Aircraft engineer, helicopter operations, IT and business process and projects. Internationally renowned composer. @auchentrachle.bsky.social

2 subscribers

How to get URL link on X (Twitter) App

The 1948 structure of the NHS

The 1948 structure of the NHS

1. Govt spends money into the private sector. Govt creates a deficit in its bank account and the private sector gets a surplus in its.

1. Govt spends money into the private sector. Govt creates a deficit in its bank account and the private sector gets a surplus in its.

2/ There is an assumption that it means the govt has spent more than it has taxed. An easily invoked fear, and journalists use this buzzword technique all the time. For instance, what image does the word "Weimar" make you think of? This perhaps?

2/ There is an assumption that it means the govt has spent more than it has taxed. An easily invoked fear, and journalists use this buzzword technique all the time. For instance, what image does the word "Weimar" make you think of? This perhaps?

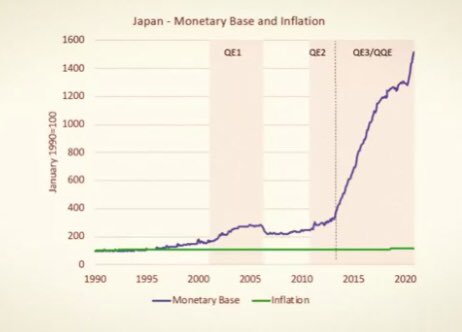

https://twitter.com/elonmusk/status/18244103154228718672/ Increase in money supply vs inflation 1.

https://twitter.com/Peston/status/1805181207983849473It is a mistake to think only of it as a debt, and a mistake to treat govt finances like a household.

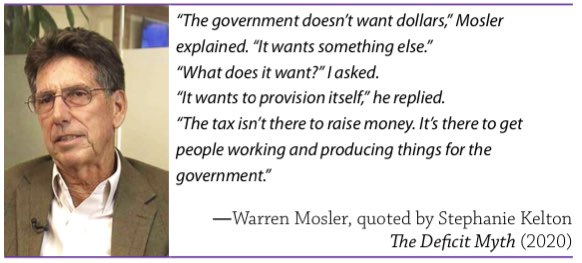

The difference between a currency user and a currency issuer is critical. We, the “taxpayers” are currency users. The government that imposes and collects tax, is the issuer. It creates money when it spends, we can’t (apparently it’s illegal). They know Thatcher lied.

The difference between a currency user and a currency issuer is critical. We, the “taxpayers” are currency users. The government that imposes and collects tax, is the issuer. It creates money when it spends, we can’t (apparently it’s illegal). They know Thatcher lied.

…that we *need* rich people so that we can tax them to pay for stuff.

…that we *need* rich people so that we can tax them to pay for stuff.

What do you think people would reply to these 3 questions:

What do you think people would reply to these 3 questions:

https://twitter.com/implausibleblog/status/1764262309810032796The media and journalists like Kuenssberg are actors for the establishment who want to preserve their wealth and power. A few economists are beginning to report the truth about the money system…

2/7. "Taxpayer money" was cemented in public consciuosness in 1983 by Margaret Thatcher. But it's a lie. "Return" and "revenue" have specific meanings. Taxpayers have no money of their own, and do not create money. Taxes return HMgov's money to the issuer—HMgov.

2/7. "Taxpayer money" was cemented in public consciuosness in 1983 by Margaret Thatcher. But it's a lie. "Return" and "revenue" have specific meanings. Taxpayers have no money of their own, and do not create money. Taxes return HMgov's money to the issuer—HMgov.

https://twitter.com/theifs/status/1700147224859295980So why do we pay taxes if the govt can just “print money”? The money story starts with the imposition of a tax liability on the currency using households and businesses. Govt requires the tax is paid in the currency it alone issues. Tax is what gives the govt’s currency value 2/8

https://twitter.com/malcolm_reavell/status/1593896003916136448