How to get URL link on X (Twitter) App

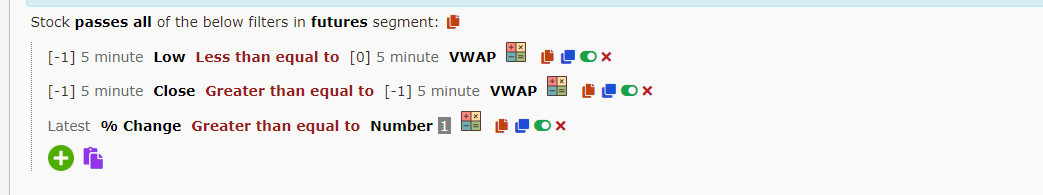

Sector Potential -

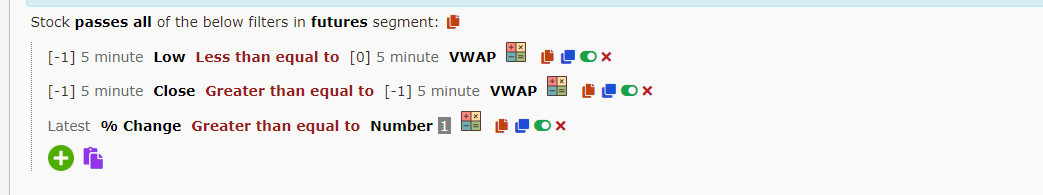

Sector Potential -

https://twitter.com/myfirststock99/status/1559104989867360257?s=20&t=W7odDeVocuMU-XkF0ktLmw