For Web3 to succeed, each layer of the Web3 tech stack needs to become economically sustainable

⛓️ Blockchains

📄 Applications

🔮 Oracles

In pursuit of this goal, #Chainlink is pioneering the creation of a sustainable oracle economy 🧵

blog.chain.link/sustainable-or…

⛓️ Blockchains

📄 Applications

🔮 Oracles

In pursuit of this goal, #Chainlink is pioneering the creation of a sustainable oracle economy 🧵

blog.chain.link/sustainable-or…

Web3 represents a global movement focused on replacing prone-to-failure trusted intermediaries with decentralized trust-minimized infrastructure

Despite the bear market and all the fear, development hasn't stopped, but actually increased

Web3 is inevitable

Despite the bear market and all the fear, development hasn't stopped, but actually increased

Web3 is inevitable

To realize the full potential that Web3 can offer the world, the infrastructure underlying Web3 must become economically sustainable

This means each layer of the Web3 tech stack must earn fees from users and/or other the layers of the stack

This means each layer of the Web3 tech stack must earn fees from users and/or other the layers of the stack

Web3 consists of:

Blockchains: Underlying ledgers of the Web3 economy where assets/data are stored

Applications: Products/services that provide tangible value and utility to consumers

Oracles: Collection of trust-minimized services that apps require but cannot get from chains

Blockchains: Underlying ledgers of the Web3 economy where assets/data are stored

Applications: Products/services that provide tangible value and utility to consumers

Oracles: Collection of trust-minimized services that apps require but cannot get from chains

The fees paid by users who interact with Web3 apps not only support the applications themselves, but also the blockchain and oracle networks that make their operation possible

This sustainable value flow is crucial for a robust scalable ecosystem

This sustainable value flow is crucial for a robust scalable ecosystem

As adoption of Web3 grows, so does the amount of fees paid into the ecosystem, resulting in increasing sustainability

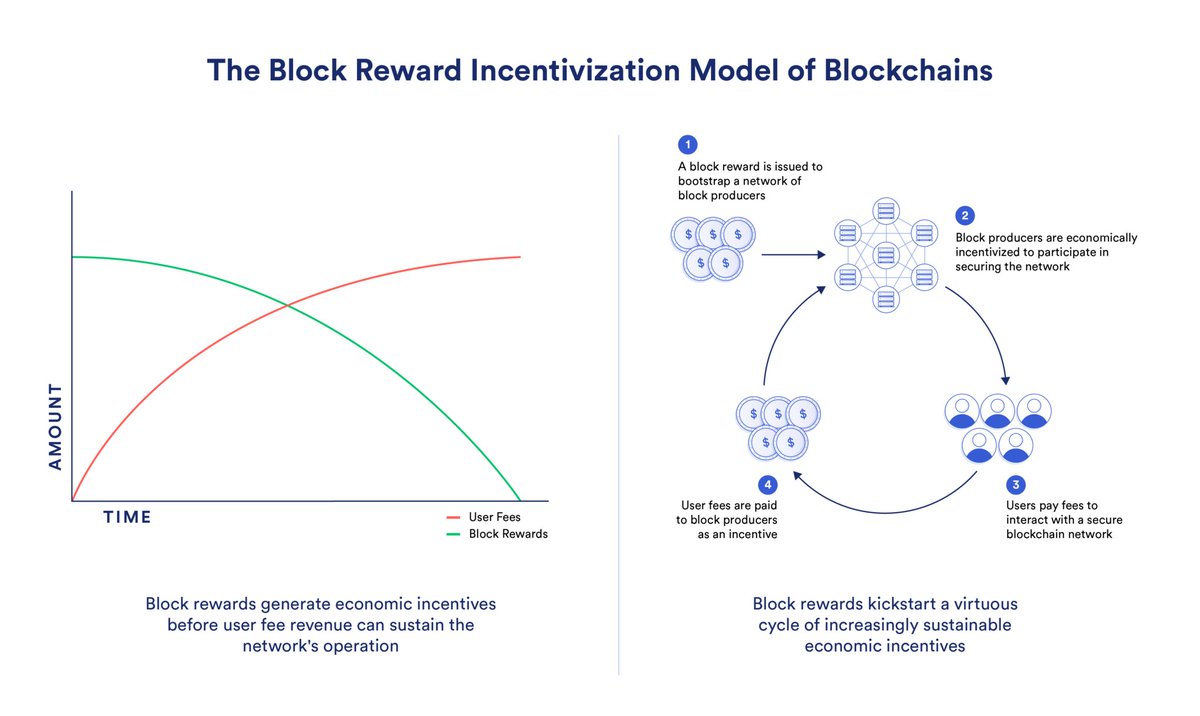

But we're still at the early stages of Web3 today and reaching full sustainability from fees will take time

How is this gap filled in the meantime?

But we're still at the early stages of Web3 today and reaching full sustainability from fees will take time

How is this gap filled in the meantime?

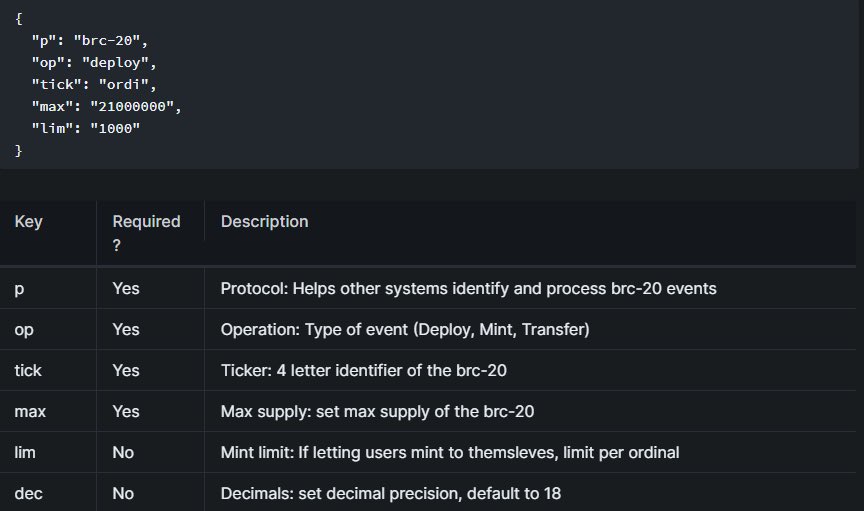

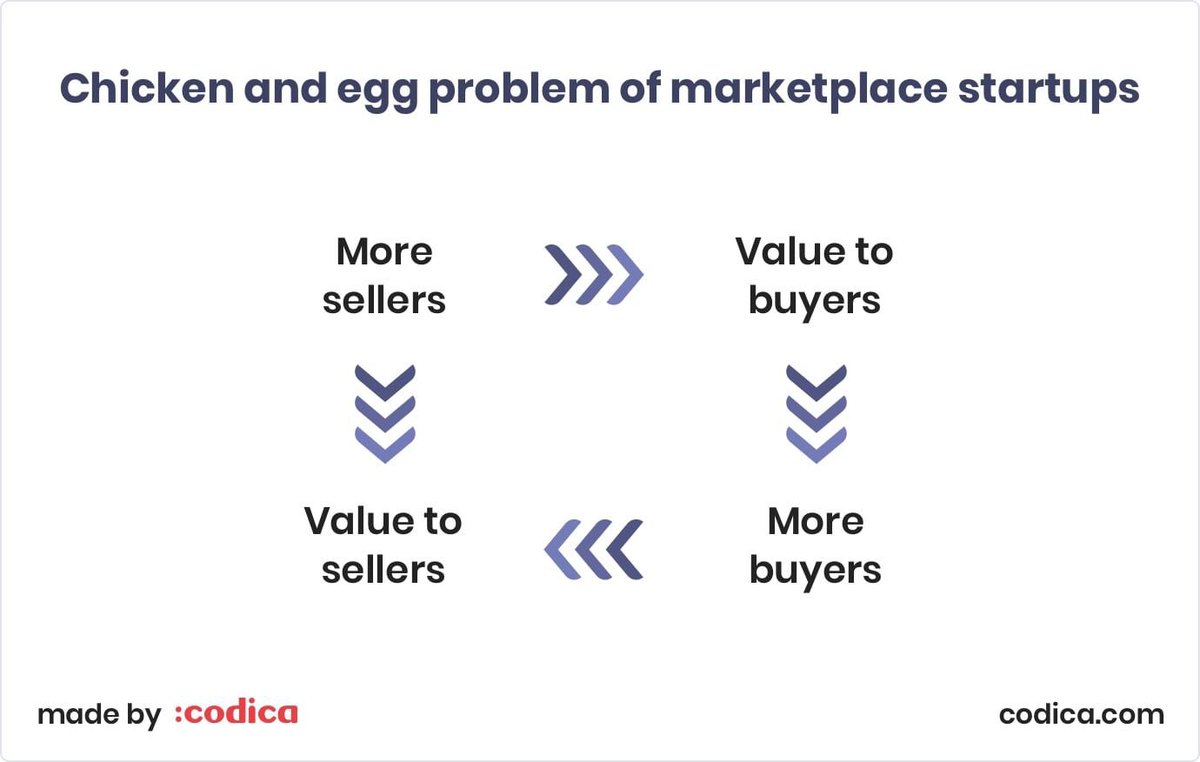

Simply put, to kickstart any two-sided market, a chicken or egg problem needs to be solved

Without paying users (buyers), there is no economic incentive for service providers (sellers) to exist

Without service providers, there are no services for users to purchase and consume

Without paying users (buyers), there is no economic incentive for service providers (sellers) to exist

Without service providers, there are no services for users to purchase and consume

Historically, Web3 protocols have overcome this challenge via token subsidization

Token incentives are provided to service providers to participate in the network's operation (supply side) and/or to users to utilize the platform to attract more usage (demand side)

Token incentives are provided to service providers to participate in the network's operation (supply side) and/or to users to utilize the platform to attract more usage (demand side)

Subsidies have proven effective at enabling protocols to provide high-quality services before a sufficient level of fees are generated to fully cover service provider operating costs

The goal is reach sustainability where subsidies are no longer required

The goal is reach sustainability where subsidies are no longer required

Subsidies can be seen across Web3:

Blockchains provide block rewards to miners/validators in exchange for network security

Applications provide token incentives to users to incentivize usage

Oracles provide oracle rewards to nodes in exchange for securing oracle services

Blockchains provide block rewards to miners/validators in exchange for network security

Applications provide token incentives to users to incentivize usage

Oracles provide oracle rewards to nodes in exchange for securing oracle services

Just as block rewards have proven effective for kickstarting blockchain ecosystems, so too have oracle rewards proven effective for oracle ecosystems

Fees remain the long-term source of rewards, subsidies bridge the gap

But what operating costs do oracle networks need to cover?

Fees remain the long-term source of rewards, subsidies bridge the gap

But what operating costs do oracle networks need to cover?

On-Chain: Gas costs of publishing oracle reports on-chain

Off-chain: Node infrastructure, full nodes, data subscriptions, monitoring, and management costs

Cryptoeconomic Security: Node profit margins and staking rewards

Coordination: Launch, maintenance, R&D, and support costs

Off-chain: Node infrastructure, full nodes, data subscriptions, monitoring, and management costs

Cryptoeconomic Security: Node profit margins and staking rewards

Coordination: Launch, maintenance, R&D, and support costs

However, subsidies cannot last forever, therefore any oracle network that attempts to forgo creating long-term sustainable economics introduces significant risk

So how is Chainlink is driving towards creating a sustainable oracle economy?

So how is Chainlink is driving towards creating a sustainable oracle economy?

Chainlink Economics 2.0 is a set of initiatives focused on increasing user fees, reducing operating costs, and establishing greater cryptoeconomic security

The ultimate goal is that node operators, coordinators, and stakers are supported in an economically sustainable manner

The ultimate goal is that node operators, coordinators, and stakers are supported in an economically sustainable manner

New monetization models are being introduced to increase the user fees and reduce payment friction

- Usage-based: Payments made based on ongoing service usage

- User fee-sharing: % of dApp fees paid into the network

- BUILD program: % of dApp native token paid into the network

- Usage-based: Payments made based on ongoing service usage

- User fee-sharing: % of dApp fees paid into the network

- BUILD program: % of dApp native token paid into the network

Various operating cost reduction strategies are being introduced

- OCR2: Efficient oracle network consensus

- Low-latency oracles: Users pay costs of publishing reports on-chain

- Feed Deprecation: Removing unused feeds

- SCALE: Blockchains subsidize oracle operating costs

- OCR2: Efficient oracle network consensus

- Low-latency oracles: Users pay costs of publishing reports on-chain

- Feed Deprecation: Removing unused feeds

- SCALE: Blockchains subsidize oracle operating costs

LINK will play an increasingly important role in the network's security

- Payments: Native LINK payments or non-native payments converted into LINK

- Security: Staked LINK back oracle services and earns portion of fees

- Reputation: Staked LINK creating inter-node competition

- Payments: Native LINK payments or non-native payments converted into LINK

- Security: Staked LINK back oracle services and earns portion of fees

- Reputation: Staked LINK creating inter-node competition

Chainlink Economics 2.0 ultimately represents a multi-pronged approach to accelerating the network's economic sustainability

However, reaching full sustainability will take time, given the amount of fees paid largely depends on the growth and adoption of Web3 as a whole

However, reaching full sustainability will take time, given the amount of fees paid largely depends on the growth and adoption of Web3 as a whole

To support the network's growth until full economic sustainability is achieved, tokens from the non-circulating supply are employed as subsidies, including as oracle rewards

In this regard, Chainlink is moving towards a more predictable, longer-term release schedule

In this regard, Chainlink is moving towards a more predictable, longer-term release schedule

Approaches towards achieving economic sustainability in Web3 are ever-evolving as new use cases are developed and and the infrastructure improves

Likewise, Chainlink Economics 2.0 is not a static initiative, but will also likely evolve and evolve over time to support the network

Likewise, Chainlink Economics 2.0 is not a static initiative, but will also likely evolve and evolve over time to support the network

Ultimately, I believe Web3 presents the most viable path towards improving society by re-establishing trust between mutually-distrusting entities by executing agreements on a credibly neutral settlement layer that is viewable to all and tamperable by none

To learn more about the value flows between layers of the Web3 stack and how Chainlink is pioneering the creation of sustainable oracle economics, I highly recommend taking a read of this recent blog

blog.chain.link/sustainable-or…

blog.chain.link/sustainable-or…

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter