Let's talk about the KUJI/ATOM @TeamKujira FIN board for a hot minute

I've talked about it before: logicalgraphs.blogspot.com/2023/05/kujira…

But I want to hammer home its importance to you, my dear fren, as a trader.

Why? I just made 7% ROI, annualized to 1.4k% APR, on a $KUJI-arb on that board

I've talked about it before: logicalgraphs.blogspot.com/2023/05/kujira…

But I want to hammer home its importance to you, my dear fren, as a trader.

Why? I just made 7% ROI, annualized to 1.4k% APR, on a $KUJI-arb on that board

FIRST! Let's go over the particulars of this arb.

1. I borrowed 500 $KUJI

2. I sold it for $ATOM on KUJI/ATOM (limit order)

3. I bought the $KUJI back from that $ATOM on KUJI/ATOM (limit order)

4. I repaid the borrow.

5. I profited.

It's.

That.

Simple.

1. I borrowed 500 $KUJI

2. I sold it for $ATOM on KUJI/ATOM (limit order)

3. I bought the $KUJI back from that $ATOM on KUJI/ATOM (limit order)

4. I repaid the borrow.

5. I profited.

It's.

That.

Simple.

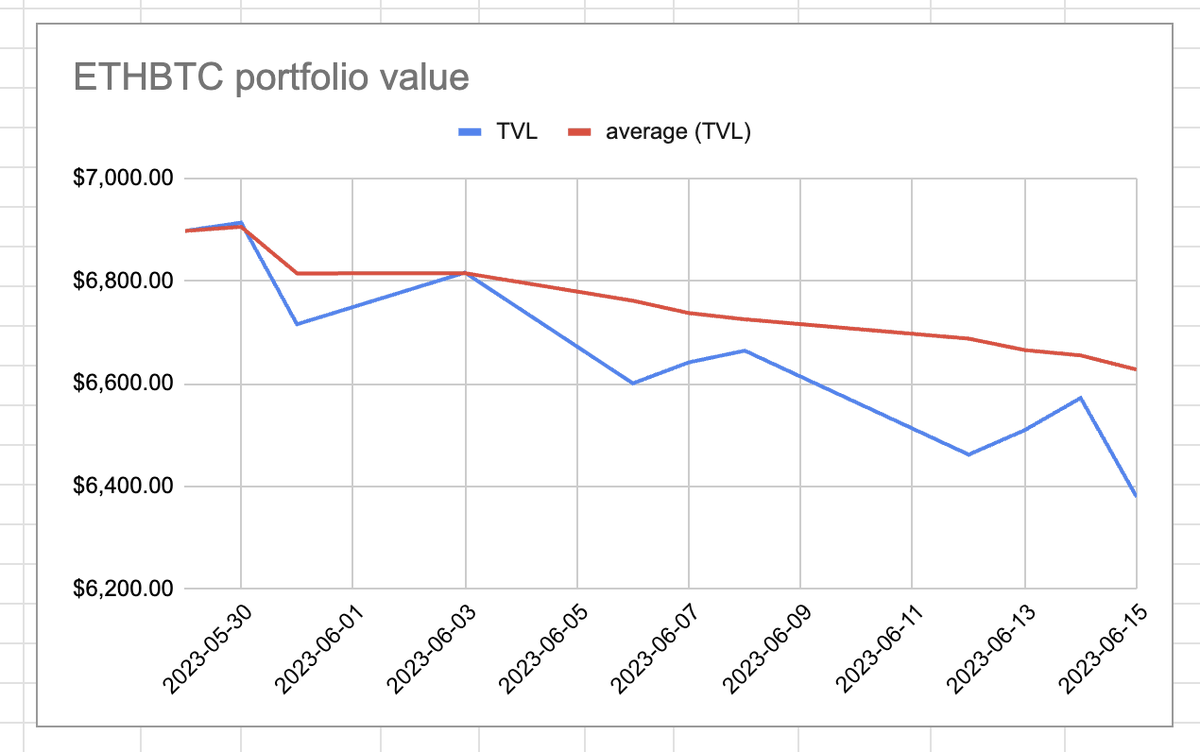

Specifically,

2023-06-12 entry: 500 $KUJI -> 49.4 $ATOM, SELL at 0.0988

2023-06-14 exit: 49.4 $KUJI -> 538 $KUJI, BUY at 0.0917

ROI: 7.74%, annualized to 1,413% APR

2023-06-12 entry: 500 $KUJI -> 49.4 $ATOM, SELL at 0.0988

2023-06-14 exit: 49.4 $KUJI -> 538 $KUJI, BUY at 0.0917

ROI: 7.74%, annualized to 1,413% APR

Now, there are some interesting things to call out in KUJI/ATOM-'arbs.'

*What is the price of $KUJI on entry? on exit?

*What is the price of $ATOM on entry? on exit?

Because, ICYMI: both tokens' prices have swung WILDLY these past few days.

How do price-swings affect the arb?

*What is the price of $KUJI on entry? on exit?

*What is the price of $ATOM on entry? on exit?

Because, ICYMI: both tokens' prices have swung WILDLY these past few days.

How do price-swings affect the arb?

The answer for $KUJI-price/$ATOM-price questions is:

無

That is to say, the prices of these tokens are not important to this arb. What's important is the RATIO of their prices.

If you sell at a higher ratio, then buy-back at a lower ratio,

THE ARB WORKS

REGARDLESS OF PRICES!

無

That is to say, the prices of these tokens are not important to this arb. What's important is the RATIO of their prices.

If you sell at a higher ratio, then buy-back at a lower ratio,

THE ARB WORKS

REGARDLESS OF PRICES!

THAT, my dear frenz, is the magic of arbs on the KUJI/ATOM FIN board: you're not looking at the prices of $KUJI or $ATOM, you're looking at the ratio between them. When the ratio trends up, BOOM!, you ride that trend, buy low, then sell high, and it also works, vice-versa.

You want more magic?

Here's more magic.

The 24h-volume of the KUJI/ATOM board is 4k, ... on a quiet day. That means the likelihood of your trade getting executed in the maelstrom of activity is much higher on this board than on most other boards on @TeamKujira FIN.

Here's more magic.

The 24h-volume of the KUJI/ATOM board is 4k, ... on a quiet day. That means the likelihood of your trade getting executed in the maelstrom of activity is much higher on this board than on most other boards on @TeamKujira FIN.

Do you want even more magic?

Okay, then.

Because of the 'mystical'-ratio of the KUJI/ATOM board, that has indirect bearing on price...

Because it's a high-volume board, ...

*My arbitration on axlUSDC/USK is ~1% gain, every arb.

*My arbitration on KUJI/ATOM is regularly 10%.

Okay, then.

Because of the 'mystical'-ratio of the KUJI/ATOM board, that has indirect bearing on price...

Because it's a high-volume board, ...

*My arbitration on axlUSDC/USK is ~1% gain, every arb.

*My arbitration on KUJI/ATOM is regularly 10%.

"BUT HOW DO I GET STARTED, o, el munificent geophf?"

I say: start smol, and start focus. How? Like this.

Take, e.g. 50 $KUJI, sell it at one limit (order), then when that order clears, buy it back with the $ATOM at a lower limit (order).

Presto: you have more $KUJI! IT WORKED!

I say: start smol, and start focus. How? Like this.

Take, e.g. 50 $KUJI, sell it at one limit (order), then when that order clears, buy it back with the $ATOM at a lower limit (order).

Presto: you have more $KUJI! IT WORKED!

Alternatively, if you're jones'n for an $ATOM arb, then buy $ATOM with $KUJI with a buy limit order, and, when that fills, sell the $KUJI at a higher price (limit order) and WHAMMO! MORE $ATOM! IT WORKED!

See?

Easy peasy! Lemon squeezy!

Give it a go. The KUJI/ATOM board is 🪄

See?

Easy peasy! Lemon squeezy!

Give it a go. The KUJI/ATOM board is 🪄

This🧵is rolled up as an article on my blog at logicalgraphs.blogspot.com/2023/06/fin-ku…

Other articles, pensées, HOWTOs, and #cryptocurrency resources are available on my blog at logicalgraphs.blogspot.com/p/crypto-howto…

Do you like this🧵? RT the OT --v and share the♥️

Other articles, pensées, HOWTOs, and #cryptocurrency resources are available on my blog at logicalgraphs.blogspot.com/p/crypto-howto…

Do you like this🧵? RT the OT --v and share the♥️

https://twitter.com/logicalgraphs/status/1669718676805746688

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter