I really didn't want to do a Tweet thread on the @SECGov suit against @binance, but then I read it and...

...it's absolutely FULL of GEMS. I can't not do it.

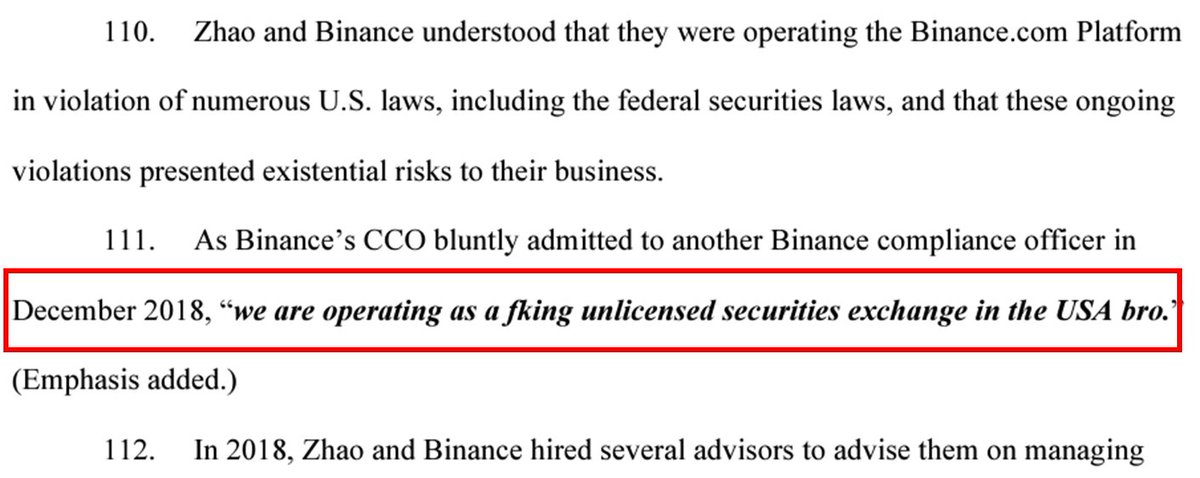

Example - Binance CCO in 2018:

"we are operating as a fking unlicensed securities exchange in the USA bro."😱😂

🧵👇

...it's absolutely FULL of GEMS. I can't not do it.

Example - Binance CCO in 2018:

"we are operating as a fking unlicensed securities exchange in the USA bro."😱😂

🧵👇

1. It's worth stating that it's not just a suit against Binance - the SEC is also suing @cz_binance himself.

I suspect we will never see CZ voluntarily set foot on US soil again, nor countries with whom we have strong extradition treaties...

I suspect we will never see CZ voluntarily set foot on US soil again, nor countries with whom we have strong extradition treaties...

2. The core claim is CZ and Binance *knowingly* operated an illegal, unregistered US securities business, stripping Americans of the "investor and market protections [securities] laws provide."

Throughout, we see @binance acknowledge it may be violating the law, but plow ahead.

Throughout, we see @binance acknowledge it may be violating the law, but plow ahead.

3. Further claims include sales of crypto that the SEC considers "securities" and misrepresenting of controls while raising VC capital (including from defenseless retail investors).

Likewise, US Binance volumes were misrepresented by CZ entities wash trading to juice them.

Likewise, US Binance volumes were misrepresented by CZ entities wash trading to juice them.

4. 1776

CZ & Binance claimed its US operations (including the BAM Management and BAM Trading entities) were independent of CZ and Binance.

However, US employees referenced the "shackles" CZ had over them. BAM Trading's CEO said the team was a "puppet."

CZ owns 81% of BAM US.

CZ & Binance claimed its US operations (including the BAM Management and BAM Trading entities) were independent of CZ and Binance.

However, US employees referenced the "shackles" CZ had over them. BAM Trading's CEO said the team was a "puppet."

CZ owns 81% of BAM US.

5. Staking is an Unregistered Security Offering 👀

...and $BNB and other coins were unregistered security offerings (including $SOL, $ADA, $MATIC, $FIL, and $BUSD).

$COIN gotta be nervous af.

...and $BNB and other coins were unregistered security offerings (including $SOL, $ADA, $MATIC, $FIL, and $BUSD).

$COIN gotta be nervous af.

6. Despite CZ emphasizing that "CREDIBILITY is the most important asset for any exchange" and claims that surveillance & controls would be installed to protect investors...

...for roughly 3 years, CZ's own entity, Sigma Chain AG, engaged in wash trading to increase US volumes.

...for roughly 3 years, CZ's own entity, Sigma Chain AG, engaged in wash trading to increase US volumes.

7. Binance is sketchy af, bruh.

Binance is a Cayman LLC, but has refused to identify where its HQ exists. [cough China cough ]

As CZ says, "Wherever I sit is the Binance office. Wherever I meet somebody is going to be the Binance office."

Offices are for suits, man.

Binance is a Cayman LLC, but has refused to identify where its HQ exists. [cough China cough ]

As CZ says, "Wherever I sit is the Binance office. Wherever I meet somebody is going to be the Binance office."

Offices are for suits, man.

8. CZ personally took $62.5 million out of a Binance bank account between Oct 2022 - Jan 2023

That's not inherently illegal...

...but, personally, I can't help but notice it coincides with the window when FTX was failing and CZ's takedown of @SBF_FTX became public.

That's not inherently illegal...

...but, personally, I can't help but notice it coincides with the window when FTX was failing and CZ's takedown of @SBF_FTX became public.

9. Below is a high-level overview of the CZ / Binance empire.

Sigma Chain and Merit Peak appear to be akin to SBF's Alameda prop trading / market-making entity: CZ's personal investment funds.

You'll note BAM US was capitalized in part by US investors (see the 19% share).

Sigma Chain and Merit Peak appear to be akin to SBF's Alameda prop trading / market-making entity: CZ's personal investment funds.

You'll note BAM US was capitalized in part by US investors (see the 19% share).

10. bUT iT's NOt a sECurITy!

Tell that to $BNB's 2,100x return in its first 6 years of existence and its reasonable expectation of dynamic value and profit based on a contract (i.e., the Howey Test).

2100x?! Holy mackerel.

Tell that to $BNB's 2,100x return in its first 6 years of existence and its reasonable expectation of dynamic value and profit based on a contract (i.e., the Howey Test).

2100x?! Holy mackerel.

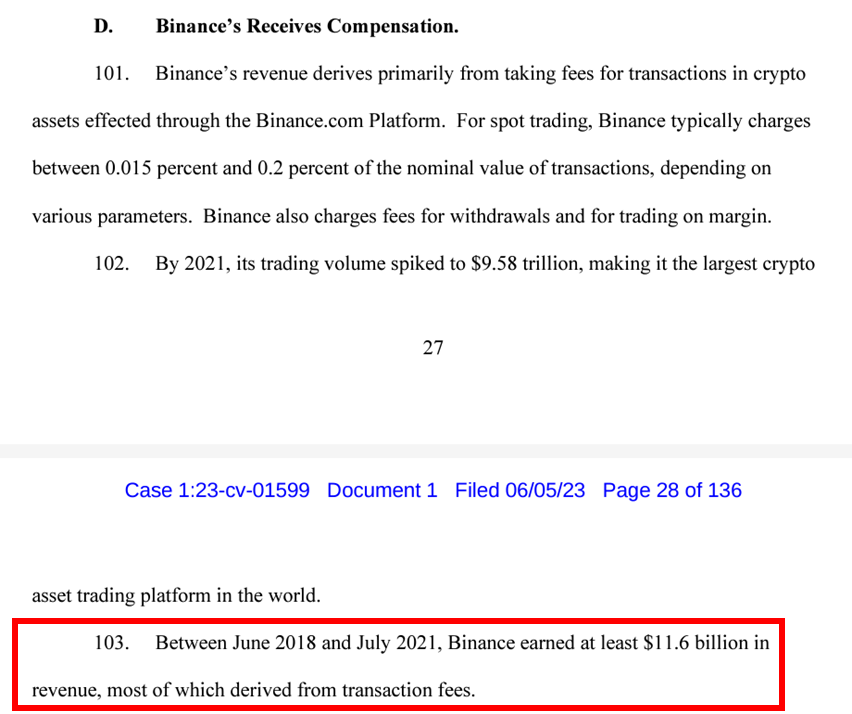

11. Binance is HUGE and Generates a Ton of Revenue

For the three years ending July 2021, Binance earned "at least $11.6 billion in revenue, most of which derived from transaction fees."

Ken Griffin must be blushing - that's quite the scalping. 🔪🤑🩸

For the three years ending July 2021, Binance earned "at least $11.6 billion in revenue, most of which derived from transaction fees."

Ken Griffin must be blushing - that's quite the scalping. 🔪🤑🩸

12. Tai Chi!

Binance had a plan called "the Tai Chi Plan" meant to "reveal, retard, and resolve built-up enforcement tensions" in the US.

As it became clear its US business was violating laws, CZ wanted to help route VIP US investors offshore to create plausible deniability.😱

Binance had a plan called "the Tai Chi Plan" meant to "reveal, retard, and resolve built-up enforcement tensions" in the US.

As it became clear its US business was violating laws, CZ wanted to help route VIP US investors offshore to create plausible deniability.😱

13. Yes, Our Ethics Can Be Bought

Along those lines, Binance continued to quietly guide key US accounts to "use VPN" to get around its KYC that used IP address tracking.

"We always have a way for whales." 😂

Oh, and "CZ will definitely agree to this..."

Along those lines, Binance continued to quietly guide key US accounts to "use VPN" to get around its KYC that used IP address tracking.

"We always have a way for whales." 😂

Oh, and "CZ will definitely agree to this..."

14. They Knew

From the inception of $BNB, Binance was preparing for an SEC Wells notice.

But CZ demanded they go forward with it.

As the CCO described, "cutting US from .com already costed [CZ] an arm/leg, he’s not gonna hold back on getting that rev[enue] back somehow.” 👀

From the inception of $BNB, Binance was preparing for an SEC Wells notice.

But CZ demanded they go forward with it.

As the CCO described, "cutting US from .com already costed [CZ] an arm/leg, he’s not gonna hold back on getting that rev[enue] back somehow.” 👀

15. FTX vibes + the Binance US CEO was CEO of what, exactly?

In the US business, CZ was constantly directing money to be moved around, including to and from his personal vehicles.

At times, the Binance US CEO didn't even know it was happening.

CZ was heavily conflicted.

In the US business, CZ was constantly directing money to be moved around, including to and from his personal vehicles.

At times, the Binance US CEO didn't even know it was happening.

CZ was heavily conflicted.

16. SEC Flexed its Guns

In sum: bad for Binance, but also a sneak preview for what altcoins and $COIN may face down the road.

-End-

If you found this useful, please Like and Retweet the first tweet, and throw me a Follow.

I occasionally go in-depth.🙏

In sum: bad for Binance, but also a sneak preview for what altcoins and $COIN may face down the road.

-End-

If you found this useful, please Like and Retweet the first tweet, and throw me a Follow.

I occasionally go in-depth.🙏

https://twitter.com/compound248/status/1605773370439700483?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter