Have been playing around with bridges a little more recently

In this thread I'll cover all the main bridges comparing:

Fees

Time

Asset/Chain support

Here are the best ones! 👇

In this thread I'll cover all the main bridges comparing:

Fees

Time

Asset/Chain support

Here are the best ones! 👇

Below we'll cover:

@Orbiter_Finance @circle @BungeeExchange @AcrossProtocol @wormholecrypto @deBridgeFinance @LayerZero_Labs @SynapseProtocol @squidrouter

I'll also include my preferences when it comes to bridging too

Fees are based on bridging 1 ETH or equivalent in $ value.

@Orbiter_Finance @circle @BungeeExchange @AcrossProtocol @wormholecrypto @deBridgeFinance @LayerZero_Labs @SynapseProtocol @squidrouter

I'll also include my preferences when it comes to bridging too

Fees are based on bridging 1 ETH or equivalent in $ value.

Orbiter Finance @Orbiter_Finance

Fees - $3-5 (0.05% + withholding fee)

Time - Sub 30s

Support - Most L2 chains, (not L1's/NonEVM)

Also has no token - points mean prizes!

Fees - $3-5 (0.05% + withholding fee)

Time - Sub 30s

Support - Most L2 chains, (not L1's/NonEVM)

Also has no token - points mean prizes!

Circle CCTP via Bungee @BungeeExchange

Fees - $1, 0% slippage though!

Time - Slow, always 20-30 mins

Supports - Only USDC but the best way to transfer USDC anywhere!

1 million dollars and next to zero cost, I like this a lot even though it takes 20 mins

Fees - $1, 0% slippage though!

Time - Slow, always 20-30 mins

Supports - Only USDC but the best way to transfer USDC anywhere!

1 million dollars and next to zero cost, I like this a lot even though it takes 20 mins

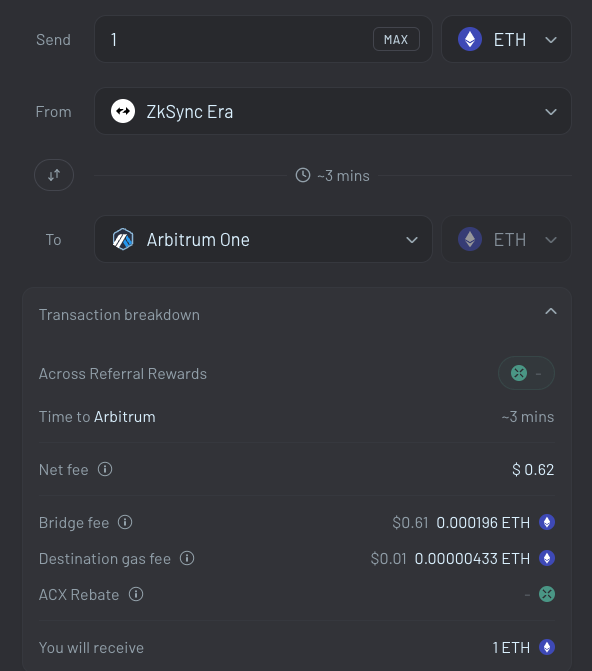

Across @AcrossProtocol

Fees - sub $1

Time - Quick, usually 1-2 minutes in my experience

Supports - Only 7 EVM chains, not the biggest variety

For a quick bridge not bad + if you use ref links, can make back some fees with ACX rewards

Fees - sub $1

Time - Quick, usually 1-2 minutes in my experience

Supports - Only 7 EVM chains, not the biggest variety

For a quick bridge not bad + if you use ref links, can make back some fees with ACX rewards

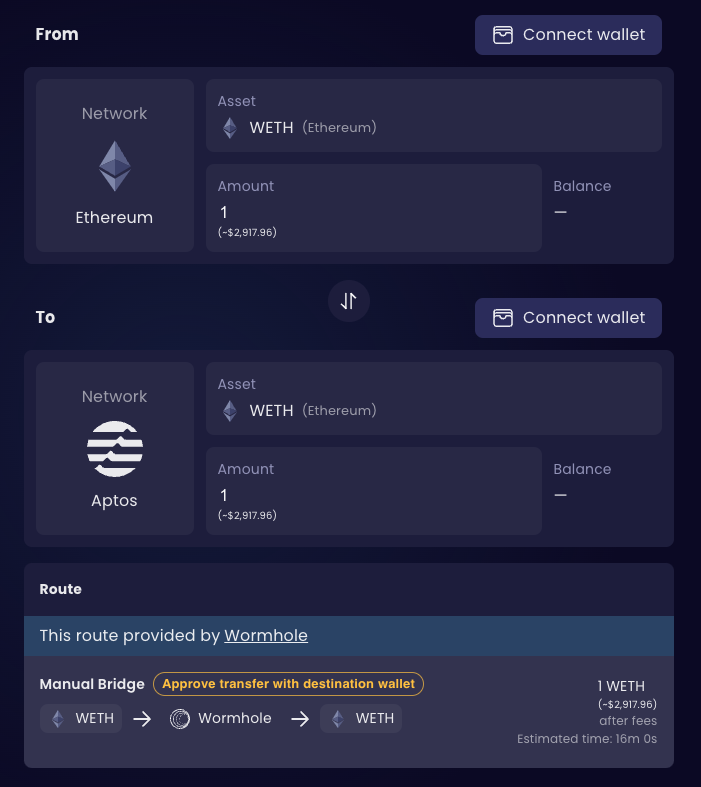

Portal (Wormhole) @wormholecrypto

Fees - Almost 0 (not including gas)

Time - Dependent on chain used (can be 10+ mins)

Support - Wide range of chains including Cosmos, Aptos, Sui & Solana

Terrible experience with wrappers.

You have to check if theres liquidity before bridging!

Fees - Almost 0 (not including gas)

Time - Dependent on chain used (can be 10+ mins)

Support - Wide range of chains including Cosmos, Aptos, Sui & Solana

Terrible experience with wrappers.

You have to check if theres liquidity before bridging!

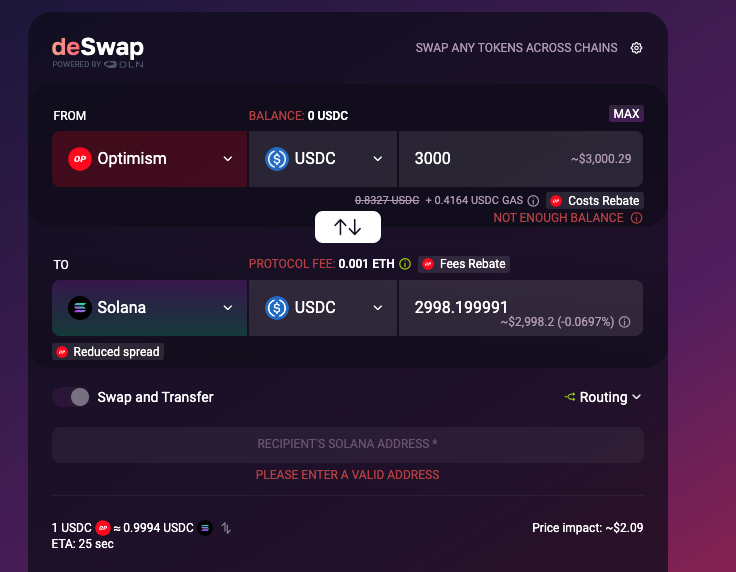

deBridge @deBridgeFinance

Fees - $3 + slippage and gas

Time - Sub 30 seconds

Support - Main EVM chains + SOLANA

They also have token swaps across chain too which is a game changer for me!

No token 👀

Fees - $3 + slippage and gas

Time - Sub 30 seconds

Support - Main EVM chains + SOLANA

They also have token swaps across chain too which is a game changer for me!

No token 👀

Stargate (LayerZero) @StargateFinance

Fees - $1-5 + gas

Time - less than 5 mins, sometimes long!

Support - wide range of EVM chains (but not all can transfer between each other which is annoying)

Rarely use this now given fees

Fees - $1-5 + gas

Time - less than 5 mins, sometimes long!

Support - wide range of EVM chains (but not all can transfer between each other which is annoying)

Rarely use this now given fees

Synapse @SynapseProtocol

Fees = $1-3, generally a little more slippage than other places

Time - 1-3 mins

Support - does support some niche EVM chains including Canto and Metis.

Not much for me to use and do here

Fees = $1-3, generally a little more slippage than other places

Time - 1-3 mins

Support - does support some niche EVM chains including Canto and Metis.

Not much for me to use and do here

Squid Router @squidrouter

Fees - generally pretty good, low

Time - Slow, 30 mins usually for me

Support - The best for Cosmos x EVM by far, the main way I get into/out of cosmos

Main bridge I use for Cosmos eco

Fees - generally pretty good, low

Time - Slow, 30 mins usually for me

Support - The best for Cosmos x EVM by far, the main way I get into/out of cosmos

Main bridge I use for Cosmos eco

To summarise my favourites:

For L2 - L2 bridges - @Orbiter_Finance because of low fees and speed

For stables (I use USDC typically) - @circle via @BungeeExchange is my favourite

Solana - @deBridgeFinance, so fast!

Cosmos - @squidrouter, only option

For L2 - L2 bridges - @Orbiter_Finance because of low fees and speed

For stables (I use USDC typically) - @circle via @BungeeExchange is my favourite

Solana - @deBridgeFinance, so fast!

Cosmos - @squidrouter, only option

Thanks to @cryptoaioli and @563defi for helping with some of these too, good chads, go follow them.

Let me know if theres anything missing? What is your favourite?

Let me know if theres anything missing? What is your favourite?

• • •

Missing some Tweet in this thread? You can try to

force a refresh