Will large-scale #batteries store the energy when it is cheap and sell it back when expensive? My short answer is no.

A short thread. (1/10)

A short thread. (1/10)

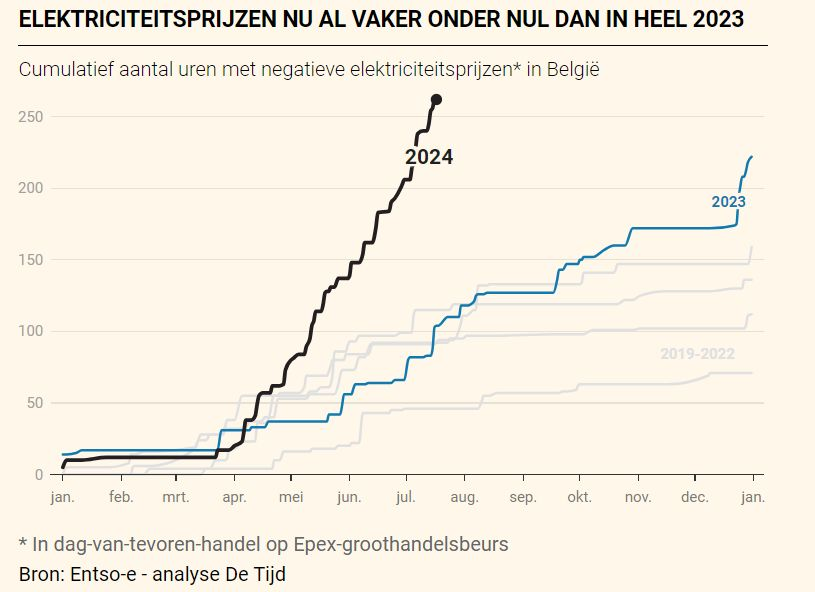

Volatility is on the rise with renewables, especially solar. Just check what happened last week in Europe. Very low and negative prices all other Europe for lunch. (2/10)

Solar was clearly one of the main factors. The residual load in Germany getting close to zero (negative in the Netherlands). (3/10)

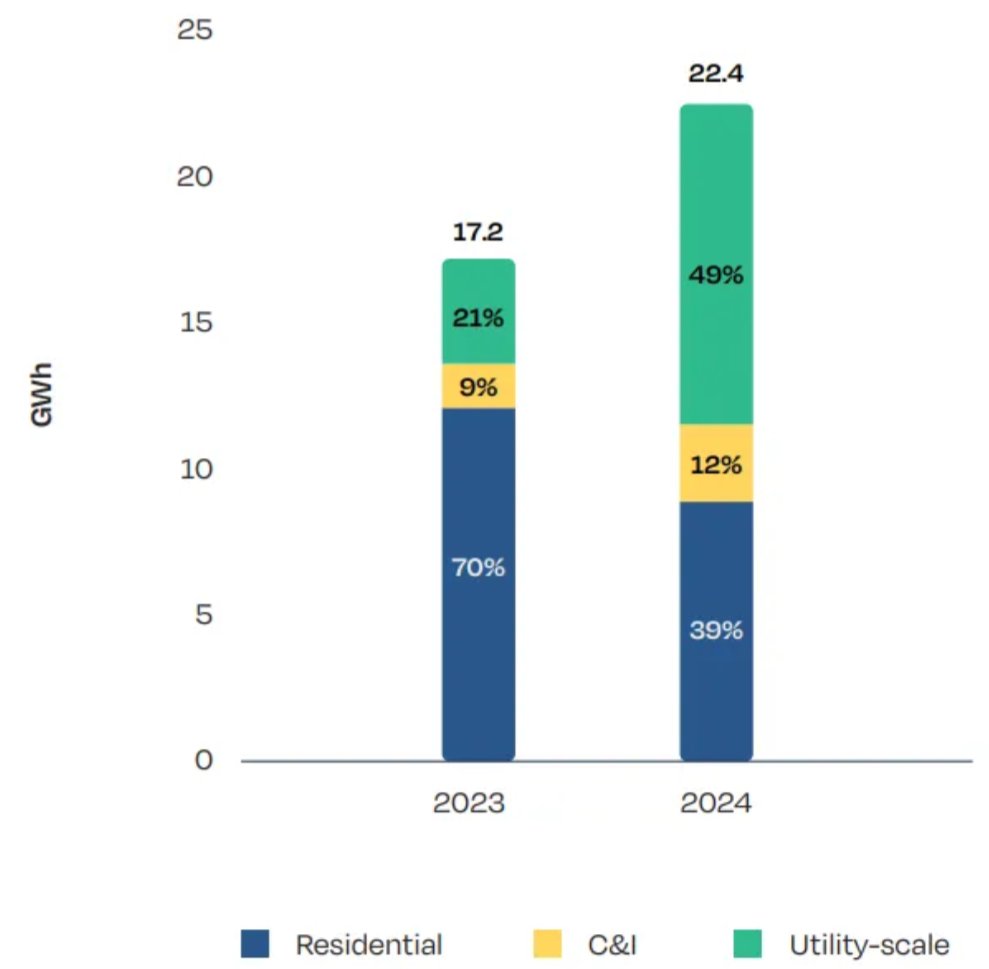

Should we install large-scale batteries to store excess energy and gives it back during the evening?

No, it is far from making economic sense today (happy to discuss assumptions). Basically, one spread per day is not enough to justify investing in large-scale batteries. (5/10)

No, it is far from making economic sense today (happy to discuss assumptions). Basically, one spread per day is not enough to justify investing in large-scale batteries. (5/10)

I am not the only one to say that, I believe. @iain_staffell (6/10)

Or check the calculated revenues in this great study (sciencedirect.com/science/articl…). Far from justifying investing in large-scale batteries. (7/10)

Should we do any large-scale batteries? Yes, we should! But not for energy arbitrage...but for power reserves, very-short term portfolio management (balancing, intraday), renewables integration, grid congestion, ... Just not to store a lot of energy and give it back later. (8/10)

But probably the true potential is with Electric Vehicles. The stored energy would be much larger...of course, these batteries are not primarily made for that, so the potential is much lower. Still, great potential...if we have incitative tariffs. (9/10) @RWTH

• • •

Missing some Tweet in this thread? You can try to

force a refresh