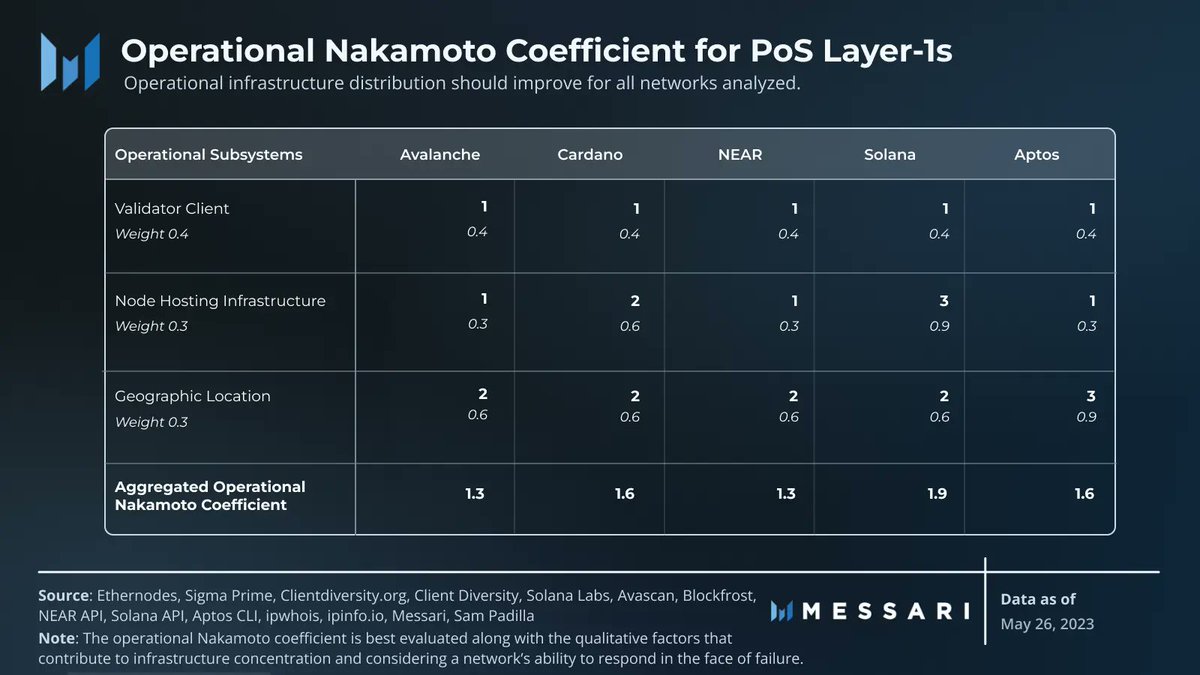

11/ Operational Nakamoto coefficients measure client diversity, hosting distribution, and geographic distribution.

It's essential to assess these factors to evaluate the operational decentralization of PoS networks.

It's essential to assess these factors to evaluate the operational decentralization of PoS networks.

12/ To assess network resilience, we computed operational Nakamoto coefficients for @avax, @Cardano, @NEARProtocol, @solana, and @Aptos_Network.

Weighted averages were assigned to node software (0.4), node hosting infrastructure (0.3), and geographic location (0.3).

Weighted averages were assigned to node software (0.4), node hosting infrastructure (0.3), and geographic location (0.3).

13/ Across all networks analyzed, @avax and @NEARProtocol score 1.3, @Cardano and @Aptos_Network score 1.6, and @solana slightly surpasses others with a score of 1.9.

No network requires multiple unrelated failures to disrupt its operation.

No network requires multiple unrelated failures to disrupt its operation.

14/ One common trend is the reliance on similar infrastructure and early-developed clients, with AWS and representation in the United States and Germany being prominent.

Stake concentration is consistently higher than validator distribution.

Stake concentration is consistently higher than validator distribution.

15/ As networks evolve, it's essential to prioritize operational decentralization.

Validator operators should diversify hosting solutions and leverage technologies like DVT for enhanced security.

Validator operators should diversify hosting solutions and leverage technologies like DVT for enhanced security.

16/ For an in-depth evaluation of Validator Decentralization: Geographic and Infrastructure Distribution in Proof-of-Stake Networks, check out the full report from @sunnydece and @theSamPadilla.

zpr.io/9GkHyV7dKRmY

zpr.io/9GkHyV7dKRmY

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter