I understand Marc’s comment that secondary sales are an open legal question and whether a Howey analysis must be applied to secondary market transactions. But when you look at the existing case law in totality it strongly favors that you must apply Howey at each subsequent sale.

https://twitter.com/marc_fagel/status/1670828108562436096

If an investment contract remained one in perpetuity it would nullify the common enterprise factor moving forward.

Hypothetical:

Ripple sells XRP to Johnny Crypto’s business who pays his employees in XRP. His employees have never heard of Ripple and use XRP on their debit… twitter.com/i/web/status/1…

Hypothetical:

Ripple sells XRP to Johnny Crypto’s business who pays his employees in XRP. His employees have never heard of Ripple and use XRP on their debit… twitter.com/i/web/status/1…

The employee owes his friend $500 but, instead he gets the friend to accept 1K XRP. The friend has the $1K XRP sent to his @UpholdInc XRP address. That friend hires @attorneyjeremy1 to write up a contract and asks Jeremy if Jeremy will accept XRP as payment, which Jeremy does.

Jeremy adds the XRP to his already large bag. XRP suddenly 🚀 to $10 and Jeremy surprises Thien-Vu on a trip to Florence, Italy 🇮🇹. It’s Friday and the banks are closed so Jeremy contacts @TapJets and pays for a private flight ✈️ paying with his XRP.

If you don’t apply Howey at the time of each transaction and XRP is a security per se b/c Ripple sold to a guy name Johnny Crypto then, in effect, Johnny Crypto, his employee, the employee’s friend, Jeremy Hogan, Uphold, and TapJets are all in a common enterprise w/Ripple.

The fact that people acquired XRP as a payment becomes irrelevant. It becomes irrelevant if TapJets immediately sold the XRP for fiat to pay their employees and costs, thus, clearly not acquiring it for investment or relying on the efforts of anyone. What about the Foreman case?

2nd Circuit said:

“when a purchaser is motivated by desire to use or consume the item purchased -- "to occupy the land or to develop it themselves," as the Howey Court put it, the securities laws do not apply.”

Do 🍊 become securities sold by grocers?

“when a purchaser is motivated by desire to use or consume the item purchased -- "to occupy the land or to develop it themselves," as the Howey Court put it, the securities laws do not apply.”

Do 🍊 become securities sold by grocers?

@Spend_The_Bits uses #XRP to spend #BTC. You can spend $100K #BTC buying a car 🚙 using the SpendTheBits app and it will cost you .00005XRP to do it. According to the SEC the $100K in #BTC is not a security but the .00005 XRP (fraction of a penny) are securities. 🤦♂️

@Spend_The_Bits offers an alternative to Ripple’s ODL (although much smaller scale) yet it is in a common enterprise with Ripple, according to the SEC. We all should be able to recognize the absurdity. This is why I got involved in @LBRYcom on behalf of @naomibrockwell.

https://twitter.com/ashleyprosper1/status/1669719624835817473

We have the Howey case. We have Joiner. We have the Foreman case and consumptive intent = no securities laws apply. We have Telegram making clear that the Gram itself is only alphanumeric code and was not the security. The Hinman speech says the token itself is not the security.

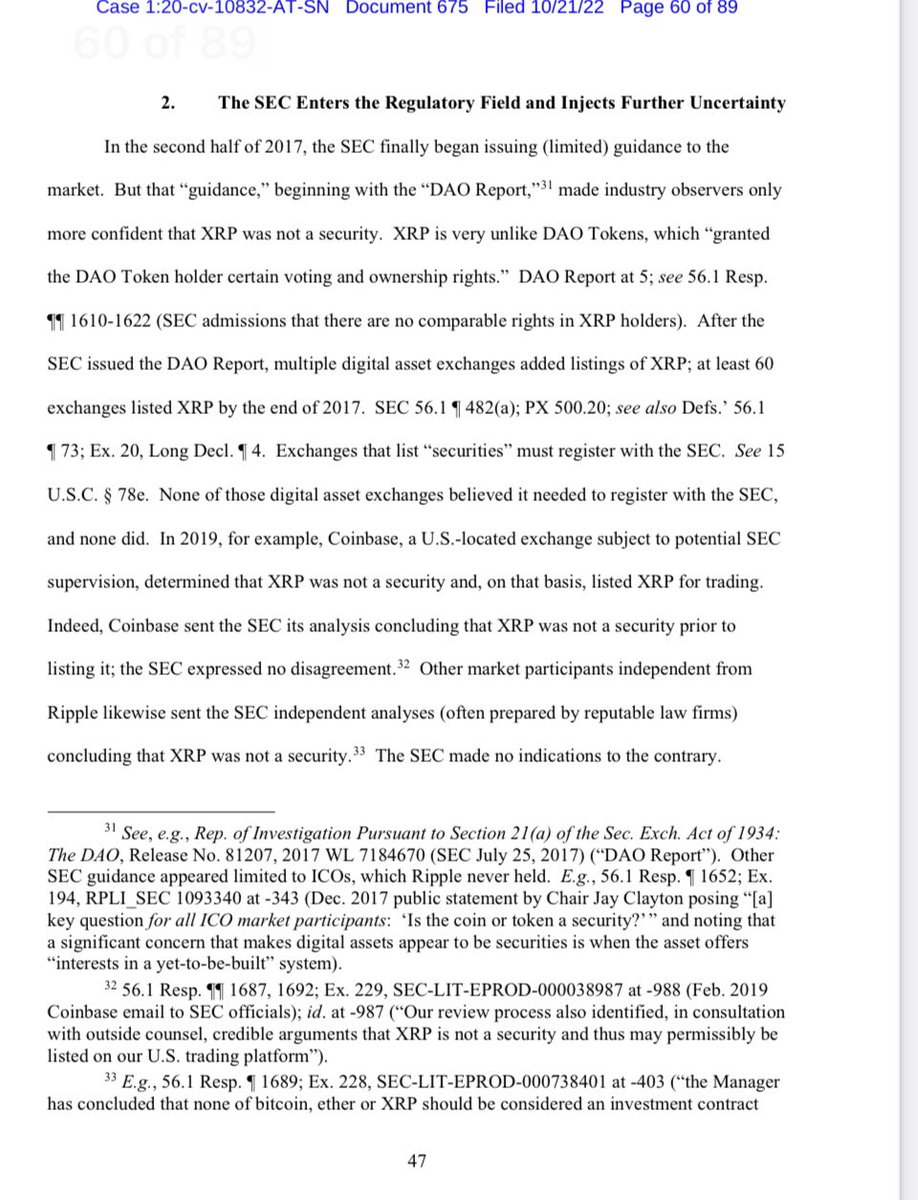

Clayton’s letter to @SenTedBuddNC agreed the token itself is not the security. In the Ripple case, the SEC says “stripped down XRP is just computer code” and denied making the argument that XRP is per se a security (which, in effect is what they argued).

The Aqua-Sonic case Judge said Howey was to be applied at the time of the transaction. @NYcryptolawyer did an exhaustive study on federal appellate case law and found no case to support the underlying asset being the security.

In my amicus brief I challenged the SEC to cite one single case that found an investment contract when there existed zero privity or communication between a buyer and a seller/promoter. The SEC couldn’t do it.

So when you take all the law into consideration, the SEC has NOTHING to support its theory that secondary market sales are also securities. Some may argue that the SEC has a right to pursue novel theories, unsupported by the law. I disagree.

The SEC has the authority provided by Congress and existing law. And if they push novel, unsupported theories, then say Hello, Fair Notice Defense.

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter