In the 2019 bear market bottom, I got caught on the sidelines waiting to buy #Bitcoin lower. I listened to on-chain gurus and their favorite metrics.

Learn from my mistakes. Thread on:

- Which Bitcoin price metrics have value & why

- Where we are in the Bitcoin market cycle

Learn from my mistakes. Thread on:

- Which Bitcoin price metrics have value & why

- Where we are in the Bitcoin market cycle

After 6 years full-time learning, I believe there’s 3 reliable price drivers:

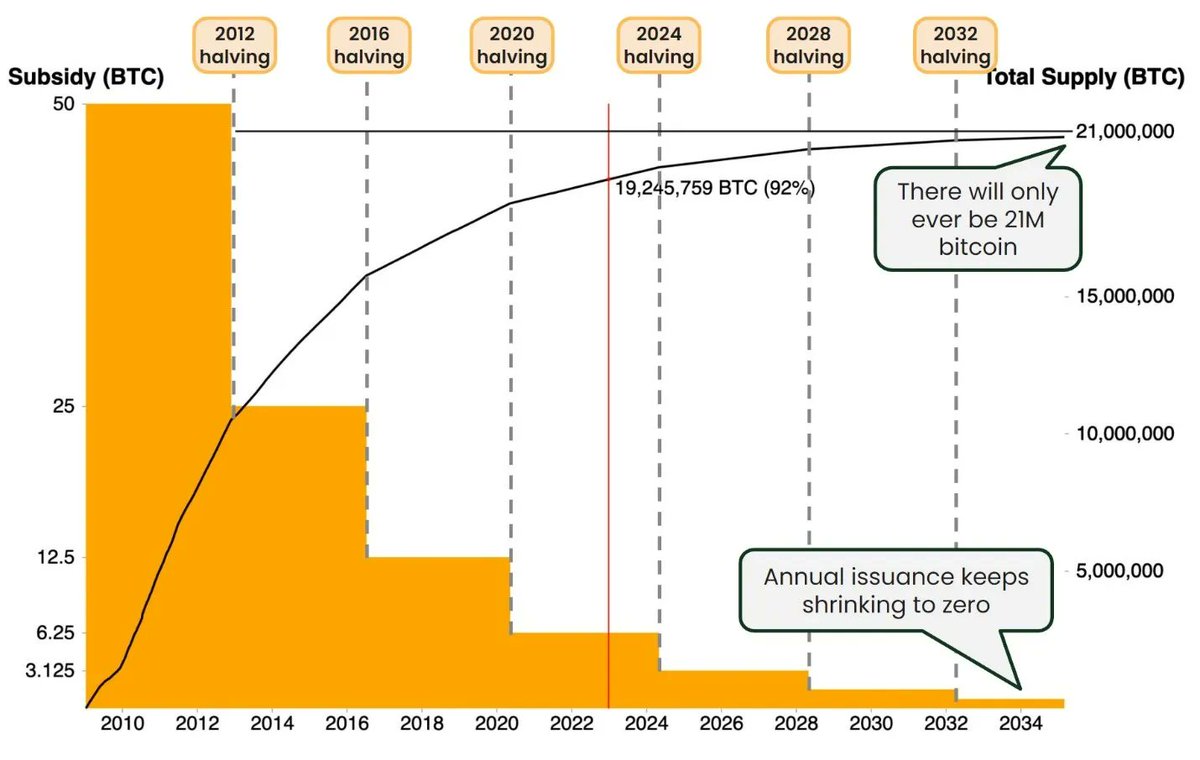

1. Bitcoin’s halvings (increasing scarcity over time)

2. Human psychology amplifying volatility in the wake of the halvings

3. Macroeconomic conditions (e.g. QT/QE)

#1 + #2 create this dynamic:

1. Bitcoin’s halvings (increasing scarcity over time)

2. Human psychology amplifying volatility in the wake of the halvings

3. Macroeconomic conditions (e.g. QT/QE)

#1 + #2 create this dynamic:

Everything else is reading tea leaves, retroactively finding spurious patterns, or downstream of the above 3 drivers.

But these downstream indicators are useful. Some quantify and capture human psychology in action.

Here are 3 worth knowing...

But these downstream indicators are useful. Some quantify and capture human psychology in action.

Here are 3 worth knowing...

2-Year Moving Average Multiplier

This metric shows when the market is running much hotter or colder than the average #Bitcoin price over the prior two years.

I think it captures something about how we collectively adjust our "fair" valuation of Bitcoin slowly as a society.

This metric shows when the market is running much hotter or colder than the average #Bitcoin price over the prior two years.

I think it captures something about how we collectively adjust our "fair" valuation of Bitcoin slowly as a society.

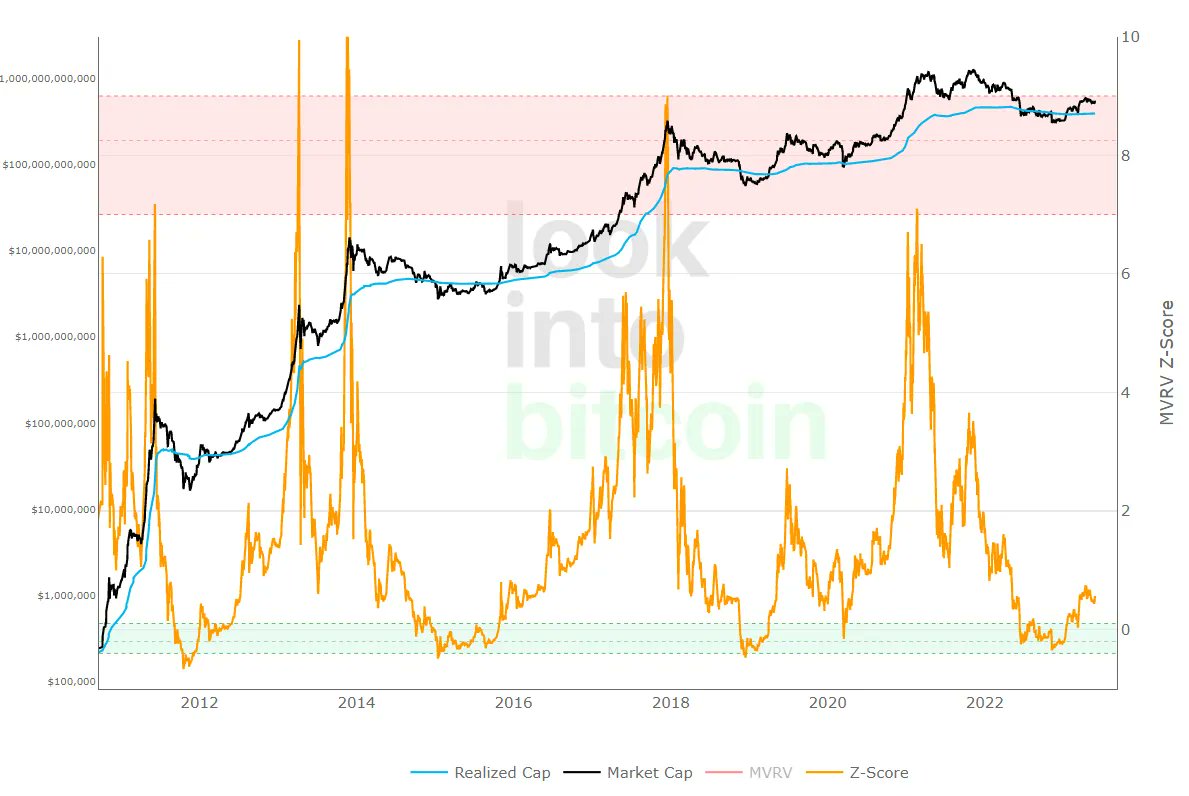

MVRV Z-Score

This metric quantifies the degree of variance between the current market price of Bitcoin and the average last value at which coins moved.

Again, this captures something about the human psychology of this market (Driver #2), more than anything else

This metric quantifies the degree of variance between the current market price of Bitcoin and the average last value at which coins moved.

Again, this captures something about the human psychology of this market (Driver #2), more than anything else

Cumulative Value Coin Days Destroyed (CVDD)

This one is the most mysterious. This metric captures the extent of distribution of long-held coins over time, which seems to directly correlate to the extent the "price floor" of what ppl value BTC at shifts upwards over time.

This one is the most mysterious. This metric captures the extent of distribution of long-held coins over time, which seems to directly correlate to the extent the "price floor" of what ppl value BTC at shifts upwards over time.

Ultimately, for Bitcoin, it's all about the relentless march of increasing scarcity (via the halvings) and how humanity reacts to this changing landscape and slowly digests what inelastic, decreasing new supply means for an asset's value.

Human psychology & macro layer on top.

Human psychology & macro layer on top.

• • •

Missing some Tweet in this thread? You can try to

force a refresh