What is Macro/Crypto Summer and why does it matter?

Well, macro summer has started, its the part of The Everything Code cycle where the ISM picks up (GDP growth).... 1/

Well, macro summer has started, its the part of The Everything Code cycle where the ISM picks up (GDP growth).... 1/

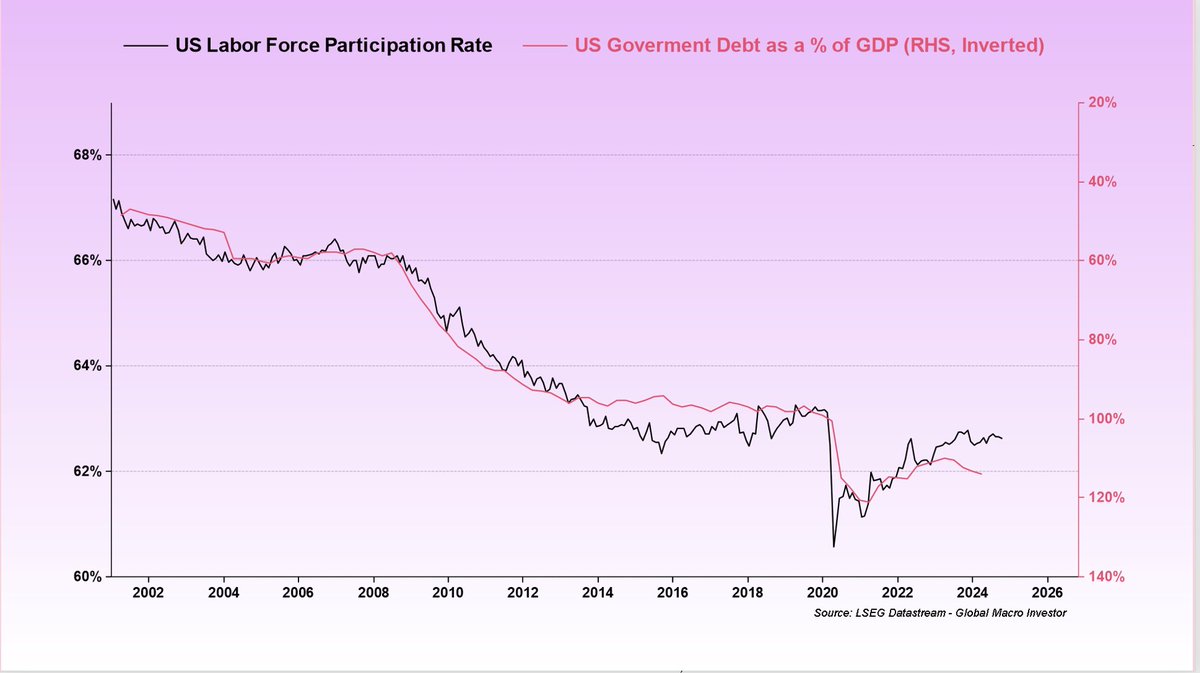

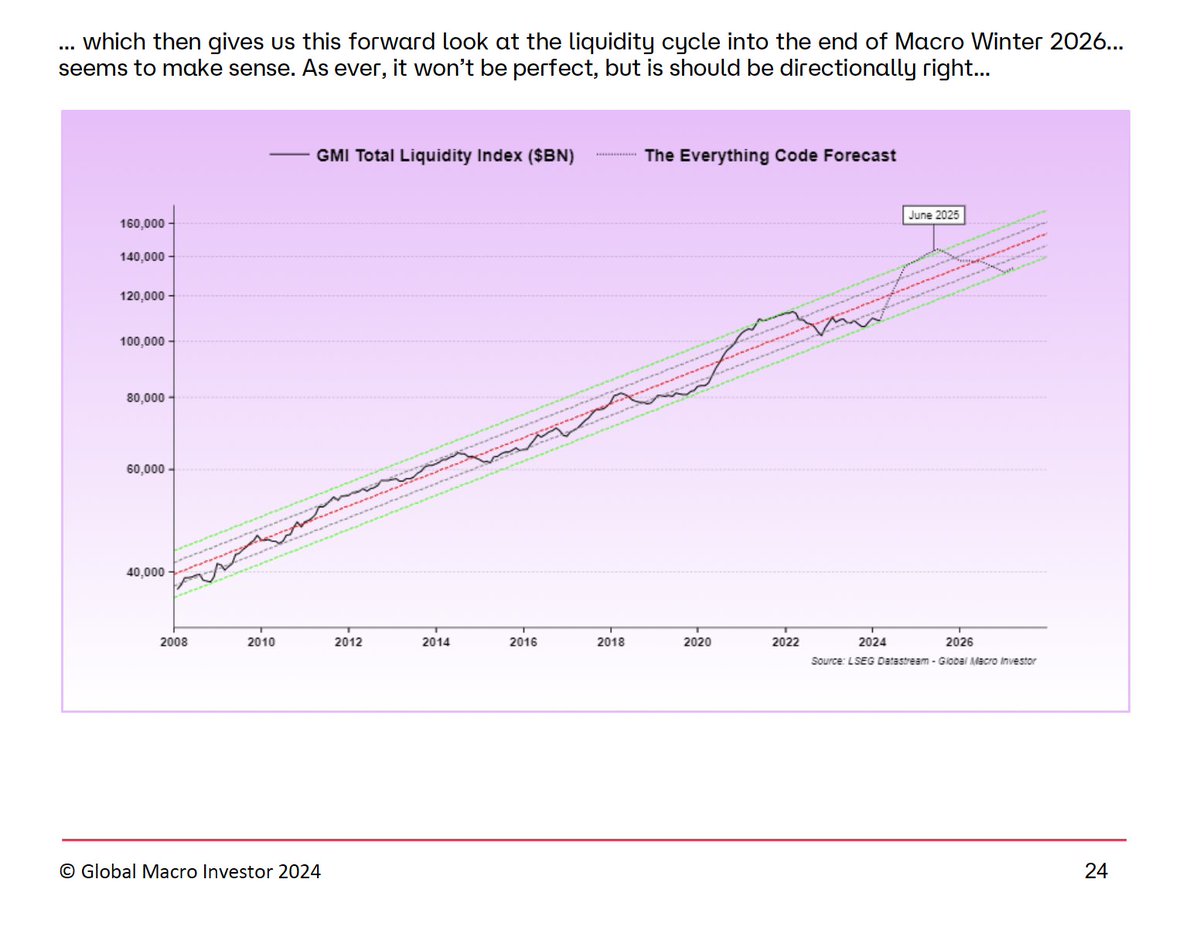

And that is driven by liquidity, which bottomed at the end of 2022... macro summer and fall are all about liquidity rising and is a core part of The Everything Code thesis...

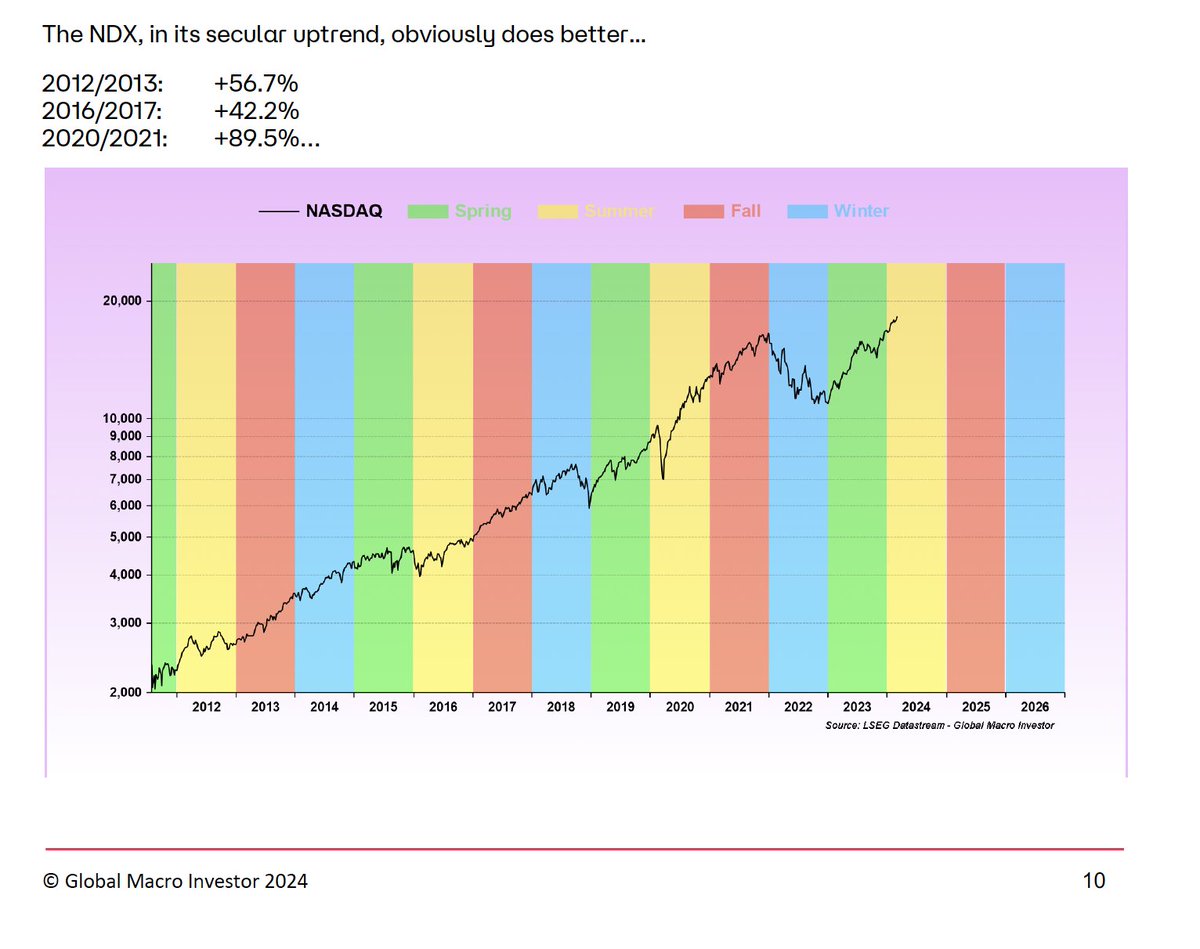

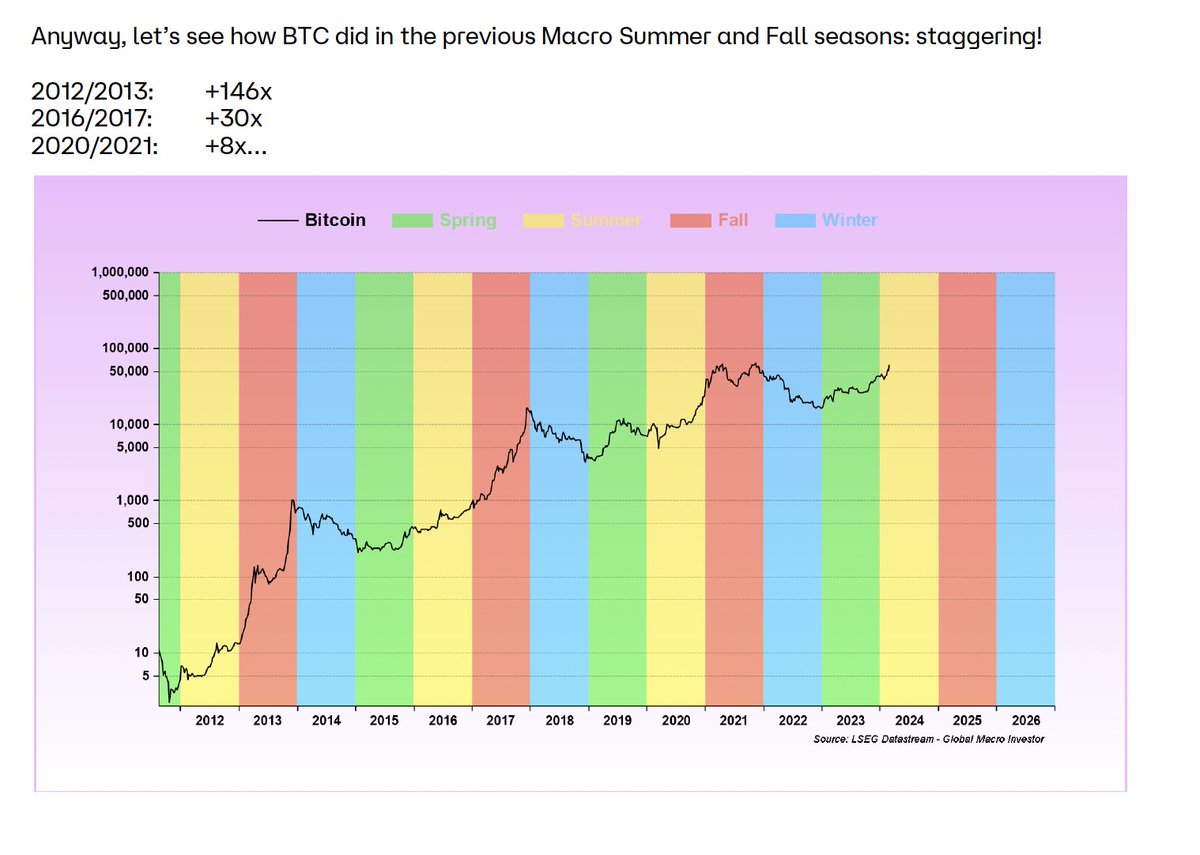

But Bitcoin LOVES macro summer and fall even more.

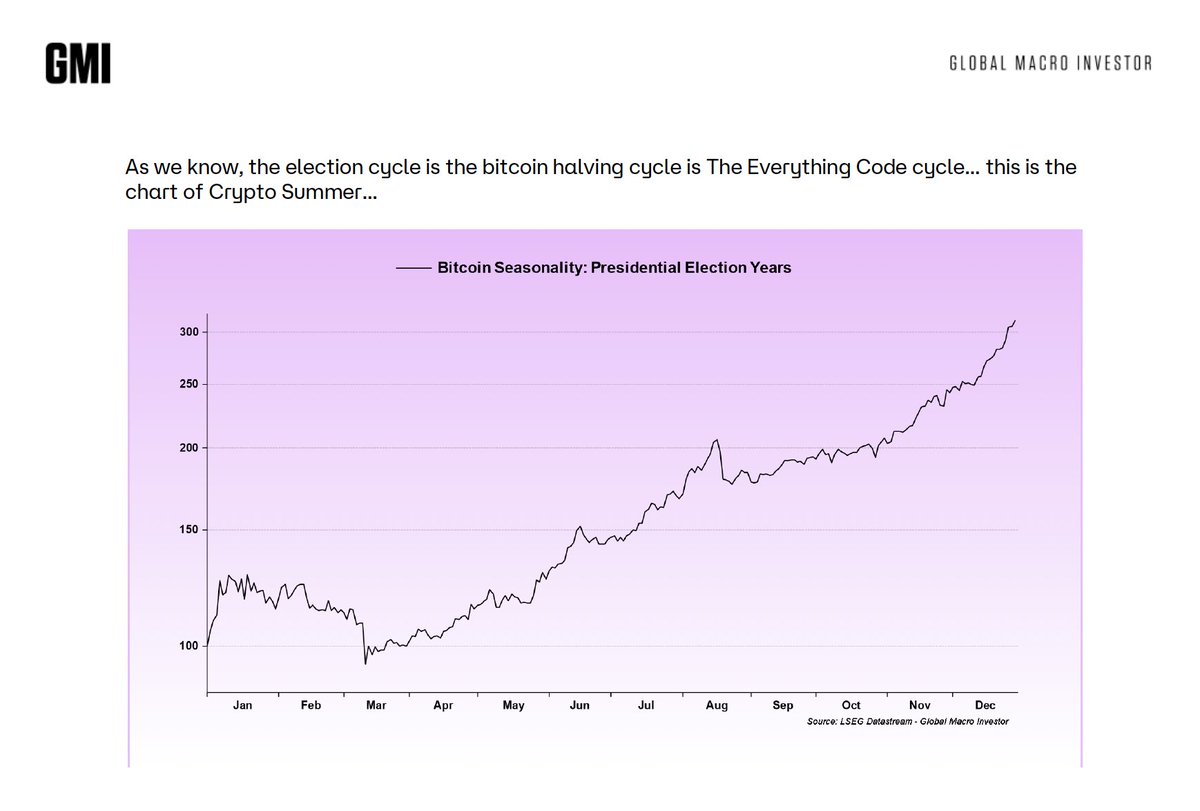

Crypto summer has started and fully develops post-halving...it's all the same Everything Code cycle...

Crypto summer has started and fully develops post-halving...it's all the same Everything Code cycle...

And liquidity should rise all the way into the end of 2025... I dont expect an exact match here (more subdued) but who knows...

Using many of our Everything Code inputs, we get a forecast of global liquidity that looks like this. Ive no idea whether its China, the EU, Japan or the US that drives this or maybe a bit of all. Time will tell...

The work we have done on The Everything Code in Global Macro Investor (GMI) has been central to my investing strategy and got us max long tech and crypto in Dec 2022. We have forecasts out to end of 2025 for crypto and tech from this work, but obviously I won't publish them here.

But the bigger game is yet to be played out as Alt season arrives and we fully enter the Banana Zone.

The Banana Zone cometh, and it is a huge wealth-generating machine.

Patience will be rewarded.

In the meantime, don't fuck this up. #DFTU

The Banana Zone cometh, and it is a huge wealth-generating machine.

Patience will be rewarded.

In the meantime, don't fuck this up. #DFTU

• • •

Missing some Tweet in this thread? You can try to

force a refresh