Unlocking trapped liquidity on the Avalanche and Arbitrum ecosystem💰 🗝️ Join us at: https://t.co/r6ald3uMlY

How to get URL link on X (Twitter) App

Jan 10th - July 10th (2024): Number goes up

Jan 10th - July 10th (2024): Number goes up

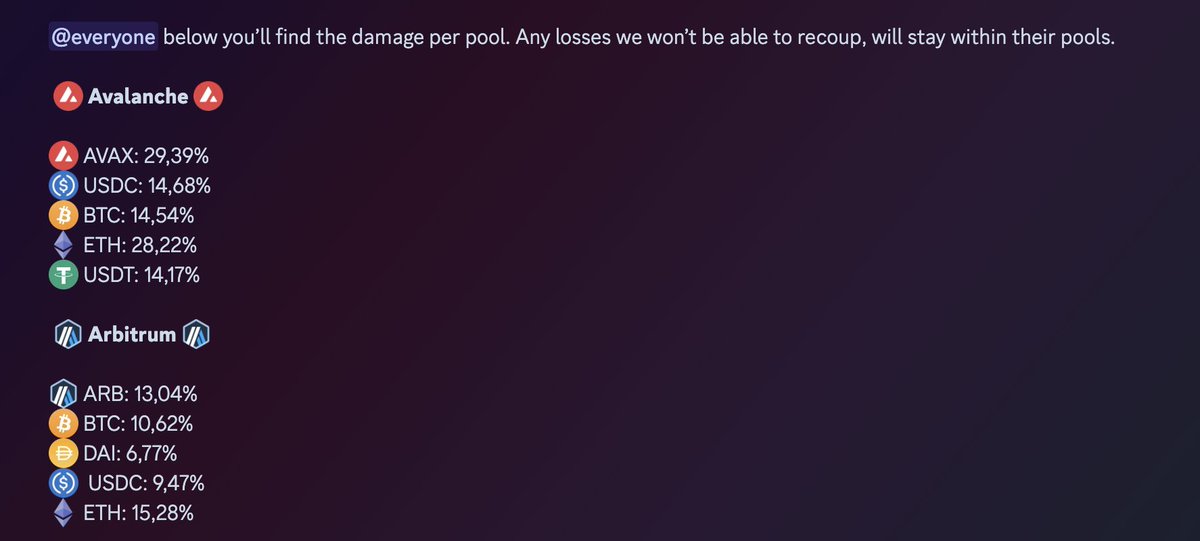

https://x.com/DeltaPrimeDefi/status/1856343701381058677

This thread is written to help those affected by the attack in their decision between the two assets. If you were affected, you hold rTKNs today.

This thread is written to help those affected by the attack in their decision between the two assets. If you were affected, you hold rTKNs today.

DeltaPrime at the Avalanche Summit...

DeltaPrime at the Avalanche Summit...

$PRIME or $sPRIME?

$PRIME or $sPRIME?

USDC ➡️ sAVAX

USDC ➡️ sAVAX

🏆TVL crossed $10M🏆

🏆TVL crossed $10M🏆

First a look at what makes people (yours truly included) borrow at these rates in the first place:

First a look at what makes people (yours truly included) borrow at these rates in the first place: