2023 might be 1936 all over again - beyond the weather 🤔

Yes, I'm a nerd🤓

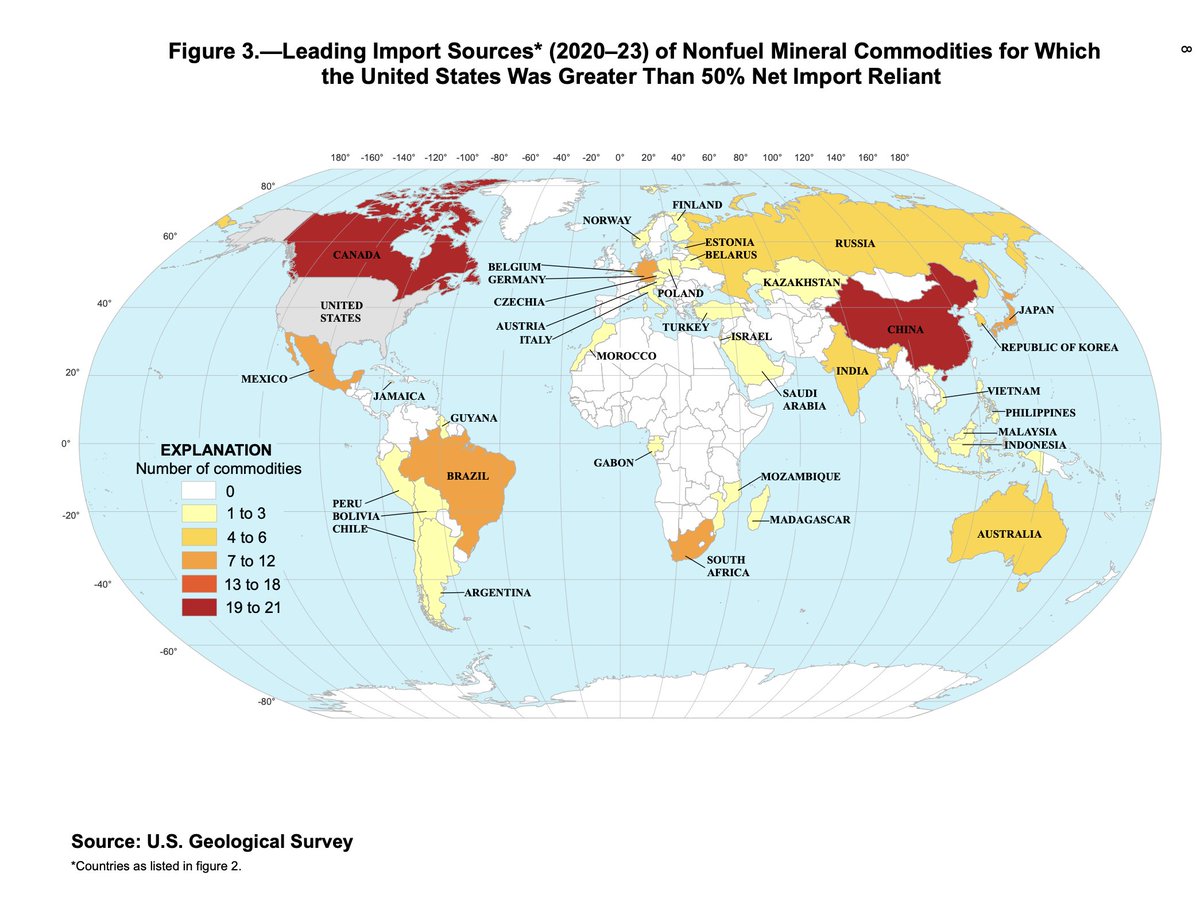

Spent my entire afternoon looking at El Niño (blue) & La Niña (pink) data for the past century. Stars reflect triple dip La Niña, which we just finished. Might explain our unusually dry weather./thread

Yes, I'm a nerd🤓

Spent my entire afternoon looking at El Niño (blue) & La Niña (pink) data for the past century. Stars reflect triple dip La Niña, which we just finished. Might explain our unusually dry weather./thread

Weaker triple dip La Niñas occurred in 1973-76 & 1998-2001 - perhaps why the drought severity wasn't as extreme as previous triple dips.

From mid-April 2022 more than 97% of Texas was gripped by drought

👋 Hi Texas - if history is any guide, then it looks like El Niño will bring you some relief.

Yup, appears to be happening...

👋 Hi Texas - if history is any guide, then it looks like El Niño will bring you some relief.

Yup, appears to be happening...

Earth scientists, historians, and archaeologists have theorized El Niño had a role in the demise of several ancient civilizations, including the Inca, other cultures in the Americas (don't worry El Niño, ChatGPT has you covered for modern civilization)

earthobservatory.nasa.gov/features/ElNin…

earthobservatory.nasa.gov/features/ElNin…

“The onset of El Niño has implications for placing 2023 in the running for warmest year on record when combined with climate-warming background”

stalbertgazette.com/beyond-local/h…

Sort of like 1936 after the 1933-35 triple dip?

stalbertgazette.com/beyond-local/h…

Sort of like 1936 after the 1933-35 triple dip?

Hmmm, interesting to see that 1936 was also a pretty bad year for forest fires in North America & Australia.

'If there was a “worst fire season” in the last century or so it would probably be 1936'

parkscanadahistory.com/series/op/banf…

trove.nla.gov.au/newspaper/arti…

'If there was a “worst fire season” in the last century or so it would probably be 1936'

parkscanadahistory.com/series/op/banf…

trove.nla.gov.au/newspaper/arti…

"1936 North American cold wave ranks among the most intense cold waves in recorded North American meteorological history. The Midwest US and the Prairie Provinces of Canada were hit the hardest, but only the SW and California largely escaped its effects"

markvoganweather.com/2015/12/20/a-l…

markvoganweather.com/2015/12/20/a-l…

Hold on winter of 1936!

Care Our Earth said that Record-Breaking Cold Waves in the Winter 2022-2023 *Linked to Global Warming* had you beat:

careourearth.com/record-breakin…

Care Our Earth said that Record-Breaking Cold Waves in the Winter 2022-2023 *Linked to Global Warming* had you beat:

careourearth.com/record-breakin…

Please humour me & allow me to speculate, if 2023 is 1936 - will 2024 be 1937?

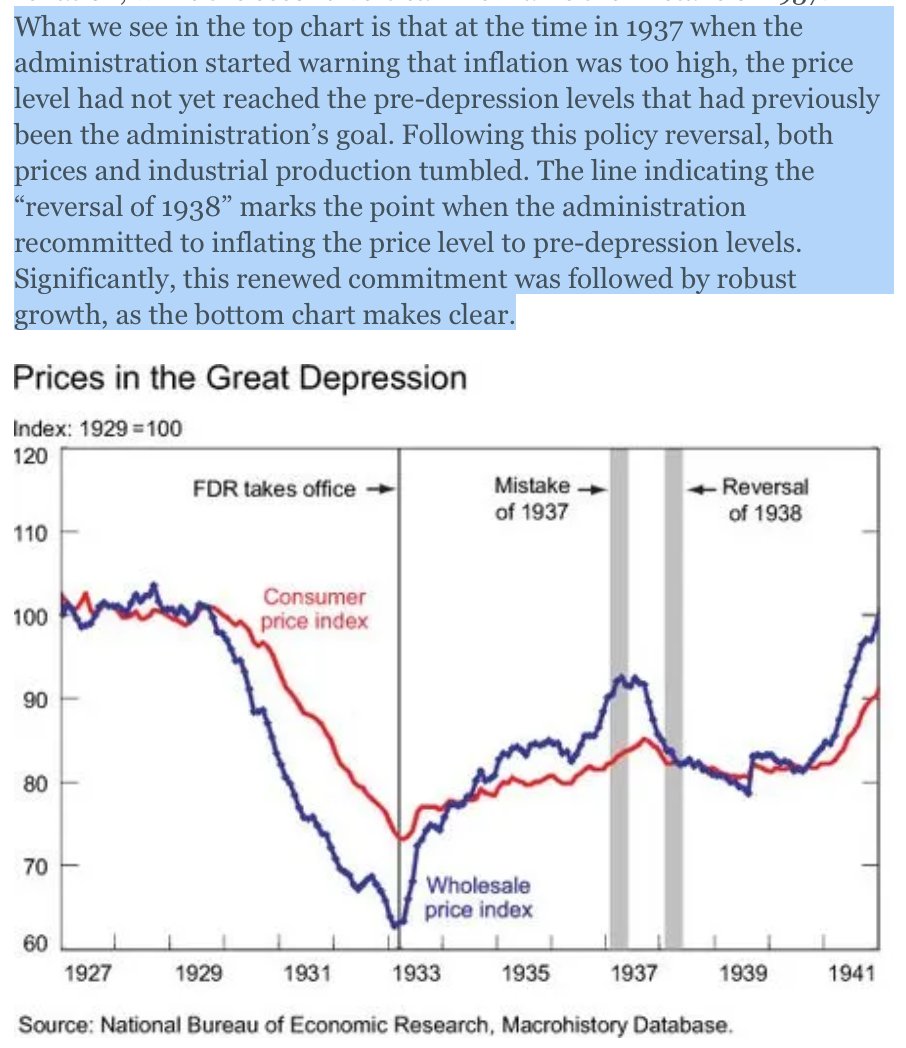

1933-1937: Reflation policy backed by an aggressive increase in government spending, the maintenance of large deficits, the abandonment of the #gold standard, and monetary easing.

1933-1937: Reflation policy backed by an aggressive increase in government spending, the maintenance of large deficits, the abandonment of the #gold standard, and monetary easing.

'Short-term interest rates were constrained at zero, if people expect prices will rise, the real rate of interest turns from positive to negative. It becomes more economical to spend $ than save it. Reflation can also repair balance sheets of over leveraged households & firms.'

The Mistake of 1937 was to relinquish benefits of reflation & set all policy levers in reverse. Fed officials hinted at hikes, endorsed austerity in fiscal policy; the key concern was containing inflation rather than sustaining recovery.

'It is unlikely, however, that a modern economist put in the same position would respond to the commodity price rise in the same way. Economists today generally do not focus on commodity prices without regard to the behavior of the aggregate price index'

libertystreeteconomics.newyorkfed.org/2011/06/commod…

libertystreeteconomics.newyorkfed.org/2011/06/commod…

'Today’s economists, guided by economic research on general equilibrium models over the past several decades are a bit better at distinguishing movements in relative prices driven by temporary disruptions—such as the rally in commodity markets in 1937—

from movements in core inflation, which may reflect broader inflation pressures.'

2023: 2008 or 1936? I'm going with 1936.

/END

2023: 2008 or 1936? I'm going with 1936.

/END

• • •

Missing some Tweet in this thread? You can try to

force a refresh