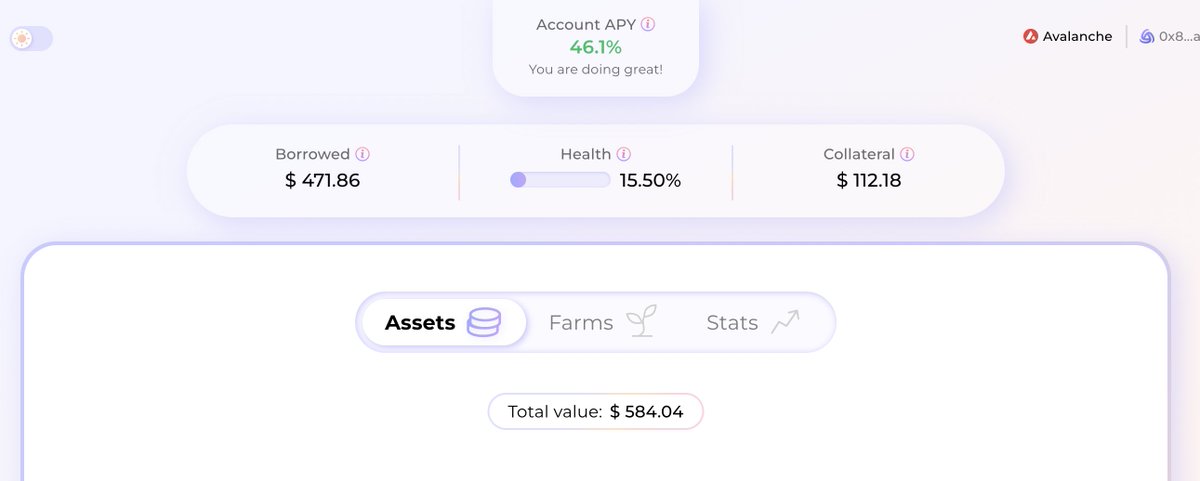

Let's get liquid💧@BenqiFinance💧

Comparing 3 easy $sAVAX strategies, and how they impact your Prime Account.

Comparing:

- Health (leverage)

- Current APY

- Risks (all have sAVAX depeg+smart contract)

- Rewards

- Intuitiveness to set up

- Efforts to manage

🧵🧵🧵🧵🧵🧵🧵🧵

Comparing 3 easy $sAVAX strategies, and how they impact your Prime Account.

Comparing:

- Health (leverage)

- Current APY

- Risks (all have sAVAX depeg+smart contract)

- Rewards

- Intuitiveness to set up

- Efforts to manage

🧵🧵🧵🧵🧵🧵🧵🧵

USDC ➡️ sAVAX

This is for the #AVAX Bulls amongst us. The ones that look at a $14,89 price and laugh. Who know it will never be this low again and put their money where their mouth is.

What's that strat?

1⃣Deposit $USDC

2⃣Borrow $USDC

3⃣Swap all to $sAVAX

4⃣Farm it all

This is for the #AVAX Bulls amongst us. The ones that look at a $14,89 price and laugh. Who know it will never be this low again and put their money where their mouth is.

What's that strat?

1⃣Deposit $USDC

2⃣Borrow $USDC

3⃣Swap all to $sAVAX

4⃣Farm it all

USDC ➡️ sAVAX

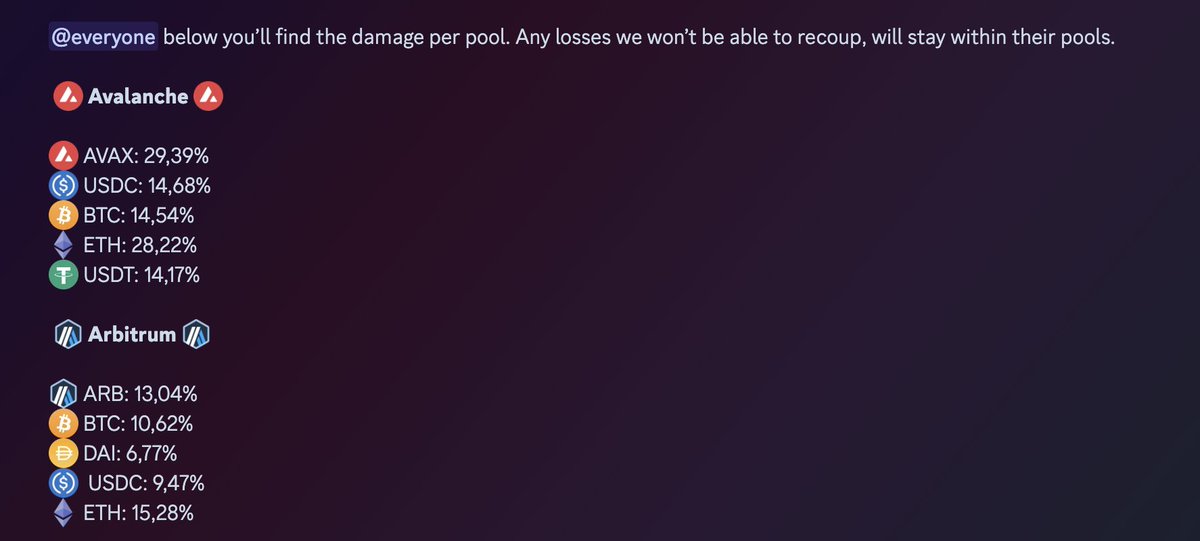

☑️Example health: 20.19% (4x)

☑️Current APY: 39.7%👍

☑️Risk: AVAX price 📉

☑️Rewards: AVAX price📈 + farm APY

☑️Set up: Very easy✅

☑️Manage style: Active👀

☑️Example health: 20.19% (4x)

☑️Current APY: 39.7%👍

☑️Risk: AVAX price 📉

☑️Rewards: AVAX price📈 + farm APY

☑️Set up: Very easy✅

☑️Manage style: Active👀

AVAX ➡️ sAVAX

The strat for the Delta Neutralists. You don't know what the market will do, and quite frankly, you don't care either. Whether we go up or down, you just want to print.

1⃣Deposit #AVAX

2⃣Borrow $AVAX

3⃣Swap all to $sAVAX

4⃣Farm it all

The strat for the Delta Neutralists. You don't know what the market will do, and quite frankly, you don't care either. Whether we go up or down, you just want to print.

1⃣Deposit #AVAX

2⃣Borrow $AVAX

3⃣Swap all to $sAVAX

4⃣Farm it all

AVAX ➡️ sAVAX

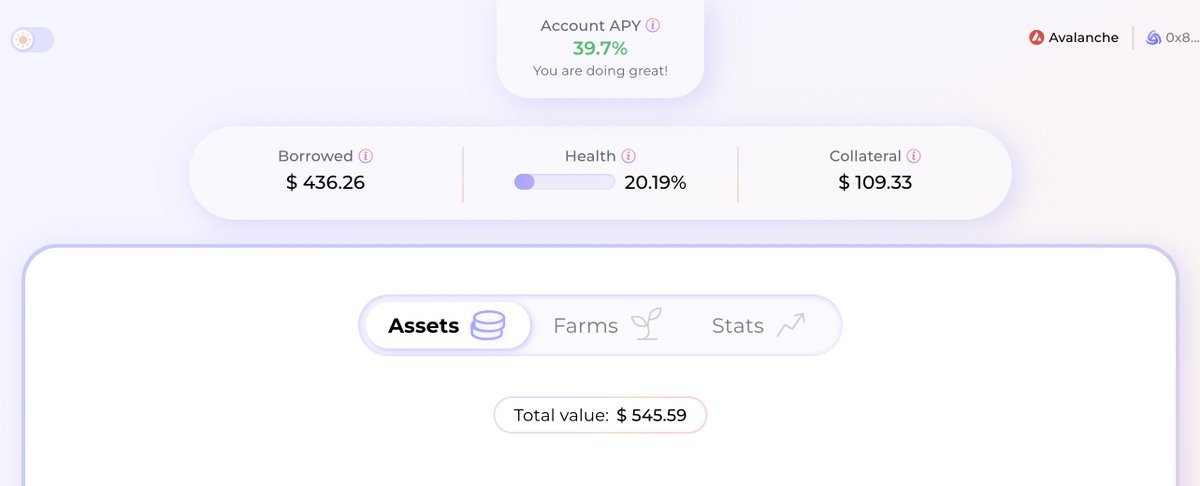

☑️Example health: 9.55% (4.5x)

☑️Current APY: 44.5%👍

☑️Risk: Borrow APY surpasses farm APY📉

☑️Rewards: farm APY📈

☑️Set up: Very easy✅

☑️Manage style: Passive⛵️

☑️Example health: 9.55% (4.5x)

☑️Current APY: 44.5%👍

☑️Risk: Borrow APY surpasses farm APY📉

☑️Rewards: farm APY📈

☑️Set up: Very easy✅

☑️Manage style: Passive⛵️

BTC ➡️ sAVAX

While you don't know what the crypto market will do, you do know that #AVAX will outperform the others, and definitely BTC. Mitigated exposure, is gud exposure.

1⃣Deposit #BTC

2⃣Borrow #BTC

3⃣Swap all to $sAVAX

4⃣Farm it all

While you don't know what the crypto market will do, you do know that #AVAX will outperform the others, and definitely BTC. Mitigated exposure, is gud exposure.

1⃣Deposit #BTC

2⃣Borrow #BTC

3⃣Swap all to $sAVAX

4⃣Farm it all

BTC ➡️ sAVAX

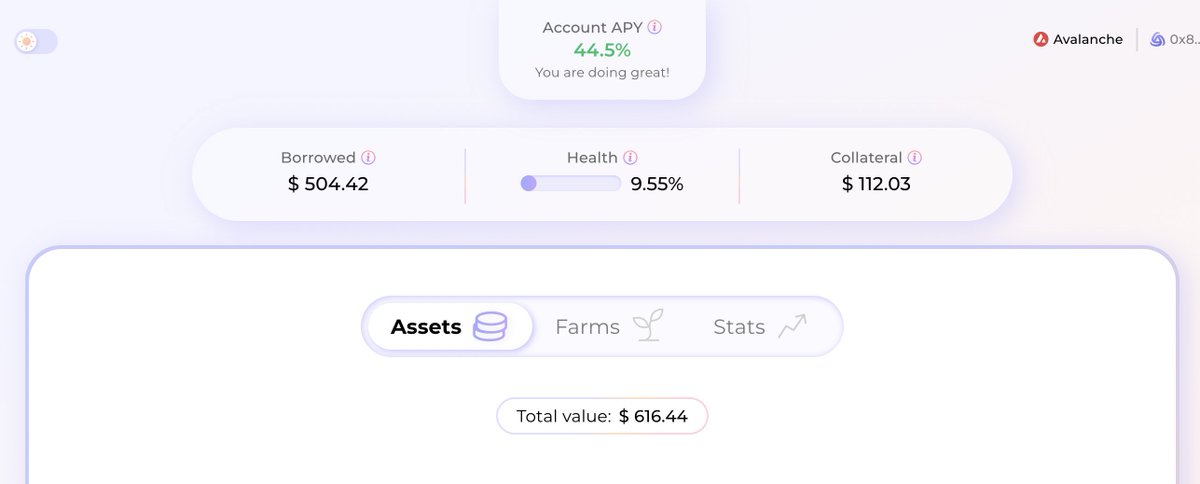

☑️Example health: 15.5% (4.25x)

☑️Current APY: 46.1%👍

☑️Risk: BTC outperforms AVAX📉

☑️Rewards: AVAX pwns + farm APY📈

☑️Set up: Very easy✅

☑️Manage style: Passive⛵️

☑️Example health: 15.5% (4.25x)

☑️Current APY: 46.1%👍

☑️Risk: BTC outperforms AVAX📉

☑️Rewards: AVAX pwns + farm APY📈

☑️Set up: Very easy✅

☑️Manage style: Passive⛵️

That's a wrap! Next to exposure, you always want to check for other potential risks. Check out our full safety measures here: docs.deltaprime.io/protocol/safety

@vector_fi was used, but we could have used @yieldyak_ as well. Minor APY difference is mainly due to different measuring methods

@vector_fi was used, but we could have used @yieldyak_ as well. Minor APY difference is mainly due to different measuring methods

• • •

Missing some Tweet in this thread? You can try to

force a refresh