Everyone knows EigenLayer isn't a normal project.

But I think 90% of people didn't fully understand the power of $EIGEN. It's not just any token.

I'm breaking down the 40-page long whitepaper into 30 tweets.

Let's talk about this "Universal Intersubjective Work Token"...

But I think 90% of people didn't fully understand the power of $EIGEN. It's not just any token.

I'm breaking down the 40-page long whitepaper into 30 tweets.

Let's talk about this "Universal Intersubjective Work Token"...

Before we start, I want to specify that 2/3 of the paper explains complex games regarding cryptoeconomic security and why the infrastructure is safe.

I'm going to keep it simple, there's no reason to explain all those details in this thread.

I'm going to keep it simple, there's no reason to explain all those details in this thread.

1/

Universal Intersubjective Work Token... fancy term huh? Let's unpack it starting from the basics.

What's a Work Token? Usually, we refer to work tokens as those that need to be staked to perform digital tasks.

$ETH and $SOL are work tokens.

Universal Intersubjective Work Token... fancy term huh? Let's unpack it starting from the basics.

What's a Work Token? Usually, we refer to work tokens as those that need to be staked to perform digital tasks.

$ETH and $SOL are work tokens.

2/

Work tokens are used not only for digital work (i.e. validating), but also for punishing non-compliant workers, a process usually called slashing.

There are 1-2 limitations to existing work tokens:

1. They are special-purpose.

2. They are objective.

Work tokens are used not only for digital work (i.e. validating), but also for punishing non-compliant workers, a process usually called slashing.

There are 1-2 limitations to existing work tokens:

1. They are special-purpose.

2. They are objective.

3/

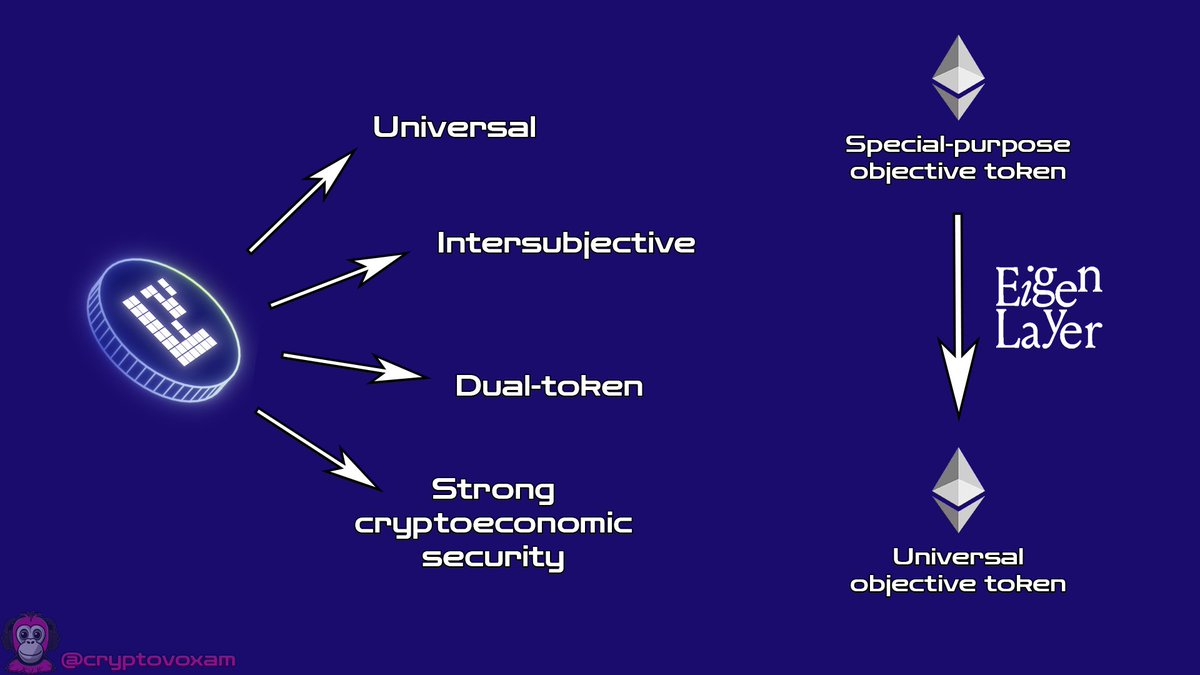

$ETH is a SPECIAL-PURPOSE OBJECTIVE work token used "just" to validate Ethereum blocks inside the Ethereum protocol.

But now, thanks to EigenLayer, $ETH has become a UNIVERSAL OBJECTIVE work token, because it can now be used for validating external services (aka AVS).

$ETH is a SPECIAL-PURPOSE OBJECTIVE work token used "just" to validate Ethereum blocks inside the Ethereum protocol.

But now, thanks to EigenLayer, $ETH has become a UNIVERSAL OBJECTIVE work token, because it can now be used for validating external services (aka AVS).

4/

It's still an objective token, because restaking provides cryptoeconomic security (via slashing) only for faults that are clearly attributable and verifiable onchain.

There is no room for subjectivity here.

It's still an objective token, because restaking provides cryptoeconomic security (via slashing) only for faults that are clearly attributable and verifiable onchain.

There is no room for subjectivity here.

5/

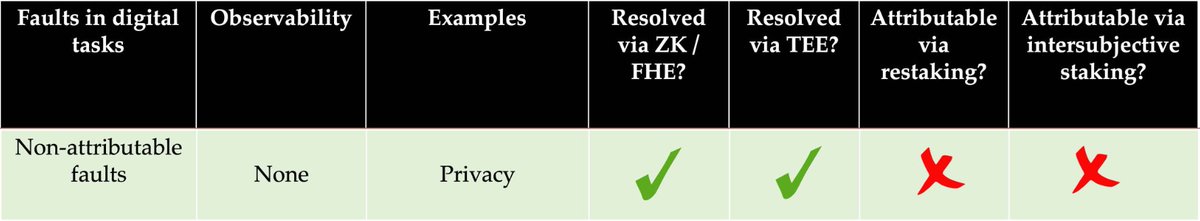

To understand the scope of an intersubjective token we need to understand the categorization of faults in digital tasks.

Three categories:

- Objectively attributable faults

- Intersubjectively attributable faults

- Non-attributable faults

To understand the scope of an intersubjective token we need to understand the categorization of faults in digital tasks.

Three categories:

- Objectively attributable faults

- Intersubjectively attributable faults

- Non-attributable faults

6/

1. Objectively Attributable Faults

Belong to this category everything that can be validated (or invalidated) purely mathematically and cryptographically.

If Alice's address has 1 ETH and I want to validate a transaction where she sends 2 ETH, it's clear that it's not valid.

1. Objectively Attributable Faults

Belong to this category everything that can be validated (or invalidated) purely mathematically and cryptographically.

If Alice's address has 1 ETH and I want to validate a transaction where she sends 2 ETH, it's clear that it's not valid.

2. Intersubjectively Attributable Faults

If an oracle providing the price of an asset goes to zero for a few seconds, there is no way to determine with certainty that the asset isn't worth zero.

Observers will come to a consensus on whether the price reported was correct or not

If an oracle providing the price of an asset goes to zero for a few seconds, there is no way to determine with certainty that the asset isn't worth zero.

Observers will come to a consensus on whether the price reported was correct or not

8/

3. Non-Attributable Faults

These are faults not attributable outside the victim of the fault.

Since a 3rd party can't attribute and punish, the only way to avoid them is by making the validators sufficiently decentralized and collusion-resistant.

3. Non-Attributable Faults

These are faults not attributable outside the victim of the fault.

Since a 3rd party can't attribute and punish, the only way to avoid them is by making the validators sufficiently decentralized and collusion-resistant.

9/

Another important piece we need to comprehend is the role of social consensus.

Ethereum's security comes from the combination of staking and slashing + Ethereum's social consensus.

Another important piece we need to comprehend is the role of social consensus.

Ethereum's security comes from the combination of staking and slashing + Ethereum's social consensus.

10/

The social consensus is the community's intervention when "tyranny-of-majority" attacks happen.

If the majority of validators collude to steal money and validate an invalid state of the chain, the social layer could intervene to fork the chain.

The social consensus is the community's intervention when "tyranny-of-majority" attacks happen.

If the majority of validators collude to steal money and validate an invalid state of the chain, the social layer could intervene to fork the chain.

11/

In the end, something is valuable if people think it is.

The fork could perhaps become the new main chain, where the most valuable ETH are.

Someone could find value in the original chain, that's why assets like $ETC or $BCH aren't worth zero.

In the end, something is valuable if people think it is.

The fork could perhaps become the new main chain, where the most valuable ETH are.

Someone could find value in the original chain, that's why assets like $ETC or $BCH aren't worth zero.

12/

We understood that social consensus enables the resolution of intersubjective conflicts, yet for various reasons I won't delve into here, it's crucial to limit social intervention to rare occasions.

We understood that social consensus enables the resolution of intersubjective conflicts, yet for various reasons I won't delve into here, it's crucial to limit social intervention to rare occasions.

13/

Extending the usage of the social consensus for resolving additional digital tasks will be a violation of the "don't overload Ethereum's social consensus" rule.

You can read more about it in this masterpiece written by @VitalikButerin: vitalik.eth.limo/general/2023/0…

Extending the usage of the social consensus for resolving additional digital tasks will be a violation of the "don't overload Ethereum's social consensus" rule.

You can read more about it in this masterpiece written by @VitalikButerin: vitalik.eth.limo/general/2023/0…

14/

Any digital task where fault can be objectively attributed should tap into Ethereum's security (restaked ETH).

The gap for intersubjective attributable faults is filled by $EIGEN, a forkable token.

Any digital task where fault can be objectively attributed should tap into Ethereum's security (restaked ETH).

The gap for intersubjective attributable faults is filled by $EIGEN, a forkable token.

15/

The token's forkability isn't an EigenLayer invention.

@AugurProject is a prediction market, its token REP is staked to report what happened in the real world.

REP token holders are slashed if they disagree with a majority of token holders, but...

The token's forkability isn't an EigenLayer invention.

@AugurProject is a prediction market, its token REP is staked to report what happened in the real world.

REP token holders are slashed if they disagree with a majority of token holders, but...

16/

if a group of REP holders dissent, they can initiate a forking event that creates two ERC20 tokens.

Every REP holder now needs to decide if they want to keep REP1 or migrate to REP2.

If REP1 clearly represents the truthful answer, then everyone will choose it.

if a group of REP holders dissent, they can initiate a forking event that creates two ERC20 tokens.

Every REP holder now needs to decide if they want to keep REP1 or migrate to REP2.

If REP1 clearly represents the truthful answer, then everyone will choose it.

17/

While Augur pioneered cryptoeconomic security for intersubjective faults, there were 2 main problems:

Token specialization and fork-unaware applications.

While Augur pioneered cryptoeconomic security for intersubjective faults, there were 2 main problems:

Token specialization and fork-unaware applications.

18/

- Specialization:

Augur was application-specific, while EigenLayer needs a forkable token that works for every possible intersubjective fault made by every possible AVS, a much more complex mechanism.

- Specialization:

Augur was application-specific, while EigenLayer needs a forkable token that works for every possible intersubjective fault made by every possible AVS, a much more complex mechanism.

19/

- Fork-aware:

Every holder of the REP token needs to be aware of forking and claim the right version of the (forked) token.

This couldn't be the right choice, EigenLayer needs a system where fork-unaware apps like DeFi apps are unaffected by the eventuality of a fork.

- Fork-aware:

Every holder of the REP token needs to be aware of forking and claim the right version of the (forked) token.

This couldn't be the right choice, EigenLayer needs a system where fork-unaware apps like DeFi apps are unaffected by the eventuality of a fork.

20/

EIGEN has been designed to have 4 important features:

- UNIVERSALITY

- ISOLATION

- METERING

- COMPENSATION

EIGEN has been designed to have 4 important features:

- UNIVERSALITY

- ISOLATION

- METERING

- COMPENSATION

21/

First Feature: Universality

Easy to understand. EIGEN can fork for any intersubjective fault in any AVS where there will be near-universal agreement.

Oracle Mispricing?

Bridges that claim as valid on Chain A an invalid state of Chain B?

Censored transactions?

First Feature: Universality

Easy to understand. EIGEN can fork for any intersubjective fault in any AVS where there will be near-universal agreement.

Oracle Mispricing?

Bridges that claim as valid on Chain A an invalid state of Chain B?

Censored transactions?

22/

Second Feature: Isolation

Eigen is creating an isolation chamber between the DeFi use cases and the staking use cases of $EIGEN.

Second Feature: Isolation

Eigen is creating an isolation chamber between the DeFi use cases and the staking use cases of $EIGEN.

23/

With what they call the achievement of "Solid Representation", an $EIGEN holder could stay inactive or locked into defi positions for years but still be able to redeem tokens from any of the (descendent) forks they agreed with.

That's where the dual-token model comes from.

With what they call the achievement of "Solid Representation", an $EIGEN holder could stay inactive or locked into defi positions for years but still be able to redeem tokens from any of the (descendent) forks they agreed with.

That's where the dual-token model comes from.

24/

Enter: $EIGEN and $bEIGEN.

bEIGEN is used for intersubjective staking.

EIGEN is used for fork-unaware applications: it's a wrapped version that allows every holder to redeem the forks of bEIGEN at any given time later.

Enter: $EIGEN and $bEIGEN.

bEIGEN is used for intersubjective staking.

EIGEN is used for fork-unaware applications: it's a wrapped version that allows every holder to redeem the forks of bEIGEN at any given time later.

25/

In the whitepaper, they explain why a single-token model lacks "solid representation" and therefore has been discarded.

The two-token model will undergo multiple versions. Without going into details...

In the whitepaper, they explain why a single-token model lacks "solid representation" and therefore has been discarded.

The two-token model will undergo multiple versions. Without going into details...

26/

V1: It doesn't offer solid representation

V2: It achieves solid representation, but it still has the trust assumption of the Security Council acting honest

V3: It's resilient against a malicious security council

V1: It doesn't offer solid representation

V2: It achieves solid representation, but it still has the trust assumption of the Security Council acting honest

V3: It's resilient against a malicious security council

If you want more details, you'll find all your answers on pages 13 to 16 of the whitepaper.

28/

Third and fourth features: Metering and Compensation

The involvement of Social Consensus shouldn't be free or cheap.

The protocol requires two types of economic costs:

- DPF: Deflation-per-Fork

- CPF: Commitment-per-Fork

Third and fourth features: Metering and Compensation

The involvement of Social Consensus shouldn't be free or cheap.

The protocol requires two types of economic costs:

- DPF: Deflation-per-Fork

- CPF: Commitment-per-Fork

29/

DPF pays off the social cost of switching while the CPF pays off the social cost of rejecting malicious forks,

These costs should be higher than the social cost of getting involved in the intersubjective challenge because if not, people are not incentivized to participate.

DPF pays off the social cost of switching while the CPF pays off the social cost of rejecting malicious forks,

These costs should be higher than the social cost of getting involved in the intersubjective challenge because if not, people are not incentivized to participate.

30/

The whitepaper now focuses on explaining how an intersubjective fork should work from the perspective of stakers and AVS in any possible scenario.

We're going to make a trust assumption here (nerdy joke), but I want to highlight just a few things:

The whitepaper now focuses on explaining how an intersubjective fork should work from the perspective of stakers and AVS in any possible scenario.

We're going to make a trust assumption here (nerdy joke), but I want to highlight just a few things:

32/

To achieve Strong Cryptoeconomic security you need Attributable Security.

In the pooled security model, all of the malicious validator's stake is burned.

In the attributable security mechanism, only a fraction is burned while the remaining is redistributed to harmed AVS.

To achieve Strong Cryptoeconomic security you need Attributable Security.

In the pooled security model, all of the malicious validator's stake is burned.

In the attributable security mechanism, only a fraction is burned while the remaining is redistributed to harmed AVS.

33/

I will close with these images that showcase examples of applications that can benefit from intersubjective staking.

1. Foundational modules that an AVS could use

2. Concrete use cases

I will close with these images that showcase examples of applications that can benefit from intersubjective staking.

1. Foundational modules that an AVS could use

2. Concrete use cases

Tagging the best, are you bullish on $EIGEN guys?

@Slappjakke

@crypto_linn

@DefiIgnas

@0xTindorr

@0xSalazar

@0xMughal

@poopmandefi

@eli5_defi

@Flowslikeosmo

@jake_pahor

@arndxt_xo

@DeFi_Made_Here

@DeFi_Dad

@CJCJCJCJ_

@CryptoShiro_

@hmalviya9

@ayyyeandy

@rektdiomedes

@RakkiOtoko

@Slappjakke

@crypto_linn

@DefiIgnas

@0xTindorr

@0xSalazar

@0xMughal

@poopmandefi

@eli5_defi

@Flowslikeosmo

@jake_pahor

@arndxt_xo

@DeFi_Made_Here

@DeFi_Dad

@CJCJCJCJ_

@CryptoShiro_

@hmalviya9

@ayyyeandy

@rektdiomedes

@RakkiOtoko

Thank you for reading all the thread, I know it was a bit heavy.

In case you find it useful, you can support me by engaging with the post below.

Follow @Cryptovoxam for more... cheers! 🎈

In case you find it useful, you can support me by engaging with the post below.

Follow @Cryptovoxam for more... cheers! 🎈

https://twitter.com/1381209926891139075/status/1787223062871752992

• • •

Missing some Tweet in this thread? You can try to

force a refresh