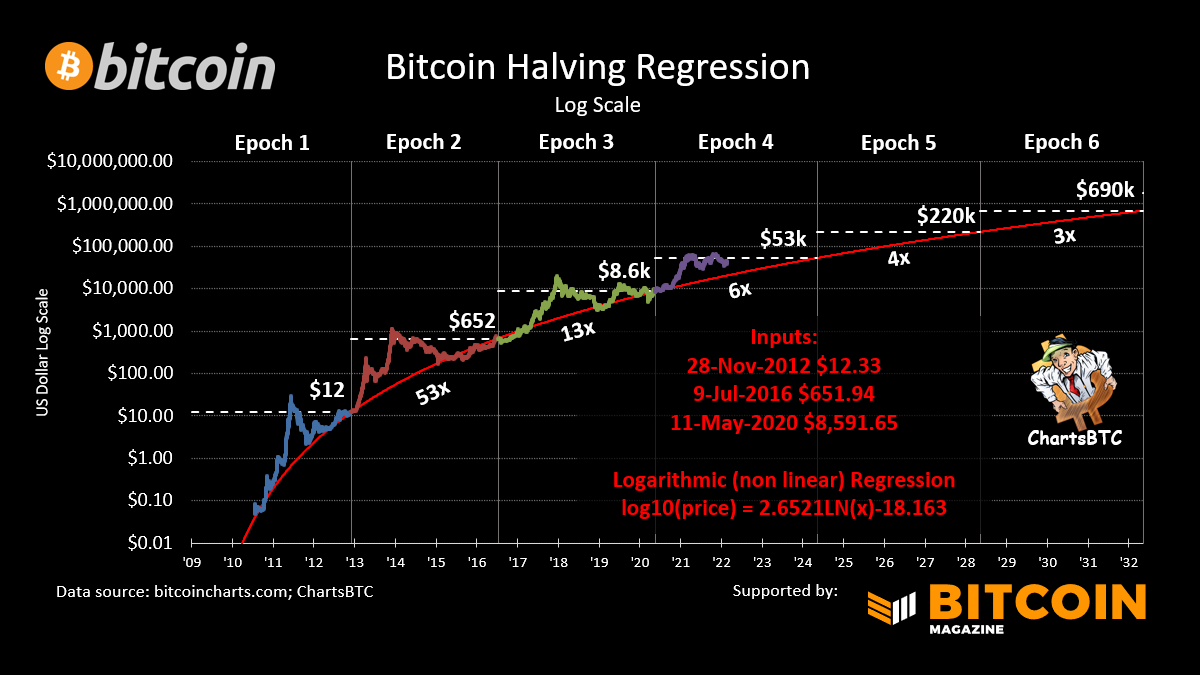

#bitcoin chart thread starting with Yearly Candles /1

I've been MIA lately. The current algorithm hasn't been providing the dopamine I got used to. Here's a week of charts in one thread. Let see if the algorithm likes it. If you want me to post more, like and retweet.

I've been MIA lately. The current algorithm hasn't been providing the dopamine I got used to. Here's a week of charts in one thread. Let see if the algorithm likes it. If you want me to post more, like and retweet.

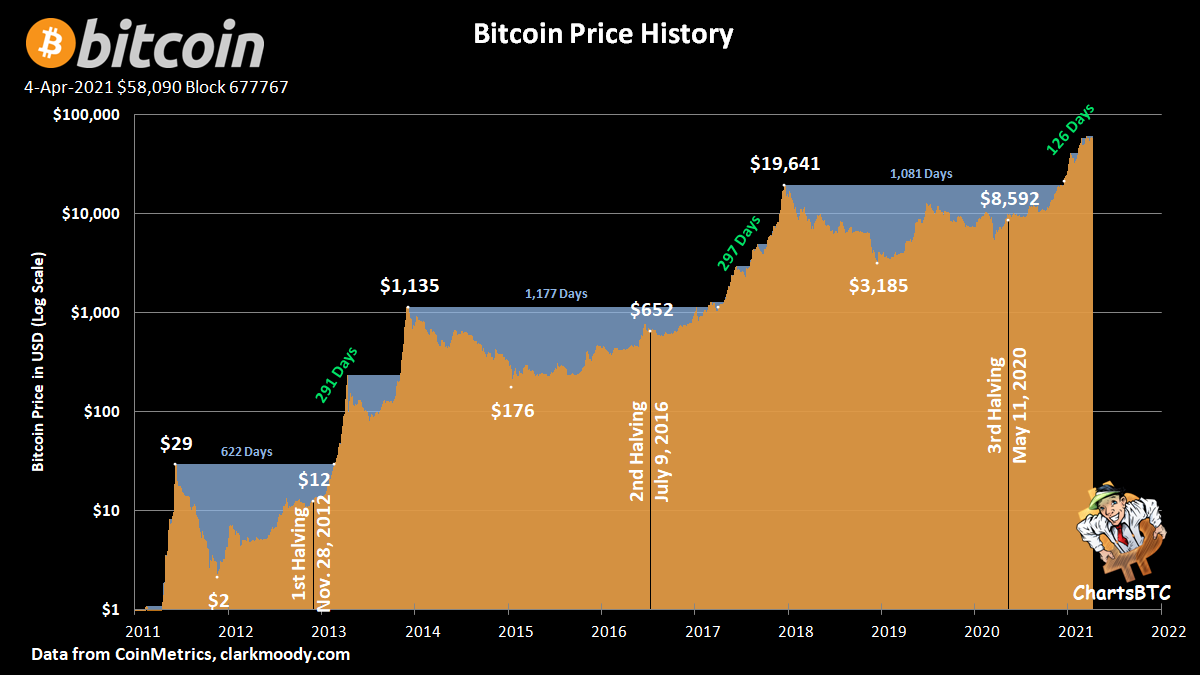

bitcoin drawdowns - pessimist should stay away, there are only a few days every 4 year that bitcoin hits new all time highs (but they're glorious) /6

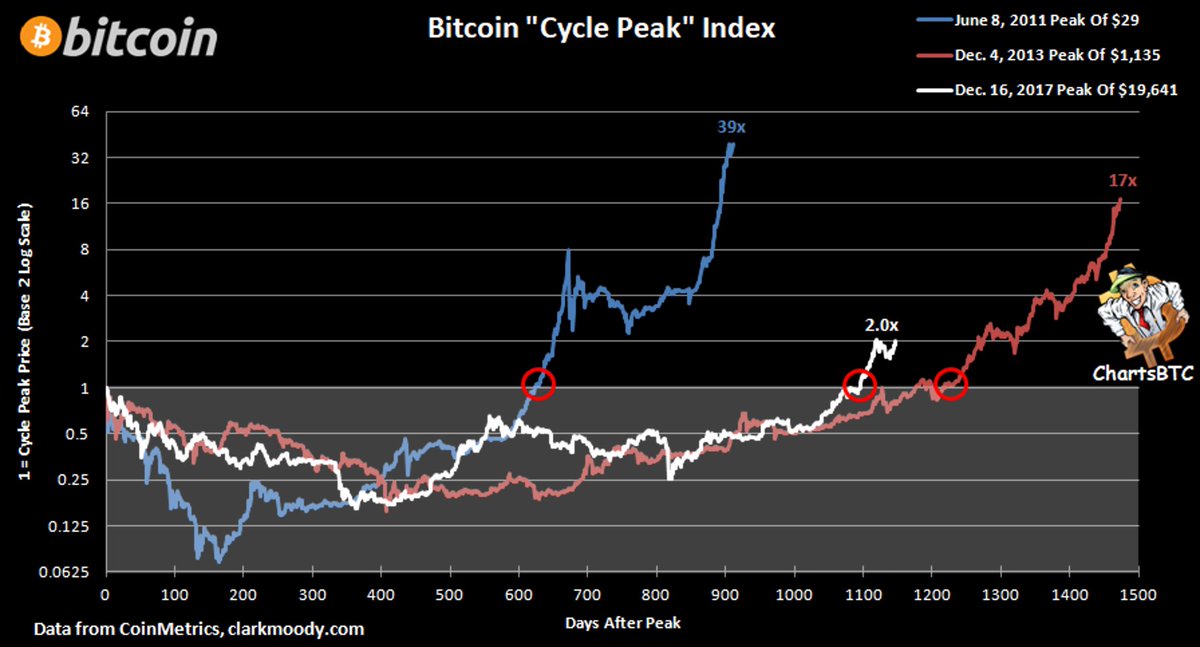

Comparing bitcoin cycles in log scale - log scale shows that the draw down this cycle wasn't nearly as deep as prior ones but that likely because we didn't get a blow off top /8

almost certainly a coincidence, the price halfway through the prior 2 cycles was slightly below the halving price 2 years later. Can we get another coincidence? /11

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter