How to Create Screeners 🧵🧵

1) Golden Cross

2) Bounced from 200 EMA

3) EMA Confluence

4) Higher High

5) High Volume

6) Narrow Range

7) Microcaps with sales 🔼

8) Dividend stocks

9) Penny with sales 🔼

10) High Promoter stake

Explained in this thread

Kindly Retweet Like 🙏 twitter.com/i/web/status/1…

1) Golden Cross

2) Bounced from 200 EMA

3) EMA Confluence

4) Higher High

5) High Volume

6) Narrow Range

7) Microcaps with sales 🔼

8) Dividend stocks

9) Penny with sales 🔼

10) High Promoter stake

Explained in this thread

Kindly Retweet Like 🙏 twitter.com/i/web/status/1…

First of All click Create Scan on Chart Ink and start by clicking that + sign

First Basic Screener ( Technical ) -

1) Golden Crossover - 50 EMA Crossing 100

Only one Condition -

Latest close ( EMA 50 ) Crosses above EMA 100

First Basic Screener ( Technical ) -

1) Golden Crossover - 50 EMA Crossing 100

Only one Condition -

Latest close ( EMA 50 ) Crosses above EMA 100

2) Stocks that Bounce from 200 EMA or near 200 EMA

Condition -

Latest Low is < 200 EMA

Latest close is > 200 EMA

Means it went below 200 EMA but closed above that

Condition -

Latest Low is < 200 EMA

Latest close is > 200 EMA

Means it went below 200 EMA but closed above that

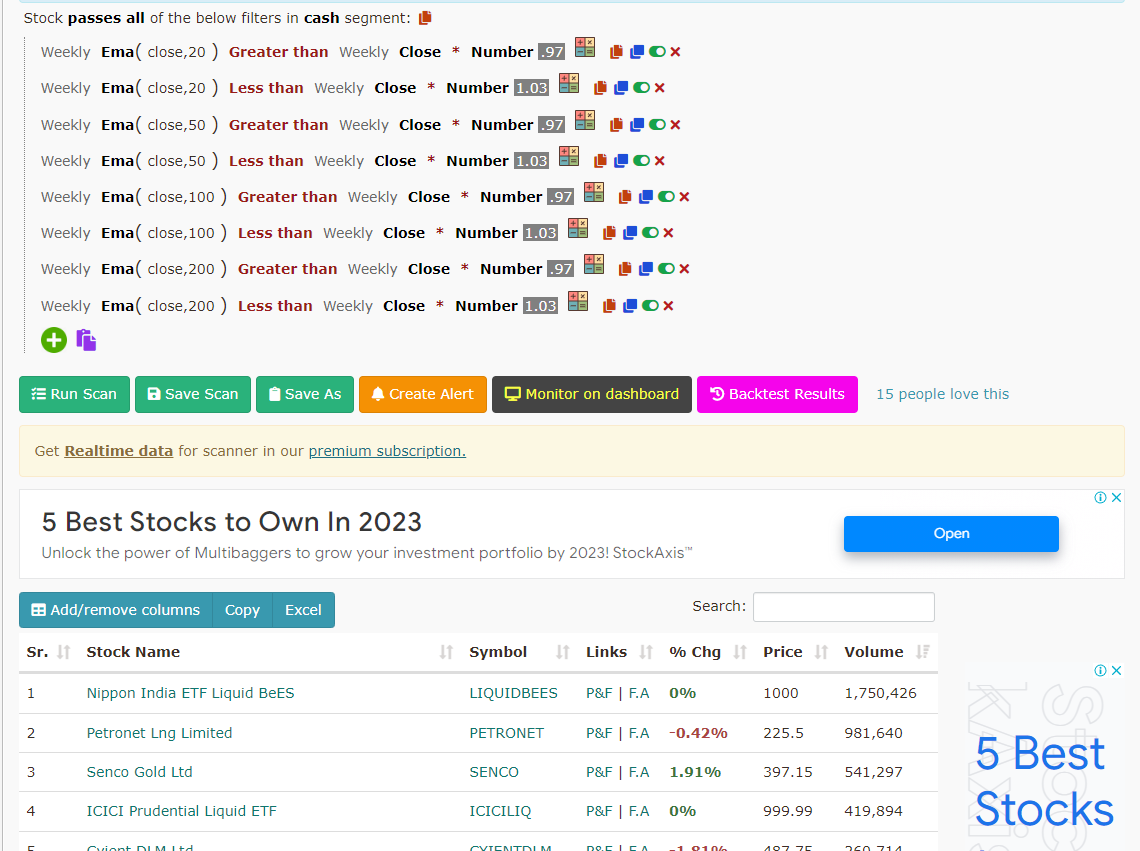

3) 20-50-100 EMA Confluence

Confluence generally decide the move, R:R is always best when you trade at EMA Confluence

Conditions - All EMAs must have close value

Confluence generally decide the move, R:R is always best when you trade at EMA Confluence

Conditions - All EMAs must have close value

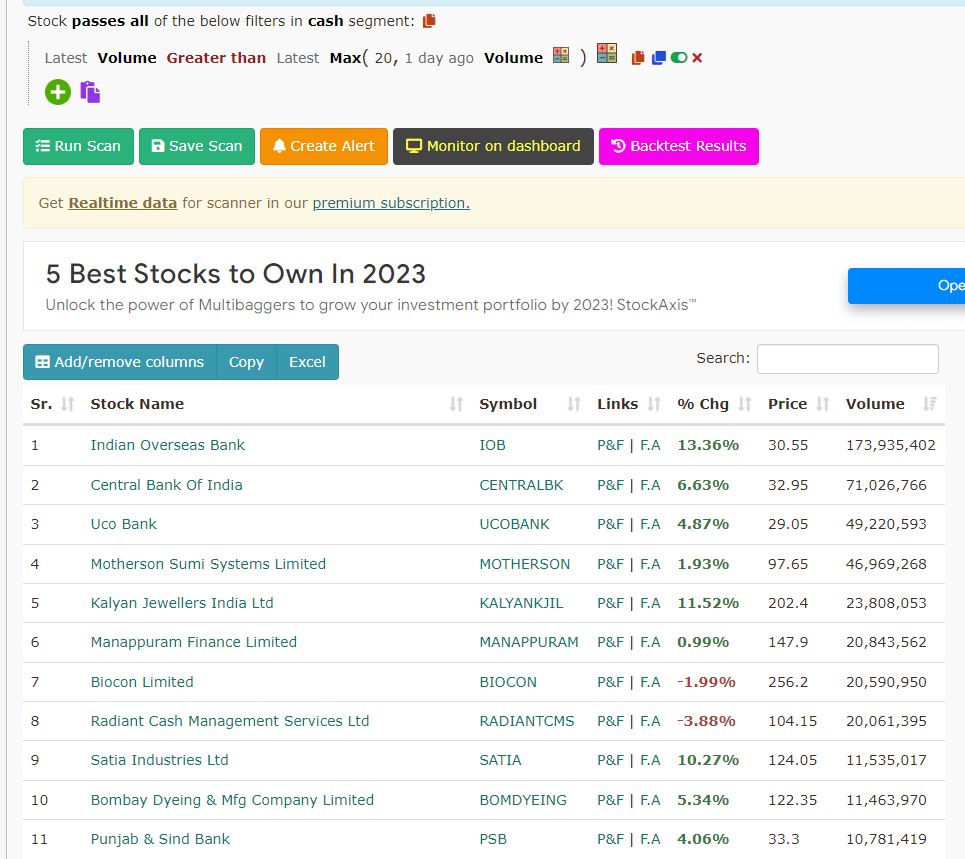

5) Volume Blast -

When Volume is greater than last 20 days here -

Modify according to requirement

Max Function used means volume latest is greater than max volume of last 20 days

When Volume is greater than last 20 days here -

Modify according to requirement

Max Function used means volume latest is greater than max volume of last 20 days

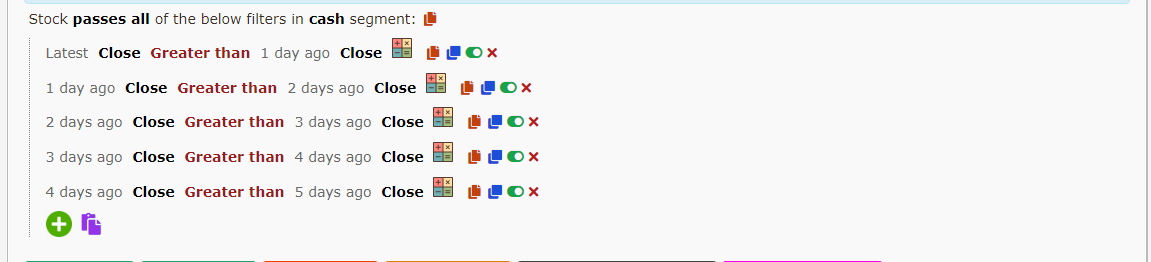

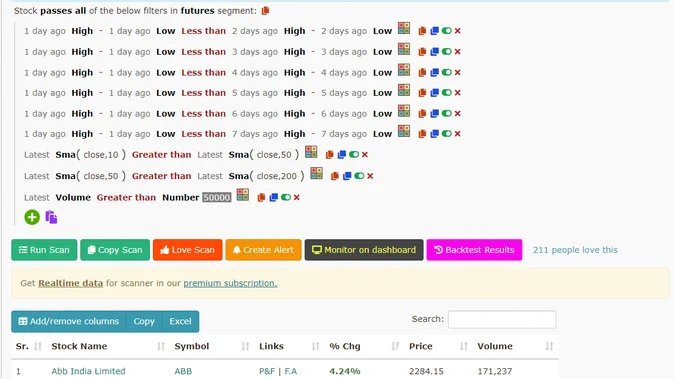

6) Stocks with narrowing Range

Means Big Move is Near

Condition - Everyday difference between high and low must be less than previous day diff

Diff of High Low Today < Diff of High Low Yesterday

and So on for number of days you want

Means Big Move is Near

Condition - Everyday difference between high and low must be less than previous day diff

Diff of High Low Today < Diff of High Low Yesterday

and So on for number of days you want

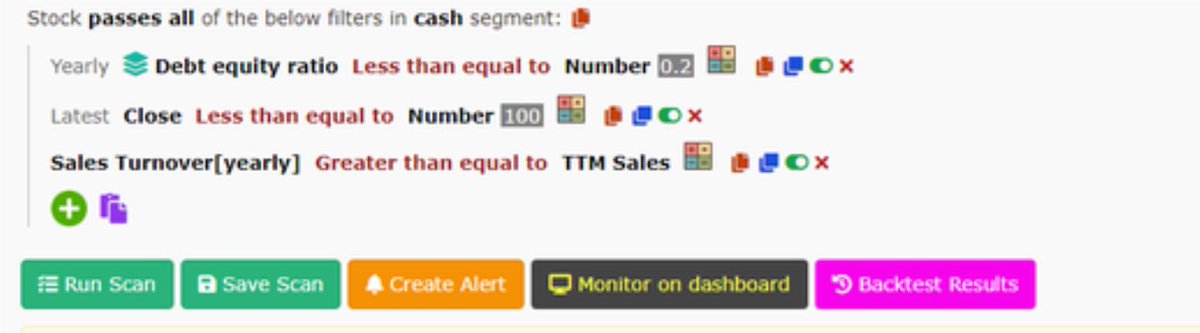

7) Stocks UNDER 100 with low Debt and Rising Sales

Conditions -

1) D/E Ratio < 0.2 ( change according to you )

2) Price < 100

3) Current year sales more than last year

Conditions -

1) D/E Ratio < 0.2 ( change according to you )

2) Price < 100

3) Current year sales more than last year

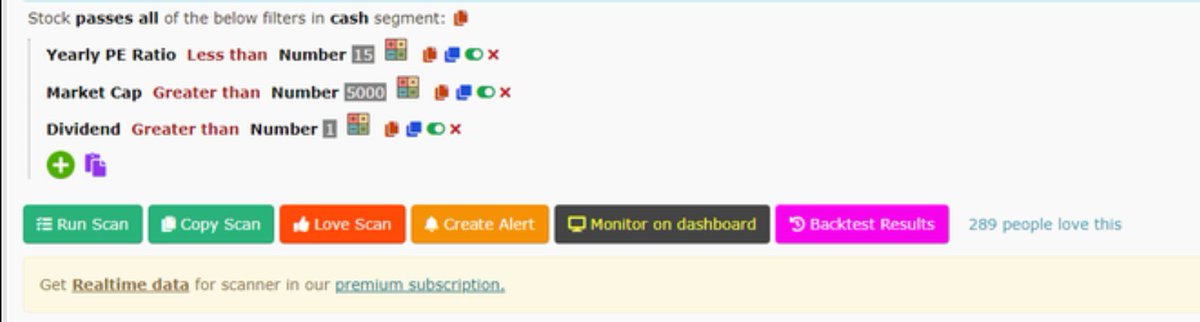

8) Good Dividend Paying Stocks which can grow

Conditions -

1) Dividend > 1

2) PE Ratio < 15

3) Mcap > 5000

Change conditions according to your research -

Conditions -

1) Dividend > 1

2) PE Ratio < 15

3) Mcap > 5000

Change conditions according to your research -

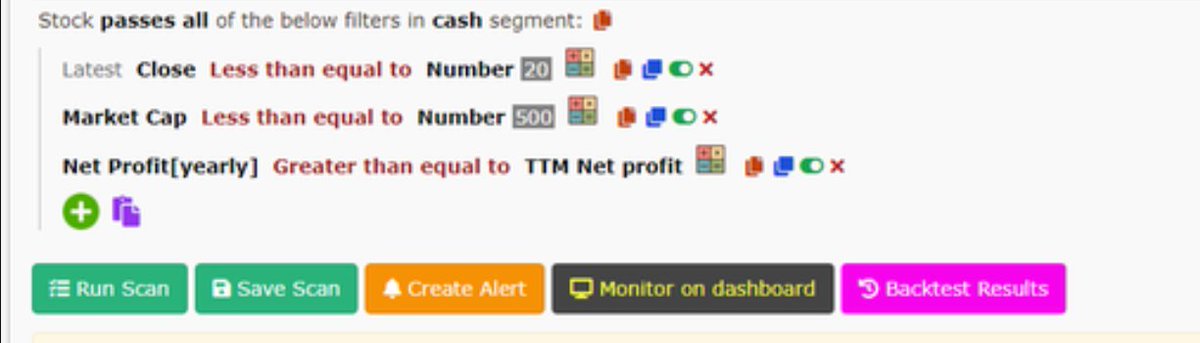

9) Penny Stocks Rising Profits -

Conditions -

1) Price < 20

2) Mcap < 500 Cr

3) Rising Profits ( one can compare for many years )

Conditions -

1) Price < 20

2) Mcap < 500 Cr

3) Rising Profits ( one can compare for many years )

This is how you all can create screeners according to your research and strategy 🙏

Please follow my handle @myfirststock99

for more such info

Do join telegram - t.me/TradeTheTrend_…

Please follow my handle @myfirststock99

for more such info

Do join telegram - t.me/TradeTheTrend_…

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter