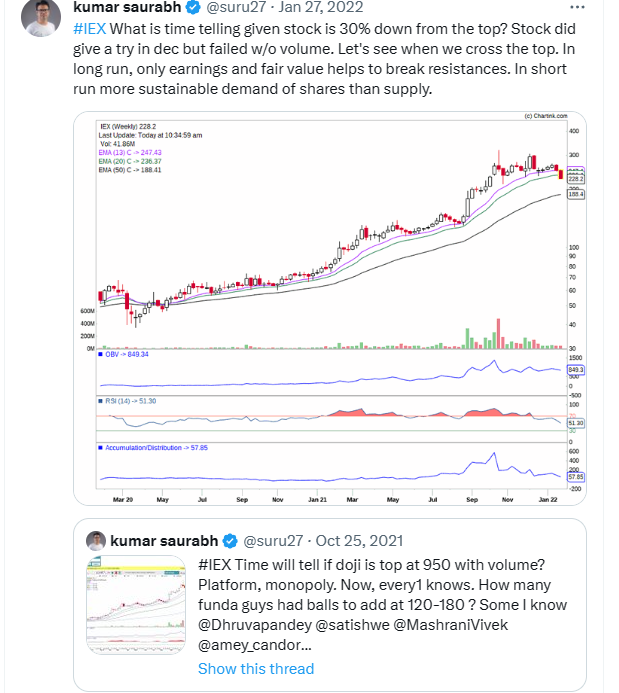

#IEX A chronological history of all tweets on IEX for learning purposes and current stand in the end

1st caution (it is always probabilistic, sometimes works, sometimes does not)

1st caution (it is always probabilistic, sometimes works, sometimes does not)

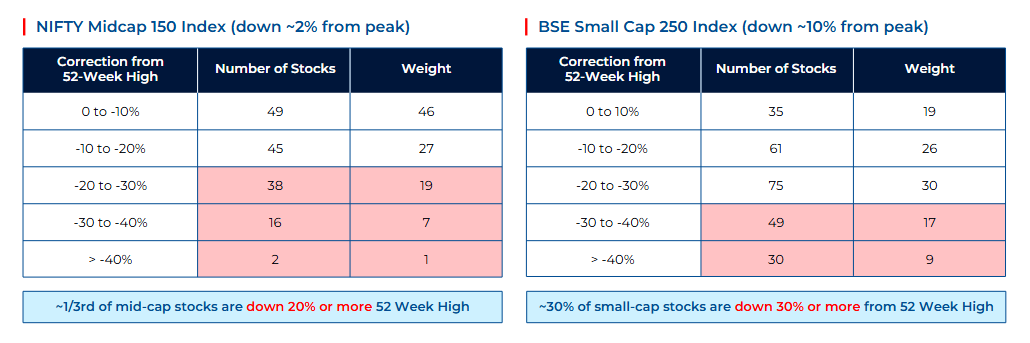

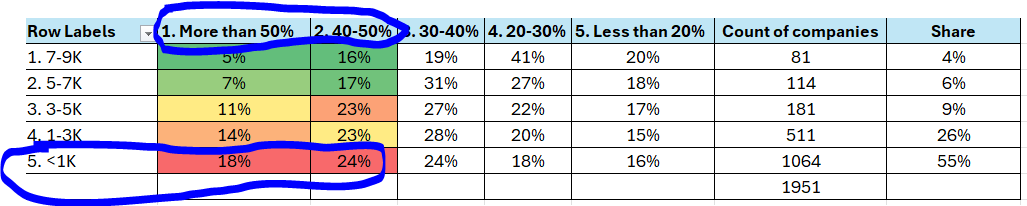

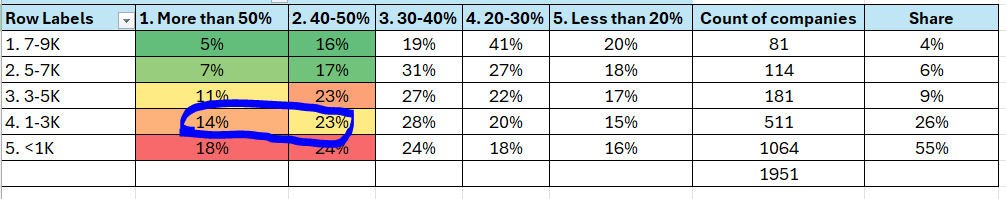

Currently stand:

As an investor: willing to look fundamentally. If you have views on why it has enough margin of safety to give 15%+ CAGR return if one invests with 2–3-year time horizon. If you have one, please provide comments backed by numbers and data.

As an investor: willing to look fundamentally. If you have views on why it has enough margin of safety to give 15%+ CAGR return if one invests with 2–3-year time horizon. If you have one, please provide comments backed by numbers and data.

Please avoid qualitative statements.🙏

As a trader: Charts are obvious. If do not understand, learn technical analysis. s of now, highly bearish unless some big hands control the supply led fall

As a trader: Charts are obvious. If do not understand, learn technical analysis. s of now, highly bearish unless some big hands control the supply led fall

• • •

Missing some Tweet in this thread? You can try to

force a refresh