Did you know that @justinsuntron was a few mins away from a $1bil liquidation

Did you know that @Tetranode provided the biggest redemption in Liquity's history?

& did you know that there will ALWAYS be $11m of LUSD liquidity on @CurveFinance ?

Time for a few stories... 📖

👇

Did you know that @Tetranode provided the biggest redemption in Liquity's history?

& did you know that there will ALWAYS be $11m of LUSD liquidity on @CurveFinance ?

Time for a few stories... 📖

👇

Today, we'd like to go back on some Liquity folklore & share the stories of our Chads who, despite their Chadness, sometimes made mistakes

These chads are chads for a reason: they learn from it & tend to have mishaps that benefit the community

ft. @Tetranode, 0x71 & more

🧵👇

These chads are chads for a reason: they learn from it & tend to have mishaps that benefit the community

ft. @Tetranode, 0x71 & more

🧵👇

-- 1. Accidental Protocol Owned Liquidity --

We all know how sweaty palms can get when moving with size onchain

Immutability can be a harsh mistress when attention slips away.

Our first chad, 0x711CD, fortuitously became part of @LiquityProtocol's & @CurveFinance's history

👇

We all know how sweaty palms can get when moving with size onchain

Immutability can be a harsh mistress when attention slips away.

Our first chad, 0x711CD, fortuitously became part of @LiquityProtocol's & @CurveFinance's history

👇

We do not know who 0x711CD is to this day, but the Liquity community is forever grateful to him.

He remains active as of 28 days ago, so it was about due time to share his story.

So what happened there?

He remains active as of 28 days ago, so it was about due time to share his story.

So what happened there?

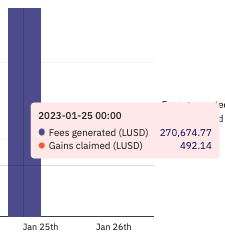

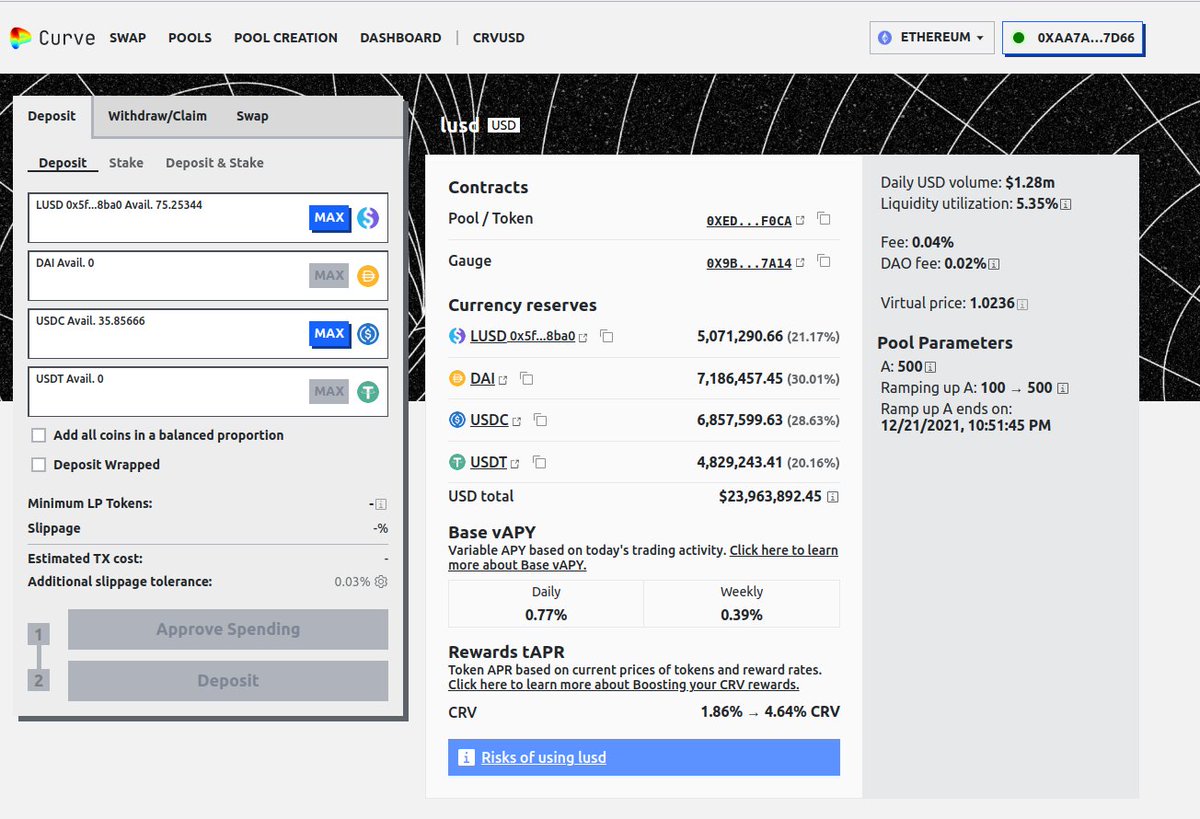

It's all about the @CurveFinance $LUSD / $3CRV ($USDC, $USDT & $DAI) pool:

Home of about $24M worth of liquidity, increasingly more balanced, but that's another story.

Home of about $24M worth of liquidity, increasingly more balanced, but that's another story.

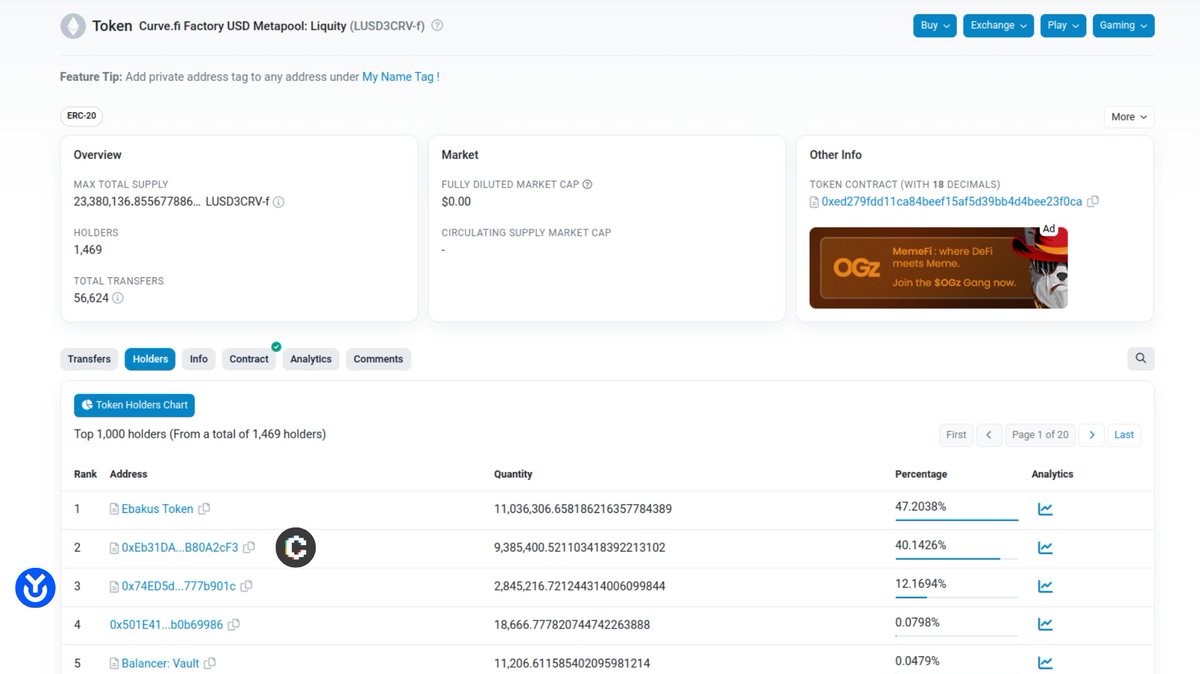

Let's look at the LP token holders:

See Ebakus Token Contract, with 47% of the supply? More than deposited in the @ConvexFinance vault & @iearnfinance vault, the second and third entries.

Let's start with the best news: the LP tokens sent there are essentially... burned 🔥

See Ebakus Token Contract, with 47% of the supply? More than deposited in the @ConvexFinance vault & @iearnfinance vault, the second and third entries.

Let's start with the best news: the LP tokens sent there are essentially... burned 🔥

So what happened there?

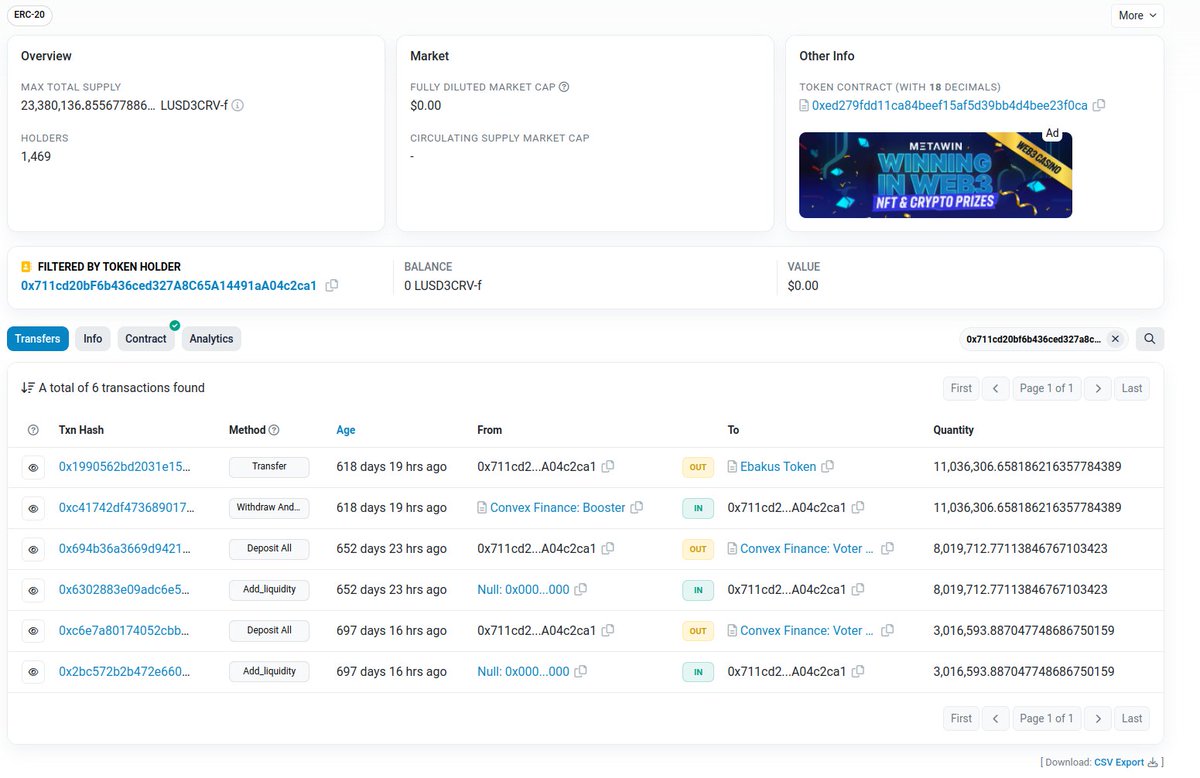

- Zooming in on 0x711CD's interactions with LUSD/3crv contract, we can see he was a large LUSD LP who even used @ConvexFinance, up to Sep 18, 2021.

Then, he withdraw all assets & sent them the Ebakus token contract.

- Zooming in on 0x711CD's interactions with LUSD/3crv contract, we can see he was a large LUSD LP who even used @ConvexFinance, up to Sep 18, 2021.

Then, he withdraw all assets & sent them the Ebakus token contract.

Here's Chad 0x711CD's sending ~11M LP tokens, about ~$11.3M worth, to the Ebakus token contract:

The error likely stems from a too-hasty copy/paste, but your guesses are as good as ours!

etherscan.io/tx/0x1990562bd…

The error likely stems from a too-hasty copy/paste, but your guesses are as good as ours!

etherscan.io/tx/0x1990562bd…

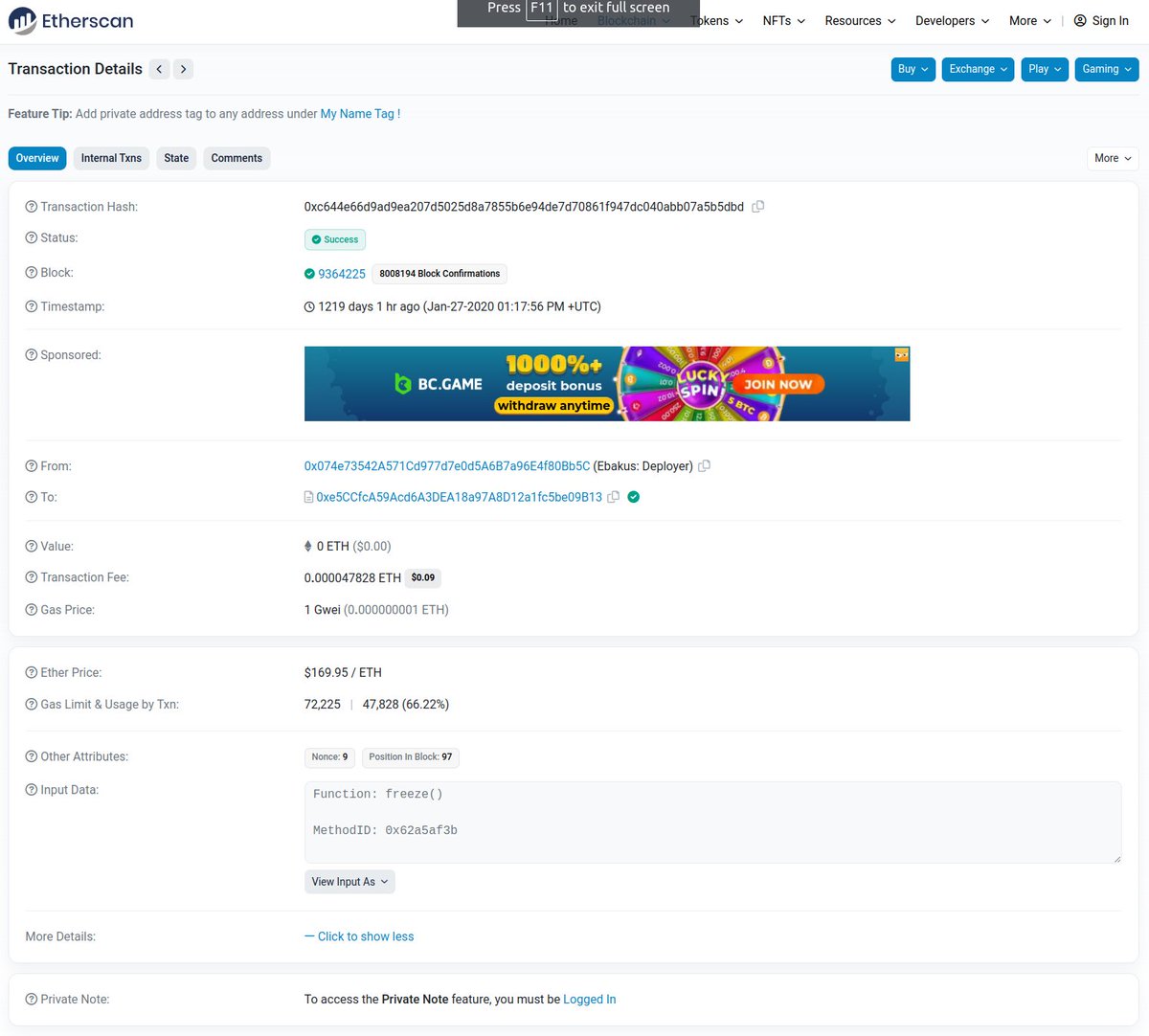

What's @EbakusNetwork, you might ask? We're not sure; they have been inactive since 2021, and froze transfers on their $EBK token a while ago too:

etherscan.io/tx/0xc644e66d9…

etherscan.io/tx/0xc644e66d9…

At the end of the day, what mattered was assessing whether or not the LP tokens could be withdrawn:

Luckily, the EBK token contract is pretty simple, with a limited number of functions... and none including anything related to sweeping funds accidentally sent to the contract 🥳

Luckily, the EBK token contract is pretty simple, with a limited number of functions... and none including anything related to sweeping funds accidentally sent to the contract 🥳

Meaning that 11M LP token / currently roughly 47% of the whole LUSD/3CRV pool ownership has been forever burned 🔥

It seems pretty comfy for the LUSD LPs who harness the @CurveFinance gauge or @ConvexFinance, as the alpha whale will never dilute their rewards!

It seems pretty comfy for the LUSD LPs who harness the @CurveFinance gauge or @ConvexFinance, as the alpha whale will never dilute their rewards!

It's also reassuring to know that whatever happens, even if ALL of $LUSD @CurveFinance LPs were to withdraw from the pool, there will still be the $11.3M from Chad 0x711CD to maintain a solid baseline of liquidity.

0x711CD further diversified $LUSD POL, just like @ChickenBonds

0x711CD further diversified $LUSD POL, just like @ChickenBonds

--- 2. Redemption Shenanigans ---

@Tetranode is an avid user since the early days, quickly joined the Discord, and shared the love around on CT. 🙏

We even have a TetraChungus chilling at the office! Courtesy of @TokenBrice, who apparently owns "way too many".

@Tetranode is an avid user since the early days, quickly joined the Discord, and shared the love around on CT. 🙏

We even have a TetraChungus chilling at the office! Courtesy of @TokenBrice, who apparently owns "way too many".

Tetra is a power user of the protocol, but like most of Liquity's tinkerers, it was an iterative process.

Indeed, there could be a bit of a learning curve for Liquity, especially when it comes to unprecedented functions back then, such as Redemptions.

Indeed, there could be a bit of a learning curve for Liquity, especially when it comes to unprecedented functions back then, such as Redemptions.

At Liquity's launch, the spirits were also vastly different: Liquity was smashing TVL thresholds with an ETH on a meteoric rise.

Our story happened a few months after, back in October 2021. Tetra was hungry for leverage to further capitalize on the ETH dynamism.

Our story happened a few months after, back in October 2021. Tetra was hungry for leverage to further capitalize on the ETH dynamism.

Looking to leverage his Trove, Tetra harnessed the Redemption function, enabling the conversion of LUSD to ETH against the least collateralized Troves of the protocol... the bulk of which was Tetra's.

Who else than @Tetranode could be worthy of redeeming himself?

Who else than @Tetranode could be worthy of redeeming himself?

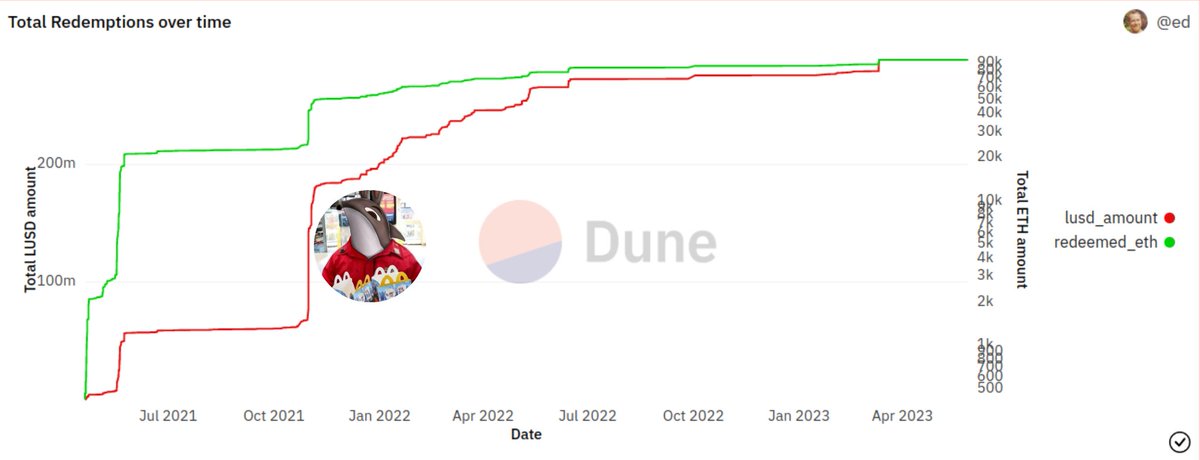

Because of the baseFee mechanism, here to protect the protocol against quick LUSD supply spikes/shrinks - Tetra paid an increasing fee, leading to a nice payout to LQTY stakers: about $5M

He'd have achieved better pricing using LUSD's DEX liquidity

He'd have achieved better pricing using LUSD's DEX liquidity

His deed will forever be remembered as the biggest redemption event, with millions of $LUSD redeemed on that day.

It remains easy to spot on @edwardmulraney's @DuneAnalytics dashboard:

It remains easy to spot on @edwardmulraney's @DuneAnalytics dashboard:

Our favorite part of this story is probably @Tetranode's node reaction, one of a 100% pure-breed Whale Chad.

Once he realized what happened, he told the stakers to "enjoy"

Once he realized what happened, he told the stakers to "enjoy"

--- 3. NFT Chicken Chad ---

@ChickenBonds had their fair of Triva share too, here's a quick one.

There are various ways to get involved with the Chicken Bonds, be it at the bond (egg) stage or through the liquid ERC-20 $bLUSD

Today's 🐔 chad harnessed the NFTs!

@ChickenBonds had their fair of Triva share too, here's a quick one.

There are various ways to get involved with the Chicken Bonds, be it at the bond (egg) stage or through the liquid ERC-20 $bLUSD

Today's 🐔 chad harnessed the NFTs!

About two months ago, DeFi4ever.eth sold a Chicken Out NFT for 10 ETH.

Chicken In and Out NFTs are like POAP; they hold no assets - only the eggs do!

While DeFi4ever Chickened Out and thus missed out on bLUSD, he secured ~$19k profits with the sale:

looksrare.org/collections/0x…

Chicken In and Out NFTs are like POAP; they hold no assets - only the eggs do!

While DeFi4ever Chickened Out and thus missed out on bLUSD, he secured ~$19k profits with the sale:

looksrare.org/collections/0x…

-- Biggest liquidatable trove 🤯 🛎️ --

Last but not the least, there is his royal highness, @justinsuntron

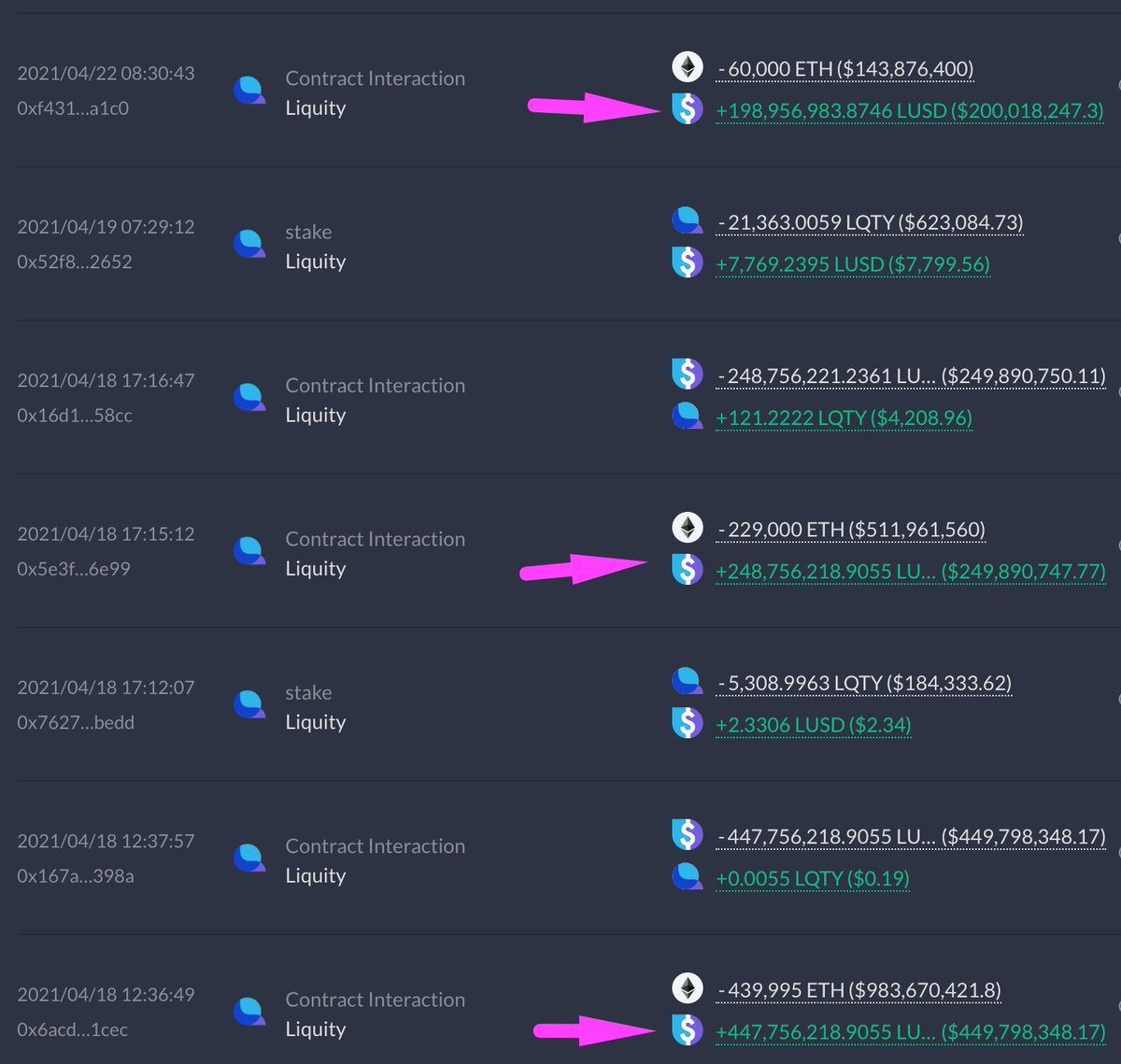

Liquity launched on April 5th 2021 & within a couple of weeks, Justin took out over $1B dollars (600k ETH) worth of loans on Liquity

Last but not the least, there is his royal highness, @justinsuntron

Liquity launched on April 5th 2021 & within a couple of weeks, Justin took out over $1B dollars (600k ETH) worth of loans on Liquity

A month later on May 19th, there were liquidations across crypto

ETH dropped from $3.4k to 1.8k within a few hours -> Liquity entered Recovery Mode, & over 300 troves got liquidated

There were a few minutes in which Justin's 600k ETH trove dropped to under 150% CR ratio! 🤯

👇

ETH dropped from $3.4k to 1.8k within a few hours -> Liquity entered Recovery Mode, & over 300 troves got liquidated

There were a few minutes in which Justin's 600k ETH trove dropped to under 150% CR ratio! 🤯

👇

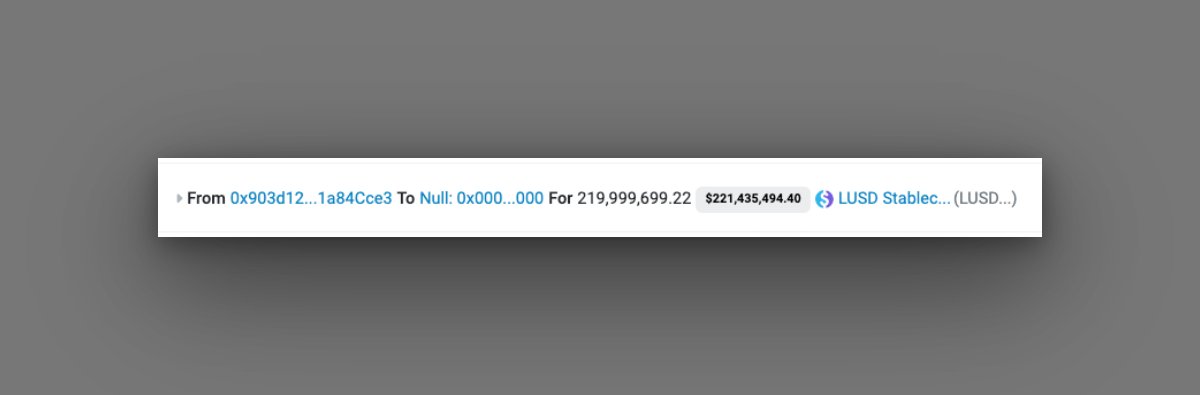

Luckily, Justin was able to stave off liquidation through:

-Troves with lower collateral ratios being liquidated first (which raised protocol health)

-Paying off $220m of his debt

-Liquidation bots not being as efficient (targeting Troves by size) as to where they are now

-Troves with lower collateral ratios being liquidated first (which raised protocol health)

-Paying off $220m of his debt

-Liquidation bots not being as efficient (targeting Troves by size) as to where they are now

Now let's hear your stories!

What are your happy #DeFi mistakes?

Immutability can sometimes give a positive twist to a mistake, as seen with 0x711CD, who will now be forever part of @LiquityProtocol, as the top supplier, potentially ever, of LUSD/3crv @CurveFinance POL

What are your happy #DeFi mistakes?

Immutability can sometimes give a positive twist to a mistake, as seen with 0x711CD, who will now be forever part of @LiquityProtocol, as the top supplier, potentially ever, of LUSD/3crv @CurveFinance POL

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter