1/ frxETH v2: The LSD Game-Changer 💥

Last month, @samkazemian dropped news on the upcoming @fraxfinance frxETH v2 release which will revolutionize the fast-growing $20B $ETH LSD market.

I've painstakingly distilled all of the key alpha on the update to 10 tweets:

🧵👇

#crypto

Last month, @samkazemian dropped news on the upcoming @fraxfinance frxETH v2 release which will revolutionize the fast-growing $20B $ETH LSD market.

I've painstakingly distilled all of the key alpha on the update to 10 tweets:

🧵👇

#crypto

2/ What is frxETH v1?

frxETH v1 innovated on the LSD system by having two tokens:

1️⃣ $frxETH - ETH pegged stablecoin

2️⃣ $sfrxETH - interest bearing LSD token

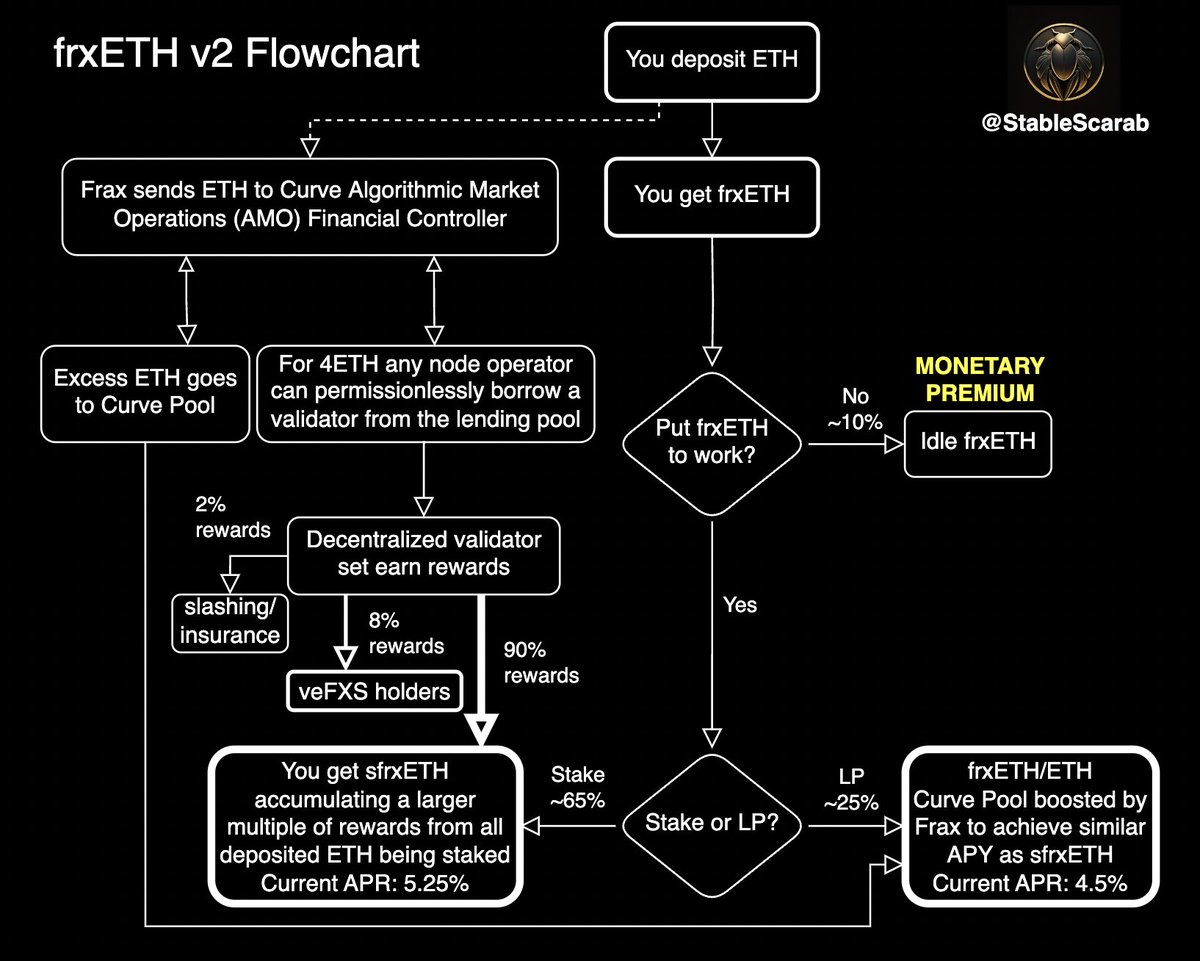

By having other uses for frxETH (like LPing), those who stake sfrxETH have a higher APR than any LSD. See flowchart:

frxETH v1 innovated on the LSD system by having two tokens:

1️⃣ $frxETH - ETH pegged stablecoin

2️⃣ $sfrxETH - interest bearing LSD token

By having other uses for frxETH (like LPing), those who stake sfrxETH have a higher APR than any LSD. See flowchart:

3/ How is frxETH v2 different?

The challenge with v1 was that Frax ran all the validators. The innovation in frxETH v2 allows decentralization of the validator set while maintaining best-in-class APR. See updated flowchart below:

The challenge with v1 was that Frax ran all the validators. The innovation in frxETH v2 allows decentralization of the validator set while maintaining best-in-class APR. See updated flowchart below:

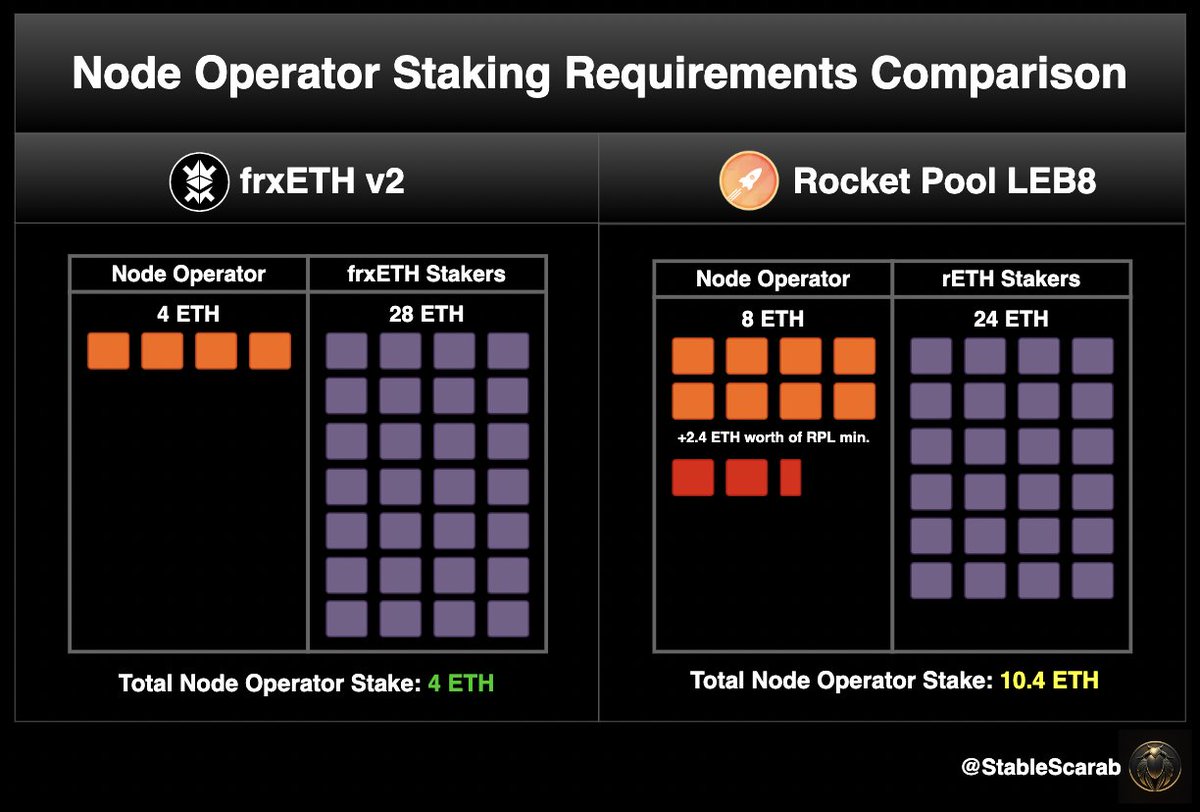

4/ Like @Rocket_Pool, frxETH v2 allows the permissionless borrowing of validators. Unlike Rocket Pool, Frax allows it for just 4ETH, vs Rocket Pool LEB8: 8ETH + 2.4ETH of $RPL "insurance":

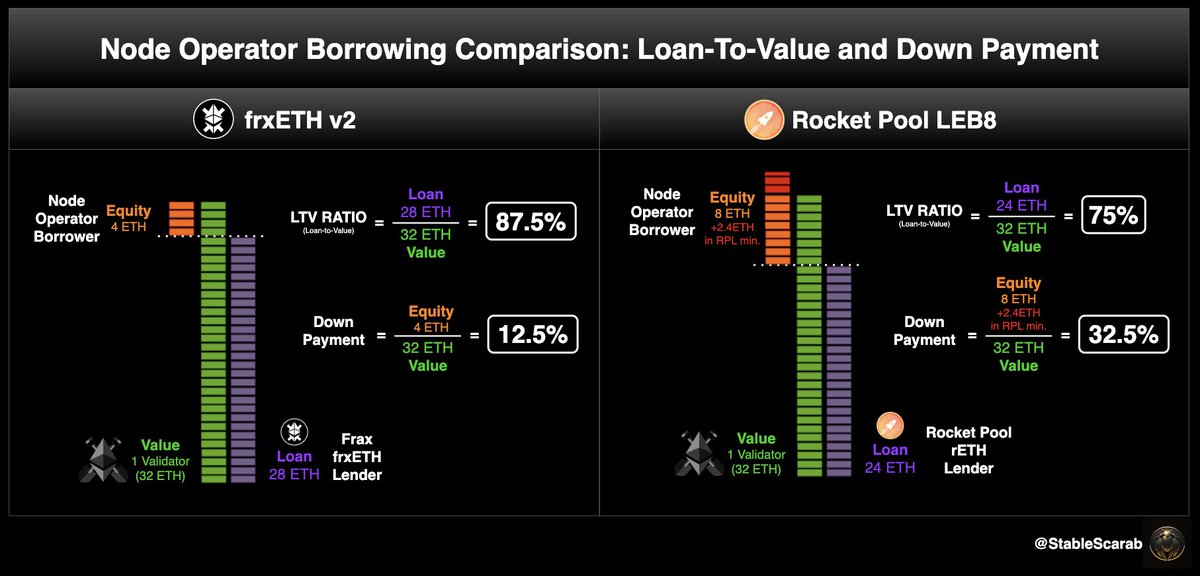

5/ A lower collateral requirement allows node operators to get more leverage on the proof-of-stake yield. However, there is no systemic risk because the validator is what's being borrowed and will be automatically ejected if it gets slashed by too much. 🔪

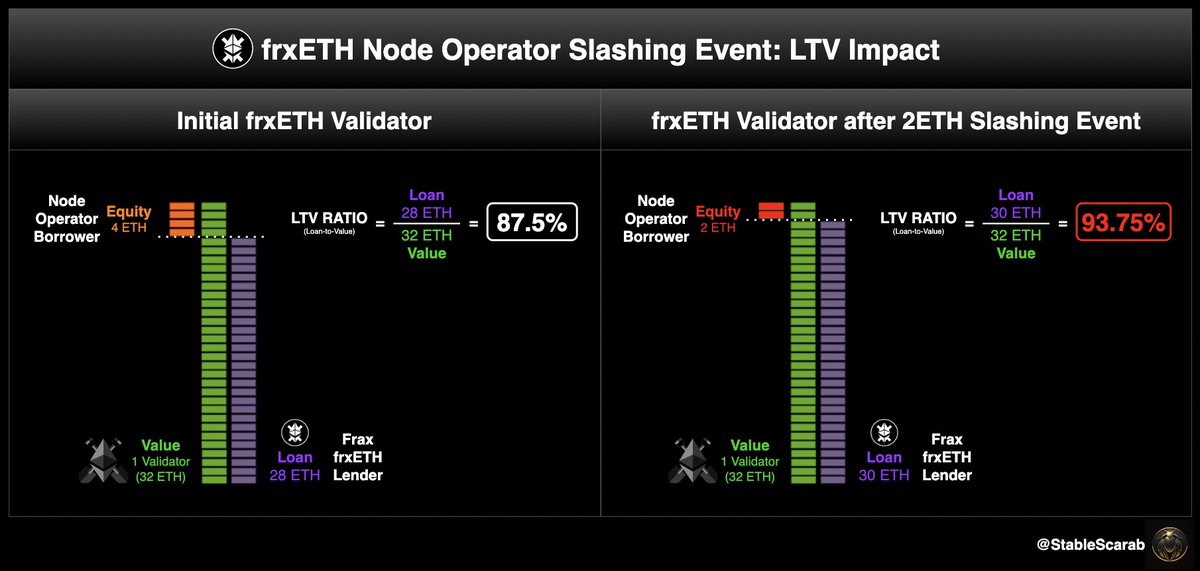

6/ Let's take a look at what happens if a node gets slashed by 2ETH. LTV goes from 87.5% to 93.75%. The validator would get ejected before reaching these levels.

7/ What's in it for Frax?

Frax applies a variable interest rate to the ETH loaned to node operators, determined by the availability of frxETH. The highest performance NOs stand to make the most. This allows Frax to decentralize validators while maintaining the best-in-class APR.

Frax applies a variable interest rate to the ETH loaned to node operators, determined by the availability of frxETH. The highest performance NOs stand to make the most. This allows Frax to decentralize validators while maintaining the best-in-class APR.

8/ To summarize, frxETH v2:

✅ Best-in-class APR

✅ Fully Decentralized Validators

✅ Highest Node Operator Capital Efficiency

✅ Deep Liquidity

frxETH v1 was the fastest LSD to go from 0 to 200k ETH staked🚀

frxETH v2 decentralizes the system to expand without limit🌌

✅ Best-in-class APR

✅ Fully Decentralized Validators

✅ Highest Node Operator Capital Efficiency

✅ Deep Liquidity

frxETH v1 was the fastest LSD to go from 0 to 200k ETH staked🚀

frxETH v2 decentralizes the system to expand without limit🌌

9/ If you want to dive deep into LTV ratios and the math behind the capital-efficiency of frxETH v2, I recommend checking out this article I wrote for @FlywheelDeFi. I also highly recommend subscribing to their podcast and newsletter for tons of quality Frax and DeFi alpha.

https://twitter.com/SScarabLinks/status/1678499867579039745

10/ That's the thread! If you learned something, like/retweet the first tweet below, comment if you have a question, and follow me @StableScarab for more Frax, LSD, and crypto analysis.

https://twitter.com/StableScarab/status/1678512409470996481

11/ Tagging LSD and DeFi legends:

@rektdiomedes

@DefiMoon

@DefiIgnas

@thedefiedge

@crypto_linn

@0xFinish

@WinterSoldierxz

@arndxt_xo

@ThorHartvigsen

@CryptoShiro_

@Moomsxxx

@rektdiomedes

@DefiMoon

@DefiIgnas

@thedefiedge

@crypto_linn

@0xFinish

@WinterSoldierxz

@arndxt_xo

@ThorHartvigsen

@CryptoShiro_

@Moomsxxx

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter