1/5

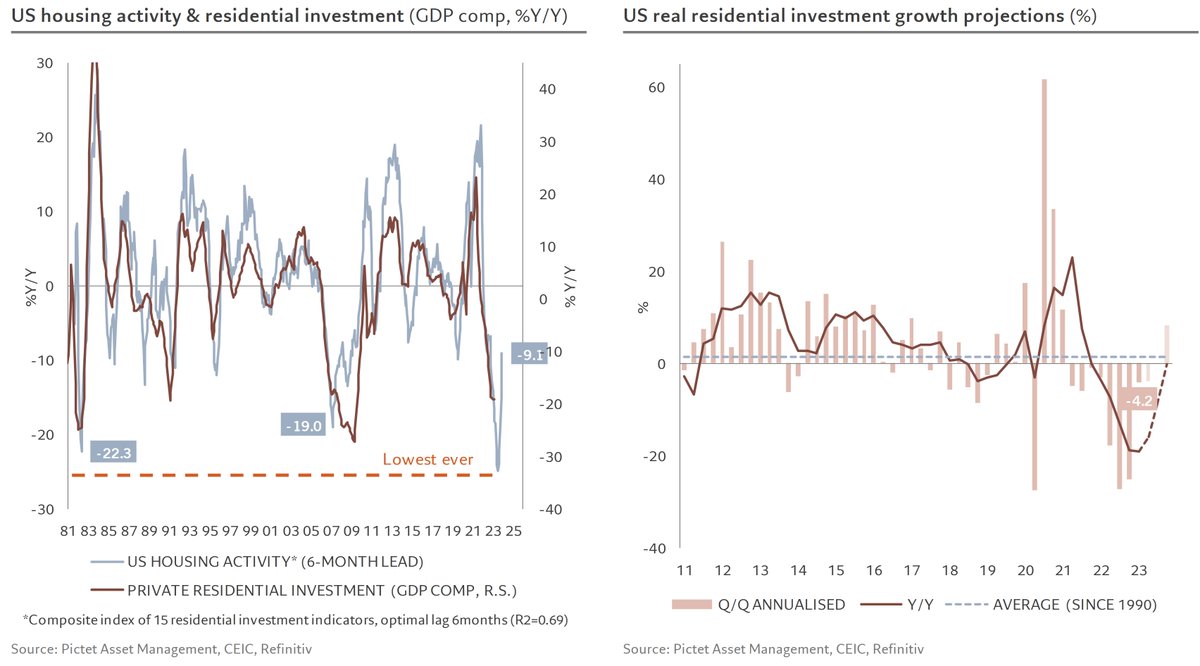

After 11 months of collapse, which took our #US housing activity indicator to its lowest point in over 10 years, it has rebounded for the 6th consecutive month, with 10 out of 15 components up, among which housing starts (+22% m/m !), …

After 11 months of collapse, which took our #US housing activity indicator to its lowest point in over 10 years, it has rebounded for the 6th consecutive month, with 10 out of 15 components up, among which housing starts (+22% m/m !), …

2/5

… homebuilders’ sentiment up 5 points, in expansive territory for the first time in 11 months and median new home price to disposable income ratio which fell 15% since its peak, returning to its >20-year average

… homebuilders’ sentiment up 5 points, in expansive territory for the first time in 11 months and median new home price to disposable income ratio which fell 15% since its peak, returning to its >20-year average

3/5

One of the implications of the rebound in our activity indicator is that the residential component of GDP should stop contributing negatively to growth as early as Q3, supporting the idea of a soft landing for the US

One of the implications of the rebound in our activity indicator is that the residential component of GDP should stop contributing negatively to growth as early as Q3, supporting the idea of a soft landing for the US

5/5

All in all, the US residential market has bottomed out, but the rebound should remain contained, with rates for new mortgages still high and debt servicing still at 26% of median income for the purchase of an existing home

All in all, the US residential market has bottomed out, but the rebound should remain contained, with rates for new mortgages still high and debt servicing still at 26% of median income for the purchase of an existing home

• • •

Missing some Tweet in this thread? You can try to

force a refresh