#UBI is becoming increasingly popular. You can explain it in a tweet or on the back of a postage stamp.

What could go wrong? Nothing so obviously beneficial could have a downside, right? You just give money to people who need it. It's fair, it's equitable, it's anti-poverty.

🧵👇

What could go wrong? Nothing so obviously beneficial could have a downside, right? You just give money to people who need it. It's fair, it's equitable, it's anti-poverty.

🧵👇

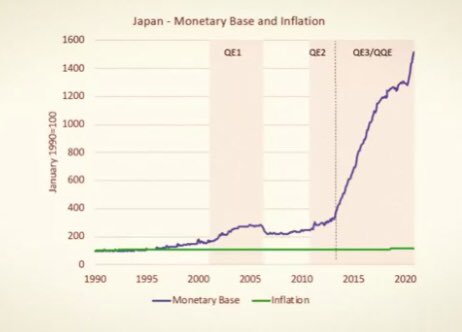

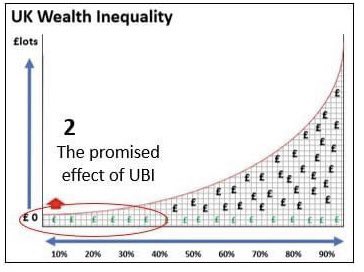

It solves a problem of not enough money. But it's the wrong solution. The problem is a distribution problem. Regressive taxation, laws that favour rentier wealth extraction, capital over labour, de-funding and privatising public services, remove wealth from the lower percentiles.

If you give everyone a small amount of money you do not solve a money shortage problem, you feed a distribution problem.

Even those well intentioned, well motivated self employed types to whom the UBI appeals so much will find that the reality does not live up to the dream.

Even those well intentioned, well motivated self employed types to whom the UBI appeals so much will find that the reality does not live up to the dream.

The underlying distribution problem will continue to siphon wealth from the lower percentiles and direct it to the upper percentiles.

All you will have done is inflate the whole wealth distribution curve by the value of the UBI and it will settle at a new, slightly higher, level.

All you will have done is inflate the whole wealth distribution curve by the value of the UBI and it will settle at a new, slightly higher, level.

Those in relative poverty before the UBI will still be in relative poverty after the UBI, the only difference being the numbers in everyone's bank accounts will have increased by the value of the UBI.

That is as simple an explanation as can be made.

That is as simple an explanation as can be made.

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter