I recently (2023-06-10) took out a leveraged short against 0.05 $wETH on @TeamKujira blockchain.

HOWTO: leverage short on @TeamKujira, even though they don't provide that for you on FIN, ... yet: logicalgraphs.blogspot.com/2023/05/howto-…

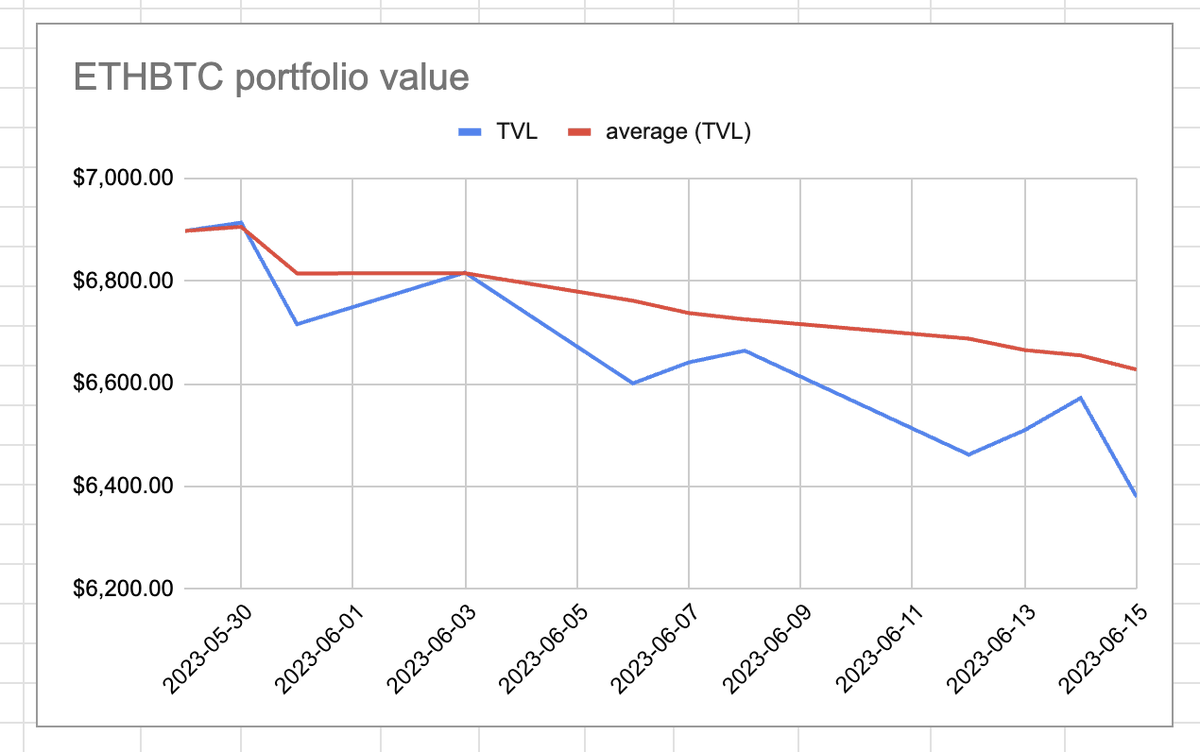

2023-06-10 entry: 0.05 $wETH 1.6xSHORT, $1,803.87-per

HOWTO: leverage short on @TeamKujira, even though they don't provide that for you on FIN, ... yet: logicalgraphs.blogspot.com/2023/05/howto-…

2023-06-10 entry: 0.05 $wETH 1.6xSHORT, $1,803.87-per

You see that my SPREADSHEETSZORXEN! sez to close the short at $1,639-per (PT).

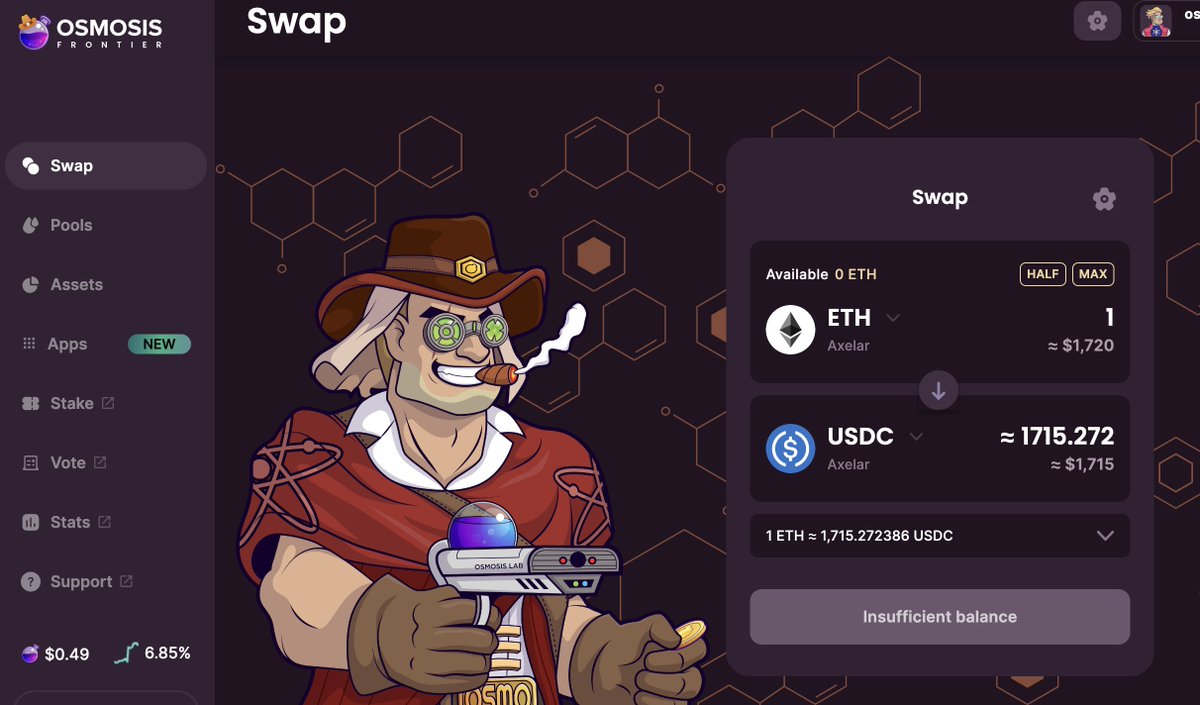

You also see that @osmosiszone quotes $wETH at $1,632-per.

Yeup. Time to close this short.

But here's the thing ...

You also see that @osmosiszone quotes $wETH at $1,632-per.

Yeup. Time to close this short.

But here's the thing ...

"What is 'the thing'?" you ask.

Well, besides being John Carpenter's Magnum Opus, the thing is this:

Some ... 'very generous soul' is willing to buy $wETH at 1,557.89-$USK-per on wETH/USK FIN board.

Translating to $axlUSDC, that $1653-per, or: $20-more-per than @osmosiszone 😎

Well, besides being John Carpenter's Magnum Opus, the thing is this:

Some ... 'very generous soul' is willing to buy $wETH at 1,557.89-$USK-per on wETH/USK FIN board.

Translating to $axlUSDC, that $1653-per, or: $20-more-per than @osmosiszone 😎

Hey, if YOU want to buy $wETH at $20 above market price, then I will HAPPILY SELL you ALLES teh $wETH that you want to buy!

No. problem. what. so. ever.

Upshot: ALWAYS! always-always, as an arbiteur, look for these inefficiencies in the marketplaceSSSz, even across blockchains.

No. problem. what. so. ever.

Upshot: ALWAYS! always-always, as an arbiteur, look for these inefficiencies in the marketplaceSSSz, even across blockchains.

SO!

*I withdraw funds necessary to buy $wETH both to close the short AND to sell on the wETH/USK board.

*I bridge that liquidity to @osmosiszone

*then swap $axlUSDC for $wETH

*then bridge the $wETH back using IBC transfers.

*I withdraw funds necessary to buy $wETH both to close the short AND to sell on the wETH/USK board.

*I bridge that liquidity to @osmosiszone

*then swap $axlUSDC for $wETH

*then bridge the $wETH back using IBC transfers.

I close my $wETH short by returning the borrowed $wETH to @TeamKujira Ghost

2023-06-15 exit: 0.05 $wETH, $1,632-per

ROI: 10.53%, annualized to 630% APR 🎉🎉🎉

Holy... wow. 😱

Consequently, this frees up the 278 $USK that I supplied as collateral.

This short: filled with WIN!

2023-06-15 exit: 0.05 $wETH, $1,632-per

ROI: 10.53%, annualized to 630% APR 🎉🎉🎉

Holy... wow. 😱

Consequently, this frees up the 278 $USK that I supplied as collateral.

This short: filled with WIN!

The $wETH short-win-goodness gets even better, as I have 0.1 $wETH I bought at $1,632-per on @osmosiszone that I sell on @TeamKujira wETH/USK FIN at 1,557.89-$USK-per, or $1,653-per.

That order fills instantaneously.

2023-06-15: SELL 0.1 $wETH, 1,557.89-per

ROI: 1.29%, ∞% APR

That order fills instantaneously.

2023-06-15: SELL 0.1 $wETH, 1,557.89-per

ROI: 1.29%, ∞% APR

What are the takeaways?

* borrowing is good or bad?

Depends.

Borrowing an asset falling in price is good, so if you know your token and you see it's going down, you can borrow then sell it now to make profit in the short sale when you buy it back at a lower price.

* borrowing is good or bad?

Depends.

Borrowing an asset falling in price is good, so if you know your token and you see it's going down, you can borrow then sell it now to make profit in the short sale when you buy it back at a lower price.

Another takeaway:

* inspiration

If you see a token-price-trend, know this: not everyone does.

LEVERAGE your insight: look for inefficiencies in the marketplace, buying tokens underpriced and selling tokens overpriced.

That's what we arbiteurs do: bring balance to the galaxy.

* inspiration

If you see a token-price-trend, know this: not everyone does.

LEVERAGE your insight: look for inefficiencies in the marketplace, buying tokens underpriced and selling tokens overpriced.

That's what we arbiteurs do: bring balance to the galaxy.

This 🧵is rolled up as an HOWTO on my blog at logicalgraphs.blogspot.com/2023/06/closin…

Other HOWTOs, articles, pensées, and #cryptocurrency resources are available on my blog at logicalgraphs.blogspot.com/p/crypto-howto…

Do you like this 🧵? RT the OT --v and share the ♥️

Other HOWTOs, articles, pensées, and #cryptocurrency resources are available on my blog at logicalgraphs.blogspot.com/p/crypto-howto…

Do you like this 🧵? RT the OT --v and share the ♥️

https://twitter.com/logicalgraphs/status/1669263116604153856

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter